The business model of American telecom operators is exactly the same as that of their European counterparts. Yet the capitalizations of European telecom groups have been stagnating at the same levels for nearly ten years, while the stock market rise of American telecoms has not decelerated over the same time horizon. The main reason for this difference in performance lies in market structures.

European telecoms such as Deutsche Telekom, Orange or Telefonica operate in an extremely competitive sector. With just over 40 major telecom operators in Europe, with no real differentiation possible, the market is akin to pure and perfect competition. By extension, operators are price takers. In other words, they have no pricing power and will simply adopt the market price. Thus, margins are often low and no economic profit (ROIC>WACC) can be created. The absence of value creation - higher than the required dividend yield by the shareholders - explains the sluggish stock market performance of these companies over the last ten years.

In the United States, while the market is of equivalent size, there are only three major operators. As explained in the introduction, the US telecoms market has gone through a consolidation phase that Europe has not yet experienced. This stage is very important in an industrial cycle, as it allows the weakest companies to be bought out by the strongest and most efficient ones, or even to be forced to close down, thus handing over their market share to the competition.

.

In Europe, the European Commission prevents this consolidation of the sector, not wishing to create a European telecommunications triopoly as is the case in the United States. This decision explains the current structure of the European market, a structure that is extremely beneficial to consumers who see prices remain relatively low. However, this barrier to the free market also has its limits. Without value creation, the large investments needed to upgrade the network to 5G cannot be made, because the profitability is too low without a possible increase in profitability, which would be achieved by raising prices. Is it really a decision that will benefit customers in the long term to artificially maintain a highly competitive market? The question deserves to be asked.

In any case, European operators have launched a crusade to make Brussels bend and thus allow mergers and acquisitions that were previously systematically rejected by the European Competition Authority. The objective: to consolidate the sector, increase prices and thus have sufficient profitability to invest. Starting with the deployment of 5G, which has fallen seriously behind other regions of the world.

Acquisition Mania

To come back to our main subject, it was to overcome these structural difficulties and to gain access to the most lucrative telecom market in the world that Deutsche Telekom entered the USA. The gamble, risky and daring for the time, really took shape after the 2001 acquisition of VoiceStream Wireless Corporation, later renamed T-Mobile. A decade later, in 2013, and after resisting the numerous assaults of AT&T, which wanted to buy them, T-Mobile merged with MetroPCS Communications, then the sixth largest American operator. The group was listed on the stock exchange in the same year and in 2020, a new key step took place: T-Mobile merged with Sprint, the fourth largest American operator.

Shareholding

To date, Deutsche Telekom controls 49% of T-Mobile's capital. SoftBank, which entered the capital at the time of the T-Mobile - Sprint merger, has largely sold its stake, which now amounts to only 3% in the American subsidiary of Deutsche Telekom. The rest of the shareholding remains very institutional and fragmented.

This shareholding is clearly the jewel in the crown of Deutsche Telekom, which thanks to it, performs better than most other European operators. In twenty years, T-Mobile has amassed 110 million customers, becoming the third largest telecommunications operator after Verizon and AT&T. A performance that pays off when you own 49% of the entity.

Moreover, as the European sector is not very dynamic for the moment, Deutsche Telekom intends to focus on this hyper-strategic asset. The German group is not hesitating to free up resources by selling certain subsidiaries such as T-Mobile Netherlands, or the controlling stake in its infrastructure network towers to a consortium led by Brookfield.

Valuation

The current price of $152 per share, the group's market capitalization is $189 billion, while its enterprise value is close to $295 billion.

First observation: if we compare T-Mobile with a European peer such as Orange, its revenue is exactly twice as high, but its enterprise value is almost five times higher. In order to understand the reasons for this discrepancy, let's briefly compare it with Orange.

What do we see at Orange?

In terms of growth, Orange's revenues have hardly changed over the last cycle 2011-2021 - they have even decreased from €45bn to €42bn. Operating margins have decreased, and if earnings per share have increased, it is primarily due to an unusual interest rate environment and multiple low-cost financing arrangements that have lowered the interest expense. The same is true of cash flow, which has remained stable at around 10 billion euros per year. The problem comes from ever higher investments, which have doubled over the period. From approximately €4.5 billion to €8 billion per year. As a result, cash profit is severely compressed to between €1.5 and €2 billion per year. All of this profit is distributed as dividends. It is impossible, in this situation, to envisage a consolidation of the sector without a critical increase in debt. At the same time, a capital increase at these depressed prices would make shareholders cringe and would most likely push share prices down even further to keep the dividend yield decent. In short, at Orange, margins and profits are too low to both pay shareholders well and ensure the very expensive investments.

What about T-Mobile?

Over the 2011-2021 cycle, T-Mobile has increased its revenues by a factor of 4, largely due to the external growth operations detailed above. We note that margins have not suffered - a sign of successful integrations and healthier competitive dynamics in the US market - unlike the operating margins of Orange or Vodafone, which have been halved over the same period.

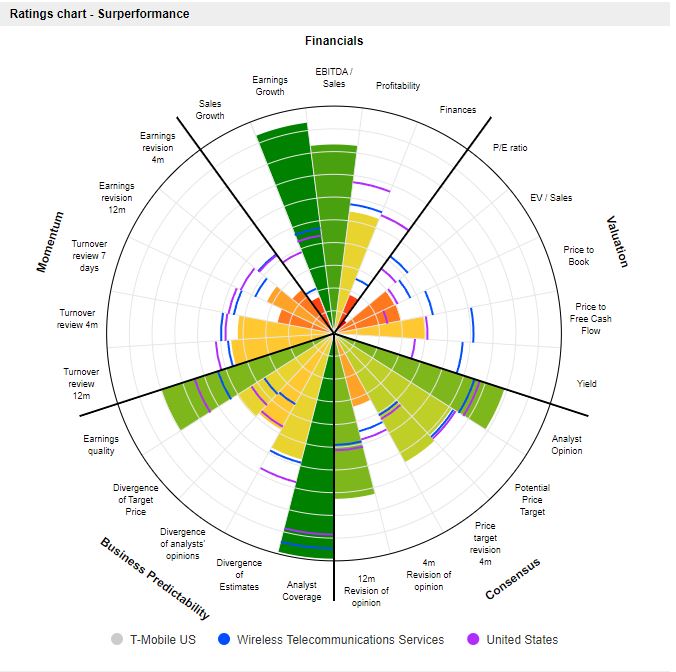

Beyond the figures, we can also note that the management of T-Mobile and therefore of Deutsche Telekom is more highly rated than that of Orange. Since the beginning of the American adventure, T-Mobile has shown an unparalleled timing of execution. A pioneer in this field, it entered the American market following the dot-com bubble in 2001. Then the acquisition of MetroPCS in 2013 took place in a globally depressed telecom market. Finally, the acquisition of Sprint was timely, as the American group was struggling with the complicated restructuring of its $40 billion debt. Add to all this an excellent network in the US and a lead on 5G compared to its competitors Verizon and AT&T, and you get a very good valuation.

To continue our analysis, we'll approach the stock from two distinct directions, one will be conservative and performance-based, another will be more optimistic and more projection-based

.

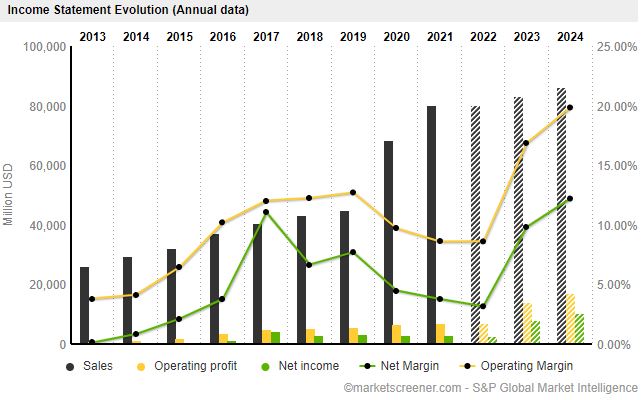

T-Mobile US Income Statement - MarketScreener

In terms of cash earnings, T-Mobile's situation is not that different from its European peers. Here too, capital intensity consumes all operating cash flow. This is why net debt has almost quadrupled in four years - $107 billion in the last half of 2022 compared to $30 billion at the end of 2018 - and this despite a $20 billion capital increase in 2020 when it merged with Sprint.

That said, one key difference exists compared to European operators: T-Mobile does not pay a dividend, preferring a strategy that is entirely focused on growth. This is very important to keep in mind since most telecoms today are considered by their shareholders as "dividend pigs". However, T-Mobile does not seem to want to take this path since it is stated in the group's investor relations that: "T-Mobile US does not have any plans to pay a dividend on its common stock at this time". It's hard to get much clearer than that.

By way of comparison, T-Mobile's two big American rivals, Verizon and AT&T, both cash flow positive, are in a much less pronounced growth pattern. Verizon's revenues have grown from $110 billion to $133 billion between 2011 and 2021, while AT&T's have increased from $127 billion to $169 billion. Price appreciation is also lower as fewer profitable investments are made, leading the groups to redistribute the majority of the results in the form of dividends.

In this market environment, with an unproven ability to generate cash profits and a PE of 110 at a price of $150 per share, investing in T-Mobile remains a risky bet. The growth potential in North America seems to have reached its limits and a market share war would not help anyone now that the sector is well consolidated. Still, T-Mobile, known for its exceptional deals, is not out of potential solutions. It is rumored in several specialized media that Deutsche Telekom could make a deal with Patrick Drahi - Altice. This could for example take the form of an "asset swap" consisting of T-Mobile recovering the mobile subscribers of Altice US against the participation of Deutsche Telekom in the capital of British Telecom (BT Plc). A company in which Patrick Drahi has been strengthening his stake for some time.

Optimistic case:

After this decade of insane growth, the time has finally come for T-Mobile's management to focus on the profitability of its operations and, by repercussion, "free up cash". This change in strategy is scheduled for this year. The management has transmitted its free cash flow projections:

2022: $7.5 billion 2023: $13 to $14 billion 2024: $17 billion

Of course, these are only management projections, but this explosion of profitability is a clear indication of the group's new strategic direction. The launch of a massive share buyback program of up to $60 billion over the next three years is also underway. In other words, all free cash flow should be returned to shareholders. At current prices, is this the best option or would a dividend payment be more interesting? It's hard to say without really knowing the management's intentions, but without further pronounced growth over the next few years, this would certainly look like an unequivocal destruction of value. So you have to believe that T-Mobile's growth is still far from peaking. This is why the most optimistic analysts are projecting a free cash flow per share of USD 15 to 20 within two years. This optimism is only half-hearted given the company's current valuation. Finally, the defensive nature and the strong pricing power of the US telecom industry are additional arguments. We have to believe that in 2022, some households will place their mobile subscription lower than their mortgage on their Maslow pyramid.

The execution of T-Mobile's operations has been remarkable over the last decade. The company's profile is original. The bet on growth is maintained in the face of competitors who are re-focusing on shareholder returns. The year 2022 marks the inflection of this strategy and the switch to a policy of return of capital. This will be done through optimization of the asset portfolio, share buybacks and additional synergies with Sprint. This remains a daring gamble, especially in a mature market, and already seems to be well taken by the market. We are therefore far from a contrarian bet. "

You pay a very high price for a cheery consensus" - W. Buffett

By

By