Key Takeaways

- SEBI holds investors of AIFs having UPSI/ MNPI in breach of insider trading norms for investment decisions of AIFs

- Investors into pooled investment vehicles exposed to substantial risk for actions beyond their control and visibility

- Compliance seems rather impractical and creates complications for both the AIF and its investors - bad law that needs to studied for its potential implications

Background

In a move that could significantly impact the investment landscape into pooling vehicles,

First, should each unitholder of an AIF now negotiate for complete visibility on trades being executed by the AIF? Second, is it commercially viable for AIFs to be precluded from investing/ divesting merely because one of its investors possesses UPSI, so that its investors can comply with insider trading laws? Third, what is the duty of the AIF if an investor informs it of being in possession of UPSI? Fourth, will SEBI's guidance apply to all kinds of pooled investment vehicles, including listed REITs, InvITs?

Brief Facts

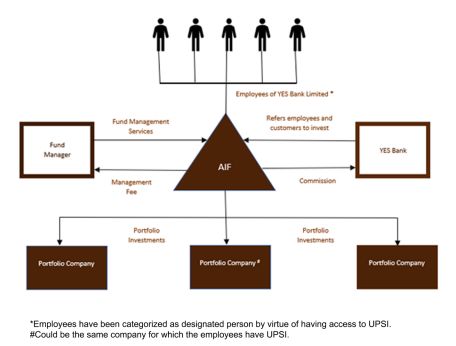

Under the Insider Trading Regulations, persons having UPSI are not permitted to trade (directly or indirectly) in the underlying listed securities. In this context,

SEBI's Guidance: Analysis and Implications

SEBI through its informal guidance (Guidance) has held that the employee investors who are in possession of UPSI would in fact be in breach of the Insider Trading Regulations if the AIF invests in listed securities which the UPSI corresponds to. The foundation of this Guidance is likely to open a pandora's box to be overcome by fund managers and investors of AIFs.

- No control or visibility for investors over AIF investments. Insider Trading Regulations are fundamentally designed as anti-abuse provisions - to prevent an insider from directly or indirectly trading while in possession of UPSI so that price sanctity of the public markets is protected. However, an investor under the AIF regime has no control or visibility over the investment decisions made by the AIF. It would be one thing to impose trading restrictions on a fund manager who is in possession of UPSI. However, imposing restrictions on investors of an AIF seems like a stretch since an ordinary investor in a blind pool cannot influence the investment or divestment decisions made by an AIF in any manner, nor would he have knowledge / access to the proposed investments of the AIF.

This Guidance also restricts the ability of investors (who are insiders by virtue of their professional standing) to invest in AIFs, one among the very few investment avenues available. Not just AIFs, this may very well be relevant for investments into other pooling vehicles too. For instance - say an accountant obtains UPSI of a company 'Z' while undertaking a due diligence exercise. The accountant has historically been an investor in a listed InvIT, which in-turn holds certain shares of 'Z'. If the InvIT now divests the securities of 'Z' - a decision over which the accountant has no prior visibility or control - the accountant will be liable for breach of insider trading regulations.

SEBI's stance could have been appreciated if the fund structure was such that the investor had a binding say in the investment / divestment decisions made by the AIF - and the investor consciously used the AIF as a go-between entity to circumvent the Insider Trading Regulations. In this case, quite to the contrary, investors of an AIF typically have zero prior visibility/ control on the exact investment targets of an AIF. The practical application of the Guidance attacks the essence of investment vehicles and the ease with which investors could invest under the AIF regime. Overall, given the very design of AIFs, the Guidance seems ill-reasoned and extremely onerous on investors of AIFs. - Commercial unviability for AIFs. For investors of an AIF to comply with the Insider Trading Regulations as prescribed under the Guidance, the following provisions will have to be negotiated: (a) all AIFs have to provide a clear line of sight to investors - in advance - of their proposed investments, so that the investors may confirm if they are in possession of UPSI with respect to the proposed investees; and (b) if an investor communicates to the AIF of being in possession of UPSI, the AIF will have to refrain from trading in the relevant security. The commercial absurdity of such a proposition needs very little explanation. To begin with, the supremacy of the IM - a fundamental tenet of the AIF system - is compromised by effectively allowing investors a veto over every single investment. It is also impractical for AIFs to coordinate with investors (hundreds of investors, in retail AIFs) before making an investment. The very purpose of setting up a pooled investment vehicle and allowing an independent investment manager to manage its operations will stand dismantled. Due to these challenges, investors will certainly be dissuaded from investing into AIFs/ pooled investment vehicles which may in-turn trade in listed securities.

Conclusion

Strictly speaking, the Guidance is likely to be relevant only in the context of Category II AIFs and Category III AIFs, since these AIFs generally invest in listed securities. However, the first principles of law enunciated in this Guidance may as well be extended to other pooled investment vehicles such as REITs and InvITs or even to listed companies. It is important to note that the SEBI Act provides sufficient ammunition to hold an investor liable if a trade has been executed (indirectly through an AIF) purely to circumvent the remit of Insider Trading Regulations. However, in our view, there is sufficient ground to argue that the Insider Trading Regulations should not apply to situations where the investors have no influence over the investment / divestment decisions of the pooled investment vehicle.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Heena Ladji

717, Tower B

One BKC, BKC

400051

Tel: 759832 0964

E-mail: drishya.kumar@resolutpartners.com

URL: www.resolutpartners.com

© Mondaq Ltd, 2022 - Tel. +44 (0)20 8544 8300 - http://www.mondaq.com, source