Low-cost airlines have not reinvented the wheel. They simply bet that travelers would be willing to sacrifice service for price. And they were right. Let's start by looking at their savings opportunities compared to traditional airlines.

To summarize, the savings come from four main areas:

- They reduced services and travel amenities to a minimum. In some cases (Ryanair) in an extreme way.

- They also reduced short-haul flight programs on very busy routes.

- They lowered the number of different aircraft models in the fleet as much as possible in order to mutualize maintenance costs.

- They are leasing "secondary" airport terminals.

Hyper-pressurized gross margins force these companies to compress operating costs to the extreme. This does not, however, protect them from the brutal realities of the airline industry:

- It is a cyclical industry with large incompressible fixed cost structures.

- It is very exposed to changes in economic conditions and the price of oil

- It is very competitive, which annihilates any "pricing-power" and pulls the prices down.

- It has an extremely high capital requirement.

Three major European players in the sector:

Ryanair is the pioneer of the sector. The Irish company has a charismatic founder and an original brand communication that often makes headlines. See their Twitter feed for example (frankly hilarious) and this collection of tasty quotes from O'Leary in the Guardian.

EasyJet has recurrent problems in its management and operations, probably a sign of a weaker corporate culture than Ryanair. The company was already in trouble, but the pandemic made it worse and it has not been able to raise £5.5 billion in debt and equity in a hurry. This is where we see the effect (positive or negative, it's debatable) of central bank interventions, because without the credit facilities put in place, a company like EasyJet would probably have disappeared.

Wizz Air, the Hungarian challenger, has tried to take advantage of the situation to buy EasyJet. But the attempt did not succeed, as the financial markets saved the company. Wizz is developing very aggressively in Europe with two key elements, its target clientele (the emerging middle class of Eastern Europe) and its lower labor costs. Wizz Air, like Ryanair, is a "genetically" aggressive player (even without O'Leary!) and has just announced an expansion plan in the Middle East via a joint venture in Abu Dhabi.

.

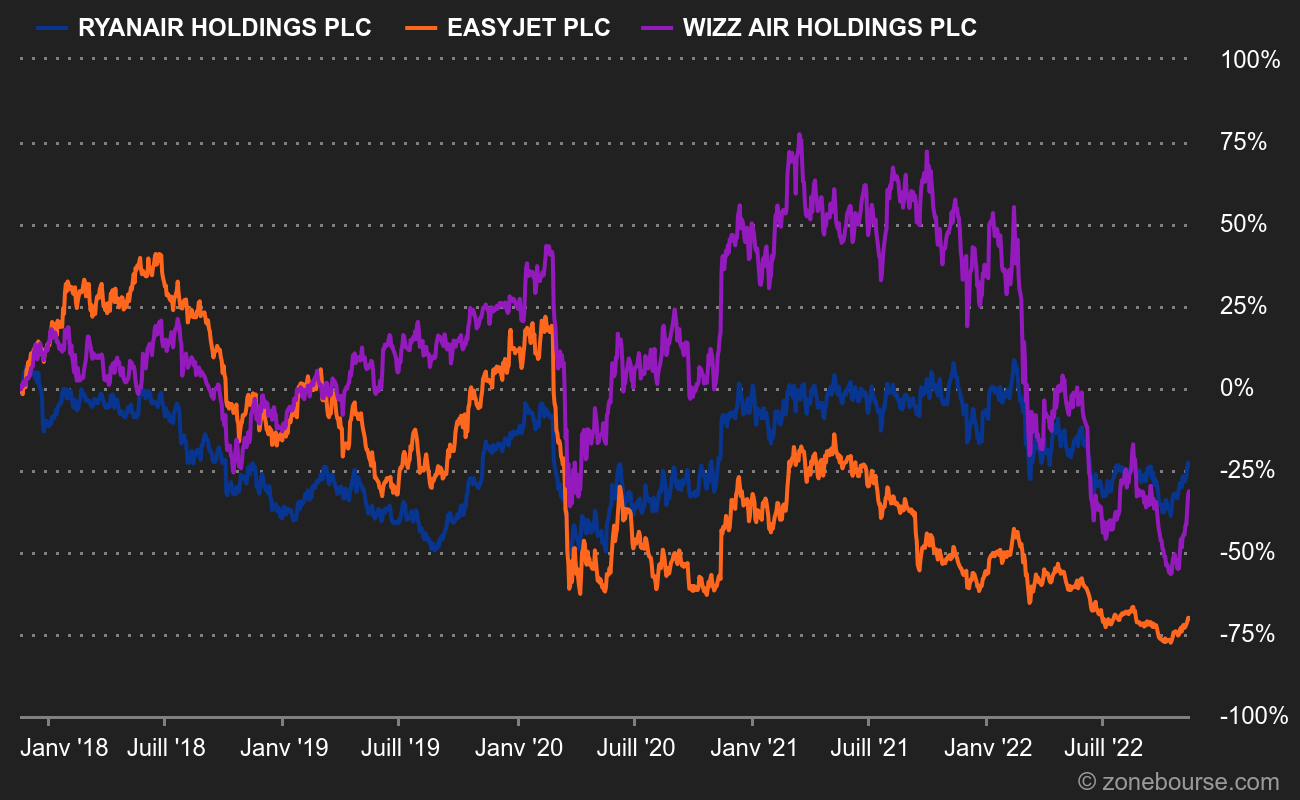

Over 5 years, difficult paths, but even more so for EasyJet

Let's take a very quick overview of the financial dynamics of the three airlines, in broad strokes:

Ryanair

The Irish carrier experienced strong growth between 2012 and 2020, with revenues rising from €4.4 to €8.5 billion. Then came the pandemic-related downturn, the scars of which are still visible: only €4.5bn in revenues in FY2021/2022. Ryanair has the highest profitability of the three companies reviewed, due to more aggressive cost control. Whoever has flown on their planes immediately understands what we are talking about. Over the decade that corresponds to a full cycle (2012/2022), from the euro crisis to the pandemic, Ryanair manages to generate cash for its shareholders, which in itself is a feat in civil air transport. 4.5 billion euros in total, or an average of 450 million euros per year. It should be noted that the accounting profits seem to overestimate the real profit capacity, as is often the case in capital-intensive activities where investments exceed depreciation. The allocation of capital is also quite singular, with all profits devoted to share buybacks, at an average valuation over the cycle of 12 times EBIT. This is a far cry from a value stock. Ryanair still had to take on some debt to pass Covid. The net debt (€1.4 billion) oscillates between 3 and 4 times the "normalized" annual earnings capacity

.

The British company has followed the same trajectory as Ryanair, but at a slower pace. Revenues have increased from £3.4 billion to £5 billion between 2011 and 2019. But they are in free fall with only $1.5 billion last year. On the other hand, the group has never generated cash profits for its shareholders: it is less well managed than Ryanair. EasyJet's margins are the lowest of the three carriers considered here. The group has had to compensate with capital increases and debt. Wizz Air tried to buy EasyJet in September 2021 for £1.2 billion, but was turned down.

There is undoubtedly a potential turnaround on the case, but the track record does not really argue in its favor.

The revenue dynamics are similar: revenues rose from €766m to €2.7bn between 2012 and 2020. Before falling back to €1.6 billion post-pandemic. Unlike its two rivals, Wizz is heavily indebted (€2.8bn), as there was no capital increase to overcome the covid hurdle. History will tell if this was a good idea. The Hungarian company generated €1.1 billion in cash profits over the last cycle, which is considerable given the size of the company and its relatively recent history (but which was focused on 2019, which was perhaps a cycle top). In return, this cash is not returned to shareholders but is used to fuel growth and, as mentioned, a very aggressive price positioning. For the first nine months of 2022, the accounts are suffering from a disaffection of Europeans for air travel and high kerosene prices. Apparently, Wizz has not chosen to hedge its bets, which reinforces the aggressive aspect of its profile.

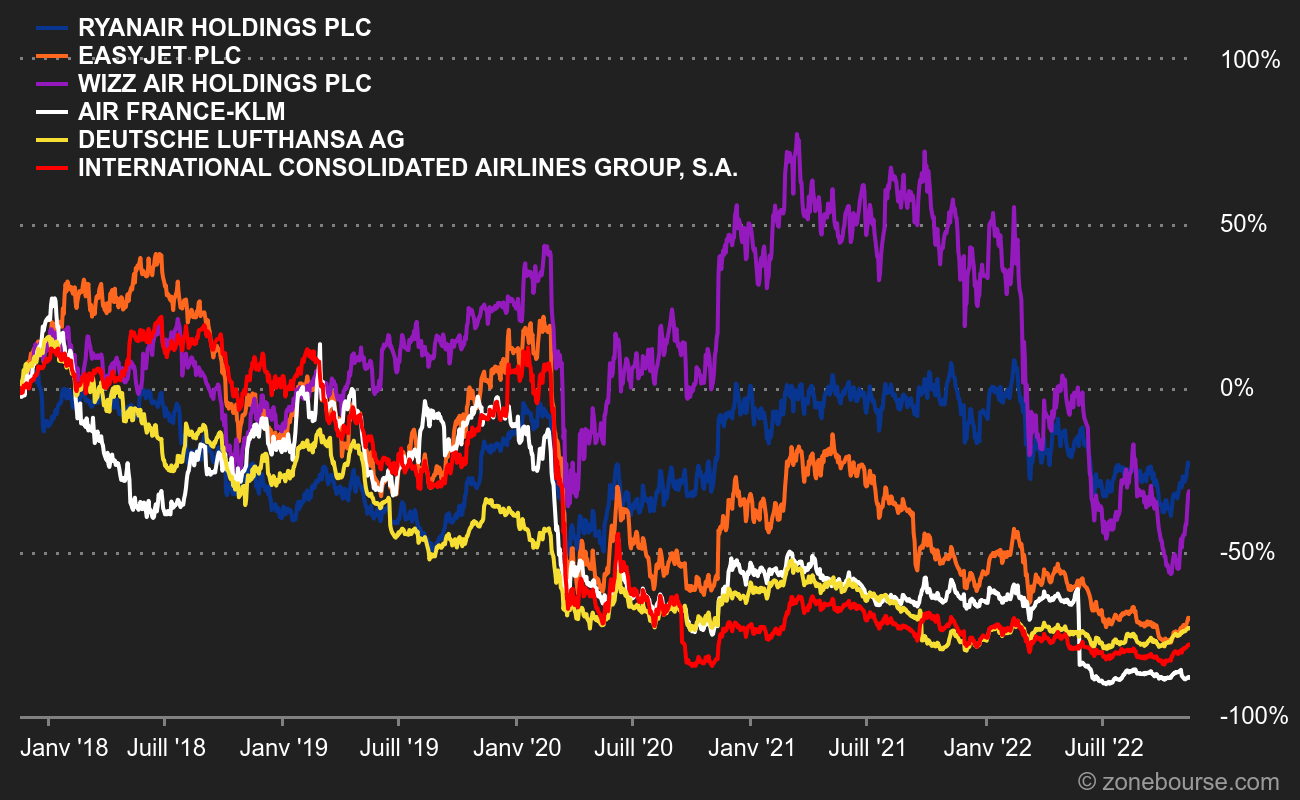

To conclude, we have a kind of "favorite" stock in Ryan Air, which is richly valued. We have EasyJet, which had a tougher time. And an aggressive outsider with a lot of debt, Wizz Air. To the credit of these airlines, they have survived and even (except for EasyJet) generated profits, which is a feat in itself in the airline industry, since the big European airlines are huge cash incinerators, at least to date. But let stay cautious : the sector is facing a lot of risks. Some investors might wonder why they should bother with complicated stocks when there are simpler and less risky investments?

By

By