TORONTO, Nov. 22, 2022 /CNW/ - Vox Royalty Corp. (TSXV: VOX) (NASDAQ: VOXR) ("Vox" or the "Company"), a returns focused mining royalty company, is pleased to announce that it has executed a binding royalty sale and purchase agreement dated November 21, 2022 with Gloucester Coal Ltd ("Gloucester") and acquired Gloucester's Cardinia development-stage gold royalty in Western Australia for A$450,000 (approximately US$300,000) cash (the "Transaction"). The Company is also pleased to announce that it has completed the acquisition of First Quantum Minerals Ltd.'s (TSX: FM) ("FQM") Canadian royalty portfolio, previously announced on November 10, 2022, which closed on November 21, 2022.

The acquired royalty, previously produced on a bulk sampling basis, is a 1% Gross Value of Sales royalty above 10,000oz cumulative gold production (~9,100oz remaining hurdle) on mining lease M37/86, which is operated by Kin Mining Ltd (ASX: KIN) ("Kin"), and is part of Kin's flagship Cardinia Gold Project, which is located 30km east of Leonora in Western Australia (the "Cardinia Royalty"). The Cardinia Royalty was created in 1993 pursuant to an Option Agreement between Sons of Gwalia Ltd and Centenary International Mining Ltd, the latter of which became CIM Resources Ltd, and eventually, Gloucester.

Riaan Esterhuizen, Executive Vice President - Australia stated: "This overlooked 1993 vintage gold royalty is Vox's ideal low-cost acquisition – a fully-permitted and shovel-ready gold project, located in the prolific Leonora district of Western Australia within trucking distance of 4 existing mills with over 10Mtpa processing capacity. This transaction was originated using Vox's proprietary royalty database of over 8,500 royalties, to identify an overlooked gold royalty inherited through a broader 2012 corporate acquisition. Regional consolidation within the Leonora region is underway with Genesis Minerals' acquisition of Dacian Gold and merger talks ongoing between Genesis and St Barbara, all of which bodes well for Kin Mining's prospects at the Cardinia Gold Project."

Transaction Highlights(1)(2)

- Provides exposure to the pre-feasibility-stage 1.4Moz (34.5Mt @ 1.27g/t) resource(1) Cardinia Gold Project ("CGP") that is strategically located within 100km of 4 existing gold mills (with total processing capacity of over 10Mtpa) in the prolific Leonora gold region of Western Australia;

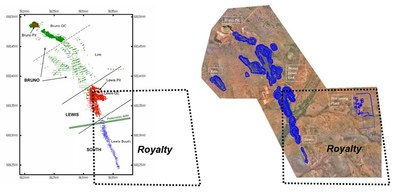

- The Cardinia Royalty covers the majority of the Lewis deposit, which forms a key part of the Bruno-Lewis JORC-compliant gold resource estimate(1) of 12.1Mt @ 1.0g/t for 388,000oz (September 2022, 0.4g/t Au cut-off) and the Lewis East Prospect, which hosts recent drilling intersections(2) of 11m @ 3.85g/t Au, 44m @ 0.47g/t Au and 6m @ 3.63g/t Au;

- A mining proposal for the Lewis open pit deposit was approved by the Department of Mines, Industry Regulation and Safety (DMIRS) on November 10, 2021, which Vox believes could pave the way for potential toll-treatment production from one of the regional mills;

- In 2016, trial mining was conducted at the East Pit of the Lewis Deposit via a Toll Milling Agreement with Golden Mile Milling's (now owned by Karora Resources Inc. ("Karora") (TSX: KRR)) Lakewood CIL processing facility in Kalgoorlie, which processed a parcel of ore totalling approximately 14,779 tonnes that produced 908oz at an average recovery rate of 94%; and

- Existing infrastructure and related key hardware such as mills, a crusher, conveyors and structural steel are already owned by Kin, which Vox believes could create potential for fast-track development of a standalone Cardinia operation.

Asset Overview – Cardinia Gold Project(3)

The CGP covers a 656km2 land package located 30km from Leonora within the North Eastern Goldfields, the easternmost subdivision of the Archaean Yilgarn Block. The combined 1.4Moz JORC Resource Estimate is hosted in oxide-dominant ore zones at three centres – Cardinia, Mertondale and Raeside.

The CGP sits upon greenstone rocks from the Minara Group, which is composed of the basal Welcome Well Formation, followed by the Minerie Formation and overlain by the Murrin Murrin Formation. Cardinia Mineralisation is shallow crustal with the understanding of a low sulphidation epithermal system developing. Gold mineralisation is very strongly associated with Silver, Arsenic, Bismuth, Antimony, Zinc and Tungsten and is within a large, disseminated pyrite – silica – potassic alteration envelope.

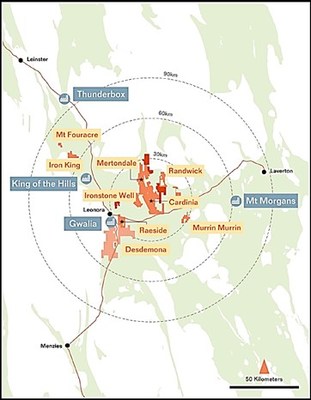

The CGP is strategically located within 100km of four existing gold mills; the 4.0Mtpa King of The Hills mill (Red 5 Limited), the 3.0Mtpa Thunderbox mill currently undergoing a major expansion to 6.0Mtpa (Northern Star Resources Ltd), the 3.0Mtpa Mt Morgans mill (Dacian Gold Ltd) and the Gwalia 1.4Mtpa mill (St Barbara Limited) – as shown in Figure 2 below.

The Cardinia Royalty covers mining lease M37/86, which is located centrally within the Cardinia mining centre and covers the majority of the Lewis deposit, the Lewis South Deposit and the emerging Lewis East prospect – as shown in Figure 3 below.

In 2016, trial mining was conducted at the East Pit of the Lewis Deposit via a Toll Milling Agreement with Golden Mile Milling's (now, Karora) Lakewood CIL processing facility in Kalgoorlie and a Cartage Agreement with MLG Oz Pty Ltd for load and haul to the processing facility. This Lewis Deposit trial mining resulted in processing a parcel of ore totalling approximately 14,779 tonnes that produced 908oz at a 94% recovery. Refer to Figure 1 for a 2016 snapshot of the extraction of remaining ore at the final bench of the Lewis Stage 1 East Pit.

Bruno-Lewis Resource Estimate as at 21 September 2022(1)

| Cut-off Grade

(g/t Au) | Tonnes

(Kt) | Grade

(g/t Au) | Contained Gold (Koz) |

Measured | 0.4 | 769 | 1.2 | 31 |

Indicated | 0.4 | 7,699 | 1.0 | 257 |

Measured & Indicated | 0.4 | 8,468 | 1.0 | 288 |

Inferred | 0.4 | 3,594 | 0.9 | 100 |

Table 1: Bruno-Lewis Mineral Resource Estimate

(Source: Kin resource update announcement dated 21 September 2022)

For more information on the CGP, please visit the Kin website at https://kinmining.com.au/

Transaction Closings

Closings of the Transaction and the acquisition of the FQM royalty portfolio occurred on November 21, 2022, with Vox using cash on hand to fund the payment of the Transaction.

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"), has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties and streams spanning eight jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 25 separate transactions to acquire over 50 royalties.

Further information on Vox can be found at www.voxroyalty.com.

Cautionary Statements to U.S. Securityholders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, the U.S. Securities Exchange Act of 1934, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of Vox Royalty Corp. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, statements regarding the royalties and projects related thereto (including expectations for construction decisions, resource estimates or production from the underlying projects and estimates of project success), and the ability of the Company to acquire effective ownership of all three royalties. Such statements and information reflect the current view of Vox. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Vox's actual results, performance or achievements or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources and production of a property.

Technical References & Notes:

(1) | CGP Resource Estimate released September 21, 2022 and dated September, 2022 (amended September 23, 2022) - https://www.kinmining.com.au/wp-content/uploads/2022/09/220923-Ammendment-to-CGP-MRE-Update-to-1.4Moz.pdf. |

| a. | The information relating to Mineral Resource Estimation results for the Cardinia Hill, Bruno Lewis and Hobby deposit relates to information compiled by Cube Consulting (Mr Mike Millad). Kin's disclosure states that Mr Millad is a Member of the Australian Institute of Geoscientists (#5799), a full time employee of Cube Consulting, and has sufficient experience of relevance to the styles of mineralisation and the types of deposit under consideration, and to the activities undertaken to qualify as a Competent Person as defined in the 2012 edition of the JORC "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". |

| b. | Bruno-Lewis Mineral Resource Estimates estimated by Cube Consulting are reported in accordance with JORC 2012 using a 0.4g/t Au cut-off within AUD2,600 optimisation shells. |

(2) | CGP exploration results are reported by Kin on the following basis https://www.kinmining.com.au/wp-content/uploads/2022/09/220923-Ammendment-to-CGP-MRE-Update-to-1.4Moz.pdf: |

| a. | The information contained in this press release relating to Exploration Results relates to information compiled or reviewed by Glenn Grayson, a member of the Australasian Institute of Mining and Metallurgy. Kin's disclosure states that Mr. Grayson has sufficient experience of relevance to the styles of mineralisation and the types of deposit under consideration, and to the activities undertaken to qualify as a Competent Person as defined in the 2012 edition of the JORC "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". |

(3) | CGP project background information sourced from the following sources: |

| a. | Cardinia Gold Project overview website: https://www.kinmining.com.au/projects/cardinia/ |

|

| b. | Kin 2022 Diggers & Dealers Presentation dated August 1, 2022: https://www.kinmining.com.au/wp-content/uploads/2022/08/220801-Diggers-and-Dealers-Presentation.pdf |

SOURCE Vox Royalty Corp.

© Canada Newswire, source Canada Newswire English