In a potential boost for uranium, more nations commit to carbon-neutral goals, as the weekly spot price increases incrementally.

-Japan promises zero emissions by 2050

-Paladin Energy's restart plans

-The weekly spot price increases marginally

Yoshihide Suga, Japan's new prime minister, came to office in September promising continuity from his predecessor, Shinzo Abe. But in one way he has already distinguished himself.

During his first speech to the Diet as prime minister, on October 26th, he promised to reduce Japan's net emissions of greenhouse gases to zero by 2050. This breaks with Mr Abe's foot-dragging on climate change. It also brings Japan in-line with Britain and the European Union and slightly ahead of China, which last month promised zero emissions by 2060. Japan is the world's third-biggest economy and fifth-biggest emitter and is considered to have a relatively poor record on emissions cuts.

Ultimately this leads to questions about Japan's future energy mix and the role of nuclear power, according to industry consultant TradeTech. For now, the country is considered committed to its 2018 energy policy, which includes 20-22% nuclear power in the energy mix by 2030.

TradeTech notes the return of nuclear power in Japan has been slow following the March 2011 Fukushima accident that saw the entire fleet of commercial reactors shut down for safety inspections and upgrades. Since then, nine reactors have been cleared for restart and 18 are in the process of restart approval.

South Korea also made a pledge for carbon neutrality this week and in Europe, the European Commission (EC) said it "will not stand in the way" of countries that choose to build new nuclear power stations.

According a recent update on the BBC website, the UK government is close to giving the green light to a new nuclear power station at Sizewell in Suffolk. Talks with the Sizewell contractor, EDF, are considered to have intensified in recent weeks.

This comes after the collapse of projects in Anglesey and Cumbria when Japanese firms Hitachi and Toshiba pulled out.

Government officials are insisting that it "remains committed to new nuclear". This commitment to new nuclear may be included as part of a 10-point government plan to be published in early November, predicts the BBC.

That plan is expected ahead of a detailed government white paper in late November which will attempt to set out the course of UK energy policy for decades to come.

According to TradeTech, the UK government is reportedly considering an ownership stake at Sizewell and consumers may see a small addition to their bills to pay for the project as it is being built. This is in order to reduce costs of financing a project that may cost up to US$25.9 billion and take about 10 years to build.

Company News

In a quarterly activities report Paladin Energy ((PDN)) highlighted restart activities at the globally significant Langer Heinrich uranium mine. The company continues to engage with potential customers with a view toward securing uranium term-price contracts with sufficient term and value to underpin the restart.

The company also confirmed FY21 expenditure guidance of US$9.5m, which would be a significant decrease from the US$16.8m incurred during the 2020 financial year.

Uranium Pricing - During the week

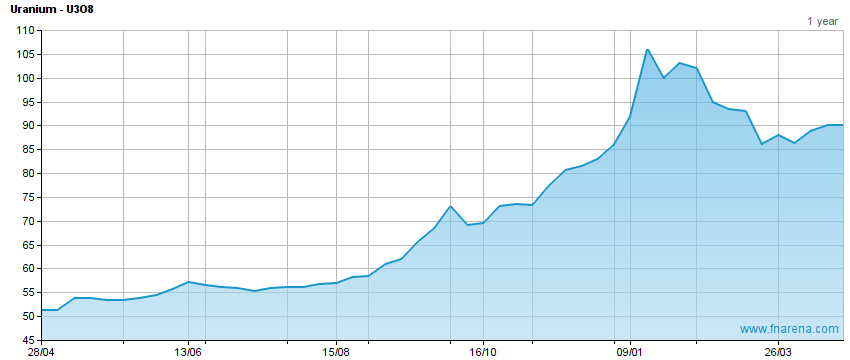

TradeTech's Weekly Uranium Spot Price Indicator is at US$29.90/lb, up US$0.20/lb from last week and up US$0.25/lb from the October 29 Daily Spot Price Indicator.

Total spot uranium transactional volume for the last week of October totalled just over 2mlbs pounds U3O8 equivalent.

The 0.7% week-on-week rise in the weekly spot price marks the first positive movement in the indicator in three months. The Weekly Spot Price Indicator has increased nearly 50% since late October 2017, and has risen almost 24% in the last year and has averaged a 0.5% weekly increase in 2020. The average weekly uranium spot price for 2020 is US$29.69/lb, US$3.85/lb above the 2019 average.

TradeTech's term price indicators are unchanged at US$34.00/lb (mid) and US$37.00/lb (long).

Uranium Pricing - During the month

TradeTech's monthly spot price, for October 31 is US$29.90/lb, a decrease of -US$0.20 from end-September.

The drop in the spot price followed a month that was relatively quiet with 31 transactions involving 7.0mlbs reported, up from the 4.9m lbs recorded in September.

Buyers in the spot uranium market in October consisted mainly of primary producers and intermediaries, including traders and financial entities. Utilities accounted for less than 20% of the total volume purchased in the spot market during October.

The spot uranium price hovered at US$30.00/lb for the first week of the month, before slipping. By the third week of October, the spot price indicator fell to US$29.50/lb, but immediately reversed direction during the last week to close out the month at US$29.90/lb.

FNArena is proud about its track record and past achievements: Ten Years On

All material published by FN Arena is the copyright of the publisher, unless otherwise stated. Reproduction in whole or in part is not permitted without written permission of the publisher.

© 2020 Acquisdata Pty Ltd., source FN Arena