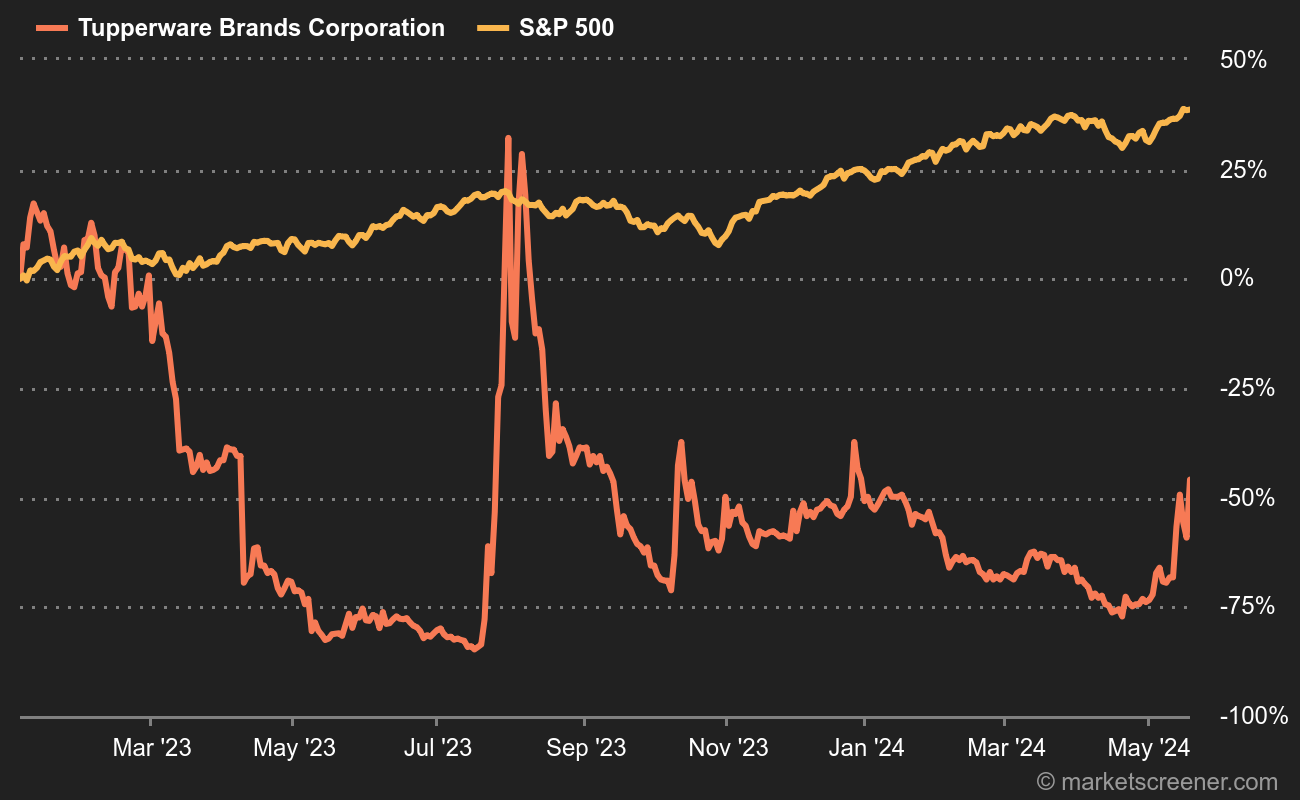

Amazon may well gain 9% at the Wall Street opening after its quarterly results. Booking may well soar by 12% thanks to its upgraded forecasts. It's Tupperware that's going to make small investors' eyes shine, with a gain of over 50% in after-hours trading. The legendary brand of plastic food boxes, in dire financial straits, finalized a debt-restructuring agreement, providing some short-term breathing space. The stock more than quintupled in the space of a few sessions, on the model of the theme stocks that animated the stock market during and after the pandemic, from GameStop to AMC Entertainment to Hertz.

The stock's surge left a few short sellers out in the cold. Research firm Ortex estimates that 30.8% of Tupperware's float was recently sold short. Short sellers are said to have lost $33 million over the past three weeks.

Plastic is fantastic

The Orlando, California-based company announced last night that it had reached an agreement with creditors extending the maturity of of $348 million in principal and reallocated interest and fees to fiscal 2027, while reducing and reallocating $150 million in cash interest and fees. Tupperware also reduced its amortization payments by $55 million until fiscal 2025, and gained access to a $21 million revolving loan.

Tupperware was trading at USD 3.52 last night, having bottomed out at USD 0.61 on July 19. Management had indicated several weeks ago that the company's difficulties were likely to lead to bankruptcy.

By

By