With a new all-time high of $73,000, one month left to the halving, and market sentiment showing “Extreme Greed”, Bitcoin-related speculations are heating up.

While long-term institutional and corporate investors are gobbling up BTC at an astonishing pace, traders are doubling their efforts in the derivatives markets, which register record open interests. For the moment, however, the number of Bitcoin millionaires stays much lower than in the previous rallies, suggesting that we are still early in the bull run and that there are long-term holders who are taking profit. Exchanges’ orderbooks, better supplied on the selling side, witness the same process.

These aspects are prompting various hypotheses about the market structure: bulls vs bears, whales vs newcomers, long-term investors vs day traders…

Let’s see how this Bitcoin bull run is going so far and what we can expect in the near future.

Funds and firms hoarding BTC

Bitcoin spot ETFs continue breaking new records. Only two months after their launch, BlackRock’s $IBIT and Fidelity’s $FBTC already rank third- and fourth-biggest funds by year-to-date flow, outpacing some of the industry’s behemoths, such as $VTI, $SPLG, or $QQQ.

Ten Bitcoin ETFs are now managing over $55 billion in assets with double that in volume at $110 billion, notes Bloomberg’s ETF specialist Eric Balchunas.

On the corporate side, Microstrategy founder and famous Bitcoin bull Michael Saylor announced buying 12,000 more BTC. The company now holds 205,000 BTC in its treasury, the equivalent of $14.8 billion. It doesn’t come as a surprise that its stocks skyrocketed along the leading cryptocurrency: $MSTR gained + 150% in 3 weeks.

Bitcoin open interest rises

For those who don’t have Michael Saylor’s patience or conviction, derivatives are a popular way of playing the Bitcoin market. Open interest (the amount of active positions held by market participants) in various Bitcoin-related products is reaching record heights. The table compiled by on-chain analytics firm Coinglass shows just how high the derivatives speculation has risen.

In traditional finance, the Chicago Mercantile Exchange registered an all-time high for its BTC futures – $11.5 billion of open interest. Crypto exchanges, both centralized and decentralized, are showing $25.5 billion of outstanding contracts.

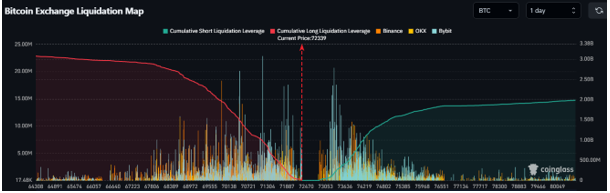

Liquidations, of course, go together with derivatives and leveraged trading. According to Coinglass data on crypto exchanges, at the time of writing almost $2 billion worth of short positions risk being liquidated if BTC rises over $76,500, and almost $3 billion worth of long positions will be wiped out if BTC falls below $68,000.

In the current low-liquidity climate, such exposure can lead to dramatic consequences. If any sudden event sways the price to either side, it risks triggering cascading liquidations, which would exaggerate price movements immensely.

Where are the new millionaires?

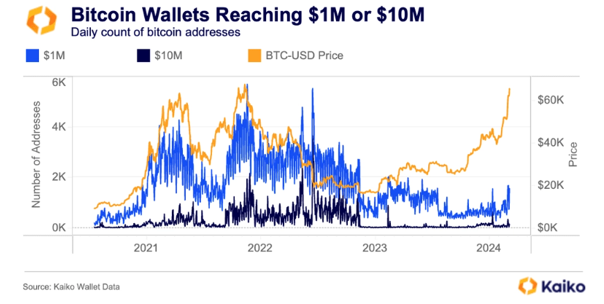

Each Bitcoin growth cycle helps create a whole new group of nouveaux riches. Blockchain intelligence firm Kaiko recently published a graph showing that so far, less than 2,000 wallets with $1 million worth of BTC are registered daily.

In contrast, the last bull run registered over 4,000 such wallets per day, and over 2,000 wallets with a $10 million balance per day.

The low number of Bitcoin millionaires suggests the bull run is still in the early stages – after all, the Bitcoin cycle used to peak approximately 500 days after the halving. This means that new capital – especially brought by new retail buyers – is yet to come. This can also be a sign of the growing consolidation of big accounts (exchanges and funds) or mean that BTC whales (wallets with over 1,000 BTC) are taking profit at new heights.

Indeed, Bitcoin’s aggregated order book across 33 centralized exchanges, compiled by Kaiko, shows a growing imbalance between potential sellers and buyers. The gap between the total value of ask (sell orders) and bid (buy orders) within 2% of the market price has widened to nearly $100 million, which is about five times its usual value. Furthermore, the ask side has relatively more liquidity, suggesting there are more sellers – potentially the abovementioned whales.

This has prompted some analysts to suggest that BTC price rally might face a temporary setback, potentially leading to a bigger drop if combined with derivatives liquidations.

Bitcoin is in unchartered territory now, and its next moves are anyone’s guess. What we can be sure about, though, is that we can expect noteworthy price swings in both directions.

By

By