Block 1: Essential news

- IMF: MNBCs are coming!

Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), expressed her enthusiasm for central bank digital currencies (CBDCs) during a speech at the Singapore Fintech Festival, envisioning a future where they replace traditional currencies. In particular, she highlighted the benefits of MNBCs, such as economic resilience, financial inclusion in less-banked regions, and their lower cost compared to physical cash. Georgieva also warned against private currencies, such as cryptocurrencies, and encouraged the public sector to adapt quickly to technological developments. She emphasized the development of cross-border payments and the creation of a common platform for MNBC trading, while remaining cautious about the uncertain future of MNBCs in the face of more flexible and decentralized private currencies.

- Commerzbank obtains cryptocurrency license

Commerzbank, Germany's second largest bank, has been granted a license to offer cryptocurrency custody services, becoming the first large-scale German bank to receive this authorization. The license, granted by German financial regulator BaFin, enables the bank to develop a secure and regulated platform, primarily aimed at institutional customers. Jorg Oliveri del Castillo-Schulz, Chief Operating Officer of Commerzbank, emphasized the importance of this milestone in the bank's commitment to innovative technologies and digital assets.

- Chicago Board Exchange launches margin trading for BTC and ETH

The Chicago Board Exchange (CBOE), North America's largest options exchange, has announced the launch of margin futures contracts for bitcoin and ether, scheduled for next January. According to its press release, the upcoming arrival of margin trading for BTC and ETH is just the first step, with "more unique and revolutionary offerings" expected to emerge over the course of 2024, subject to regulatory approvals.

- JPMorgan unveils blockchain payments system

JPMorgan has unveiled a blockchain-based programmable payments system using smart contracts to automate payments based on predefined conditions. This innovation enables near-instantaneous transfers of fiat money, without human intervention, which is unheard of in the traditional banking sector. The system, already used by Siemens for scheduled transfers, represents a significant step forward, although banks remain cautious about decentralization and cryptocurrencies. This development is part of a growing trend among financial institutions to explore blockchain applications, while avoiding cryptocurrencies.

Block 2: Crypto Analysis of the Week

The Chicago Mercantile Exchange (CME) recently dethroned Binance, the global cryptocurrency exchange giant, by becoming the leading bitcoin futures trading center in terms of volume. This phenomenon, known as "flippening" in the industry, marks a moment rare enough to be highlighted, and signifies the growing interest of institutional players in crypto-assets.

CoinGlass

As a reminder, futures contracts, a type of derivative product, make it possible to bet on the future price of bitcoin, by committing to buy the asset at a price fixed in advance for a future date.

The CME, with its image of a traditional, established financial platform, contrasts sharply with the more relaxed, opaque atmosphere of native cryptocurrency platforms like Binance. This shift in transaction volumes could signal a significant change in the dynamics of the bitcoin market.

Increased activity on the CME is often seen by industry experts as an indicator of growing institutional involvement in the cryptocurrency universe. This trend is reinforced by the increase in "open interest" in CME futures contracts, which is likely to have been stimulated by the spectacular rise in the price of gold.e by the spectacular rise in bitcoin's price since the start of the year (+120%), which has inevitably attracted institutional interest in the cryptosphere.

Other factors, such as speculation around Bitcoin Spot ETFs and Halving Day, also play a role in this market dynamic. Let's take a quick look at these last two factors.

Matt Hougan, Chief Investment Officer at Bitwise, suggests that enthusiasm for Bitcoin Spot ETFs has yet to be fully captured by the market. Nevertheless, given his position in a cryptocurrency investment firm, his views may be tinged with an optimistic bias towards the market.

There's also debate over whether or not Halving Day, a scheduled event that halves the amount of new bitcoins issued and is due to take place next year - April 18, 2024 to be precise - is already built into its current price. The reduction, designed to limit the supply of bitcoins in circulation, should theoretically increase their value by making them rarer. At least, that's the theory.

However, those who believe in market efficiency could argue that this well-known, programmed event is already factored into bitcoin's current price. One might think that a pre-programmed event, of which 99.9% of bitcoin holders are aware and eagerly awaiting, should be factored into the price. The efficiency, or lack of it, of the cryptocurrency market remains a matter of debate, as does the wider debate on market predictability and the exploitation of perceived inefficiencies.

Finally, the increase in CME bitcoin futures volumes could also reflect changes in market share and regulatory challenges facing Binance in different jurisdictions.

As with many aspects of the cryptosphere, certainty is elusive, and the only constant seems to be the unpredictability of the market. Only one thing is certain at this stage: Binance has left its crown to the CME on the futures market. But for how long?

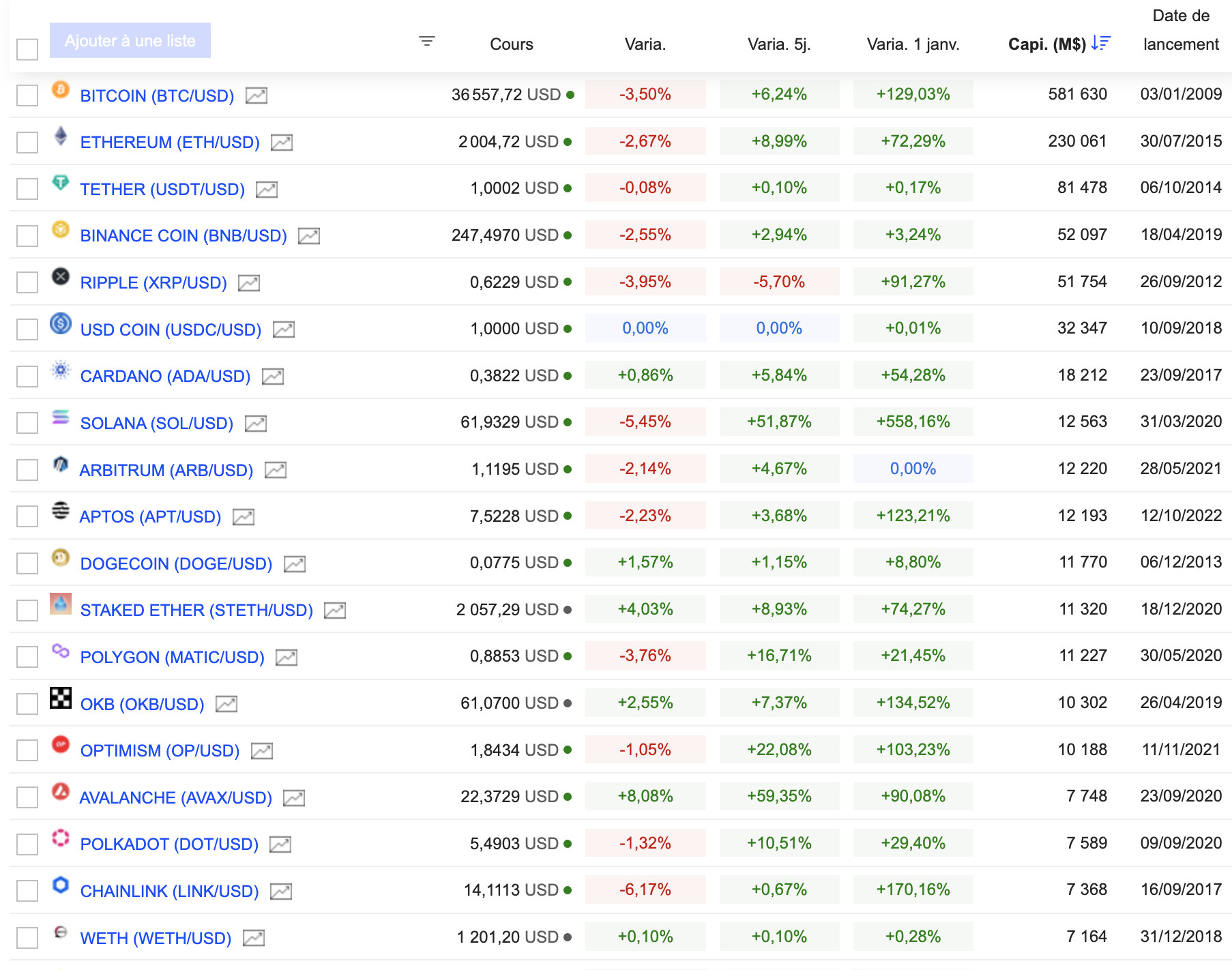

Block 3: Gainers & Fallers

Crypto chart

(Click to enlarge)

Block 4 : To read this week

The Mirai Confessions: three young hackers who built a killer web monster finally tell their story (Wired)

Another fintech abandons crypto (The Information)

Cathie Wood talks Bitcoin, Sam Bankman-Fried and the future of artificial intelligence (WSJ)

By

By