Ingersoll Rand, founded in 1871, is one of the world's pioneering compressor manufacturers. In 2020, its industrial division merged with Gardner Denver, another company specializing in industrial pumps and compressors, while retaining the historic brand name. The company's other segment was renamed Trane Technologies, an HVAC behemoth. Today, Ingersoll Rand owns more than 80 brands worldwide and employs nearly 18,000 people.

Business

It divides its business into two segments:

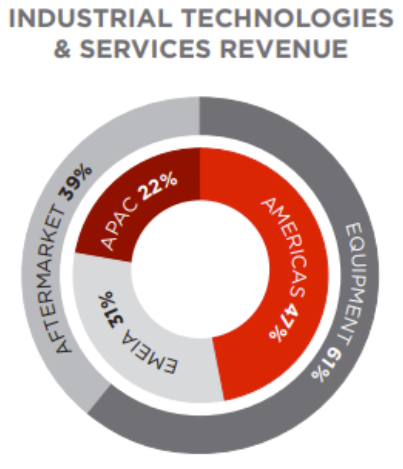

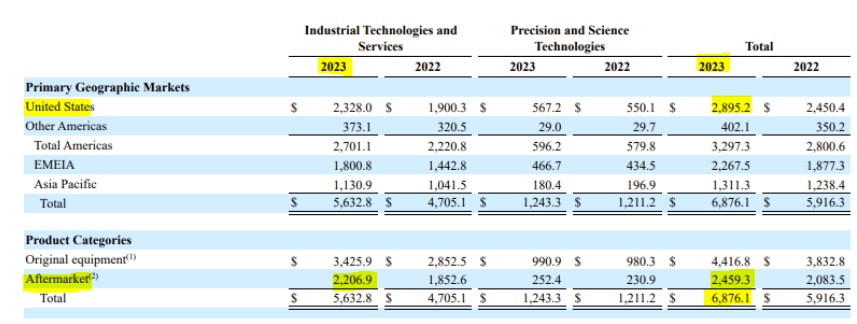

The first, Industrial Technologies and Services (ITS), accounts for 82% of the company's sales. ITS encompasses a wide range of products and services, notably air and gas compressors, which are at the heart of this segment and account for 65% of revenues. In addition to compressors, Ingersoll offers a wide range of equipment, such as blowers, fluid transfer systems, power tools and more. In addition, the company offers a complete solution including spare parts and after-sales services.

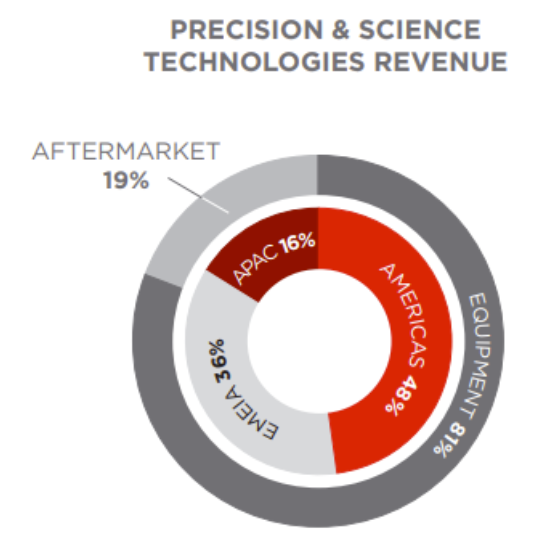

The second segment, Precision Technologies and Sciences (PST), although smaller -18% of sales-, focuses on fluid management systems -pumping, sampling, injection, etc. .to meet the specific needs of sectors such as biotechnology, pharmaceuticals and energy.

Geographically, the United States remains Ingersoll's main market, accounting for 42.1% of revenues. This is followed by Europe with 33%, Asia-Pacific with 19.1%, and America outside the USA with 5.8%.

Although equipment sales are the company's main source of revenue. The recurring after-sales service business generates over a third of sales.

Finance

Ingersoll Rand, with a market capitalization of $37 billion, ranks just behind giants such as Atlas Copco. Its price/earnings ratio (P/E) is 42x, a higher valuation than its peers. This premium is explained by performance, a trend that investors expect to continue.

In 2023, Ingersoll Rand's sales will total $6.9 billion. Since its merger in 2020, its average annual growth rate has been 12.3%. The company boasts a free cash flow (FCF) margin of 18%, ranking it among the best performers in its sector. This ability to generate cash flow has enabled Ingersoll Rand to maintain its growth strategy while rewarding its shareholders.

Over the last three years, net earnings per share (EPS) have risen by 32%, with a payout ratio of 33%. The company paid out $73 million in dividends and repurchased $1.1 billion in shares, reducing the number of outstanding shares by 3.4%.

The Industrial Technologies and Services (ITS) segment saw its revenues grow by 19.7% and its operating margin increase by 240 basis points. At the same time, the Precision Technologies and Sciences (PST) segment recorded more modest growth of 2.7% and a 3.5% decline in its order book, due to a slowdown in organic sales not offset by the various acquisitions.

In 2023, the company succeeded in lowering its long-term debt to $2.7 billion, a significant reduction compared to the $3.9 billion recorded in 2020.

Ingersoll Rand's financial position is robust, with a cash reserve in excess of $1.6 billion and free operating cash flow of $1.3 billion in 2023.

M&A growth strategy: Serial acquirers

Since its merger, Ingersoll Rand has adopted a serial acquirer strategy. In the space of three years, the group has completed over 40 acquisitions for a total of more than $2 billion.

At the same time, the company has made numerous divestments to focus on its core business. The company divested two of its segments, which at the time accounted for 20% of sales: Club Car for $1.6 billion, and its energy pumps segment for $300 million, while retaining a 45% stake in the latter.

These disposals were aimed at reducing the company's exposure to the oil and gas sector, reducing debt and improving margins, while freeing up resources to invest in organic and inorganic growth.

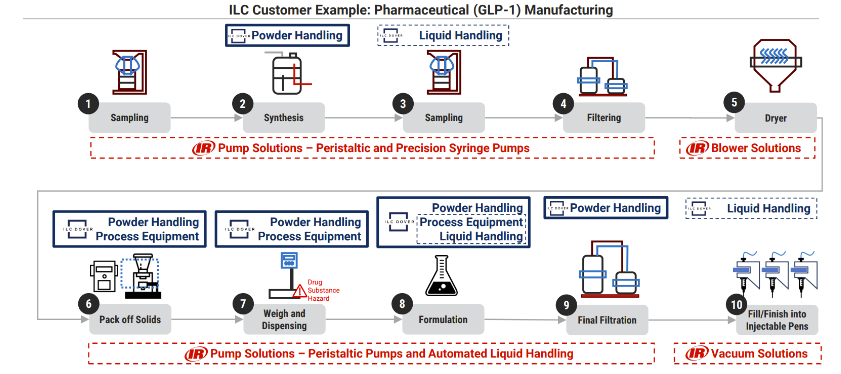

In 2024, Ingersoll Rand intensified its acquisition strategy, completing its largest acquisition to date: ILC Dover for over $2.3 billion. The company is a leader in the design and production of industrial processes for the pharmaceutical and space industries, with revenues estimated at $400 million for 2024.

This acquisition is in line with Ingersoll Rand's strategy of developing its life sciences segment, extending its presence in new markets by filling technological gaps, and being able to offer an integrated solution for the pharmaceutical sector.

Since the merger, Ingersoll Rand's stock market performance has been remarkable, with the share price up over 150%, making it the best performer in its sector.

By

By