Business model

The company offers its users an ecosystem of six integrated services:

- MercadoLibre Marketplace: an automated marketplace, classified by theme, similar to Amazon. It brings buyers and sellers together, and generates revenue by taking a commission on each transaction. MercadoLibre Classifieds complements the marketplace by helping to direct users to the main site. It's an online classifieds service for motor vehicles, real estate and services.

- Mercado Envios: a logistics solution that includes order processing and warehousing services.

- Mercado Ads : a service that enables advertisers to display ads on MercadoLibre websites.

- Mercado Shops: a solution that helps sellers create, manage and promote their own online stores, much like Shopify.

- Mercado Pago: a fintech that perfectly complements MercadoLibre. When it was created, its aim was to facilitate transactions on the Marketplace. Today, Pago does more than just that. It provides a complete platform of financial services for consumers and merchants, from online and offline payments, credit and debit cards, savings products, insurance, asset management and more.

- Mercado Credito: Mercado's credit solution, based on its loyal and committed customer base, which has historically been neglected by traditional financial institutions. It corrects this lack of access to credit through a simple, accessible service. This further strengthens the commitment of customers to the Mercado Libre platform, who are grateful that obtaining a loan is more difficult in Latin American regions.

Source : MercadoLibre

Mercado is the e-commerce leader in most Latin American countries (see map below). Its leading market is Brazil (53.8% of sales), followed by Argentina (23.7%) and Mexico (17.7%). Competitors include Americanas, AliExpress, Magazine Luiza, Amazon, Via Viero, Shopee and Falabella. The Mercado Pago fintech is positioned more as a disrupter against equally well-armed competitors (Pix, Nubank, PicPay, PagBank).

Source : MercadoLibre

By 2022, 55.1% of sales will come from the e-commerce segment (Marketplace, Classifieds, Envios, Ads and Shop) and 44.9% from the fintech segment (Pago and Credito). While the former shows year-on-year growth of 25.3%, the fintech segment boasts growth of 94.3% between 2021 and 2022.

MercadoLibre makes its money through commercial revenues (fees from the marketplace, Classifieds, product sales revenues, etc.) and fintech revenues (commissions on payment volume, interest earned on loans, financing fees linked to factoring of credit card receivables, etc.).

Its strengths

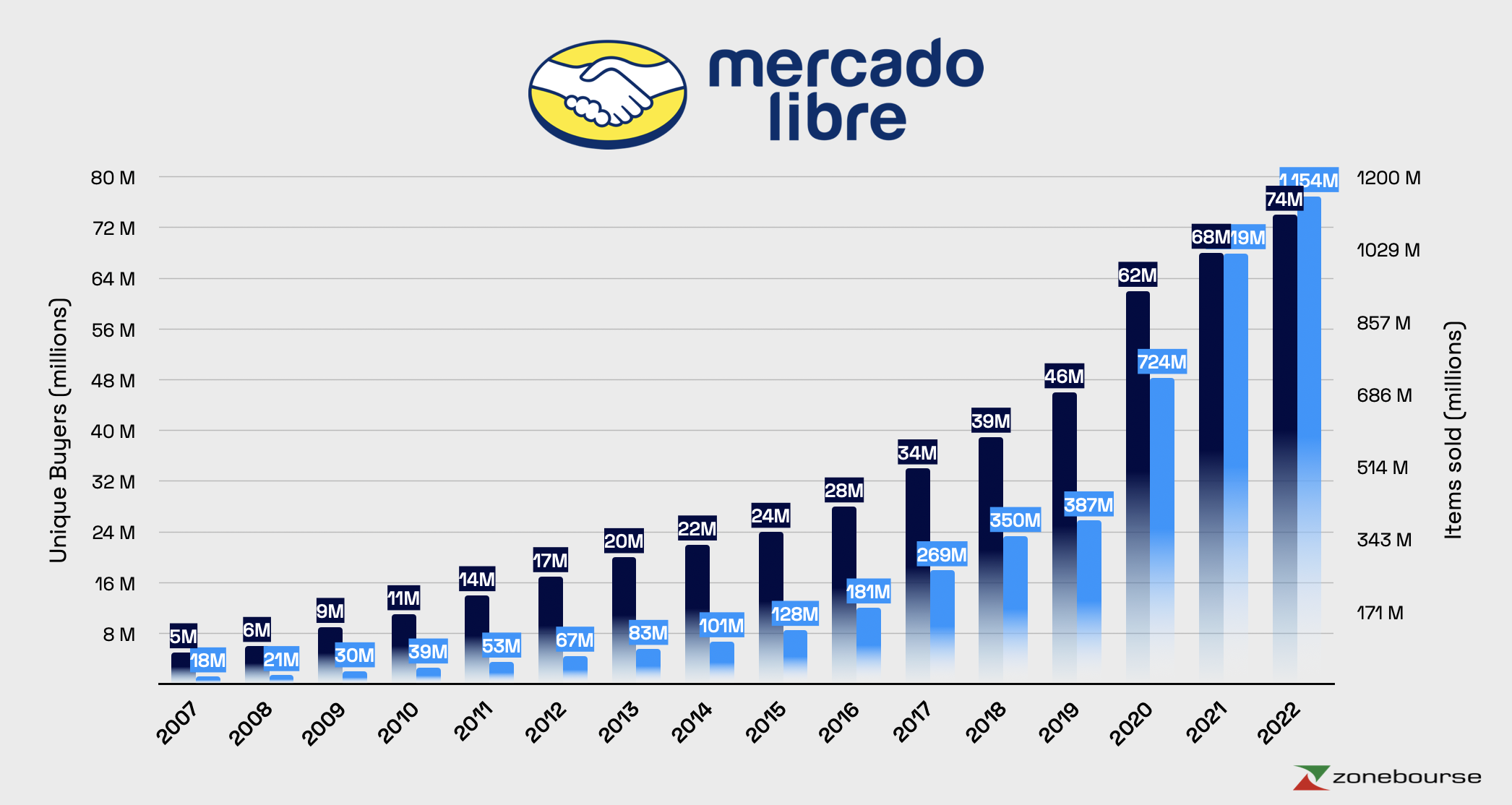

MercadoLibre has a number of strengths. First and foremost, it is the market leader in Latin America, where the transition from offline to online is one of the strongest. According to Statista, the number of e-commerce users in Latin America is set to increase from 317 million in 2022 to 387 million in 2027. In terms of monthly visits to e-commerce sites in Latin America, Mercado is No. 1, with 447 million visits per month, ahead of AliExpress (425 million) and Amazon (217 million). These are competitors to keep a close eye on, given their reputations. For Meli, the number of unique buyers is set to rise at a steady pace from 5 million in 2007 to 74 million in 2022. The number of products sold rose from 18 million in 2007 to 1154 million in 2022.

Source : Zonebourse

Thanks to its multi-category marketplace and proprietary logistics network, MercadoLibre delivers 80% of its goods in less than 48 hours. This well-organized network and effect of scale give it a moat (sustainable competitive advantage) in this market, which is difficult for a smaller new entrant to compete with. The company thus optimizes costs and maximizes cross-selling (between sites). Sellers are encouraged to use Mercado tools (Ads, Shops, Pago), further strengthening the Mercado ecosystem. The arrival of MercadoPago in 2004 facilitated online payments on its own platform (payments via QR codes, mobile sales, etc.).

Financial analysis

MercadoLibre 's sales rose from $373 million in 2012 to $10.5 billion in 2022. Diluted EPS has grown at a rate of 20% a year over the past 10 years. The profit margin, which has long been erratic, has recovered to 4.6% in 2022. MercadoLibre intensified its investment in logistics from 2015 onwards, which momentarily had a negative impact on margins, as shown in the graph below. The profit margin should improve significantly, reaching 7% in 2023 and 8.5% in 2024, according to the estimates of the analysts in charge of the file. I believe that Meli has found a sustainable way to increase its margins, thanks to lower operating, transport, merchandise sales and collection costs.

Source: MarketScreener

Profitability is high, with an ROE of 28.7%. This indicates good capital allocation by management. Capex now accounts for only 4.3% of sales. Debt is limited, with more cash than debt. A solid balance sheet.

| Fiscal Period: December | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|---|---|

| Net Debt 1 | - | - | - | - | - | - | - | - |

| Net Cash position 1 | 2,231 | 2,340 | 939 | 944 | 2,833 | 4,230 | 5,879 | 9,290 |

| Leverage (Debt/EBITDA) | - | - | - | - | - | - | - | - |

| Free Cash Flow 1 | 314 | 936 | 392 | 2,486 | 4,631 | 2,548 | 3,665 | 4,801 |

| ROE (net income / shareholders' equity) | -14.8% | -0.04% | 5.23% | 28.7% | 40.3% | 42.9% | 39.9% | 36.1% |

| ROA (Net income/ Total Assets) | -4.9% | -0.01% | 1% | 4.04% | 6.29% | 8.06% | 8.72% | 8.32% |

| Assets 1 | 3,511 | 5,656 | 8,314 | 11,919 | 15,692 | 21,005 | 26,884 | 38,041 |

| Book Value Per Share 2 | 39.90 | 33.10 | 30.40 | 36.40 | 60.60 | 98.20 | 150.0 | 236.0 |

| Cash Flow per Share 2 | 9.260 | 23.80 | 19.40 | 57.30 | 101.0 | 48.30 | 60.40 | 82.40 |

| Capex 1 | 137 | 247 | 573 | 454 | 509 | 666 | 808 | 855 |

| Capex / Sales | 5.96% | 6.22% | 8.1% | 4.31% | 3.52% | 3.79% | 3.75% | 3.32% |

| Announcement Date | 2/10/20 | 3/1/21 | 2/22/22 | 2/23/23 | 2/22/24 | - | - | - |

Source : MarketScreener

In terms of cash flow, the company converts its net profits into hard cash. The FCF margin was 23.6% in 2023. It's a cash machine.

Over the last decade, the number of shares has risen slightly, from 44.1 million in 2013 to 50.1 million in 2023. The company bought back and then cancelled several tens of thousands of shares this year.

Management team

Co-founder and CEO Marcos Eduardo Galperin has been at the helm since the very beginning. This is a good thing, as he is experienced despite his young age (51). Several members of the management committee have been with the company for some time. Martin de los Santos (CFO since 2008) or Osvaldo Gimenez (Fintech Director since 2000). This consistency in the management team is rather healthy: we know that the management knows its stuff. The management team's fixed remuneration is reasonable in relation to the profits generated. What's more, almost 80% of remuneration is correlated to operational performance. It's a hefty sum, but at least shareholders know that operational performance, and therefore stock market performance, is in management's personal interest. Especially as several of them are shareholders: 410 shares for CFO Martin de los Santos, 18,385 shares for MercadoPago director Osvaldo Gimenez, 200 shares for Juan Martin de la Serna, 4,616 shares for board member Alejandro Aguzin, 1,146 shares for board member Henrique Dubugras, etc.

Source : Glassdoor

Potential

- E-commerce and payment: Expected growth is high. South America still has a long way to go in terms of digitizing its economy.

- Cloud and advertising: Meli could follow Amazon's successful path in the cloud with AWS. There are potential markets accessible to Mercado in online advertising with Mercado Ads.

Risks

- Inflation, recession, political unrest, exchange rates: Latin American regions have been more affected by inflation in recent years. The macroeconomic context is not helping matters, with rising interest rates across the board. Mercado's balance sheet is nonetheless solid enough to cope with these hazards. The company is also exposed to local currencies, but its growth, even in dollars, has always been sustained and regular. In addition, its main listing is in the US under the ticker MELI (US58733R1023).

- Global competition: Amazon and AliExpress are major competitors to keep an eye on. Market share trends will need to be monitored over the next few years.

- Valuation: The company is currently paying 62 times forecast net earnings for 2023, 43 times next year and 30 times for 2025. Time is on our side for MercadoLibre, thanks to the strong sales growth expected and the sustained improvement in margins, both of which are drivers of stock growth. Thanks to good cash conversion and fintech revenues in particular, FCF margins are higher than profit margins. FCF Yield is 3.8% (26 times free cash flow). This puts the P/E of 62x seen above into perspective. Amazon is paying 57x its earnings for 2023, with historical growth estimated to be much lower.

Despite the risks mentioned, MercadoLibre is a high-growth company, with an experienced management team, a strong balance sheet and much-improved profitability. Latin America still offers significant growth potential in terms of the digitization of the economy over the next few years. I see potential there for a long-term investor.

By

By