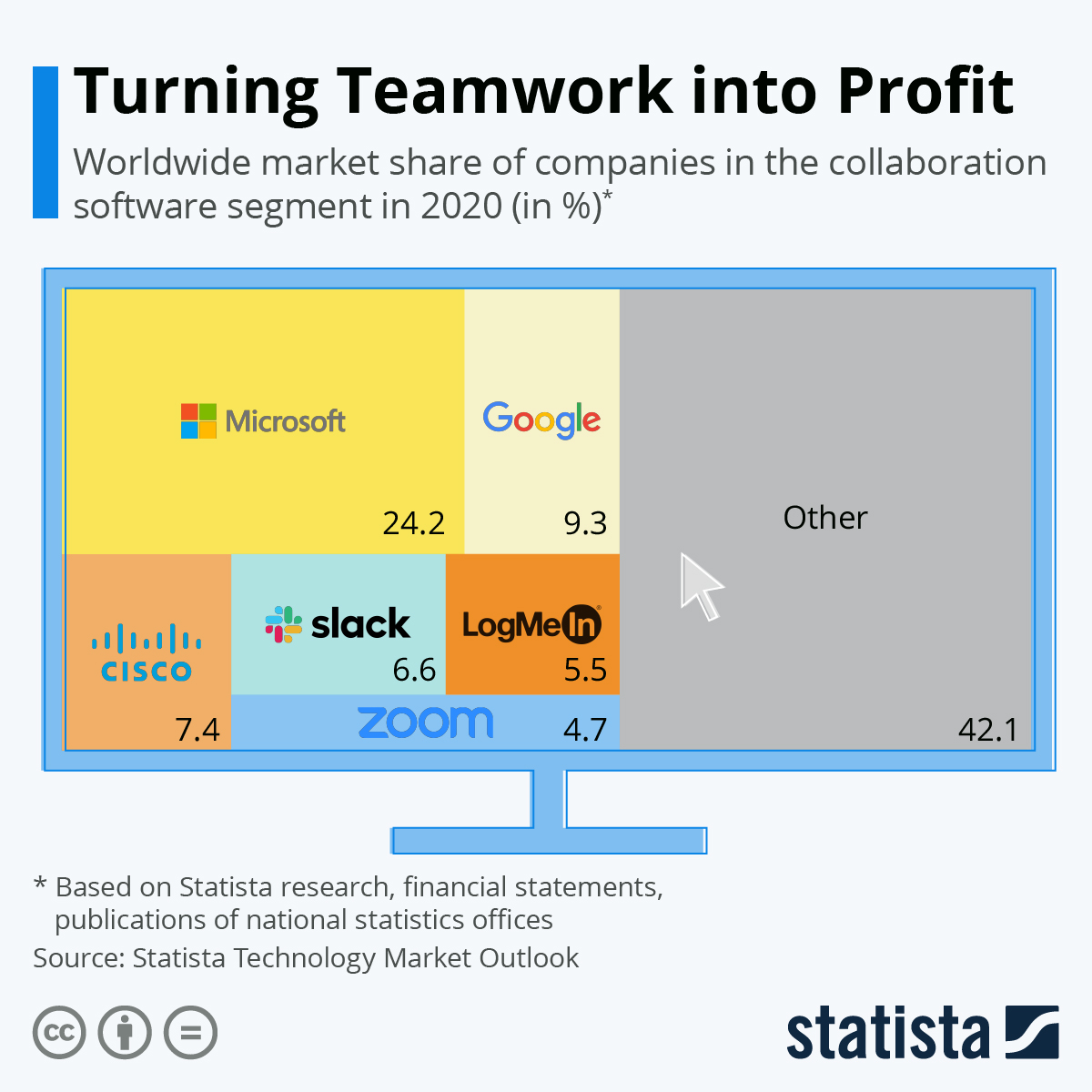

The Californian company founded by Eric Yuan in San Jose in 2011 has emerged as the big winner of this epidemic by establishing itself in the market of video conferencing, a segment that exploded during the lockdowns thanks to the introduction of online classes, meetings, exams or simply happy hours. Thanks to its natural agility due to its size (capitalization 60 times smaller than Microsoft as of 01/01/2020), Zoom has surprised all its competitors by taking a clear lead over the solutions offered by the giants of the sector. Teams has established itself as a major service, but the race is not over and Zoom is still hanging on, well ahead of Alphabet 's Meet in terms of downloads and subscriptions. Zoom should also continue to benefit from the "work from home" trend, which is clearly here to stay. The only gap in its trajectory is that Zoom has not succeeded in imposing its solution on smartphones.

Great performances to repeat to compete with the behemoths

Zoom's recent quarterly earnings announcements surprised investors (positively) with better-than-expected numbers (adjusted net income of $1.03 per share, expected to be $0.87), but that raises the question of the sustainability of the business model. Zoom's fate keeps reminding us of another former internet star, Slack. A highly successful collaborative platform, a stratospheric IPO, a devastating fad and we have three major similarities. However, for Slack, the hype fell like a soufflé out of the oven, especially because of the competition from Microsoft Teams.

The major strength of Teams naturally lies in its integration with the Office ecosystem and Windows, the operating system installed by default on 90% of corporate computers. As Microsoft is one of the companies with the largest cash reserves, it's hard to see the Redmond firm being left behind without moving a finger (or a small bill). Zoom suffers from the comparison but does not appear to be broke, with more than $6 billion in cash reserves and an excellent balance sheet. It is therefore a good option to consider for the future, depending on the business decisions that will be made in the future.

Where Zoom is expected to shine is in its ability to reinvent itself in order to diversify its offering based on the single video conferencing service. This ability was put to the test with the failed acquisition of Five9, a software company specializing in customer service. Zoom was willing to put up an absurd $14.7 billion, all in stock, or 25 times the sales of Five9, which has never made money in its 20-year history. With Five9's shareholders vetoing the acquisition, we're thinking that this may be a lesser evil for the video conferencing specialist. Zoom is currently exploring telephony with Zoom Phone, a "feature-rich, cloud-based telephony system for businesses of all sizes. "The company then boasts that it has reached two million Zoom Phone users, two years after its creation in January 2019. Whether this solution, which is still anecdotal at the moment, is a real goldmine for the future, or just a short-lived project, has yet to be proven.

A future as an independent company, or a takeover by a giant?

In spite of this great track record and development ambition, the dubious visibility of its real number of users seems like a blip in the middle of a harmonious melody. We still don't know how the users are counted, nor how much the monetized ones bring in.

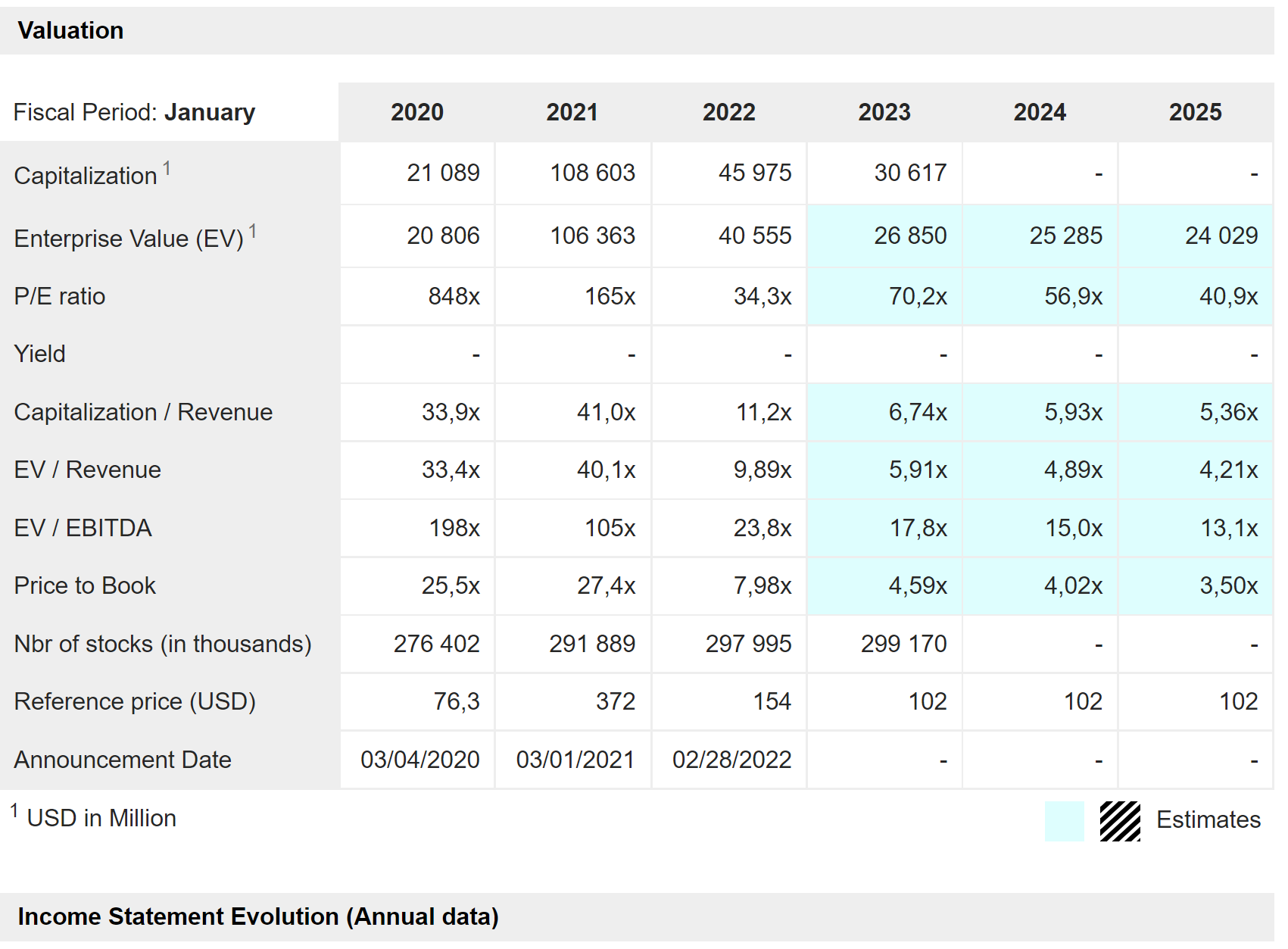

Nevertheless, this good track record does not justify the $160 billion valuation (with a P/E of 6500x!!) reached at the peak of the pandemic, which reflects more the usual speculative excess of investors than the promise of a flourishing company. Fortunately, this excess quickly faded with the recent collapse of the stock, which saw its price divided by four in just one year. Zoom now looks like an ideal acquisition for one of the tech behemoths to integrate the firm's services to complement an existing ecosystem, much like Slack was acquired by Salesforce.com. Yet Zoom maintains its desire for independence.

The chances of Zoom achieving another feat, worthy of the one it accomplished with visio during the covid, seem slim. But, now that the euphoria is over, Zoom is now valued at a little more than 6x its revenues, and 20x its free cash flow, of which we have to restate the gargantuan stock option remunerations, which eat up one third of the free cash flow.

As with our previous focus, Snowflake, insiders are selling Zoom: in 2022, CEO Eric Yuan sold more than $4M of Zoom shares, the COO sold $1.3M and the CFO sold nearly $4M.

Zoom does appear to be a bet on the future and on its ability to conquer new specific markets (verticals), rather than a bet on its traditional video conferencing service.

By

By