In the classic sense of the term, momentum is an investment vision that favors stocks that have been trending upward over the past six and twelve months. At MarketScreener, momentum includes data on the positive trend of the stock in the short (3 months), medium (6 months) and long term (12 months), but also the revisions of net earnings per share and turnover by analysts in the short and long term, weighted by the visibility of the analysts' business model and by the divergence of their estimates, assuming that analysts are rather conservative in their revisions.

In our previous selection, we chose Cal-Maine Foods, Paccar,Vertex Pharmaceuticals, Ulta Beauty and Microchip Technology. A portfolio weighted on these five positions would have generated a return of +11.93% compared to +5.50% for our benchmark, the S&P 500 index, over the first quarter of 2023 (from 31/12/2022 to 30/03/2023). At the individual level, Cal-Maine Foods gained +9.80% over the quarter, Paccar +9.72%, Vertex Pharmaceuticals +8.13%, Ulta Beauty +14.25% and Microchip Technology +17.77%. A portfolio weighted on these five positions will have generated a return of +11.93% compared to +5.50% for our benchmark, the S&P 500 index, over the first quarter of 2023 (from 31/12/2022 to 30/03/2023). At the individual level, Cal-Maine Foods gained +9.80% over the quarter, Paccar +9.72%, Vertex Pharmaceuticals +8.13%, Ulta Beauty +14.25% and Microchip Technology +17.77%. This selection clearly outperformed the US Broad Index while offering lower volatility.

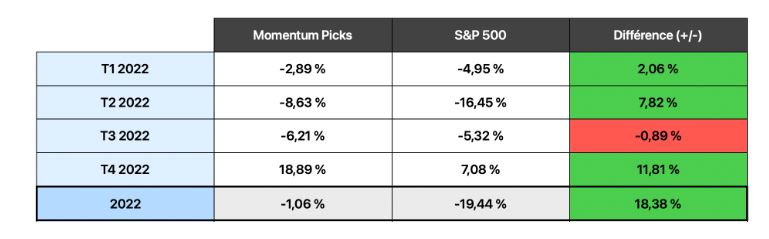

The Momentum Picks selection, which began on 31 December 2021, achieved a cumulative performance of +10.74% until 30 March 2023, compared with -15.01% for the US broad index (S&P 500), i.e. +25.75% outperformance in five quarters. This performance does not include the payment of dividends to shareholders over the period, so the real performance is still higher.

.

Parker-Hannifin Corporation (PH)

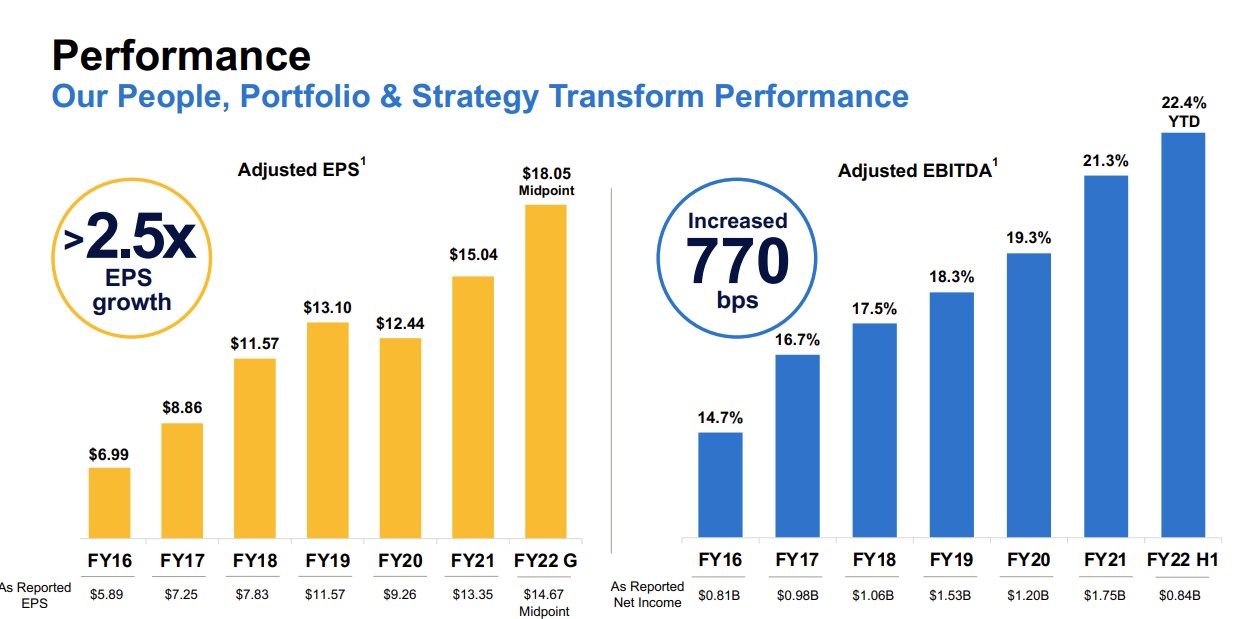

Parker-Hannifin is a specialist in the manufacture of command and control systems for many diversified industries, including aerospace and defense (16% of sales). The company has strong expertise in nine major technology areas: hydraulics, pneumatics, electromechanics, filtration, process control, fluid and gas management, sealing and protection, air conditioning and aerospace. The world leader in the motion and control segment with 11% market share, the company has been successfully deploying a dual strategy of organic and external growth for over 50 years. Its success is based on its unparalleled distribution network, exemplary capital allocation and strong free cash flow generation for its shareholders. All income statement metrics have been steadily improving for many years. Over the last decade, operating income has doubled. Its growth prospects are not waning: there is still a long way to go for this "good father" value. The management of the increase in inputs and the company's privileged position in its market make it a stock to be favored for this second quarter. The valuation is all the more reasonable given the quality of the fundamentals and the solidity of the business model in the face of economic cycles.

Copart (CPRT)

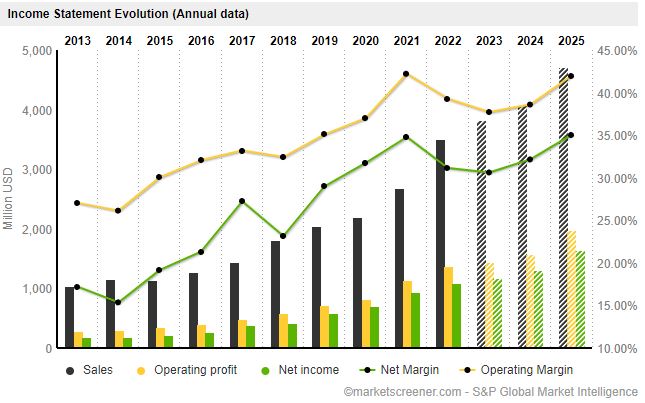

This is a company I particularly appreciate for the superiority of its business model and the quality of its management team. Founded in 1982 in California and listed on the stock exchange in 1994, Copart specializes in the auction and online sale of used vehicles, and generates most of its revenue in the United States. More than 80% of its revenues are derived from service fees charged for the use of its online auction platform, and the rest from the sale of vehicles that the group owns. Although little known, this used car market is dynamic and has been growing steadily for the past thirty years. Sellers are mainly insurance companies - which recover vehicles that have been involved in accidents or found after being stolen - and buyers are automotive professionals, primarily interested in the potential of the market.They are primarily interested in the restoration potential of the less desperate cases or, failing that, in spare parts or the resale of salvageable materials (scrap metal, plastics, etc.).). Between the two comes Copart. As an agent, the company has built up privileged links with insurers and other sellers (e.g. rental companies such as Hertz and Avis) over the years. For buyers, it has developed an online platform with a sophisticated auction system. Copart's added value lies in its platform, which connects buyers and sellers from 11 countries. Its clients are individuals, professionals (body shops, dealers or spare parts buyers) or institutions (insurance companies, car rental companies, municipalities, financial institutions or even charities). Growth, high return on investment, management skin in the game, resistance to cycles, fortress balance sheet... Copart has everything to please! Even its price is not "exorbitant" for the quality offered.

Bruker Corporation (BRKR)

Bruker Corporation develops, manufactures and distributes scientific instruments and analytical and diagnostic solutions. The company operates through four segments: Bruker Scientific Instruments (BSI) BioSpin, which develops life science tools based on magnetic resonance technology, BSI CALID in the spectronomy and processing solutions segment, BSI Nano in the microscopy instruments market, and BSI Bruker Energy & Supercon Technologies (BEST), which develops superconducting materials for use in renewable energies and other applications. Bruker has benefited and will surely continue to benefit from the booming genomic sciences market. The company has recently made several acquisitions to strengthen its offering of innovative analytical tools. Due to the diversified nature of revenues, cyclicality should be less of an issue than with more specific companies. The company also has significant exposure to healthcare, government, and academics, suggesting that spending could be less cyclical, even in recessionary markets. Another reassuring fact is that Frank Laukien, CEO and Chairman, is a 27.5% shareholder and is not selling his shares at the current price when many others are.

With its excellent fundamentals and buoyant momentum, this stock is in the DNA of this Momentum Picks selection.

Microchip Technology (MCHP)

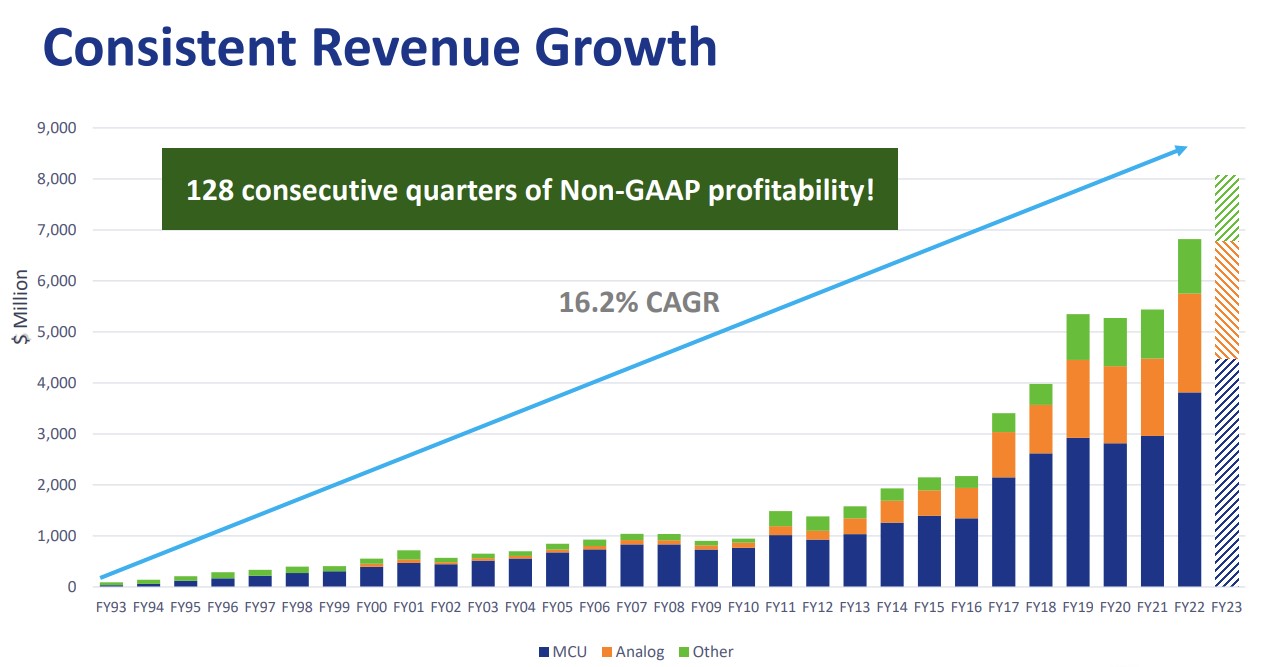

Already present in the previous quarter's selection, Microchip is an American manufacturer of semiconductors for the household goods, automotive, IT and telecom sectors. Its flagship products are microcontrollers, which account for more than 50% of its revenues, and programmable logic arrays (FPGAs for those in the know). Microcontrollers enable automation and are becoming more and more indispensable in many devices, especially in the automotive and connected object industries. The company should continue to grow this year with strong demand from its customers. The group's profitability is exemplary (net margin estimated at 27% in 2023 and ROE of 50%). The valuation seems quite cheap compared to the quality of the company and its future prospects.

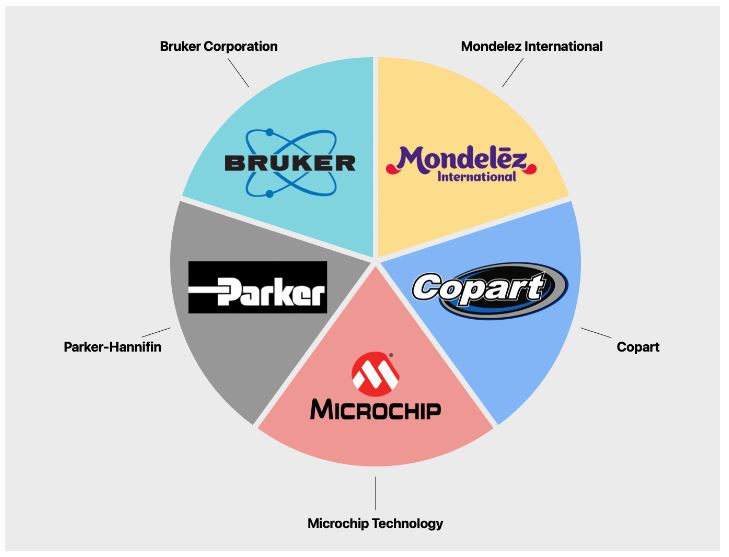

You will notice that this Momentum Picks portfolio is well balanced across five sectors: consumer staples with Mondelez, healthcare with Bruker, consumer discretionary with Copart, technology with Microchip and industrials with Parker. We will meet again at the end of June (06/30/2023) to review its progress and propose a selection for the following quarter.

By

By