Harbour Energy is the result of the merger between Chrysaor and Premier Oil, two British oil and gas groups. The first, Chrysaor, was founded in 2007 and has experienced strong growth through a series of successful acquisitions. Premier Oil had been exploring the seabed for oil and gas for over a century.

The merger of the two companies created the largest independent oil and gas company listed on London's FTSE index.

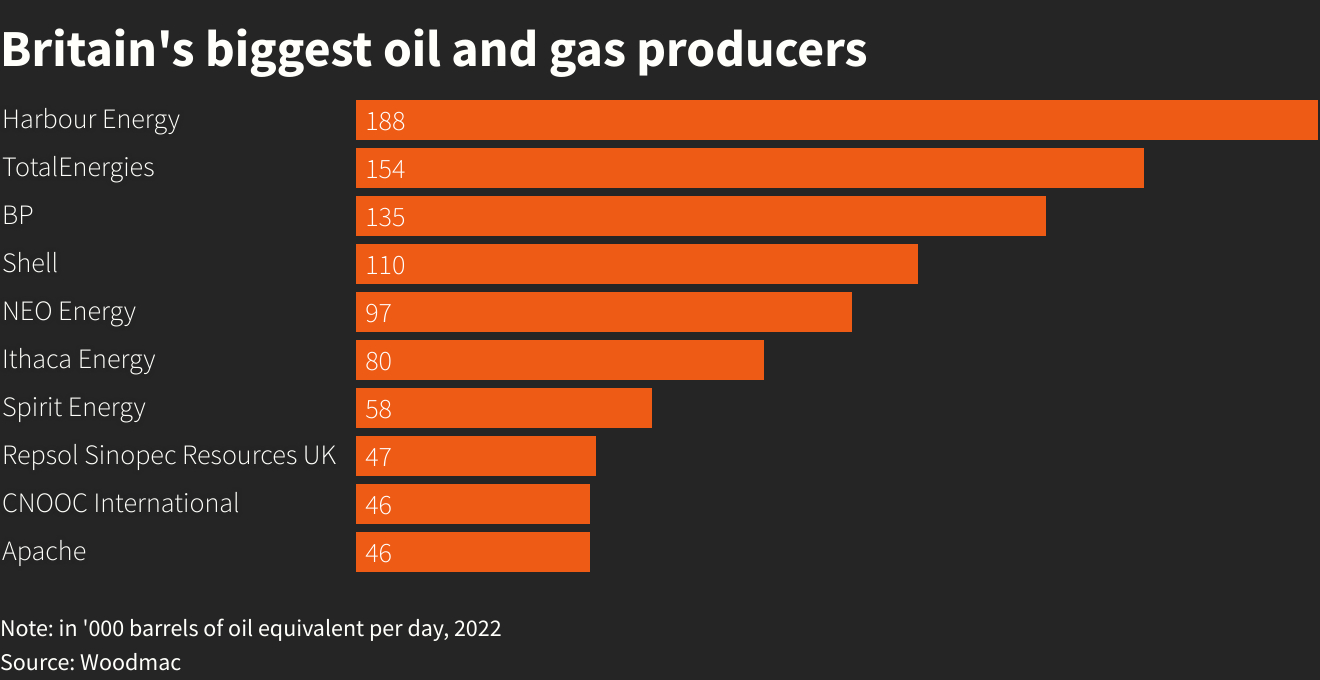

This collaboration allows for the production of up to 200,000 barrels of oil per day. To put that into perspective, Harbour accounts for 15% of the UK's oil and gas production, making it the country's largest producer. This large-scale venture is breathing new life into a region where it is relatively more expensive to extract oil than in other parts of the world.

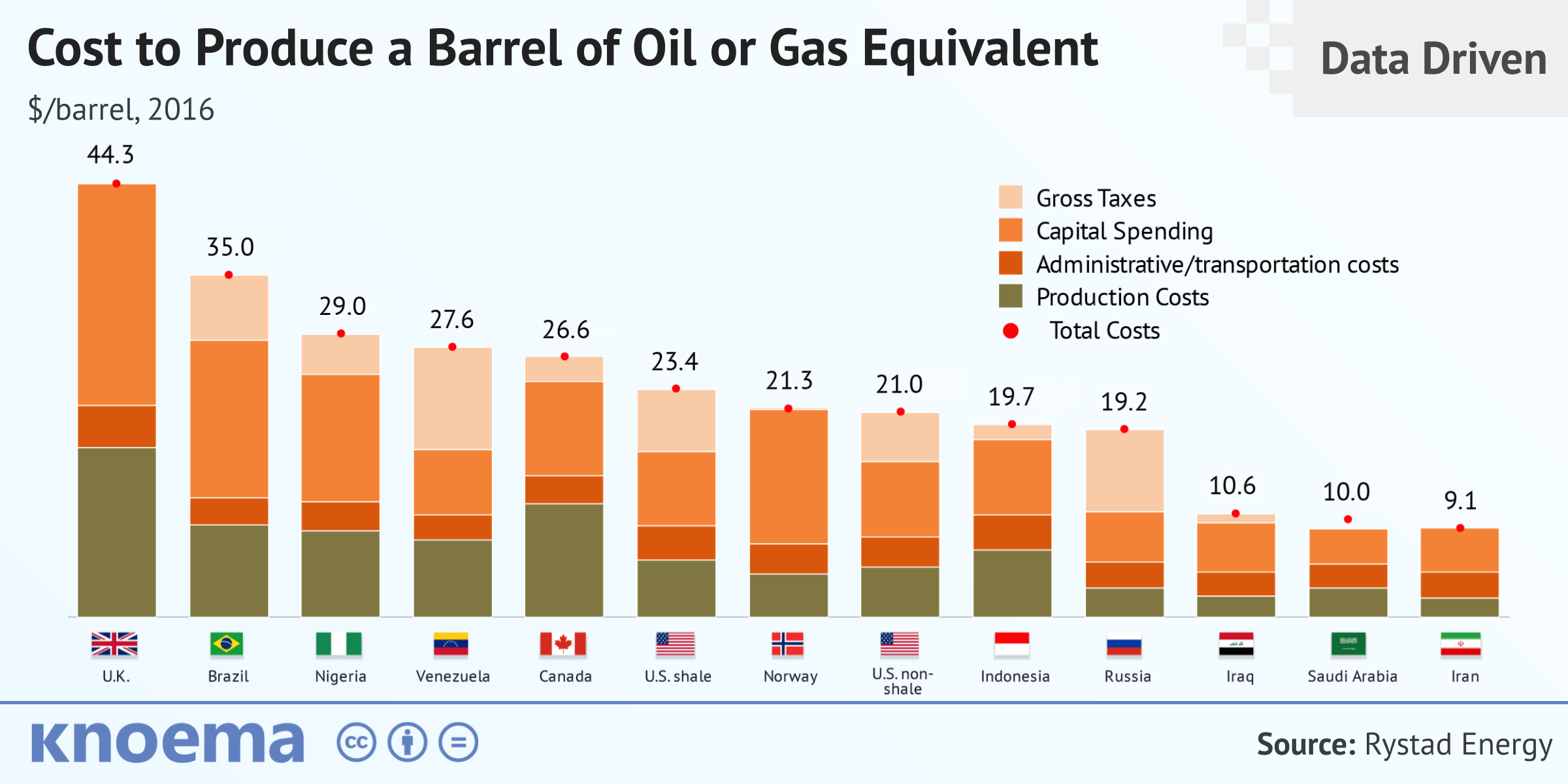

As the chart below shows, the cost of producing a barrel of oil is by far the highest in the UK. There are two reasons for this: "capital spending" (CAPEX), that is, the cost of acquiring, upgrading and maintaining. For an oil company, this is the equipment needed to drill and extract the oil. And the second "Production costs" (OPEX), that is to say, the operating costs such as the cost of transporting oil and water, electricity for the facilities, etc...

Unlike other oil companies seeking to diversify, Harbour is a pure player. Its production is divided equally between gas and oil. More than 90% of its raw materials come from the North Sea. The group stands out for its growth strategy based on mergers and acquisitions in the North Sea and internationally.

A well thought-out strategy

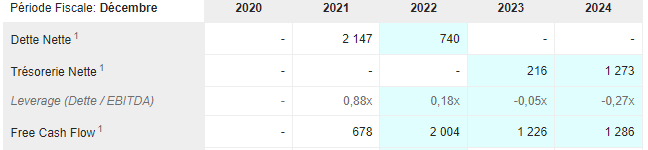

The trump card up Harbour's sleeve is its ability to increase the life of the fields it acquires in the North Sea. This low-cost operator manages to generate an operating margin of more than 50% on the sale of its barrels of Brent. Thanks to this strategy, the group generates a lot of cash flow: in 2022, Harbour has managed to generate more than $2 billion in FCF (Free Cash Flow). As for the FCF yield (an indicator measuring the capacity of a company to return cash to its investors as a percentage of value), it has grown to reach more than 51.2% in 2022. This strength allows the group to easily pay off its acquisition-related debt. Harbour paid off Premier Oil's $2.7 billion in debt in just two years.

According to the company's estimates, cash flow will be positive as early as 2023. All this cash flow will allow for new acquisitions, share buybacks or dividends to its shareholders.

The future looks bright, especially since the need to rebuild some form of energy independence for European countries only increases the attractiveness of the company for investors.

The geopolitical context of 2022 has been largely favorable to the energy sectors. The group has increased its production by more than 27%. Thanks to the rise in gas prices, its revenues increased by 53% at the same time. To top it all off, its operating margins jumped as the unit cost of a barrel of oil fell (the more the company produces and uses its facilities for new acquisitions, the lower the unit cost of a barrel).

Prospects

With this positive cash flow by 2023, the company is expanding internationally, outside the North Sea. Its latest project is the exploitation of a deposit in Indonesia in partnership with Mubadala. In terms of exploration, Harbour is not skimping on resources in the search for new deposits in the Gulf of Mexico or along the Brazilian coast. But the group is not neglecting investments in its golden goose: it is continuing to expand in the North Sea with three projects to buy oil rigs in order to increase its market share and continue to drive down the unit cost per barrel.

In addition to continuing its expansion, Harbour is diversifying on its original playing field: it is banking on carbon capture and storage. Through this process, the group will convert its old platforms with depleted gas reservoirs into permanent CO2 storage. The group plans its first CO2 injections for the year 2027, and plans to be a major player in the North Sea to address its new European issues.

Strengths:

- Ability to deliver FCF

- Leading UK producer

- One of the strongest balance sheets among the alternatives in the sector

- A well-established strategy of value creation with decommissioned assets

- A start on diversification into carbon storage to follow

Weaknesses:

- Business model requires regular external growth policy

- 90% exposure to the UK

- Possibility that FCF is only used for M&A

By

By