Renews Call for Colony Executive Chairman and CEO Tom Barrack to Be Replaced After Costing Shareholders More than $6 Billion in Equity Value Over the Last Three Years

Independent Board Nominees Bring Expertise and Extensive Experience to Turn Colony Around and Create Sustainable Shareholder Value

NEW YORK, Nov. 26, 2019 (GLOBE NEWSWIRE) -- Blackwells Capital LLC (together with its affiliates “Blackwells”), an alternative investment management firm with ownership representing an approximately 1.85% interest in Colony Capital, Inc. (NYSE: CLNY) (“Colony” or the “Company”), today announced that it will nominate five exceptional candidates for election to Colony’s Board of Directors (the “Board”) at the upcoming 2020 Annual Meeting of Shareholders.

Blackwells has been an actively involved investor in Colony and has attempted to engage privately and constructively with the Company regarding badly needed business improvement initiatives and corporate governance reforms over the course of the last year. Despite these efforts, the Company has refused to make the changes necessary to close the wide gap between Colony’s stock price and its intrinsic value. At this point, Blackwells believes that the best course of action for shareholders is to cast their vote to reconstitute the Board and remove Colony’s ineffective Executive Chairman and CEO, Tom Barrack.

“Under the right leadership, we believe Colony can be positioned to create value for shareholders and that its current stock price does not reflect Colony’s true worth,” said Jason Aintabi, Chief Investment Officer of Blackwells. “Colony’s Board has given Tom Barrack too much deference and too much latitude for too long. His continued, imperial reign over the Company damages its credibility and business prospects and creates a tremendous overhang on the stock. It is time for Mr. Barrack to go and for the Board to be reconstituted with truly independent and experienced business leaders, who can provide effective and constructive oversight.”

Among his many failures, Mr. Barrack was the architect of the three-way merger between Colony Capital, NorthStar Realty Finance and NorthStar Asset Management, which was announced in June 2016. At the time of the merger’s closing on January 10, 2017, the three companies had a combined market capitalization of $9 billion.1 Since then, Colony’s share price has fallen 66%, destroying more than $6 billion of shareholder wealth. Over the same time period, the MSCI US REIT Index, S&P 500, Colony’s proxy peer group, and an index of alternative asset managers comprised of firms from Colony’s proxy peer group have returned approximately +27%, +45%, +66%, and +111%, respectively.2

1 Colony Capital 8-K filing dated January 10, 2017.

2 Source: Total shareholder returns from Bloomberg as of November 15, 2019. REIT Index is MSCI US REIT Index. Proxy Peers consist of: APO, ARES, BAM, BX, CBRE, CG, DRE, HCP, HPT, HST, JLL, KKR, KW, OAK, PLD, VTR and WPC per Colony’s 2019 proxy statement. Alternative asset managers consist of: APO, ARES, BX, CG, and KKR per Colony’s 2019 proxy statement.

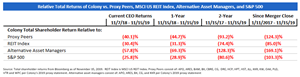

Despite Mr. Barrack’s strategic and execution failures in the three-way merger, the Board appointed Mr. Barrack, then Colony’s Executive Chairman, to the additional role of Chief Executive Officer upon the “resignation” of Richard Saltzman on November 7, 2018. As Colony’s new CEO, Mr. Barrack has continued to fail shareholders: Colony’s total shareholder return is deeply negative, while the peers and relevant indexes are up materially (and in most cases near all-time highs).

Total Returns of Colony vs. Alternative Asset Managers, Proxy Peers, S&P 500, and MSCI US REIT Index Since Merger Close on 1/11/17

Relative Total Returns of Colony vs. Proxy Peers, MSCI US REIT Index, Alternative Asset Managers, and S&P 500

“We believe the capital markets apply a lugubrious discount to Colony’s assets and cash flow because of Mr. Barrack,” continued Mr. Aintabi. “The Board has allowed Mr. Barrack to dilly-dally and work remotely from Aspen, Colorado, where Colony has no offices, even while the business is in need of extraordinary attention, simplification and focus. Colony cannot succeed with a part-time and distracted CEO.”

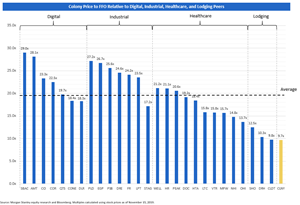

Colony Price to FFO Relative to Digital, Industrial, Healthcare, and Lodging Peers

Colony’s share price fell more than twenty percent following the Company’s 2Q 2019 earnings conference call in August 2019. In the aftermath of this additional example of poor leadership and market skepticism, Blackwells sent a letter to the full Board of Colony, urging change. The full text of the letter is appended below.

To date, the Board has rejected Blackwells’ recommendations for change, instead expressing its support and admiration for Mr. Barrack, effectively endorsing Mr. Barrack’s past performance and strategic decisions and his unilaterally formulated succession plan. Faced with a Board that seems to regard itself subservient to the Chairman and CEO, shareholders must take action. Accordingly, Blackwells will nominate a slate of independent professionals for election to the Board at the upcoming annual meeting. These nominees have extensive experience in critical areas of importance for Colony, including real estate, REIT management, M&A, capital allocation, restructuring, public markets, investment management and corporate governance.

“Three things are necessary for Colony to succeed again, regain the trust and respect of investors, and create long-term shareholder value: The Company must be simplified, must be led by a respected executive with significant public markets experience and must have a Board that is fully independent and willing to exert influence and oversight even when the decisions are uncomfortable,” continued Mr. Aintabi. “We are confident that our fellow shareholders will vote overwhelmingly for positive change at the upcoming annual meeting. Until then, we demand that the current Board fulfill its obligations and put a stop to further actions by the Company that only worsen the situation, including more reckless acquisitions and overpaid executive appointments for Mr. Barrack’s friends.”

Blackwells’ Five Independent Nominees:

Jennifer M. Hill. From 2011 to 2014, Ms. Hill served as the Chief Financial Officer of Bank of America Merrill Lynch (NYSE: BAC). While there, Ms. Hill managed a team of over 1,100 employees supporting Bank of America’s global banking and capital markets segment and her responsibilities included regulatory reporting, public audit, capital and liquidity management, strategic leadership in management metrics and forecasting and budgeting for the division and over 500 legal entities.

Prior to joining Bank of America, Ms. Hill was Group Director of Strategy and Corporate Finance at Royal Bank of Scotland from 2008 to 2011. From 2006 to 2008, Ms. Hill was the Chief Financial Officer of Tisbury Capital Management and from 1996 to 2006, Ms. Hill served as a Managing Director of Goldman Sachs, & Co.

Since January 2015, Ms. Hill has been an Independent Director of Santander Asset Management, an international asset manager, where she is the Chair of the Audit Committee and is a member of the Risk Committee. Ms. Hill also serves on the Boards of Directors of the Melqart Funds, which are London-based hedge funds focused on event-driven strategies, LaCrosse Milling, a Wisconsin-based oat milling company, and Arkadia Asset Management, a Swiss-based hedge fund.

Ms. Hill received a Bachelor of Arts in both Government and French from Hamilton College in 1987 and an MBA from Columbia University in 1994.

William W. Johnson. From 2013 to 2018, Mr. Johnson served as a Managing Director, Global Deputy and Americas Head of Credit Suisse Asset Management, an asset management firm with over $400 billion in assets under management. Prior to joining Credit Suisse, from 2010 to 2012, Mr. Johnson served as a Partner and as Deputy Head of Asset Management at Perella Weinberg Partners, a global financial services firm. From 2006 to 2009, Mr. Johnson served as Head of the Proprietary Positioning Business and the Head of Tax-Exempt Capital Markets at J.P. Morgan Chase & Co., a commercial and investment banking institution. Additionally, Mr. Johnson served as the President of Paloma Partners Management Company, an investment advisory firm, from 2001 to 2003.

From October 2009 to August 2013, Mr. Johnson served as an Independent Director of Two Harbors Investment Corporation (NYSE: TWO), a publicly-listed company focused on investing, financing and managing residential mortgage-backed securities and related investments. From 2012 to 2013, Mr. Johnson served as Independent Director at Silver Bay Realty Trust Corporation (NYSE: SBY), a formerly public REIT.

Mr. Johnson received his Bachelor of Science from the Wharton School at the University of Pennsylvania in 1984 and he received an MBA from the University of Chicago in 1988.

Jay N. Levine. Mr. Levine has served as Non-Executive, Independent Chairman of the Board of OneMain Holdings, Inc. (NYSE: OMF), one of the largest personal finance companies in the U.S., since September 2018. From October 2011 to September 2018, he served as President and Chief Executive Officer of OneMain. During his executive tenure at OneMain, Mr. Levine was repeatedly voted Outstanding CEO by Institutional Investor Magazine and oversaw the company's market capitalization expand from $1.7 billion at the time of its IPO to more than $5 billion as of 2019.

Prior to joining OneMain, Mr. Levine was a Director and, later, President and Chief Executive Officer of Capmark Financial Group, Inc., a former commercial real estate finance company, from December 2008 to September 2011. From October 2000 to December 2008, he served as President, Chief Executive Officer (Co-Chief Executive Officer from October 2000 to January 2007) and a member of the Board of Directors of Royal Bank of Scotland Global Banking and Markets, North America, a banking and financial services company. Additionally, Mr. Levine served as Chief Executive Officer and Co-Head of the Mortgage and Asset Backed Departments at RBS Greenwich Capital from 1993 to 2000.

Mr. Levine received a Bachelor of Arts in Economics from the University of California, Davis in 1984.

Todd Schuster. From April 2013 to August 2015, Mr. Schuster served as the Co-Chief Executive Officer of Ares Commercial Real Estate Corporation (NYSE: ACRE), a publicly traded specialty finance company and real estate investment trust. Under Mr. Schuster’s leadership, ACRE delivered a 67% increase in earnings per share from its fiscal years ending 2013 to 2015. He also served as Senior Partner, Real Estate for Ares Management (NYSE: ARES), a global alternative asset manager with over $140 billion of assets under management, from June 2013 to September 2015. During his tenure at ARES, Mr. Schuster also served on ARES’s Executive Committee and on the Investment Committee for all ARES's sponsored real estate debt and equity vehicles, which invested in both the US and Europe/UK.

Mr. Schuster previously founded and served as the Chief Executive Officer and as a member of the Board of Directors of CW Financial Services LLC, a commercial real estate investment services firm, from 1992 to 2009.

In addition to his executive leadership experience, Ms. Schuster also served on the Board of Directors of ACRE from April 2012 to August 2015.

Mr. Schuster received a Bachelor of Arts from Tufts University in 1982.

David P. Tomick. Mr. Tomick has served as the lead director and chairman of the audit committee on the Board of Directors of Eldorado Resorts, Inc. (NYSE: ERI), a publicly-traded hotel and casino entertainment company, since December 2014. He is the former Chairman (2012 to 2015) and Chief Financial Officer (2008 to 2011) of Securus, Inc., a company that he founded that provided GPS monitoring and personal emergency response. From 1997 to 2004, Mr. Tomick served as an Executive Vice President and Chief Financial Officer of SpectraSite, Inc. (NYSE: SSI), a formerly publicly-listed company and one of the largest wireless tower operators in the United States. He previously served as the Chief Financial Officer of Masada Security, a security systems provider, and the Vice President of Finance of Falcon Cable TV, a Los Angeles-based cable systems operator.

In addition to his service on the Board of Eldorado, Mr. Tomick has also served on the Board of Directors of Gryppers, Inc., an American-based sports technology brand and multinational supplier of recreational apparel and protective wear since 2016, Autocam Medical, a medical machinery manufacturer, since 2008 and First Choice Packaging, a packaging solutions company, since 2010. Previously, Mr. Tomick served on the Boards of Directors of Autocam Corporation, an automotive precision-machine components manufacturer, NuLink Digital, an internet service provider, TransLoc, Inc., a microtransit services technology support company, and IWO Holdings, Inc., mobile digital wireless personal communication services company.

Mr. Tomick received a Bachelor of Arts in History from Denison University in 1974 and an MBA from the Kellogg School of Management at Northwestern University in 1978.

About Blackwells Capital

Blackwells Capital was founded in 2016 by Jason Aintabi, its Chief Investment Officer. Since that time, it has made investments in public securities, engaging with management and boards, both publicly and privately, to help unlock value for stakeholders, including shareholders, employees and communities. Throughout their careers, Blackwells’ principals have invested globally on behalf of leading public and private equity firms and have held operating roles and served on the boards of media, energy, technology, insurance and real estate enterprises. For more information, please visit www.blackwellscap.com

Contact:

Gagnier Communications

Dan Gagnier / Jeffrey Mathews

646-569-5897

Blackwells@gagnierfc.com

Blackwells Capital LLC, Jason Aintabi, Jennifer M. Hill, William W. Johnson, Jay N. Levine, Todd Schuster and David P. Tomick (collectively, the “Participants”) intend to file with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement and accompanying form of proxy to be used in connection with the solicitation of proxies from the stockholders of Colony Capital, Inc. (the “Company”). All stockholders of the Company are advised to read the definitive proxy statement and other documents related to the solicitation of proxies by the Participants when they become available, as they will contain important information, including additional information related to the Participants. The definitive proxy statement and an accompanying proxy card will be furnished to some or all of the Company’s stockholders and will be, along with other relevant documents, available at no charge on the SEC’s website at http://www.sec.gov/.

Information about the Participants and a description of their direct or indirect interests by security holdings is contained can be found in the Schedule 14A filed by Blackwells with the SEC on November 26, 2019.

Disclaimer

This material does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in any state to any person. In addition, the discussions and opinions in this press release are for general information only, and are not intended to provide investment advice. All statements contained in this press release that are not clearly historical in nature or that necessarily depend on future events are “forward-looking statements,” which are not guarantees of future performance or results, and the words “anticipate,” “believe,” “expect,” “potential,” “could,” “opportunity,” “estimate,” and similar expressions are generally intended to identify forward-looking statements. The projected results and statements contained in this press release that are not historical facts are based on current expectations, speak only as of the date of this press release and involve risks that may cause the actual results to be materially different. Certain information included in this material is based on data obtained from sources considered to be reliable. No representation is made with respect to the accuracy or completeness of such data, and any analyses provided to assist the recipient of this presentation in evaluating the matters described herein may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results. Accordingly, any analyses should also not be viewed as factual and also should not be relied upon as an accurate prediction of future results. All figures are unaudited estimates and subject to revision without notice. Blackwells disclaims any obligation to update the information herein and reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. Past performance is not indicative of future results.

Appendix

August 29, 2019

Board of Directors

Colony Capital, Inc.

515 South Flower Street, 44th Floor

Los Angeles, CA 90071

Dear Colony Directors:

As you know, Blackwells Capital LLC, together with its affiliates (“Blackwells”), is a significant shareholder of Colony Capital (the “Company” or “Colony”). We and our fellow shareholders are extremely concerned about the leadership and direction of Colony and call upon you to take immediate steps to protect and grow shareholder value.

Colony’s stock trades today near its all-time low, having declined nearly 60% since the announcement of the ill-fated, three-way merger with the NorthStar entities two years ago. The stock is down 20% since Mr. Barrack was re-appointed Chief Executive Officer less than a year ago. Meanwhile, comparable REITs and asset management firms have seen their stocks rise significantly over these periods, in many cases to new all-time highs.

Earlier this month, the Company announced quarterly results in a disjointed, sloppy and unprofessional earnings call that sent investors spinning and the stock down precipitously. This most recent call was, unfortunately, just the latest in a long string of confusing disclosures and disappointing results: the Company has missed consensus EPS estimates in 14 of the last 16 quarters.

It appears to us that the business is so complex and unique that investors and management alike cannot understand its key drivers and direction, let alone arrive at a fair valuation. None of this is helped by the opacity and obtuseness of the Company’s disclosures, nor by their complexity and length.

One thing is certain: the current leadership team and business strategy are not creating value for shareholders. Colony desperately needs change or shareholders will abandon the Company at an increasing pace. The responsibility for fixing Colony falls squarely onto the Board, which has been irrepressibly derelict in overseeing management, identifying a successor CEO, allocating capital appropriately and serving shareholder interests.

We – and other shareholders with whom we have spoken – have lost confidence in Mr. Barrack as the leader of the business. We believe that he should be immediately replaced as CEO and should resign from the Board. We also believe Mr. Ganzi is not a suitable replacement as CEO. Moreover, Colony should refrain from engaging in any further acquisitions until a refreshed, properly functioning Board conducts a comprehensive review and reset of the Company’s strategy. A majority of the after-tax proceeds from the planned sale of the industrial properties should be allocated to shareholders, through a buyback. And, Colony needs to exert more influence on Colony Credit and new directors are needed at both Colony and Colony Credit.

Mr. Barrack Should Resign or Be Fired

Colony is not Mr. Barrack’s fiefdom. Mr. Barrack has an abysmal track record. Certainly, his enormous personal distractions and tangible conflicts of interest are contributing factors. With Mr. Barrack’s track record and personal issues, no reasonable, fiduciarily-aware public company Board of Directors would select Mr. Barrack as CEO of Colony or any other public company today. He is Colony’s CEO only because of inertia and, seemingly, a sense of personal loyalty felt by some of the incumbent directors. Those are not reasonable business judgments.

We believe Mr. Barrack should resign or be fired because:

- He is the architect of Colony’s failed strategy. Mr. Barrack readily admits that the three-way merger with the NorthStar entities – bringing together a Frankensteinian combination of hard-asset REIT businesses and asset-lite advisory businesses – was his idea and that he failed to conduct adequate due diligence on NorthStar. Given the billions that have been lost as a result of this ill-conceived merger (and failure of diligence), Mr. Barrack should be disqualified from making further strategic decisions on behalf of shareholders. The Board cannot rely on Mr. Barrack’s strategic judgment in light of his track record.

- He has destroyed more than $775 million in just nine months. Since returning as the CEO of Colony nine months ago, shareholders have lost $775 million, as Mr. Barrack has failed to take any definitive strategic actions to correct Colony’s business composition or performance issues.

- He is not devoting sufficient time to the job. Mr. Barrack lives in Aspen, Colorado. Colony, with twenty-one offices around the world, has no office in Aspen. It is impossible for Mr. Barrack to execute on the massive turnaround Colony requires while living in a city far from his direct reports and the business’ operations.

- He appears to have significant personal distractions that are a blemish on the reputation of the Company. Mr. Barrack is undoubtedly distracted by at least two Congressional investigations and at least one reported criminal investigation1 into his political and personal activities, including as Chairman of the Inaugural Committee for President Trump and as a man who sought a special role within the Trump administration. In addition, Mr. Barrack received a letter from Senator Elizabeth Warren documenting alleged improper and unethical activities2, and he is the subject of a staff report of the House Committee on Oversight and Reform, in which Mr. Barrack is cited for lobbying the Trump Administration for personal appointments and special arrangements that could have involved transferring nuclear technology to Saudi Arabia, potentially in violation of US law.3 Whatever their merits, these investigations certainly have been a distraction for Mr. Barrack and may blemish the reputation of the Company, if Mr. Barrack remains Colony’s CEO.4

- It appears Mr. Barrack has used friendship and politics as criteria for business deals and for allocating shareholder capital. Mr. Barrack had Washington lobbyist Rick Gates, the Deputy Chairman of the Trump Inaugural Committee, added to Colony’s payroll and kept him there until Mr. Gates became a witness in the Mueller investigation and was indicted for money laundering and violating foreign lobbying and tax laws.5 It is unclear to us whether Mr. Gates delivered any legitimate services to Colony during this period during which he was paid $20,000 per month.

On July 25, Colony announced the acquisition of Digital Bridge and a plan to appoint its CEO, Marc Ganzi, as CEO of Colony upon Mr. Barrack’s retirement. Mr. Barrack has known Mr. Ganzi for decades and regularly plays polo with Mr. Ganzi at the Aspen Valley Polo Club (which itself is sponsored by Mr. Ganzi). Mr. Barrack has admiringly said that Mr. Ganzi has “created a polo paradise” with the Aspen Valley Polo Club. Just one week before the announcement of the $325 million acquisition of Digital Bridge, on Friday, July 18 – a workday for most people – Mr. Barrack was playing polo at 11 AM in Aspen in a tournament that included Mr. Ganzi.6

We do not believe business decisions and Colony’s resources should be expended on the basis of friendship and shared hobbies. - It appears Mr. Barrack has violated Colony’s Ethics Code. Colony’s Code of Ethics for Principal Executive Officers and Senior Financial Officers (the “Ethics Code”) provides that each executive “must always conduct himself or herself in an honest and ethical manner” (Section 2) and that conflicts of interest (“a person’s private interest [that] interferes in any way or even appears to interfere with the interests of the Company as a whole”) are to be avoided (Section 3). The longstanding and significant investigations into Mr. Barrack’s conduct as Chairman of the Inaugural Committee and his advocacy for transactions that may have surreptitiously transferred nuclear technologies to Saudi Arabia appear to violate Section 2. Mr. Barrack’s use of the Company’s resources and relationships to foster his personal ambitions to serve as an ambassador or to benefit his political connections (such as Mr. Gates) or friends (such as Mr. Ganzi) appear to violate Section 3.

We know of no public company Board that would continue to employ a CEO who lived 900 miles from headquarters, has been persistently mired in investigations and scandals, appeared to put friendships above objective business evaluations and who had destroyed so much shareholder value.

Mr. Ganzi Should Not Be Colony’s Next CEO

We were surprised to learn that Mr. Barrack’s polo-playing friend, Mr. Ganzi, was named successor to Mr. Barrack. We believe a Board’s most important role is the selection of a Chief Executive. How is it, then, that the Board ceded to Mr. Barrack the selection of his successor?

We do not doubt that Mr. Ganzi has been a “leading visionary and entrepreneur driving communications infrastructure.” But, Mr. Ganzi has no public company leadership experience and, as far as we know, little knowledge of the real estate markets in which Colony operates or of public equity capital markets. With Colony’s significant performance, strategy, communications and investor relations issues, Mr. Ganzi appears to us greatly underqualified for the CEO position.

Recently, Mr. Ganzi underscored this point. At the Cowen Communications Infrastructure Conference earlier this month, Mr. Ganzi selectively told a small group of public market Colony investors about his future plans for Colony. We were not privy to the discussion and do not know what Mr. Ganzi’s plans are, but that is the point: the public markets do not allow an insider to discuss his or her material plans with a select group of investors. Mr. Ganzi also pledged to those in attendance that he would be meeting with a “small circle of trust[ed]” investors in advance of the Bank of America Merrill Lynch Conference in New York in September; we certainly hope someone will instruct Mr. Ganzi on Regulation FD prior to that.

Under proper corporate governance processes, the Board should have conducted a broad, global search for Colony’s next CEO based on merit, not friendship with the outgoing CEO. The Board should have developed a detailed specification, hired an executive recruiter, interviewed dozens of candidates, checked references and selected the single best person for the job. We are highly confident that there are talented public company executives with more relevant experience than Mr. Ganzi. Importantly, such an independent executive would also be able to objectively review Mr. Barrack’s strategy and apply fresh thinking to the configuration and execution of Colony’s business. Instead, it appears once again that Mr. Barrack is using the Company’s resources to benefit one of his friends.

We are outraged that this Board allowed Mr. Barrack to hand-pick his successor, as if the Board serves no purpose. As a public market investor, we expect Boards to execute the responsibility of hiring a CEO with great care and only after complete diligence. Mr. Ganzi should not serve as the next CEO of Colony; a new search should be conducted.

Capital Should Be Returned to Shareholders

Despite Colony’s stock sitting near an all-time low and a public market valuation that is approximately 50% of net asset value, Colony has not been actively repurchasing its stock. In Q2, no shares were purchased, despite the extension in May 2019 of the authority to purchase $246 million of stock. The only directors to personally buy stock in the last year were Ray Mikulich and Dale Reiss.

The lack of buyback activity gives shareholders the distinct sense that the Board is not bullish on the Company’s future. We believe the Company and the directors should be aggressively buying stock at these levels.

We are concerned about Colony’s other potential uses of capital. Mr. Barrack’s history of and recidivistic flirtations with vanity projects– Neverland Ranch, the Weinstein Cos., Legendary Pictures – causes us to worry about the use of the corporate check book for anything other than the purchase of Colony stock.

When the Company sells its industrial real estate portfolio, we believe a majority of the after-tax proceeds should be used to conduct a tender offer for Colony’s stock. We know Colony is trading at a massive discount to fair value; no other use of capital will have as strong a return as buying Colony stock at these prices. The Board should not authorize any further acquisitions or other uses of capital until the Company’ stock is trading closer to fair value.

Colony’s Cost Structure is Bloated and Needs to Be Meaningfully Cut

By any measure, Colony’s corporate general and administrative costs are stratospheric and unacceptable.

The Company, which manages approximately $43 billion in assets under management (AUM) and has a market cap of $2.1 billion, spends about the same amount on G&A as Brookfield Asset Management, which manages $385 billion of AUM and has a market cap of $50 billion. It is unfathomable how Brookfield and Colony could need the same infrastructure and G&A spending.

We do note that Colony’s executive compensation is significantly higher than that of Brookfield: Mr. Barrack received cash compensation in 2018 that was nearly nine times more than the CEO of Brookfield; and the overall compensation received by Mr. Barrack far exceeded that of Brookfield’s CEO. The rest of the executive team at Colony are similarly over-compensated compared to their peers at Brookfield.

Compared against its asset management and REIT peers more broadly, Colony’s corporate costs and geographic footprint are clearly oversized. The Board must examine the infrastructure and executive compensation spending at Colony and insist on significant cuts.

Colony Should Replace the Colony Credit Board and Leadership Team

Colony owns 37% of Colony Credit Real Estate (“Colony Credit”) and has allowed Colony Credit to underperform and lose credibility.

Colony Credit trades at an approximate 35% discount to its latest reported NAV. This discount to NAV is unique among commercial mortgage REITs, which generally trade at or above their stated NAV. Colony Credit’s stock performance in 2019 is also significantly worse than its peers, all of whom have rallied during the year.

We believe Colony Credit’s woes – not unlike Colony’s issues – are self-inflicted. Since its January 2018 IPO, Colony Credit has over promised and under delivered time and again, particularly around dividend coverage. Management has also surprised investors with asset impairments on numerous occasions, reflecting management’s inability to pro-actively identify and manage problem credits.

Given management’s poor track record at Colony Credit, it is critical that Colony exert its influence to change Colony Credit’s Board and executive management team. We are disappointed that Richard Saltzman, for example, has been allowed to remain Chair of Colony Credit, though he was (rightly) removed from his Colony posts. Is the Colony Credit Chairmanship a gift or a “soft landing” for Mr. Saltzman? At the expense of whom? He should be replaced, along with other underperforming executives and directors.

In the meantime, Colony Credit should be focused on reducing the discount to NAV by selling selected assets into the private capital markets and repurchasing stock. Deploying one dollar of new capital, only to have it valued at 65 cents in the public market, is a fool’s game. No new investments should be made by the existing team (or a new team), until the discount to NAV is erased.

Colony Needs New Directors

This Board has meaningfully failed shareholders. That you would leave Mr. Barrack in place at CEO, appoint Mr. Ganzi at Mr. Barrack’s behest without a fulsome CEO search, refuse to purchase (or repurchase) stock, allow the Company to operate with excessive overhead and sit idle while Colony Credit destroys value, is testament to the need for a significant Board overhaul at Colony.

We expect you to immediately replace two of your longstanding members with members we help you select, in addition to the removal of Mr. Barrack from the Colony Board. The Colony Credit Board similarly needs new directors and we expect you to replace two longstanding members there in addition to the removal of Mr. Saltzman from the Colony Credit Board, as well, with people we help you select.

Conclusion

In the absence of substantial and prompt movement by this Board, we will exercise any or all of our available rights as shareholders to advocate for and implement change. It is time for this Board to step up to the task of independent oversight or to move aside and allow new directors to do so.

Sincerely,

Jason Aintabi

Managing Partner

Notes

1 Politico, Daniel Lippman, “Trump cuts off one of his closest friend,“ August 19, 2019, https://www.politico.com/story/2019/08/19/donald-trump-cuts-off-tom-barrack-1467191.

2 “Letter to Tom Barrack Re Presidential Transition Ethics Conflicts of Interest,” Senators Elizabeth Warren, dated August 14th, 2019.

3 Press Release, “New Documents Show Corporate and Foreign Interests Seek to Influence U.S. Nuclear Policy,“ July 29, 2019, https://oversight.house.gov/news/press-releases/new-documents-show-corporate-and-foreign-interests-seek-to-influence-us-nuclear.

4 Mr. Barrack appears to be a magnet for famous people involved in scandals; he has had widely reported personal relationships with Michael Jackson, Harvey Weinstein and Jeffrey Epstein, for example.

5 The New York Times, Kenneth P. Vogel, Mark Mazzetti, Maggie Haberman and David D. Kirkpatrick, “Two Trump Allies, Seeing Unlimited Opportunity, Instead Drew Scrutiny,” July 24, 2018, https://www.nytimes.com/2018/07/24/us/politics/rick-gates-elliott-broidy-trump-payments.html

6 https://myemail.constantcontact.com/Basalt-Handicap-Gets-Under-Way-Friday-At-Aspen-Valley-Polo-Club.html?soid=1119840230806&aid=G7y2MWBZQJk

Total Returns of Colony vs. Alternative Asset Managers, Proxy Peers, S&P 500, and MSCI US REIT Index Since Merger Close on 1/11/17

Total Returns of Colony vs. Alternative Asset Managers, Proxy Peers, S&P 500, and MSCI US REIT Index Since Merger Close on 1/11/17

Relative Total Returns of Colony vs. Proxy Peers, MSCI US REIT Index, Alternative Asset Managers, and S&P 500

Relative Total Returns of Colony vs. Proxy Peers, MSCI US REIT Index, Alternative Asset Managers, and S&P 500

Colony Price to FFO Relative to Digital, Industrial, Healthcare, and Lodging Peers