|

Monday December 21 | Weekly market update |

| Fears related to the new Covid-19 strain in the U.K. is weighing on markets today, despite the adoption by the US Congress of the fiscal stimulus plan. Last week, the ongoing ultra-accommodating monetary policies of the central banks, for as long as necessary, once again supported major US indices, which set new all-time records. Nevertheless, Europe remains concerned about the lack of progress on Brexit and the euro's new surge against the dollar, which penalizes European export stocks. |

| Indexes Over the past week, in Asia, the Nikkei gained 0.4%, the Shanghai Composite 1.4%, while the Hang Seng eroded by 0.3%. In Europe, it is the DAX that stands out very clearly, with a weekly performance of 4.1%, while the CAC40 is up only 0.1%. The Footsie is standing still while negotiations between London and Brussels are struggling to reach a post-Brexit agreement. Concerning the peripheral countries of the euro zone, Portugal gained 0.4%, Italy 1.4% and Spain was stable. In the U.S., the rise dominated last week with the support of the greenback. The Dow Jones was up 0.3% over the week, the S&P500 up 1% and the Nasdaq100 has the luxury of a gain of 2.7%. However, indices are all down on Monday due to renewed health fears. |

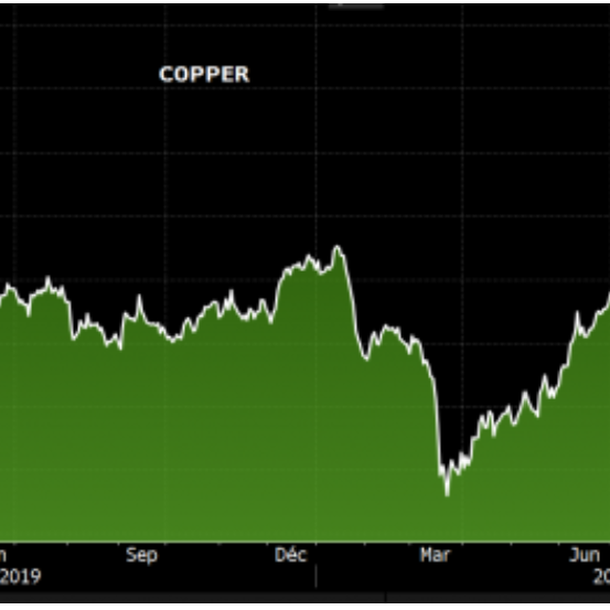

| Commodities Last week was smooth for oil, with consecutive sessions of increase. With OPEC's sustained efforts and the slow recovery of US production, the planets seem to be in favor of black gold. Brent has been on the USD 52 line, although it is back to 50 today, while the US benchmark has risen above USD 48 and is now hovering at 47. The gold metal also had a nice weekly sequence, demonstrating once again that the new records set on Wall Street and the rise of gold are not incompatible. The barbaric relic is now at USD 1880 per ounce, while silver is back to its November high at USD 26. Copper continues its uninterrupted rise (see chart). More broadly, the base metals segment remains favorably oriented, as shown by the new surge in tin and zinc. Strong acceleration of copper  |

| Equities markets Highly profitable growth stock, whose analysts have revised upwards the NBI, all with a healthy financial situation: XP INC ticks all these boxes. A Brazilian company with a market capitalization of nearly $23 billion, it operates in the provision of financial services and products through multiple channels ranging from brokerage to investment consulting and asset management. Founded in 2001, the company wanted to democratize Finance the following year to make it accessible to the largest number of Brazilians. At the time of publication of its third quarter figures, the company posted a 55% increase in sales compared to the third quarter of 2019, largely driven by the growth of its retail activities (+80% year-on-year). Sales for the full year 2020 are expected to be 48% higher than the previous year and should grow by 39% in 2021 and 32% in 2022. The outlook is bright. In addition, XP Inc. will be able to maintain its EBITDA margin around 32% for the next few years, reflecting the ability of its business process to be profitable. Analysts have revised their BNA forecasts upwards over the last 12 months. The company is also expected to have a significant cash cushion of $1.5 billion at the end of fiscal year 2020 and $1.8 billion in 2021. The share achieved a 6.8% performance over 2020. Rebound of the XP Inc. stock  |

| Bond market There have been very few movements to be detected on the European government bond markets, which consequently duplicate the lethargy of equity indices. The year 2020 ends with futures at the zenith, confirming the extremely low levels of returns. In Europe, the trajectory they will take over the next few days will probably be determined by the course of the new round of negotiations between the European Union and the United Kingdom. A regime change in the bond market is not on the agenda, as the bleak cyclical outlook and the massive demand for government securities linked to the ECB's PEPP continue to point to continued low yields. Moreover, in the temporary absence of structural supply in the market, operators are therefore no longer inclined to increase their positions, pushing the trend towards lateralisation. The German Bund is trading at -0.55% and the French OAT at -0.31%. It should be noted that the Spanish debt (rated BBB) has gone into negative territory (see graph) for a short period of time (see graph), whereas the original US 10-year bond (with a triple A rating) pays 0.95%. Brief passage of the Spanish debt into negative territory  |

| Forex market Recent trends persist in the currency market, such as the euro, which is consolidating its lead against the dollar. The major parity is trading at USD 1.217. However, the FED has just revised upwards its economic outlook. The US GDP should grow by 4.2% in 2021 and 3.2% in 2022 but with rates that will remain low. The single currency also maintains its firmness against safe havens, such as the yen, which is testing technical resistance at JPY 126.5. The sterling showed resilience in the face of Brexit uncertainty and rose to a 30-month peak against the greenback at USD 1.35 on Friday. It is now back at 1.32. The consensus forecast from Bloomberg anticipates even more ambitious targets for the British currency at USD 1.37 in 12 months time and 1.40 for 2022. On the southern hemisphere side, the Australian dollar has started to recover against the greenback, gaining more than 400 basis points since its recent low of 0.7 USD, thanks to the V-shaped recovery of the Chinese economy, its first economic partner. |

| Economic data Chinese statistics were broadly in line with expectations last week, reassuring traders about the strength of the economic recovery. Industrial production grew by 7%, retail sales accelerated to +5% (4.3% last month) and the unemployment rate fell to 5.2% (5.3% previously). As for Germany, the IFO recovered to 92.1 (90.9 previously) and the PMI indices exceeded expectations (manufacturing at 58.6 and 47.7 for services). In France, they came out at 51.1 and 49.2 respectively. For the euro zone, industrial production rose more than expected to +2.1%, the trade balance stood at 25.9B and the CPI index at -0.3%. The manufacturing and services PMI indices surprised pleasantly, rising to 55.5 and 47.3. In the U.S., the macroeconomic data were mostly disappointing, as were import prices (0.1%) and retail sales down 1.1%. The PhillyFed index fell to 11.1 (26.3 last month), the manufacturing state empire fell to 4.9 and weekly unemployment registrations rose to 885K. While the Flash PMI Manufacturing index exceeded expectations (56.5 vs. 55.9 expected), the services index just misses the consensus at 55.3 (55.7 expected and 58.4 the previous month). |

| A year of excess Friday was the Day of the Four Witches, marking the close of the 2020 stock market year. A vintage that will remain forever engraved in the minds of investors, with an annual sequence that is divided into three main stages. First of all, the worst health fears and the collapse of an economic world in forced recession, then the rapid recovery of growth stocks, taking advantage of the new situation (remote working, home services, clean energy ...) and finally the breathtaking catch-up of the cyclical sector in November with the hopes of a vaccine. These last twelve months have been synonymous with excesses but also with records at all costs. Index falls of unprecedented speed, increases of 8% in a few minutes, triple-digit performance for a myriad of values, not always profitable but rushing into the new economy, and of course, messy records on Wall Street. In addition to this, there are the unlimited liquidity envelopes poured out by the central banks. This short list is obviously not intended to be exhaustive. Considering that vaccine should generates a certain degree of normalization, the recovery of the cyclical segment could gain further ground and provide pillars for an additive rise in indices. But let's be cautious, every year brings surprises... |

By

By