Shapeways, a leading global digital manufacturing platform driven by proprietary software, has entered into an agreement to become the exclusive 3D printing manufacturer for Armor Bionics, a specialist in image segmentation and 3D medical modeling. Under the terms of the agreement, Shapeways will provide Armor Bionics with certain complex 3D printer medical models that are expected to transform procedures used for pre-planning surgeries. The personalized models are developed from patient CT scans and MRIs, allowing for diagnosis, treatment, and unparalleled surgical planning and life-saving procedures. Advantages include significantly reduced time spent in the operating room, shorter recovery times for patients, and greater ability of surgeons to anticipate potential complications during a surgery.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210728005136/en/

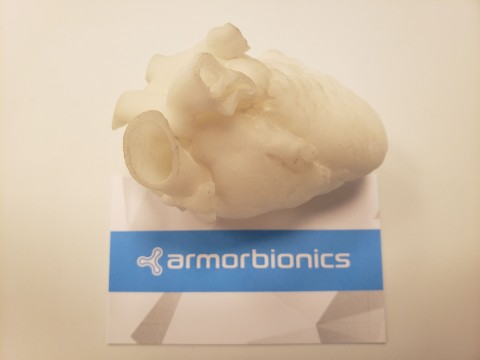

3D printed infant heart model manufactured for Armor Bionics by Shapeways transforms surgical pre-planning. (Photo: Business Wire)

On April 28, 2021, Shapeways entered into a definitive agreement with Galileo Acquisition Corp. (NYSE: GLEO), a special purpose acquisition company, related to a proposed business combination between Galileo and Shapeways. Upon the closing of the transaction, the combined company will be named Shapeways Holdings, Inc. and is expected to remain listed on the NYSE under the new ticker symbols “SHPW” and “SHPW.WS.”

Educating Patients and Empowering Surgeons

With a core strength in industrial design and 3D modeling, Armor Bionics specializes in developing medical models and offering biotechnology solutions—with the ultimate goal to make its technology available to any hospital in the world, whether at a world-class facility or a small clinic in a developing country.

Bruno Demuro, co-founder and CEO of Armor Bionics, is amplifying his company’s talents in the area of converting 2D scans to a 3D design while relying on Shapeways for their manufacturing expertise and global distribution.

“When we received the first model from Shapeways, it was absolutely perfect,” said Demuro. “Always being very thorough, means we measured the size of every bone to find out how accurate the first 3D printed model was. In comparison to the 3D design we had sent, it was flawless, which is essential since there is no room for error in the procedures for which the technique is used.”

Surgical Pre-Planning Helps Doctors to Prevent Complications

The critical nature of using 3D printed medical models becomes even more apparent when surgeons are preparing for delicate procedures like spinal surgery. Surgeons can make smaller incisions due to planning on physical models which leads to reduced bleeding and quicker recovery times. Viewing a physical 3D model of a spine, heart, or other internal organ allows doctors to plan, adjust, and practice the surgery beforehand which leads to shorter surgeries.

Dr. Christian Kreutzer, Chief of Congenital Heart Surgery at Hospital Universitario Austral and former fellow of Children's Hospital, Boston and Harvard Medical School, has worked with Armor Bionics to replicate an eight-month-old patient’s heart. While viewing the medical model, he adapted the planned surgery which helped reduce recovery time by half.

“Armor Bionics and Shapeways lets me focus on what I do best, saving children and improving their lives through surgeries. Their platform easily converts scans into physical 3D models that are to scale and guide our approach in surgical pre-planning,” says Dr. Kreutzer. “Utilizing this technology reduces time in surgery, leads to quicker recovery times, and produces more positive surgical outcomes overall.”

Shapeways Provides Global Access

Armor Bionics realized a manufacturing partnership with Shapeways would also yield the chance to reach many geographical locations easily. Shapeways’ facilities in the US and Europe help surgeons get the medical models quickly.

“One of the greatest barriers in expanding our work with even more surgical teams was the lack of reliable facilities for 3D printing models once they were sent from Uruguay, where Armor Bionics is headquartered,” continued Demuro. “By partnering with Shapeways, surgeons can now receive 3D models anywhere, with extremely fast delivery and high model accuracy.”

Armor Bionics’ services transforms medical scans into 3D printed physical models and pairs with Shapeways capabilities for an innovative solution. “Working hand-in-hand with Armor Bionics Shapeways developed a way to perform the crucial and difficult task of converting digital scans into physical form factors that can be held, manipulated, and even used for hands-on practicing of procedures,” said Miko Levy, Chief Revenue Officer at Shapeways. “This revolutionary service offering enables surgeons and hospitals to get physical models fast, makes surgeries more efficient, and can assist surgeons in numerous ways to help achieve the best outcome for their patients.”

The medical models are already being used by surgeons around the world, and Armor Bionics plans to pursue further expansion in the US and Europe.

About Shapeways

Shapeways is a leader in the large and fast-growing digital manufacturing industry combining high quality, flexible on-demand manufacturing powered by purpose-built proprietary software which enables customers to rapidly transform digital designs into physical products, globally. Shapeways makes industrial-grade additive manufacturing accessible by fully digitizing the end-to-end manufacturing process, and by providing a broad range of solutions utilizing 11 additive manufacturing technologies and more than 90 materials and finishes, with the ability to easily scale new innovation. Shapeways has delivered over 21 million parts to 1 million customers in over 160 countries.

About Galileo

Galileo Acquisition Corp. raised $138 million in October 2019 and its securities are listed on the New York Stock Exchange under the ticker symbols “GLEO.U,” “GLEO” and “GLEO.WS.” Galileo is a blank check company organized for the purpose of effecting a merger, capital stock exchange, asset acquisition, or other similar business combination with one or more businesses or entities with an initial focus on targets operating in the Consumer, Retail, Food and Beverage, Fashion and Luxury, Specialty Industrial, Technology or Healthcare sectors which are headquartered in Europe or North America, and that have a European and North American market nexus. Galileo is led by a serial SPAC sponsor team having successfully completed four business combinations, in addition to Shapeways. Its team is composed by seasoned dealmakers with diverse nationalities, M&A, principal investing and public company operating experience in both the North American and Western European markets.

On June 9, 2021, Galileo filed a registration statement (the “Registration Statement”) on Form S-4 with the U.S. Securities and Exchange Commission (“SEC”) that includes a preliminary proxy statement / prospectus in connection with the proposed business combination, which is available on the SEC website at www.sec.gov.

Forward-Looking Statements

Certain statements included in this press release are not historical facts and are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. All statements, other than statements of present or historical fact included in this press release, regarding Galileo’s proposed acquisition of Shapeways, Galileo’s ability to consummate the transaction, the benefits of the transaction and the combined company’s future financial performance, market opportunity, as well as the combined company’s strategy, future operations, estimated financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of the respective management of Shapeways and Galileo and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Shapeways and Galileo. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political, and legal conditions; the inability of the parties to successfully or timely consummate the proposed transaction, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed transaction or that the approval of the stockholders of Galileo or Shapeways is not obtained; failure to realize the anticipated benefits of the proposed transaction; the risk that Shapeways has a history of losses and may not achieve or maintain profitability in the future; the risk that Shapeways faces significant competition and expects to face increasing competition in many aspects of its business, which could cause our operating results to suffer; the risk that the digital manufacturing industry is a relatively new and emerging market and it is uncertain whether it will gain widespread acceptance; the risk that if Shapeways fails to grow its business as anticipated, its revenues, gross margin and operating margin will be adversely affected; the risk that if Shapeways’ new and existing solutions and software do not achieve sufficient market acceptance, its financial results and competitive position will decline; the amount of redemption requests made by Galileo’s stockholders; the ability of Galileo or Shapeways to issue equity in connection with the proposed transaction or in the future, and those factors discussed in Galileo’s Registration Statement, under the heading “Risk Factors,” and other documents Galileo has filed, or will file, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Galileo nor Shapeways presently know, or that Galileo nor Shapeways currently believe are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Galileo’s and Shapeways’ expectations, plans, or forecasts of future events and views as of the date of this press release. Galileo and Shapeways anticipate that subsequent events and developments will cause Galileo’s and Shapeways’ assessments to change. However, while Galileo and Shapeways may elect to update these forward-looking statements at some point in the future, Galileo and Shapeways specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Galileo’s and Shapeways’ assessments of any date subsequent to the date of this transcript. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Information Sources; No Representations

The information in the release does not purport to be all-inclusive. The information therein is derived from various internal and external sources, with all information relating to the business, past performance, results of operations and financial condition of Galileo derived entirely from Galileo and all information relating to the business, past performance, results of operations and financial condition of Shapeways derived entirely from Shapeways. No representation is made as to the reasonableness of the assumptions made with respect to the information therein, or to the accuracy or completeness of any projections or modeling or any other information contained therein. Any data on past performance or modeling contained therein is not an indication as to future performance.

No representations or warranties, express or implied, are given in respect of this release. To the fullest extent permitted by law in no circumstances will Galileo or Shapeways, or any of their respective subsidiaries, affiliates, shareholders, representatives, partners, directors, officers, employees, advisors or agents, be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this release, its contents, any omissions, reliance on information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith, which information relating in any way to the operations of Shapeways has been derived, directly or indirectly, exclusively from Shapeways and has not been independently verified by Galileo.

Additional Information and Where to Find It

In connection with the proposed transaction, Galileo has filed the Registration Statement with the SEC, which includes a preliminary proxy statement/prospectus of Galileo, as may be amended from time to time. Galileo will mail a definitive proxy statement/prospectus and other relevant documents to its shareholders.

INVESTORS AND SECURITY HOLDERS OF GALILEO ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4, WHICH WAS FILED WITH THE SEC ON JUNE 9, 2021 AND INCLUDES A PRELIMINARY PROXY STATEMENT/PROSPECTUS, AND, WHEN AVAILABLE, ANY AMENDMENTS THERETO, AND THE DEFINITIVE PROXY STATEMENT/PROSPECTUS IN CONNECTION WITH GALILEO'S SOLICITATION OF PROXIES FOR ITS SPECIAL MEETING OF SHAREHOLDERS TO BE HELD TO APPROVE THE PROPOSED TRANSACTION BECAUSE THE PROXY STATEMENT/PROSPECTUS CONTAINS AND WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. THE DEFINITIVE PROXY STATEMENT/PROSPECTUS WILL BE MAILED TO SHAREHOLDERS OF GALILEO AS OF A RECORD DATE TO BE ESTABLISHED FOR VOTING ON THE PROPOSED TRANSACTION.

Shareholders will also be able to obtain copies of the Registration Statement, including the proxy statement/prospectus, the Current Report, and any other documents filed by Galileo with the SEC, free of charge at the SEC's website (www.sec.gov).

Participants in the Solicitation

Galileo and Shapeways and their respective directors, executive officers and employees and other persons may be deemed to be participants in the solicitation of proxies from the holders of Galileo ordinary shares in respect of the proposed business combination. Galileo shareholders and other interested persons may obtain more detailed information regarding the names and interests in the proposed transaction of Galileo's and Shapeways’ directors and officers in Galileo’s and Shapeways’ filings with the SEC including the Registration Statement which includes a preliminary proxy statement/prospectus of Galileo for the proposed transaction. These documents can be obtained free of charge from the sources indicated above.

Disclaimer

This communication shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination. This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities pursuant to the proposed transactions or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210728005136/en/