These companies will look for favorable geographical areas for cryptocurrency mining and production, especially in countries or states with low electricity costs. This way, they will be able to run their machines non-stop with optimal energy cost.

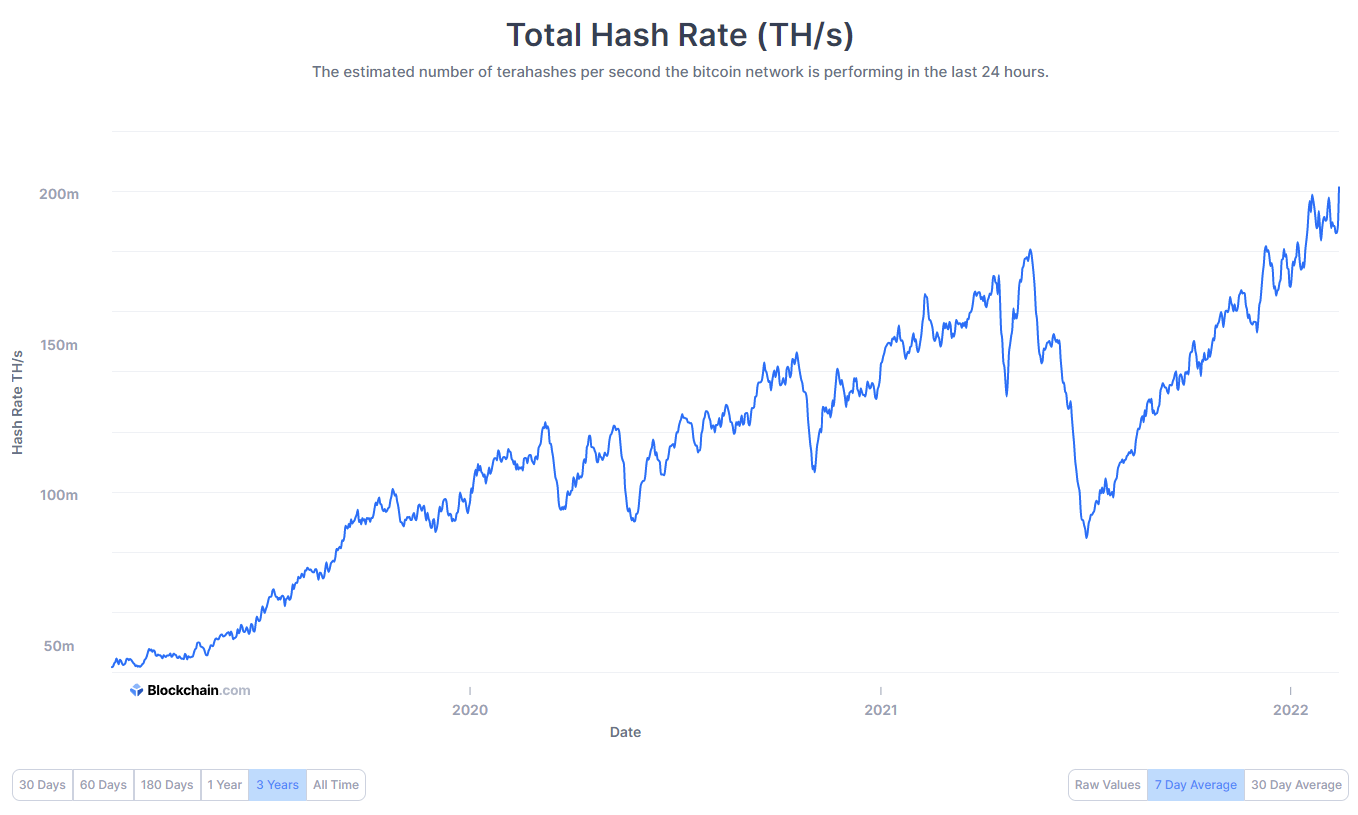

The more mining equipment they deploy, the higher their hash rate (computing power), which means that they have a better chance of validating transactions on the Bitcoin network and thus getting paid more regularly in BTC. A kind of race for computing power. We can see why the global hash rate is increasing rapidly (more and more mining hardware is connecting to the network in the hope of being paid in Bitcoins).

Source: Blockchain.com

Bitcoin mining companies express their computing power in exahash (EH/s). The higher the rate, the more computations the mining park performs. To give you an idea: 1 kH/s is 1,000 hashes per second; 1 MH/s is 1,000,000 hashes per second; 1 GH/s is 1,000,000,000 hashes per second; 1 TH/s is 1,000,000,000,000 hashes per second; 1 PH/s is 1,000,000,000,000,000 hashes per second; 1 EH/s is 1,000,000,000,000,000 hashes per second.

Now that we understand that the core business of these companies is to be able to perform the most computation with the lowest possible cost, let's explore these 3.0 miners.

Stratospheric performance

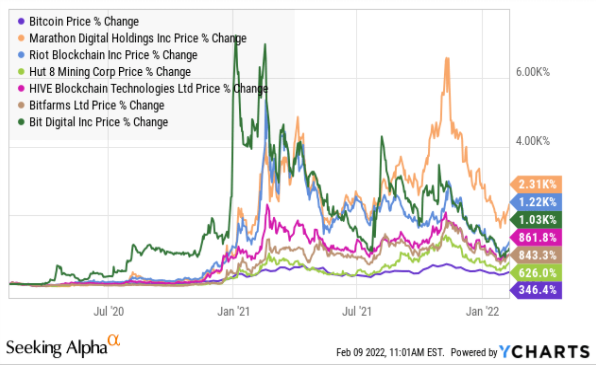

Source: Seeking Alpha

If we calculate the performance of these companies over the past two years, we notice that they all outperform bitcoin. For example, where BTC is doing 346%, Marathon Digital Holdings(MARA) is doing 2300% and Riot Blockchain (RIOT) is doing 1220%.

These companies are raking in bitcoins at an ever increasing rate as their mining base grows. So we should see the global hash rate increase in the coming months/years provided the bitcoin price continues to appreciate over time. Yes, because if these companies are producing bitcoin at the current price ($42,000), it is not impossible, and in fact quite likely, that the price will fall at some point. A phase commonly referred to as the "bear market". Thus, the price of bitcoin could be halved and the remuneration of these mining companies halved as well. But this potential fall would probably not make them tremble. They would tell me that, as usual, the bitcoin price would rebound even more strongly in the months following this fall and they would become even stronger.

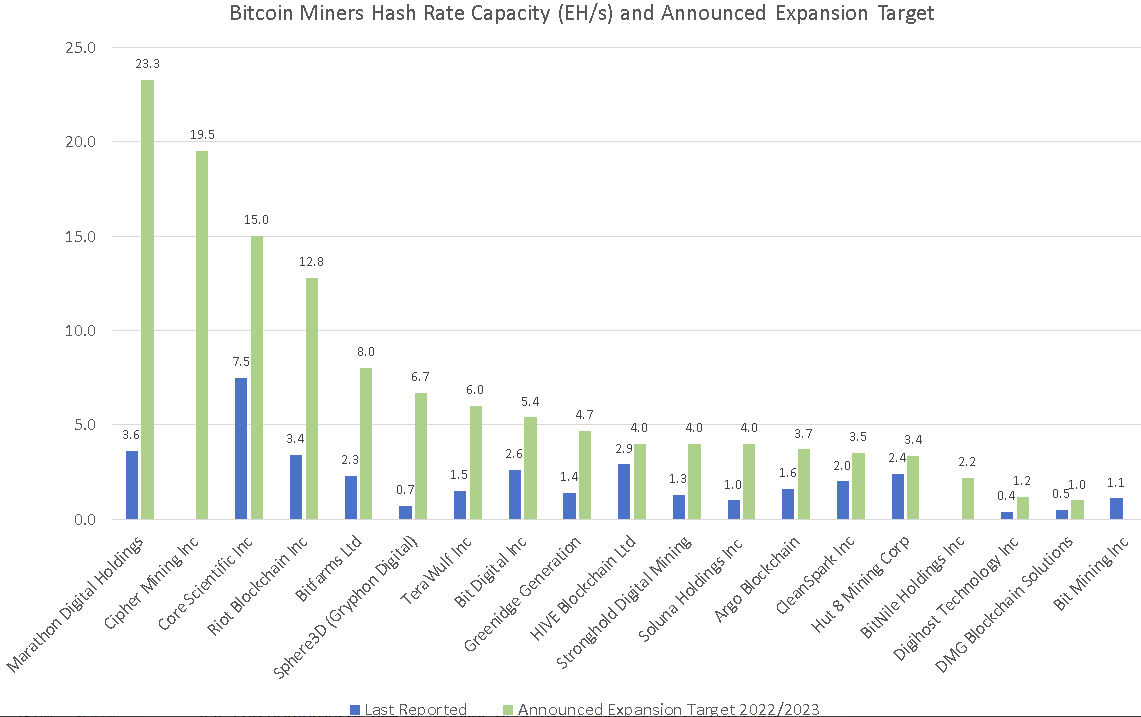

Let's take a look at the current situation in terms of hash rates.

Source: Seeking Alpha

Currently, the company with the highest hash rate is Core Scientific (CORZ) with 7.5 EH/s, which is twice as high as Marathon Digital with 3.6 EH/s. But other factors must be taken into account. In this way, we observe that Marathon Digital should become the leader of the hash rate by 2023 by seeing its computing power increase from 3.6 EH/s to 23.3 EH/s. This increase is due to the expansion of the mining fleet, which is expected to grow from 27,280 pieces of equipment to over 200,000. Cipher Mining (CIFR), another mining company, is expected to make its mark soon as we can see from the graph above. It is simply building five mining centers and should have the capacity to post a cumulative hash rate of 19.5 EH/s.

Another thing to consider is the bitcoin holdings on the balance sheet of these companies, in other words, how many bitcoins these companies already have in their possession. Marathon Digital has the largest reserve of bitcoins, with 8133, followed by Hut 8 Mining (5826) and Core Scientific (5296). At the current price ($42,000), this stash is equivalent for Marathon Digital to (8133 x $42,000) over $340 million.

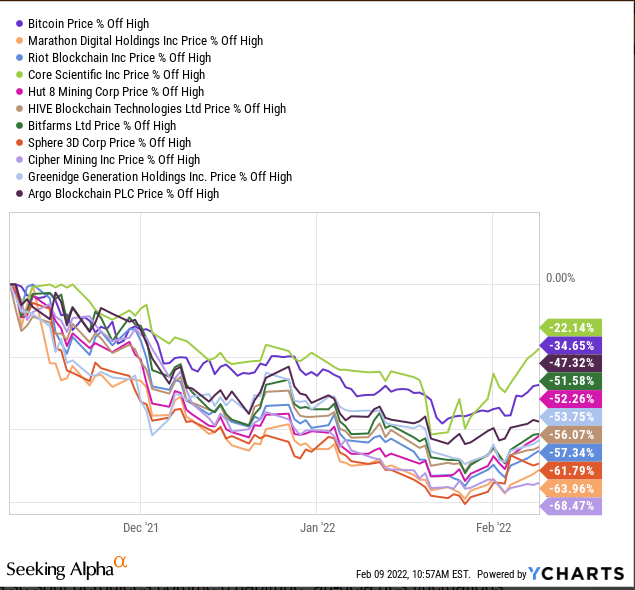

Source: Seeking Alpha

While bitcoin is down -34% over three months, Marathon Holdings, which had outperformed the digital currency in previous months, is down twice as much this time (-63.96%) against BTC. Only Core Scientific managed to resist better, or rather rebound better, by posting a negative deviation of -22.14% over the same period.

Mining companies have outperformed bitcoin during the 2020-2021 bitcoin bull run. A way for institutional, professional and retail investors to gain indirect exposure to bitcoin. On the other hand, it is clear that when the digital currency falters, the wind of panic is all the more violent on the share prices of mining companies.

However, we need to ask ourselves several questions before we jump into our securities account to buy shares of mining companies:

-New investment vehicles are emerging

While it used to be difficult for institutional and professional investors to gain "easy" exposure to digital assets, there are now a multitude of investment options. Bitcoin Futures ETFs, crypto investment funds, a proliferation of exchange platforms and perhaps, soon, a Spot ETF. Alternatives that can now seduce these investors to gain exposure to bitcoin at the expense of mining companies

-Exposure to the bitcoin price

The core business of these companies is closely linked to the bitcoin price. As we saw earlier, mining companies have so far shown little resilience to the volatility of the digital currency. In other words, it takes a strong heart to speculate on the price of these mining specialists. From a long-term perspective, investing in these companies is relatively risky. Especially since the global regulatory environment is still unclear related to the regulation of cryptocurrencies and if bitcoin were to fall drastically as a result of unfavorable regulation, these companies would be in a very bad position.

-Exposure to energy expenditure

As we have seen, these companies are extremely dependent on electricity and in particular on the energy consumption of their mining equipment. Although they are turning to renewable energy solutions (hydro, geothermal, solar, wind...), they will have to find more and more energy in their quest to achieve higher and higher hash rates in order to maximize their returns. We are still not safe from regulations that will go against the initiatives of these mining companies, especially in a concern of increasing energy waste.

-Crypto regulation

The future is unclear if not opaque on this side. From one country to another the regulatory framework is completely different. Take on the one hand El Salvador, which has made bitcoin the official currency of the country and is carrying out initiatives in favor of cryptocurrency mining, and on the other hand China, which has simply banned cryptocurrency mining on its territory, but at the same time has developed its own central bank digital currency. In the US and Europe, the regulatory framework is still vague although cryptocurrency mining is not banned. We are therefore not safe from a regulatory blow, even if time is on the side of these players as they grow over time and take with them many individual, professional and institutional investors.

-The Bitcoin philosophy

Bitcoin purists and maximalists invest directly in the digital asset for the characteristics it delivers: decentralization, transparency, security, independence... In other words, putting value in the hands of a centralized company does not reflect the philosophy of Bitcoin and its aficionados. Moreover, Bitcoin was started after the 2008 financial crisis by Satoshi Nakamoto, as an anarcho-capitalist response to "a corrupt and manipulative" financial system. In this sense, pro-bitcoins and those who will become pro-bitcoins will probably not rub their wallets in these mining companies.

Thus, we understand that the future is not easy to predict for mining companies. Although they are performing stratospherically well and attracting many speculators, having a long-term investment strategy seems relatively complicated at the moment. Nevertheless, some of the mining companies are not solely focused on cryptocurrency mining. Core Scientific and Riot Blockchain host blockchains and data centers to optimize its revenue streams.

By

By