It is also famous for its peculiar corporate culture, inherited from its mythical founder, Bob Kierlin, once called "the cheapest man in America" in the press. For Kierlin, every penny counts, and it is naturally this culture of frugality that explains the amazing journey of a company with such a seemingly banal activity.

This culture of sound economy is obvious when you look at the cash flow statements, and notice the anecdotal, not to say non-existent, remuneration in stock options, a singular contrast with contemporary practices!

A major evolution lies in the number of branches: it has decreased significantly (2,500 ten years ago vs. 1,500 today), but this is the result of a deliberate strategic pivot, as management has developed a clever concept of "on-site" distributors (like snack and beverage distributors, only bigger of course!), i.e. directly on the production sites of its clients (three-quarters of them manufacturing companies). There are now nearly 2000 "on-site" distributors, compared to zero eight years ago when the concept was launched.

In short, Fastenal's unusual operational and financial track record is well known, but what about the last ten years? Between 2012 and 2012, the company had experienced meteoric growth (sales multiplied by three and net income multiplied by six over the period). What about 2012-2022?

The dynamics remain excellent, with sales rising from $3.1B to $7B and profits following a perfectly comparable trajectory, expanding from $421M to $1.1B. We could be a little cautious and point out that the working capital requirement consumes nearly $300M per year, due to restocking, and that the profit distributable to shareholders ("free cash flow") is significantly lower than the net result ($800M last year).

This free cash flow is used by management with good sense and skill: over the last ten years, three quarters of distributable profits have been returned to shareholders in the form of dividends; the remaining quarter has been used for remarkably "timid" share buybacks, once again in stark contrast to current practices! There are only a few missing acquisitions and therefore no change in scope.

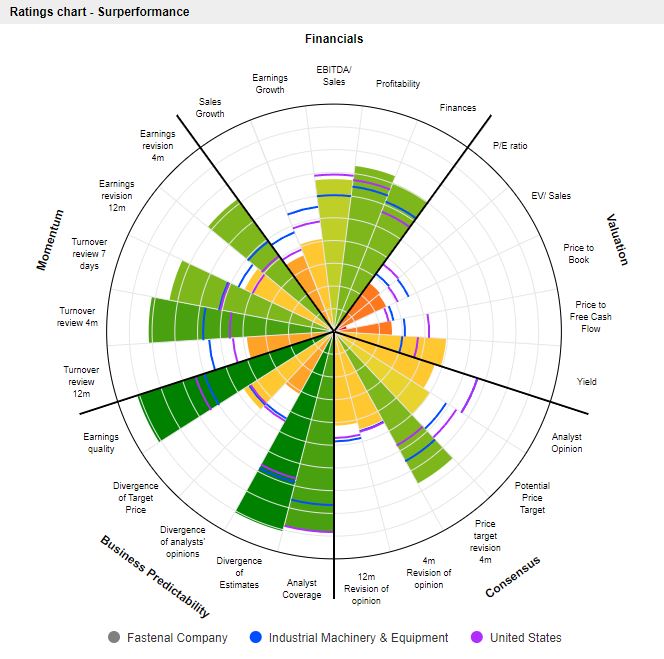

This is a remarkably well managed company, with a healthy culture, which has been able to reinvent itself and pivot in advance of difficulties, thus maintaining its remarkable financial performance over time. This "good father" management style is also apparent when we look at the balance sheet, since there is no net debt and current assets alone cover more than three times all liabilities. This does not prevent Fastenal from delivering a return on equity of 30%!

There have been some share purchases by insiders in recent months at price levels comparable to those of the moment. At $52 per share, Fastenal's market capitalization is $3B, which is a PE of x27, perfectly in line with its historical average. Each time the value went down to x20 the profits, it was a buy signal (see historical PE graph below)

Fastenal has not yet attacked the international market: there is no doubt that this is the future growth relay... This will not come without difficulties, of course, but if the history of the company proves anything, it is that management manages its strategic pivots well.

The usual risks that have been pointed out have so far never rubbed off on the business. The one that is often mentioned is Amazon, but it has actually never become a competitor due to lack of inventory and inability to match Fastenal's on-site distribution.

By

By