PGIM Investments continues to build out its actively managed fixed income ETF lineup with the launch of the PGIM Floating Rate Income ETF (NYSE Arca: PFRL). The new ETF, which seeks to maximize current income by investing primarily in senior floating rate loans, is managed by PGIM Fixed Income,1 one of the largest and most experienced leveraged finance managers with $38 billion in floating rate loan assets under management as of March 31, 2022. PGIM is the $1.4 trillion global investment management business of Prudential Financial, Inc. (NYSE: PRU).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220524005350/en/

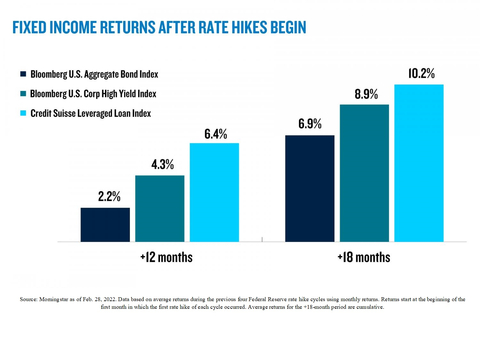

Fixed Income Returns After Rate Hikes Begin. Source: Morningstar as of Feb. 28, 2022. Data based on average returns during the previous four Federal Reserve rate hike cycles using monthly returns. Returns start at the beginning of the first month in which the first rate hike of each cycle occurred. Average returns for the +18-month period are cumulative. (Photo: Business Wire)

The PGIM Floating Rate Income ETF’s investment strategy mirrors the $4.6 billion PGIM Floating Rate Income Fund which ranks in Morningstar’s top decile for total returns over the 3‑, 5- and 10-year periods ending March 31, 2022. Both funds are managed by Brian Juliano, Parag Pandya, Robert Cignarella, Ian Johnston and Robert Meyer.

Floating rate loans may benefit from rising interest rates as the coupon they pay resets based on short-term interest rate movements. PGIM Investments’ recent analysis indicates floating rate loans have historically outperformed the broader U.S. bond market 12 to 18 months after previous Fed rate hike cycles began (see chart above).

“We’ve seen increased demand for floating rate strategies as investors look to protect against rising rates. In our view, actively managed credit selection will be a differentiating factor between managers in volatile markets, and we are thrilled to offer PGIM Fixed Income’s time-tested strategy as an ETF,” said Stuart Parker, president and CEO of PGIM Investments.

“Despite strong fundamentals, uncertainty around developments in Ukraine, inflation and central bank hawkishness underscore the importance of both credit selection and risk management,” said Brian Juliano, managing director and head of the U.S. leveraged loan team at PGIM Fixed Income. “Mechanically, the coupons that bank loans pay reset on short-term interest rate movements, which may help to mitigate the impact of rising interest rates. This structure, when paired with active management and a well-researched credit selection process, seeks to provide investors with an opportunity to be rewarded as market volatility continues.”

Learn more about the PGIM Floating Rate Income ETF.

Source: Morningstar as of March 31, 2022. Rankings are based on total return, do not include the effect of sales charges, and are calculated against all funds in the Morningstar Bank Loan category using the Fund’s Class Z shares. Total Return rankings: 1-year: 49% (119/237); 3-year: 1% (3/228); 5-year: 4% (7/212); 10-year: 3% (5/140). Since Inception: 2% (2/105).

ABOUT PGIM INVESTMENTS

PGIM Investments LLC and its affiliates offer more than 100 funds globally across a broad spectrum of asset classes and investment styles. All products draw on PGIM’s globally diversified investment platform that encompasses the expertise of managers across fixed income, equities, alternatives, and real estate.

ABOUT PGIM FIXED INCOME

PGIM Fixed Income, with $890 billion in assets under management as of March 31, 2022, is a global asset manager offering active solutions across all fixed income markets. The company has offices in Newark, N.J., London, Amsterdam, Frankfurt, Zurich, Tokyo, Hong Kong, and Singapore. For more information, visit pgimfixedincome.com.

ABOUT PGIM

PGIM, the global asset management business of Prudential Financial, Inc. (NYSE: PRU), ranks among the top 10 largest asset managers in the world2 with approximately $1.4 trillion in assets under management as of March 31, 2022. With offices in 17 countries, PGIM’s businesses offer a range of investment solutions for retail and institutional investors around the world across a broad range of asset classes, including public fixed income, private fixed income, fundamental equity, quantitative equity, real estate and alternatives. For more information about PGIM, visit pgim.com.

Prudential Financial, Inc. (PFI) of the United States is not affiliated in any manner with Prudential plc, incorporated in the United Kingdom, or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom. For more information, please visit news.prudential.com.

1 PGIM Limited also serves as a subadviser to the Fund.

2 Prudential Financial, Inc. (PFI) is the 10th-largest investment manager (out of 477) in terms of global AUM based on the Pensions & Investments Top Money Managers list published on May 31, 2021. This ranking represents assets managed by PFI as of Dec. 31, 2020.

Bloomberg U.S. Aggregate Bond Index represents securities that are SEC-registered, taxable, and U.S.-dollar-denominated. It covers the U.S. investment-grade, fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment grade, fixed rate, taxable corporate bond market. Credit Suisse Leveraged Loan Index represents the investable universe of the USD-denominated leveraged loan market. Investors cannot directly invest in an index. There is no guarantee that these forecasts will be accurate. Investing involves risks. Some investments are riskier than others. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost.

© 2022 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Morningstar category definitions included in disclosures. Bloomberg®, Bloomberg U.S. Aggregate Bond Index, and Bloomberg U.S. Corporate High Yield Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by PGIM Investments. Bloomberg is not affiliated with PGIM Investments, and Bloomberg does not approve, endorse, review, or recommend PGIM Investments products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to PGIM Investments products.

Consider a fund’s investment objectives, risks, charges, and expenses carefully before investing. The prospectus and summary prospectus contain this and other information about the fund. Contact your financial professional for a prospectus and summary prospectus. Read them carefully before investing.

Past performance is not a guarantee or a reliable indicator of future results.

Investing in mutual funds involves risks. Some mutual funds have more risk than others. The investment return and principal value will fluctuate and shares when sold may be worth more or less than the original cost and it is possible to lose money. Diversification and asset allocation do not assure a profit or protect against loss in declining markets. There is no guarantee that a Fund’s objectives will be achieved. The risks associated with each fund are explained more fully in each fund’s respective prospectus.

Fixed income investments are subject to credit, market, and interest rate risks (including duration risk and prepayment risk), and their value will decline as interest rates rise; call and redemption risk, where the issuer may call a bond held by the Fund for redemption before it matures and the Fund may lose income; liquidity risk, which exists when particular investments are difficult to sell; and emerging markets risk, which exposes the Fund to greater volatility and price declines.

Funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company. PGIM Fixed Income is an affiliate of PGIM. © 2022 Prudential Financial, Inc. and its related entities. The PGIM logo is a service mark of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

Investment products are not insured by the FDIC or any federal government agency, may lose value, and are not a deposit of or guaranteed by any bank or any bank affiliate.

1059944-00001-00

View source version on businesswire.com: https://www.businesswire.com/news/home/20220524005350/en/