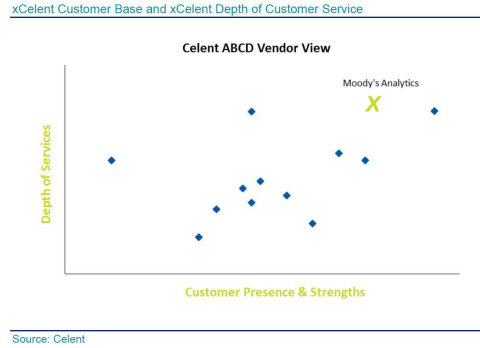

Moody’s Analytics has won the xCelent Depth of Services award in a new report from Celent. “NextGen Balance Sheet Management and ALM: Vendor ABCD” profiles 13 asset and liability management (ALM) and balance sheet management systems.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201006005072/en/

(Photo: Business Wire)

Celent recognized the depth of our ALM and balance sheet management solution, which boasts award-winning software as well as the data, economic scenarios, training, and advisory services that set Moody’s Analytics apart from other vendors. Banks will likely need these services when making the upcoming transition from interbank offered rates (IBOR) to alternate reference rates (ARR), which requires adjustments to how they launch new products, reprice existing products, recalibrate funds transfer pricing, and review their hedge accounting. To make this transition as smooth as possible banks will need a greater level of expertise, informed by granular data and realistic economic scenarios.

The RiskConfidence™ ALM system is the technological heart of our solution. It breaks silos by integrating ALM, liquidity risk management, funds transfer pricing, and business reporting in a single platform. In the current economic uncertainty, the enterprise-wide analytics it produces figure even more prominently in our customers’ strategic decisions.

With banks continually looking for ways to include credit loss estimates in their balance sheet forecasts and “what-if” scenarios, our interest rate forecasts, aligned with Moody’s Analytics broad, award-winning economic variable forecasts, stand out as another unique component of our offering.

“Beyond software and embedded analytics, Moody's Analytics incorporates and delivers other value-added services related to macroeconomic research, analysis, and insights; entity and market data (fundamental, credit, KYC, and structured finance data); scenario definition/generation; and risk management learning/training services to end clients,” said Cubillas Ding, Research Director, Celent.

“Software is the foundation, but there is much more to our solution,” said Fanny Marengo, Director at Moody’s Analytics. “Our customers can easily integrate credit content, data, and models for a comprehensive solution—closing the loop between the CFO and CRO and providing a single source of truth for balance sheet calculations.”

About Moody’s Analytics

Moody’s Analytics provides financial intelligence and analytical tools to help business leaders make better, faster decisions. Our deep risk expertise, expansive information resources, and innovative application of technology help our clients confidently navigate an evolving marketplace. We are known for our industry-leading and award-winning solutions, made up of research, data, software, and professional services, assembled to deliver a seamless customer experience. We create confidence in thousands of organizations worldwide, with our commitment to excellence, open mindset approach, and focus on meeting customer needs. For more information about Moody’s Analytics, visit our website or connect with us on Twitter or LinkedIn.

Moody's Analytics, Inc. is a subsidiary of Moody's Corporation (NYSE: MCO). Moody’s Corporation reported revenue of $4.8 billion in 2019, employs approximately 11,200 people worldwide and maintains a presence in 40 countries.

View source version on businesswire.com: https://www.businesswire.com/news/home/20201006005072/en/