Today we are looking at a real curiosity of the coast. First of all, what is incredible about Texas Pacific Land is that it has been a special situation for more than a century. It was the second stock purchased by the then 13-14 year old Warren Buffett.

Texas Pacific Land was formed in 1888 following the bankruptcy of the Texas & Pacific Railroad. In the United States, railroad companies are also gigantic landowners. After the railroad was sold off, the surviving entity was to be used to monetize the Texas & Pacific Railroad's land holdings, which included both surface and subsurface lands (i.e., their mineral rights).

Source: Texas Pacific Land

At the time, these lands lost in the middle of Texas were not worth much. But at the end of the 19th century, the first prospectors began to discover oil in Texas. As a result, TPL's property values soared.

Texas Pacific Land 's articles of incorporation specified that the proceeds from land sales could only be used to buy back shares. When Warren Buffett - a legendary investor today, but just a curious teenager at the time - got involved, in the middle of the Second World War, the trust sold various pieces of land at unhoped-for prices and bought back its shares massively. The value of the estate increased, which is typically what Warren Buffett likes best: a rising value and a falling number of shares.

Source: Texas Pacific Land

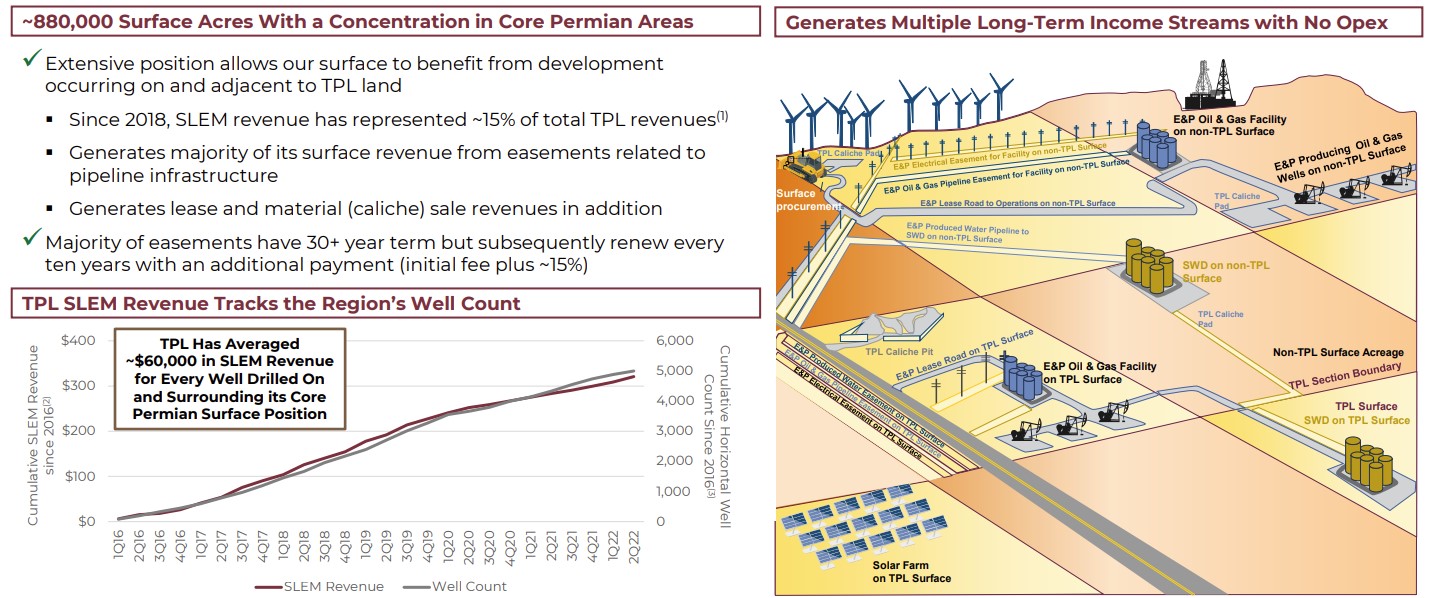

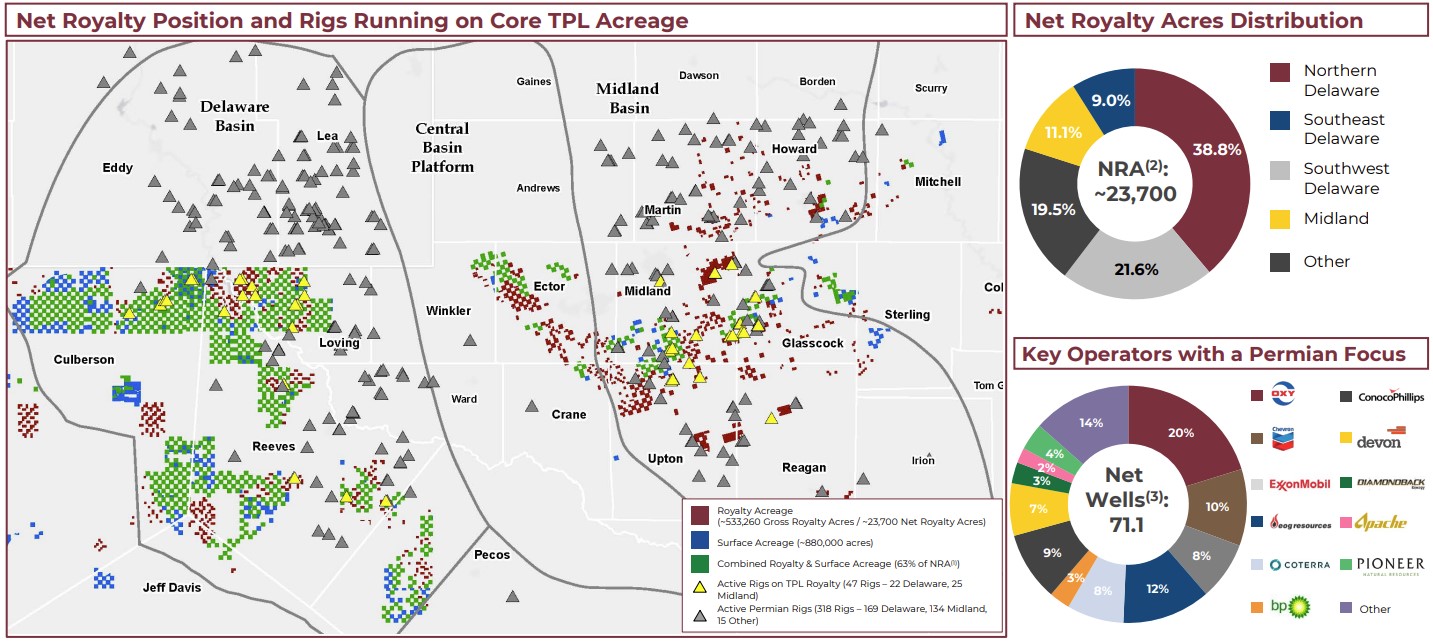

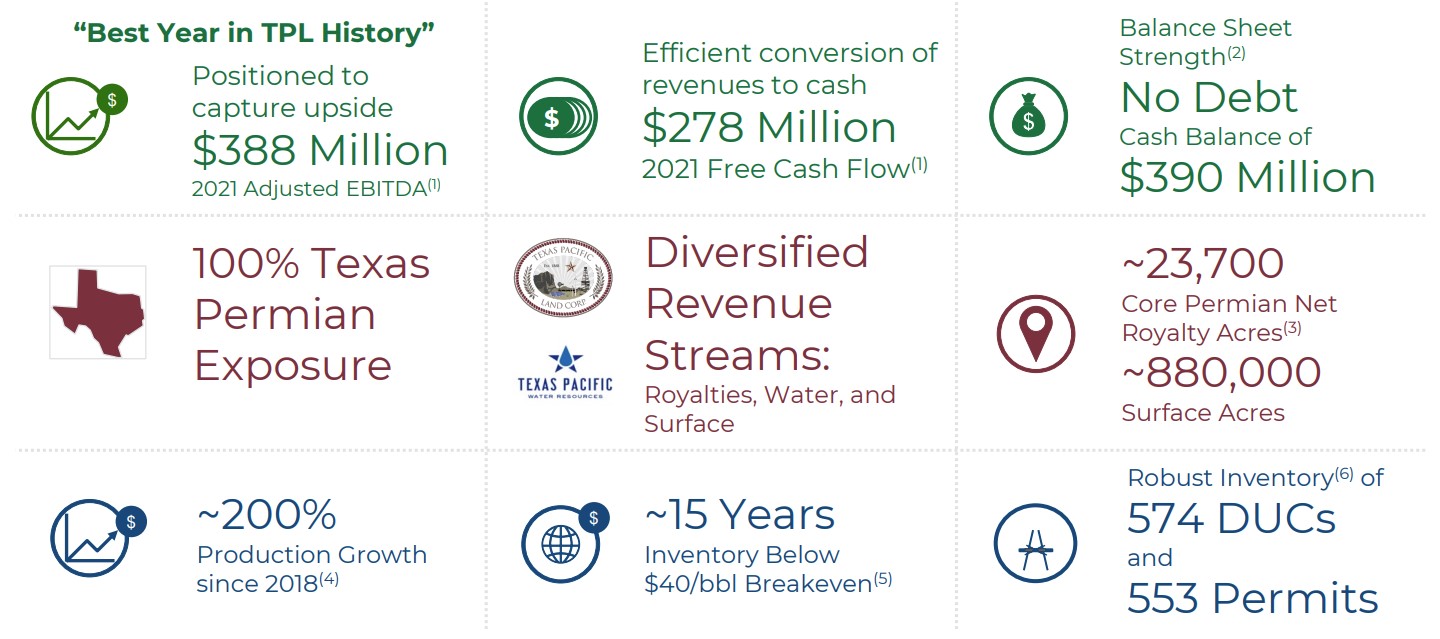

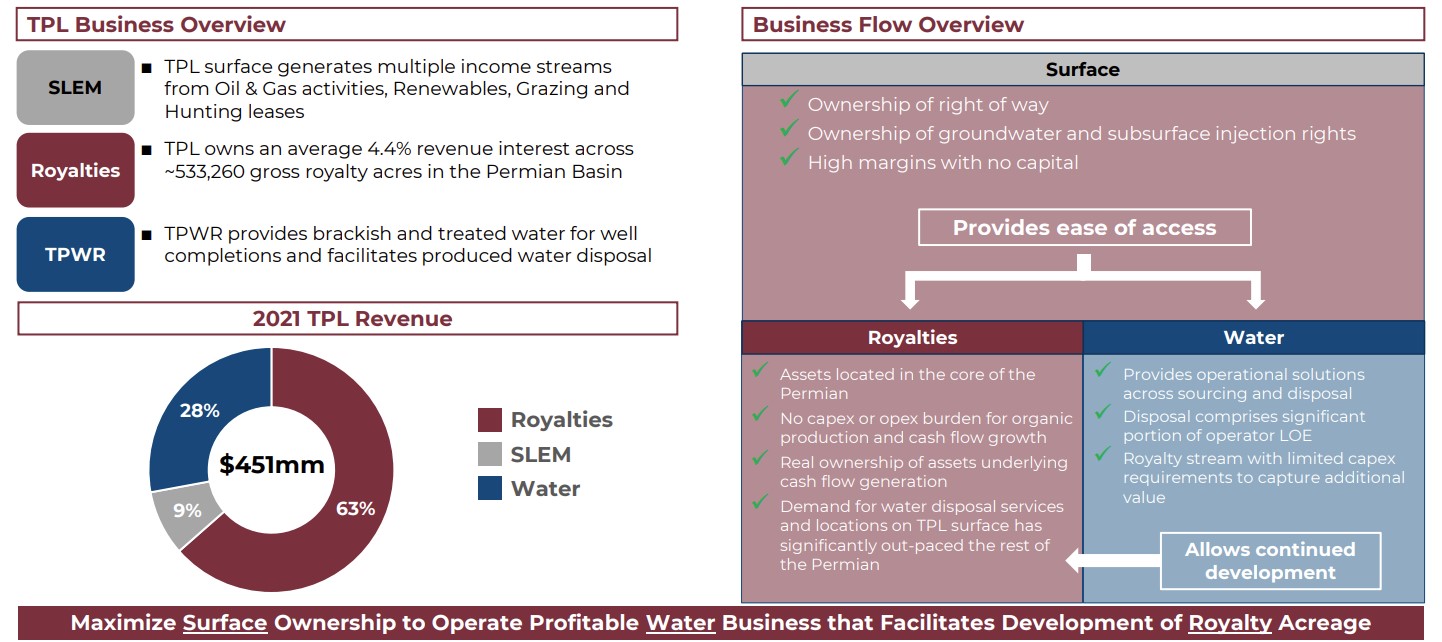

Today is 2022, and while the situation has changed significantly, the underlying premise remains the same. The company owns 880,000 acres of land in West Texas. 150 years later, Texas Pacific Land continues to monetize the incredible land holdings and associated mineral rights of the now defunct Texas & Pacific Railroad.

Source: Texas Pacific Land

But, there has been a bit of news: some of the proceeds from asset sales have been reinvested in the trust to develop new businesses, including water management and a royalty business.

Source: Texas Pacific Land

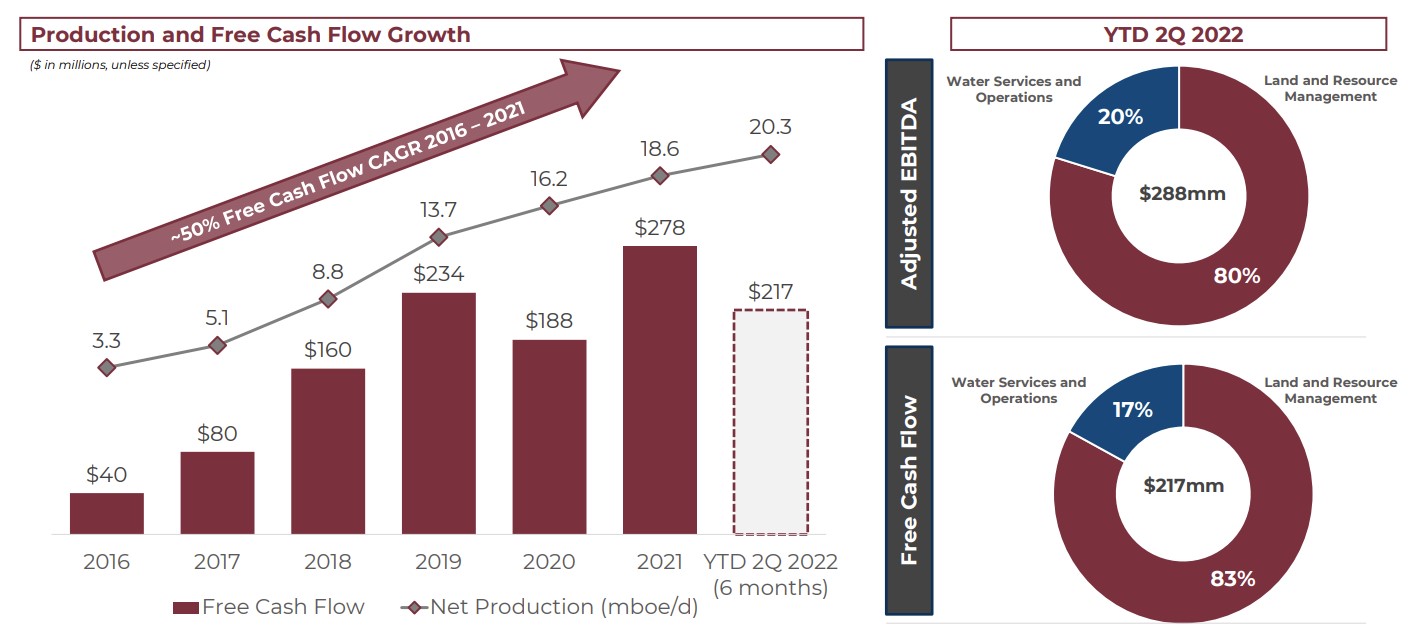

In the last decade or so, new oil extraction techniques such as horizontal drilling and hydraulic fracturing have made it much easier and more profitable to extract oil and gas in the Permian Basin. As a result, the value of its assets, primarily land, has risen sharply over the past decade.

The company now organizes its business model around four pillars. It charges its customers what is called a "surface access fee," a sort of customs duty to access their land. If you decide to build a drilling platform, you will have to pay a rent. For the record, 25% of the hydraulic fracturing rigs in the US are on Texas Pacific Land (TPL). In addition, they receive oil royalty fees, a percentage of the revenue generated on their land. Many large oil companies are their clients, such as Exxon Mobil or Chevron. Finally, their recent subsidiary created in 2017 allows them to sell water to producers, which is essential for hydraulic fracturing. One could even add as a fifth pillar the revenues generated by the purchase and resale of land, a way to speculate on land, very convenient when one knows the expertise of TPL on its land.

Source: Texas Pacific Land

Some experienced analysts have undertaken to value each of these parts - the famous "sum-of-the-parts" valuations - and have concluded that if these three elements were taken separately (the assets and liabilities), the value of the company would be reduced.If these three elements were taken separately (the land, the royalties and the water management activities), the valuation of the trust was significantly lower than the net value of its assets. Complex and certainly reserved for specialists, these models depend on a strong sensitivity to the price of oil, because of course the value of TPL's land is directly indexed to it, as well as the water management business, since the frackers are large consumers of water.

Basically, for more than a century, Texas Pacific Land has been a bet on hydrocarbon production in Texas without suffering the risk of exposure to a leveraged producer, as well as an interesting hedge against inflation. The trust's share price over the past decades proves that it was not a bad bet. And given the amount of assets still on the balance sheet, it could well be a repeat performance in the next century.

Source : Texas Pacific Land

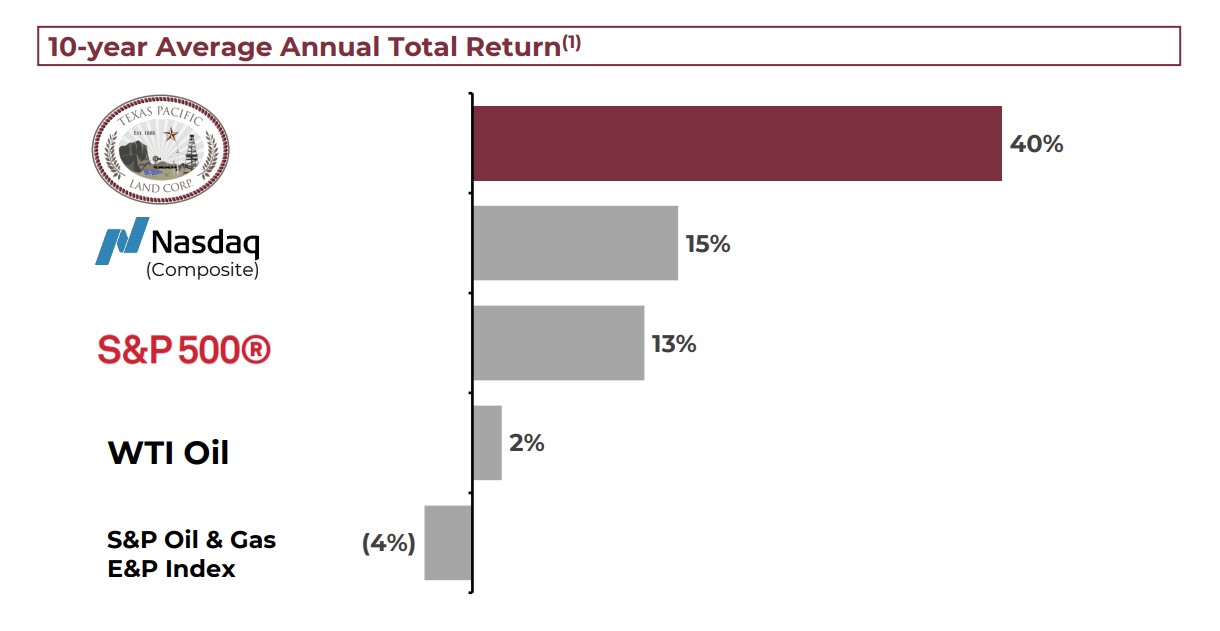

As a reminder, the company was worth less than a dollar in the early 70's, increased by 15 times in less than ten years to reach $15 before falling by 75% during the bear market of 1981-1982. It took 24 years for the stock to surpass its former highs of 1980, in 2004. From then on, the stock has made an exceptional run, going from $15 to $2,395 at the time of writing, which is a 160-bagger in less than 20 years and a 2,395-bagger since the early 1970s!

Source: MarketScreener

The situation has not escaped the attention of the famous investment fund Horizon Kinetics LLC, known for its original positions and its meticulous research work. The fund took a 25% stake a few years ago and undertook a bit of activism to reform the trust's governance, which stipulated that its directors were appointed for life.

The rise in the price of oil and gas, the sudden return of inflation, and the involvement of an activist were three incredibly favorable catalysts, since in exactly two years the price of TPL stock has increased fivefold.

Source: Texas Pacific Land

The lesson is that, even without a very complex analysis, an investor can spot a rare gem, and thanks to the three above-mentioned catalysts, decide that it is a good time to buy. At perhaps follow in Warren's footsteps, 70 years later!

By

By