The moves came as the carrier's founder sold more shares, the latest move over the past month to cut his stake.

Norwegian, which has grounded most of its aircraft and temporarily laid off 90% of staff, amounting to about 7,300 people, had said it needed access to cash "within weeks, not months".

A condition for receiving the first 300 million Norwegian crowns (23.21 million pounds) from Norway's rescue package was that commercial lenders were willing to supply 10% of that amount while the government would provide the remaining 90%.

"Norwegian is pleased to announce that two Nordic banks have obtained credit committee approval to provide a guarantee for the required 10%," a company statement said.

"Norwegian will secure the necessary headroom to pursue further guarantees from the Norwegian government."

Norway said on March 19 that Norwegian Air could obtain credit guarantees worth up to 3 billion crowns to help it weather the coronavirus crisis subject to a series of conditions.

Norwegian's shares rose following the announcement, up 2.1 at 1217 GMT, but were underperforming the Oslo stock index which was up 4.8%.

On Monday, leasing company DP Aircraft said a unit of Norwegian Air had failed to make payments relating to two Boeing 787 Dreamliner aircraft in its fleet, which had been due on March 13.

DP Aircraft and its asset manager, DS Aviation, will prioritise discussions with Norwegian "in order to determine whether and on what basis it may be able to meet its obligations," DP said.

On Tuesday, the airline confirmed it was in talks with leasing companies, including DP Aircraft, and other creditors to meet government requirements for the rescue package.

SELLING STOCKS

Separately the founder of Norwegian Air and its ex-CEO, Bjoern Kjos, and former chairman, Bjoern Kise, continued to reduce the stake they jointly hold in the airline via their holding company, HBK Holding.

On Tuesday, they cut their stake by 3,652 shares, or 0.002%, to 9.99%, according to a stock exchange disclosure. That's on top of 3.2 million shares they have sold since mid-February, according to company disclosures.

Reuters was not able to reach Kjos or Kise for comment.

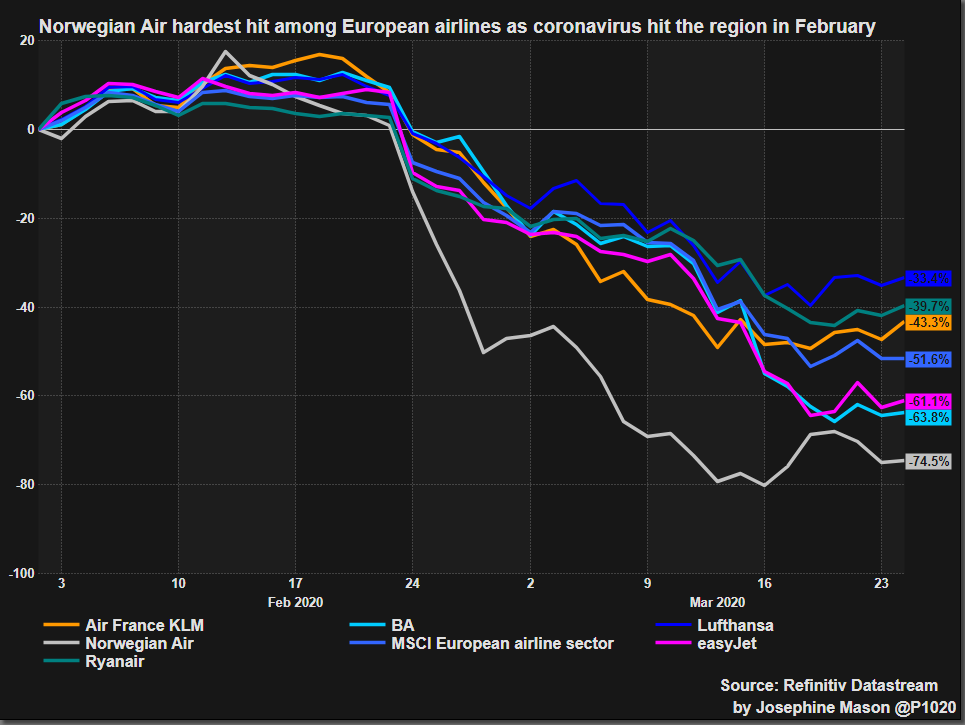

The shares have lost more than 75% of their value since February as the virus plunged the airline sector into crisis.

The airline is now working with state credit agency GIEK and Norway's trade and industry ministry to clarify the criteria and terms for receiving the remaining tranches of the scheme, it said.

A tranche of 1.2 billion crowns is dependent on creditors postponing instalments and scrapping interest payments for as long as the guarantee lasts.

Another of 1.5 billion crowns would require Norwegian to boost its equity, the government has said.

The company said it is now seeking further guarantees from financial institutions to help it access these tranches.

"The government guarantee scheme is crucial for the company as the current state of the capital markets in combination with the challenging times for the airline industry limit the options available," Norwegian said.

Norway's industry ministry did not immediately respond to a request for comment.

(GRAPHIC: Norwegian Air and other European airlines -  )

)

(Editing by David Goodman, Jason Neely and Josephine Mason)

By Terje Solsvik and Victoria Klesty