Looking back on the strongest M&A market in history and the disputes that have been emerging.

2021 was a record year for mergers and acquisitions (M&A). Driven by high valuations and abundant liquidity, the total global value of all deals reached an all-time high of

Despite the slowdown, the effects of the 2021 market frenzy are still being felt through a wave of post-acquisition disputes. These disputes are in fact a continuation of certain trends that have been developing for several years. Here are four.

Trend 1: High Valuations, Greater Scope for Disappointment

A period of exceptionally high valuations does not necessarily mean that markets, or individual acquisition targets, are overvalued. However, highly valued deals mean an increased scope for disappointment by parties in transactions. Buyers are disappointed when an acquisition target falls short of the expected returns that had been priced into the bid. Sellers can be disappointed when a significant shortfall against expectations means lower than expected earn-out payments. Disappointment breeds disputes.

Trend 2: An Accelerating Trend to Arbitrate Disputes

Most of the private M&A disputes emerging from the recent exceptionally strong market are resolved in arbitration. By one recent estimate, more than 75% of sale and purchase agreements (SPAs) have arbitration clauses.1 Arbitration institutions report, further, that shareholder, share purchase or joint venture agreements represent a significant fraction of their caseload. For example, these types of agreements represented 14% of the cases administered by the

More generally, arbitration has experienced steady, long-term growth over the last decade.

Trend 3: The Rise of

Warranty and indemnity (W&I) insurance aims to protect the parties against loss resulting from breaches of representations and warranties. W&I insurance can provide sellers with a "clean" exit. The insured party is compensated for covered claims by an insurer. Traditional W&I policies cover certain warranties included in the SPA. Newer forms extend the coverage to "fully synthetic warranties," whereby a buyer can obtain protection for matters that a seller will not or cannot warrant.

In recent years, W&I insurance has seen significant growth, and many useful innovations associated with W&I insurance have become an important aspect of M&A transactions. According to

W&I insurance has introduced new complexities into many M&A disputes. For example, differences in the damages clauses in the SPA and the equivalent clause in the insurance contract can mean different approaches to the damages valuation with respect to the same alleged breach. Synthetic warranties, covering matters that a seller will not warrant (and that therefore remain outside the SPA), can introduce additional complexities.

Trend 4: The Increasing Importance of Third-Party Funding

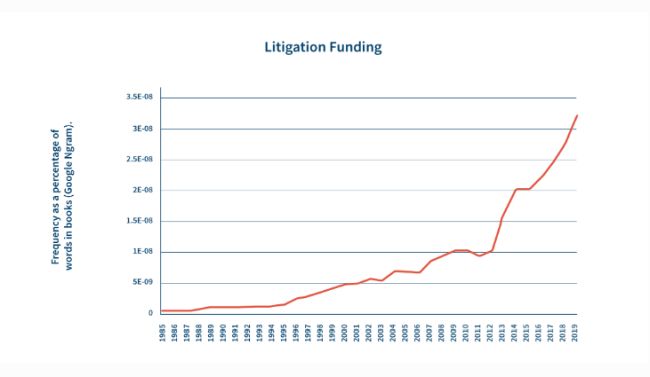

Third-party funding is the financing of litigation or arbitration by an otherwise unrelated institution, often a specialized funder. The funder generally receives a share of any payout (funding arrangements can otherwise be flexible). Third-party funding has existed for decades but has grown rapidly in recent years, and across many types of disputes. One indication of the growth in importance of litigation funding is the increase in the use of the term in publications as shown in the chart below.

Analysts expect further significant growth. According to one estimate, the global market was worth

Conclusion

As the second half of 2022 unfolds, it will be interesting to see how the headwinds of this year continue to affect M&A activity. It can be expected that the fallout from an exceptionally active 2021 market continues to translate into a higher number of post-M&A disputes, and that the trends identified above will continue to be of relevance.

Footnotes

1: Elsing/Pickrahn/Pörnbacher/Wagner, M&A-Streitigkeiten vor DIS-Schiedsgerichten (

2: LCIA 2021 Annual Casework Report, available at https://www.lcia.org/LCIA/reports.aspx

3: International Arbitration After the Pandemic, An FTI Consulting Report - published in

4:

5: CMS European M&A Study 2022, 55 and 56.

6: https://www.researchnester.com/reports/litigation-funding-investment-market/2800

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

12th Floor

WA, 98101

© Mondaq Ltd, 2022 - Tel. +44 (0)20 8544 8300 - http://www.mondaq.com, source