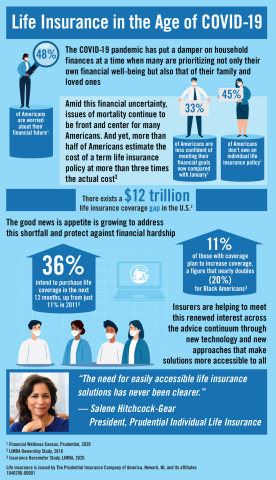

Nearly half of Americans (45%) surveyed during the COVID-19 pandemic said they do not own an individual life insurance policy and a similar amount (48%) said they are concerned about their financial future, according to Prudential’s latest Financial Wellness Census. The pandemic environment has put mortality and financial wellness into sharp focus, and accelerated the need for simple, digital options for buying financial products, including life insurance.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200916005299/en/

“As we continue social distancing, it’s more important than ever to find ways for people to buy life insurance the way they want, whether online, over the phone talking to an advisor, or a hybrid of both methods,” said Salene Hitchcock-Gear, president, Prudential Individual Life Insurance. “To that end we are enabling a high-tech, right-touch approach.”

While interactions between consumers and financial professionals have been largely, if not entirely, virtual due to the pandemic, the good news is trust in the insurance industry is at an all-time high, according to LIMRA research,[1] as an increasing number of consumers seek life insurance coverage.

Even as COVID-19 continues to keep the question of mortality front and center, a record number of Americans—36%—are saying they intend to purchase life coverage in the next 12 months, according to LIMRA. By comparison, in 2011, the figure clocked in at just 11%. Further, there is interest even among those with a life insurance policy to increase their coverage.

“We’ve seen a surge in awareness about the importance of life insurance as 11% of the general population has expressed interest in expanding their life insurance coverage since the onset of the pandemic,” said Hitchcock-Gear. “In addition, this figure nearly doubles for Black Americans, and we know COVID-19 has disproportionately affected this population in many ways. We are focusing on how to bring needed solutions to people in this time of uncertainty.”

This increased consumer interest presents the potential to reverse a decade-long decline in life insurance ownership, which has decreased by 10% since 2011, according to LIMRA’s research. Turning intention into action, however, requires innovation in the form of more easily accessible life insurance options.

Already, the pandemic has increased interest in Prudential’s e-capabilities, which aim to make life insurance more accessible to more people. For example, accelerated underwriting and digital application processing are being adopted more quickly than previously anticipated.

With 10% of Americans losing employer-provided life insurance coverage as a result of the pandemic, according to Prudential’s 2020 Financial Wellness Census, more people are left unprotected, increasing the existing $12 trillion gap in household life insurance need.2

Rather than charting a new course for Prudential, COVID-19 has instead accelerated the company’s ongoing work to implement innovative technology and platforms to meet this growing consumer need. The pandemic’s disparate impact on Black Americans and communities of color has also sharpened Prudential’s focus on addressing the financial needs of those populations.

“The need for easily accessible life insurance solutions has never been clearer,” said Hitchcock-Gear. “Black consumers in particular, with $1.3 trillion in buying power and a demonstrated interest in life insurance represent a significant area of focus for us. We are doubling down on our efforts to serve the needs of this population and millions of others across the country as we look to increase our ability to reach more people.”

About Prudential Financial

Prudential Financial, Inc. (NYSE: PRU), a financial wellness leader and premier active global investment manager, has operations in the United States, Asia, Europe and Latin America. Prudential’s diverse and talented employees are committed to helping individual and institutional customers grow and protect their wealth through a variety of products and services, including life insurance, annuities, retirement-related services, mutual funds and investment management. In the U.S., Prudential’s iconic Rock symbol has stood for strength, stability, expertise and innovation for more than a century. For more information, please visit news.prudential.com.

[1] LIMRA’s 2020 Insurance Barometer study.

22016 LIMRA Ownership Study

Life insurance is issued by The Prudential Insurance Company of America, Newark, NJ, and its affiliates

1040179-00001-00

View source version on businesswire.com: https://www.businesswire.com/news/home/20200916005299/en/