Highlights Strategy to Create Long-Term Value for Stockholders

Cautions that Icahn's Slate Facilitates Icahn's Attempts to Take Over Southwest Gas Without Paying an Appropriate Control Premium

LAS VEGAS, March 28, 2022 /PRNewswire/ -- Southwest Gas Holdings, Inc. (NYSE: SWX) ("Southwest Gas" or the "Company") today announced it is mailing a letter to its stockholders in connection with its upcoming Annual Meeting of Stockholders (the "Annual Meeting"), scheduled for May 12, 2022.

The letter highlights that stockholders should vote FOR ALL the Board's nominees on the WHITE proxy card in order to benefit from the transformation of Southwest Gas and the value unlocked by the spin-off of Centuri, noting that:

- The stakes are high – Mr. Icahn has made clear that the Icahn control slate has been assembled solely to facilitate Mr. Icahn's efforts to take control of the Company without paying an appropriate control premium to Southwest Gas stockholders. In addition, Mr. Icahn continues to advocate for his participation in the permanent financing of MountainWest (formerly Questar Pipelines), which is yet another tactic to try to disrupt the operations of the Company and take control of the Company at the expense of other stockholders.

- The Southwest Gas Board is taking bold, decisive steps necessary to create value for stockholders. Under the leadership of the Southwest Gas Board of Directors and management, the Company has continued to grow both organically and through strategic acquisitions, which have positioned Southwest Gas and Centuri to be strong independent companies with industry-leading growth prospects.

- Value unlocked by the spin-off of Centuri belongs to ALL stockholders. Over the last four years, the Southwest Gas Board and management team have nearly doubled Centuri's revenue, while valuation multiples for utility infrastructure services peers have increased. Centuri can now thrive as an independent company that is scaled, diversified and able to freely deploy capital in pursuit of growth opportunities – ensuring Centuri is fully capable of competing with the biggest players in the space. As an independent company, Centuri is expected to trade at a multiple similar to premier infrastructure service peers.

- Southwest Gas will be well-positioned for continued growth as a fully regulated natural gas leader. Following the spin-off of Centuri, Southwest Gas will become a fully regulated natural gas business with enhanced value transparency through more direct comparability to pure-play industry peers. Southwest Gas stockholders' dividend will be maintained and stockholders should not expect any reduction in the overall dividend payment.

- Mr. Icahn openly admits that the value of Southwest Gas is substantially greater than the value of his $82.50 tender offer. In his recent open letter to stockholders, Mr. Icahn publicly stated that he believes "SWX could be worth in a range of $110-$150 per share."

Southwest Gas' proxy materials are currently in the process of being mailed to stockholders. The Board strongly recommends that stockholders vote "FOR ALL" its director nominees on the WHITE proxy card promptly upon receipt. The proxy materials and other information regarding the Board of Directors' recommendation for the 2022 Annual Meeting can also be found at www.SWXBuildingValue.com.

Stockholders who have questions or who need help voting their shares may call the Company's proxy solicitor, Innisfree M&A Incorporated, at 1 (877) 825-8621 (toll-free from the U.S. and Canada) or +1 (412) 232-3651 (from other countries).

The full text of the letter being mailed to stockholders follows:

Vote the WHITE Proxy Card to Unlock the Value of Southwest Gas

March 28, 2022

Dear Fellow Stockholder,

We are writing to you today regarding the upcoming 2022 Annual Meeting of Stockholders of Southwest Gas Holdings, Inc. ("Southwest Gas"), which will be held on May 12, 2022.

As you may know, one of our stockholders, Carl Icahn, launched a two-pronged campaign to take control of your Company — he commenced a tender offer and began a proxy fight to replace the entire Southwest Gas Board of Directors (the "Board") with his own slate of 10 candidates for election to the Board (the "Icahn control slate").

Your Board unanimously rejected Mr. Icahn's inadequate, structurally coercive and highly conditional tender offer to acquire the outstanding shares of the Company for $82.50 per share. This follows the Board's previous rejection of Mr. Icahn's unsolicited tender offer for $75 per share prior to the announcement of our decision to separate Centuri as a standalone independent company.

The stakes are high — Mr. Icahn has made clear that his slate of director candidates has been assembled solely to facilitate his efforts to take control of the Company without paying an appropriate control premium to Southwest Gas stockholders. In fact, Mr. Icahn publicly stated, "at the very least, a majority of the Board needs to change in order to allow for the tender offer to be completed".

Mr. Icahn openly admits that more value than his $82.50 tender offer is available to Southwest Gas stockholders. In his recent open letter to stockholders, Mr. Icahn publicly stated that he believes "SWX could be worth in a range of $110-$150 per share". By his own admission, Mr. Icahn's offer significantly undervalues our Company and fails to compensate Southwest Gas stockholders fairly for the upside potential inherent in your share ownership.

Mr. Icahn continues to advocate for his participation in the permanent financing of MountainWest (formerly Questar Pipelines), which we believe is yet another tactic to try to disrupt the operations of the Company and take control of the Company at the expense of other stockholders. While he says there are no preconditions and claims that the financing and the tender offer are unrelated, the fact is that he is legally prohibited from purchasing shares from the Company while he has a pending tender offer. This is just another tactic of Mr. Icahn's of making illusory "commitments" that he is legally prohibited from effecting. Nonetheless, even if Mr. Icahn was able to participate in an equity financing, it would only increase his ownership in your Company and transfer even more of the value inherent in the Company from other stockholders to Mr. Icahn. The financing would put Mr. Icahn one step closer to acquiring Southwest Gas at an inadequate price. Despite our outreach, Mr. Icahn has declined to propose any real concrete terms related to his financing proposal and stated that he is only willing to provide the financing if his tender offer closes first.

Put simply, your Board and management team believe that the value inherent in your Company belongs to all stockholders, not only Mr. Icahn.

We urge you to protect the value of your investment in Southwest Gas and retain your ability to participate in the upside from our value creation plans. Don't let Mr. Icahn benefit at your expense—use the WHITE proxy card to vote FOR ALL of Southwest Gas' highly qualified directors TODAY.

YOUR BOARD IS TAKING BOLD, DECISIVE STEPS TO CREATE VALUE FOR STOCKHOLDERS AND POSITION SOUTHWEST GAS FOR ENHANCED SUCCESS

We are confident that now is the right time to unlock the significant value we have built by separating Centuri, a rapidly growing unregulated utility services platform, and Southwest Gas, a fully regulated natural gas business, into two independent companies.

Under your Board and management team, Southwest Gas has continued to grow both organically and through strategic acquisitions. These actions have positioned both Southwest Gas and Centuri to be strong independent companies with bright futures and solid growth prospects.

- Our 2021 acquisitions of MountainWest and Riggs Distler added the scale and capabilities necessary for our regulated and unregulated businesses to be strong independent companies.

- Separating Centuri via a spin-off that we anticipate to be tax-free for U.S. federal income tax purposes will unlock the value of an infrastructure services leader that we have methodically built over the last 25+ years.

Execution on this strategy began long before Mr. Icahn initiated his campaign to take control of Southwest Gas, and Mr. Icahn's actions threaten to disrupt this thoughtfully developed strategy and the execution we are ready to complete.

We expect the spin-off of Centuri to create significant financial benefits for both our regulated and unregulated businesses including:

- Unlocking value for stockholders and enhancing value transparency through more direct comparability to pure-play industry peers;

- Flexibility to meaningfully reduce future equity financing needs, including with respect to MountainWest;

- Compelling financial profiles that more accurately reflect the strengths and opportunities of each business, and as a result, enable them to more efficiently finance themselves while providing a targeted investment opportunity for stockholders;

- Improved capital allocation efficiency and strategic flexibility based on the specific initiatives and objectives of each business; and

- Distinct and expanding market opportunities and specific customer bases with enhanced potential for customer base expansion and organic growth.

THE VALUE UNLOCKED BY THE SPIN-OFF OF CENTURI BELONGS TO ALL STOCKHOLDERS

Over the last four years, your Board and management team have nearly doubled Centuri's revenue, while valuation multiples for utility infrastructure services peers have increased. We have long recognized that a separation in some form could be the best way to unlock Centuri's value, while at the same time we understood that a premature separation could shortchange stockholders of the tremendous value embedded in this business. Centuri can now thrive as an independent company that is scaled, diversified and able to freely deploy capital in pursuit of growth opportunities – ensuring Centuri is fully capable of competing with the biggest players in the space.

Centuri's attractive customer base, consisting of investment grade regulated utilities, and its track record of significant EBITDA growth, position Centuri as a strong standalone company expected to achieve a premium valuation among its industry peer set. As an independent company, we expect Centuri to trade at a multiple similar to premier infrastructure service peers.

How we expect this to occur… We currently expect the foundation of the separation structure to be a tax-free spin-off in which stockholders would receive a prorated dividend of Centuri shares. We expect the spin-off of Centuri will take place within 9 to 12 months from the announcement of the separation on March 1, 2022 with a goal of maximizing value for Southwest Gas stockholders.

SOUTHWEST GAS WILL BE WELL-POSITIONED FOR CONTINUED GROWTH AS A FULLY REGULATED NATURAL GAS LEADER

Following the spin-off, Southwest Gas will become a fully regulated natural gas business with enhanced value transparency through more direct comparability to pure-play industry peers…The spin-off will enable us to further optimize our regulated business, balance sheet and capital allocation strategy to enhance stockholder value.

… and will pay an attractive dividend. Until the spin-off, Southwest Gas intends to continue its dividend program at a payout ratio of 55% - 65% of consolidated earnings per share, with a plan to increase the payout ratio to at least levels competitive with pure-play utilities following the spin-off. The dividend will be maintained pursuant to this payout ratio and Southwest Gas stockholders should not expect any reduction in the overall dividend payment.

Southwest Gas has strong and collaborative relationships with our regulators, which contributed to near record growth in revenues and rate base in 2021. This followed a successful 2020, where the Company received constructive rate case outcomes in all three jurisdictions – Arizona, California and Nevada – that resulted in an increase in rate base of over $1 billion as well as approval of new supportive regulatory mechanisms.

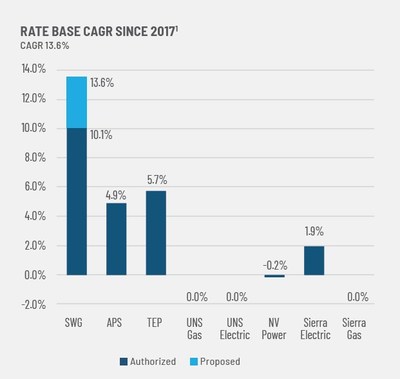

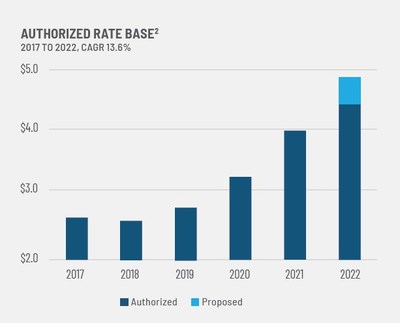

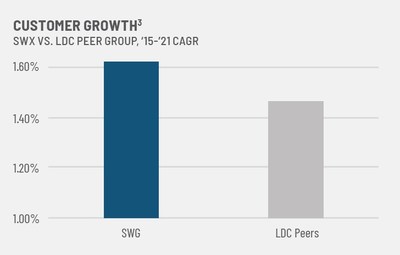

Since 2017, Southwest Gas' rate base growth is nearly double its peers, demonstrating the tremendous growth in our markets, the quality of the territories we service and the successful relationships we have with our regulators. Over the coming years, our stockholders will benefit from capital investments made over the last five years. While there is regulatory lag between investments made and approvals of rate base, the returns will be there, as 2021 growth showed.

We continue to work with all stakeholders to make targeted investments across our service territories and this approach delivered a 79% increase in rate base since 2016. In comparison, other peers, specifically NW Natural and ONE Gas, have increased rate base by ~38% and ~44%, respectively, over the same period. Our rate base growth is grounded in constructive rate case outcomes and supportive regulatory mechanisms. Further, we still have another significant rate case pending and, depending on the ultimate outcome, our rate base could increase to nearly $5 billion.

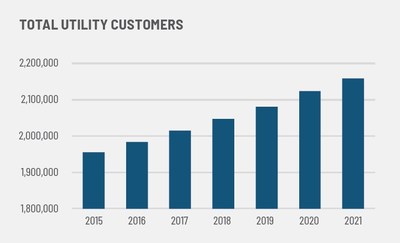

As we continue to grow Southwest Gas' customer base and rate base, stockholders can expect significant net income and EBITDA growth.

This increase in rate base is the direct result of strategic investments we made to enhance the safety and reliability of our distribution system and to meet the significant growth we continue to experience in our attractive service territories. While these investments impact financial performance when made due to the historical test period jurisdictions in which we serve, they are critical to the significant growth we are experiencing today and necessary to serve our growing customer base.

MOUNTAINWEST ACQUISITION COMPLEMENTS SWX UTILITY OPERATIONS, PROVIDING FLEXIBILITY, DIVERSIFICATION AND STABILITY

Our recent acquisition of MountainWest, which operates more than 2,000 miles of highly contracted, FERC-regulated interstate natural gas pipelines, provides a complementary and compelling suite of high-return assets that is expected to drive value by supporting dividend growth and accretion to cash flow and earnings in 2022.

MountainWest significantly broadens the Company's flexibility to source and allocate growth capital. More than 90% of MountainWest's revenue is contracted and over 70% of revenues are backed by investment grade customers. In addition, MountainWest provides improved rate base and regulatory diversification, as well as strong, stable cash flows. The addition of Mountain West reduces our reliance on capital markets for the significant capital investment required by Southwest Gas' continued local distribution company growth.

MountainWest also positions Southwest Gas to deliver on numerous attractive opportunities in the energy transition with renewable natural gas, responsibly sourced natural gas, hydrogen and CO2 transportation. We have identified numerous opportunities to enhance the value of the MountainWest assets and to foster company growth. For instance, we are seeking to reduce the carbon footprint, in the near term with coal-to-gas power conversion opportunities. In addition, there are several projects under consideration within our service area with potential in-service dates of late 2022 to late 2023.

SOUTHWEST GAS' HIGHLY QUALIFIED AND ENGAGED BOARD IS OVERSEEING A GROWTH STRATEGY TO DRIVE SUSTAINABLE STOCKHOLDER VALUE

Your Board has been thoughtfully and strategically curated, with veteran utility leaders that bring significant regulatory expertise, as well as business leaders that work and live in our service territories. Having leaders from the communities in which we operate is important for our regulators, particularly our state commissioners. Under your Board's oversight, we have created a company that is poised for further value creation across each of its businesses and the Company as a whole, and we are confident that we have the right team to take us into the future.

As part of our ongoing commitment to good corporate governance and ongoing Board refreshment, we continue to recruit strong directors to your Board.

- In 2019, we appointed Jane Lewis-Raymond and Leslie T. Thornton, two veterans of successful utilities who bring decades of experience to your Board and strengthen our culture and commitment to safety, growth and sustainability.

- In May 2021, Ms. Lewis-Raymond became the Chair of the Compensation Committee.

- On January 1, 2022, we had the pleasure of welcoming two new, independent and highly qualified directors, E. Renae Conley and Carlos Ruisanchez, who bring further diversity, proven industry experience and financial and operational expertise to your Board.

With these appointments, the Board added four independent directors since 2019. We also appointed a new independent Chairman, effective at the Company's 2022 Annual Meeting of Stockholders.

Your newly refreshed Board is made up of 10 diverse and experienced professionals, nine of whom are independent, and whom collectively bring decades of diverse industry experience and expertise in key areas including strategy, operations, finance, cyber, ESG, capital market transactions and legal/regulatory matters. With significant experience in the industries that matter most to our business, the Southwest Gas directors bring a variety of important skills and perspectives to the boardroom and have delivered impressive growth in both of the Company's business segments while overseeing a constructive and supportive relationship with our regulators.

Your Board has been deeply engaged on the key strategic issues facing the Company and has been tirelessly focused on the drivers of stockholder value. This Board will continue to drive business growth, champion transactions like the Centuri spin-off and optimize your stockholder value.

PROTECT THE VALUE OF YOUR SOUTHWEST GAS INVESTMENT: VOTE THE WHITE PROXY CARD TODAY

Your Board is open-minded with respect to value creation opportunities and will continue to take the actions that it believes are in the best interest of Southwest Gas and all stockholders.

This is a critical moment for Southwest Gas and your investment in the Company. We are confident that the forthcoming spin-off of Centuri and the execution of our strategic plans will deliver significantly greater value than Mr. Icahn's $82.50 offer, which as we have reiterated consistently, is inadequate, structurally coercive and highly conditional.

On behalf of your Board and the management team, thank you for your continued support.

Sincerely,

/s/ Michael J. Melarkey | /s/ Robert L. Boughner |

Michael J. Melarkey | Robert L. Boughner |

Chairman | Incoming Chairman |

YOUR VOTE IS IMPORTANT! |

Simply follow the easy instructions on the enclosed WHITE proxy card to vote by telephone, by internet or by signing, dating and returning the WHITE proxy card in the postage-paid envelope provided. If you received this letter by email, you may also vote by pressing the WHITE "VOTE NOW" button in the accompanying email. |

Remember--please do not vote using any gold proxy card you may receive from Mr. Icahn—even as a "protest vote." Any vote on the gold proxy card will revoke your prior vote on a WHITE proxy card, and only your latest-dated proxy counts. |

It you have questions about how to vote your shares, please call the firm assisting us with the solicitation of proxies, Innisfree M&A Incorporated, at: |

1 (877) 825-8621 (toll-free from the U.S. and Canada) |

or |

+1 (412) 232-3651 (from other locations) |

In a separate press release issued today, the Company announced the Board unanimously determined that the revised tender offer from an affiliate of Carl Icahn to acquire any and all outstanding common shares of the Company for $82.50 per share in cash is inadequate, structurally coercive, highly conditional, undervalues the Company, and is not in the best interests of all of its stockholders.

Lazard is serving as financial advisor to Southwest Gas and Morrison & Foerster LLP and Cravath, Swaine & Moore LLP are serving as legal advisors.

About Southwest Gas Holdings, Inc.

Southwest Gas Holdings, Inc., through its subsidiaries, engages in the business of purchasing, distributing and transporting natural gas, and providing comprehensive utility infrastructure services across North America. Southwest Gas Corporation, a wholly owned subsidiary, safely and reliably delivers natural gas to over two million customers in Arizona, California and Nevada. The Company's MountainWest subsidiary provides natural gas storage and interstate pipeline services within the Rocky Mountain region. Centuri Group, Inc., a wholly owned subsidiary, is a strategic infrastructure services company that partners with regulated utilities to build and maintain the energy network that powers millions of homes and businesses across the United States and Canada.

How to Find Further Information

This communication does not constitute a solicitation of any vote or approval in connection with the 2022 annual meeting of stockholders of Southwest Gas Holdings, Inc. (the "Company") (the "Annual Meeting"). In connection with the Annual Meeting, the Company has filed a definitive proxy statement with the U.S. Securities and Exchange Commission ("SEC"), which the Company has furnished to its stockholders in connection with the Annual Meeting. The Company may furnish additional materials in connection with the Annual Meeting. BEFORE MAKING ANY VOTING DECISION, WE URGE STOCKHOLDERS TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND WHITE PROXY CARD AND OTHER DOCUMENTS WHEN SUCH INFORMATION IS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE ANNUAL MEETING. The proposals for the Annual Meeting are being made solely through the definitive proxy statement. In addition, a copy of the definitive proxy statement may be obtained free of charge from www.swgasholdings.com/proxymaterials. Security holders also may obtain, free of charge, copies of the proxy statement and any other documents filed by Company with the SEC in connection with the Annual Meeting at the SEC's website at http://www.sec.gov, and at the companies' website at www.swgasholdings.com.

Important Information for Investors and Stockholders: This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. In response to the tender offer for the shares of the Company commenced by IEP Utility Holdings LLC and Icahn Enterprises Holdings L.P., the Company has filed a solicitation/recommendation statement on Schedule 14D-9 with the SEC. INVESTORS AND STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS ARE URGED TO READ THE SOLICITATION/RECOMMENDATION STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a free copy of these documents free of charge at the SEC's website at www.sec.gov, and at the Company's website at www.swgasholdings.com. In addition, copies of these materials may be requested from the Company's information agent, Innisfree M&A Incorporated, toll-free at (877) 825-8621.

Forward-Looking Statements: This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include, without limitation, statements regarding Southwest Gas Holdings, Inc. (the "Company") and the Company's expectations or intentions regarding the future. These forward-looking statements can often be identified by the use of words such as "will", "predict", "continue", "forecast", "expect", "believe", "anticipate", "outlook", "could", "target", "project", "intend", "plan", "seek", "estimate", "should", "may" and "assume", as well as variations of such words and similar expressions referring to the future, and include (without limitation) statements regarding expectations with respect to a separation of Centuri, the future performance of Centuri, Southwest Gas's dividend ratios and Southwest Gas's future performance. A number of important factors affecting the business and financial results of the Company could cause actual results to differ materially from those stated in the forward-looking statements. These factors include, but are not limited to, the timing and amount of rate relief, changes in rate design, customer growth rates, the effects of regulation/deregulation, tax reform and related regulatory decisions, the impacts of construction activity at Centuri, whether we will separate Centuri within the anticipated timeframe and the impact to our results of operations and financial position from the separation, the potential for, and the impact of, a credit rating downgrade, the costs to integrate MountainWest, future earnings trends, inflation, sufficiency of labor markets and similar resources, seasonal patterns, the cost and management attention of ongoing litigation that the Company is currently engaged in, the effects of the pending tender offer and proxy contest brought by Carl Icahn and his affiliates, and the impacts of stock market volatility. In addition, the Company can provide no assurance that its discussions about future operating margin, operating income, COLI earnings, interest expense, and capital expenditures of the natural gas distribution segment will occur. Likewise, the Company can provide no assurance that discussions regarding utility infrastructure services segment revenues, EBITDA as a percentage of revenue, and interest expense will transpire, nor assurance regarding acquisitions or their impacts, including management's plans or expectations related thereto, including with regard to Riggs Distler or MountainWest. Factors that could cause actual results to differ also include (without limitation) those discussed under the heading "Risk Factors" in the Company's most recent Annual Report on Form 10-K and in the Company's and Southwest Gas Corporation's current and periodic reports, including our Quarterly Reports on Form 10-Q, filed from time to time with the SEC. The statements in this press release are made as of the date of this press release, even if subsequently made available by the Company on its Web site or otherwise. The Company does not assume any obligation to update the forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments, or otherwise.

Participants in the Solicitation: The directors and officers of the Company may be deemed to be participants in the solicitation of proxies in connection with the Annual Meeting. Information regarding the Company's directors and officers and their respective interests in the Company by security holdings or otherwise is available in its most recent Annual Report on Form 10-K filed with the SEC and the recent definitive Proxy Statement on Schedule 14A filed with the SEC in connection with the Annual Meeting. Additional information regarding the interests of such potential participants is included in the proxy statement for the Annual Meeting and other relevant materials to be filed with the SEC.

Contacts

For investor information, contact: Boyd Nelson, (702) 876-7237, boyd.nelson@swgas.com; or Innisfree M&A Incorporated, Scott Winter/Jennifer Shotwell/Jon Salzberger, (212) 750-5833.

For media information, contact: Sean Corbett, (702) 876-7219, sean.corbett@swgas.com; or

Joele Frank, Wilkinson Brimmer Katcher, Dan Katcher / Tim Lynch, (212) 355-4449.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/southwest-gas-mails-letter-to-stockholders-reiterating-value-unlocked-by-spin-off-of-centuri-and-urging-stockholders-to-vote-the-white-proxy-card-for-all-of-southwest-gas-highly-qualified-directors-301511549.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/southwest-gas-mails-letter-to-stockholders-reiterating-value-unlocked-by-spin-off-of-centuri-and-urging-stockholders-to-vote-the-white-proxy-card-for-all-of-southwest-gas-highly-qualified-directors-301511549.html

SOURCE Southwest Gas Holdings, Inc.