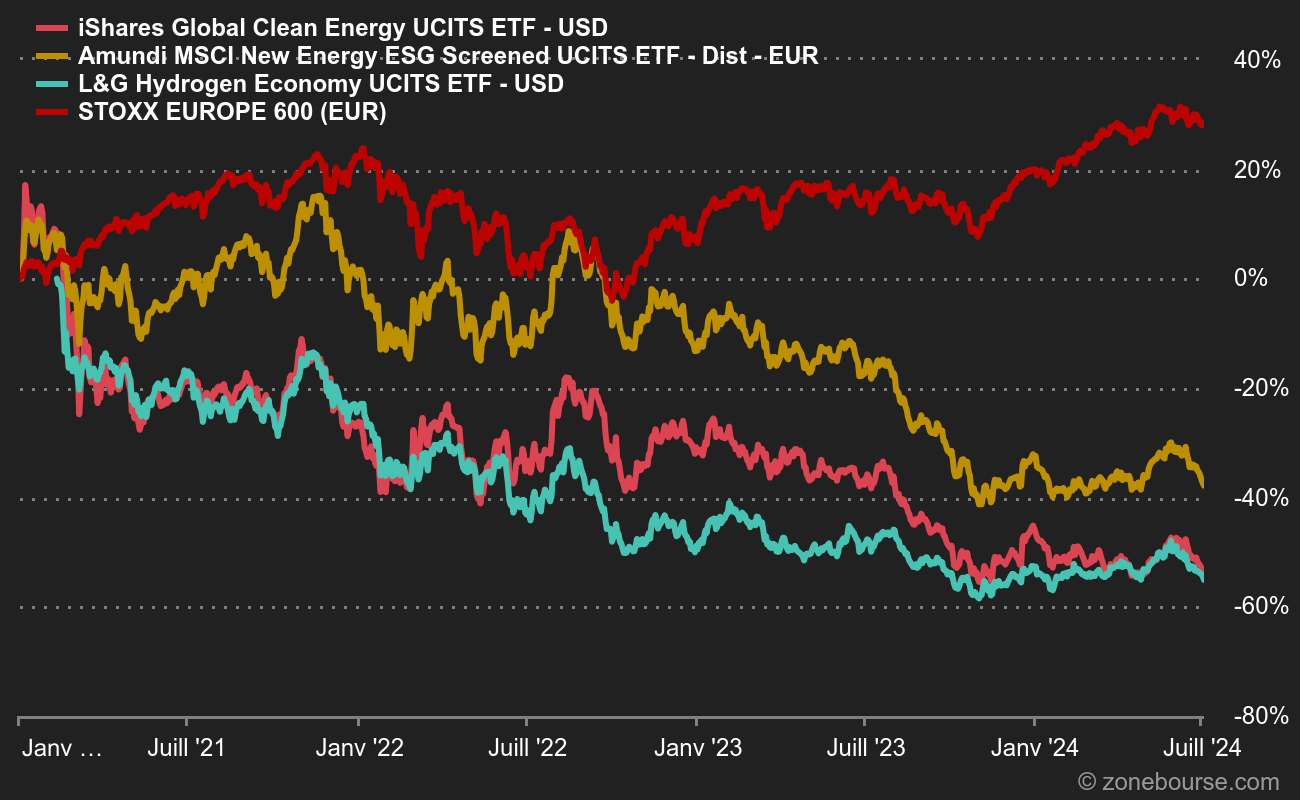

* iShares Clean Energy (INRG): the heavyweight of the sector ($5.5bn in assets at the end of April), which offers physical replication of a portfolio of 82 stocks, for a not exactly cheap fee of 0.65% and a distributive system. Among the holdings are Vestas , Orsted , Enphase , Iberdrola , Xcel Energy, Enel, Nextera , Solaredge , Plug Power, etc. It is not devoid of more original lines such as Flat Glass, McPhy, Encavis , Meyer Burger and Albioma . Europe and the United States each account for just under 40% of the portfolio. Please note that this fund is in dollars. It follows the S&P Global Clean Energy Index.

* Lyxor New Energy (NRJ): an ETF that is also popular with investors (€1.1bn in assets under management at the end of April), which tracks 54 companies in RobecoSAM's World Alternative Energy Total Return Index, which only includes companies that derive at least 40% of their revenues from alternative energy activities. The top holdings are Schneider Electric, Vestas, Carrier Global, Orsted, STMicroelectronics, Nibe Industrier, Enphase, Tdk, Solaredge and Cree. The more original positions include Neoen, Arcosa, Boralex, Soitec, Algonquin Power and Scatec. A euro fund with a 0.6% fee and a 2% decline in 2021.

* L&G Hydrogen Economy (SOHYDRON): this recent fund is already well endowed ($375m as at 29 April). As its name suggests, it focuses on the hydrogen ecosystem. It is denominated in dollars and has fees of 0.49%. Its benchmark is the Solactive Hydrogen Economy Index NTR, which it physically replicates with dividend accumulation. Major holdings include Cummins, Daimler, Linde, Kolon, Air Products, Toyota, The Chemours Company, Johnson Matthey and Siemens. There are also more innovative holdings such as McPhy, Ceres, Hexagon Composites, Nel ASA and PowerCell. The ETF has lost 10% since its inception on 21 February.

By

By