Brent crude settled at $45.13 a barrel, gaining 78 cents, or 1.76%, while U.S. West Texas Intermediate crude settled at $42.62 a barrel, rising 28 cents, or 0.66%.

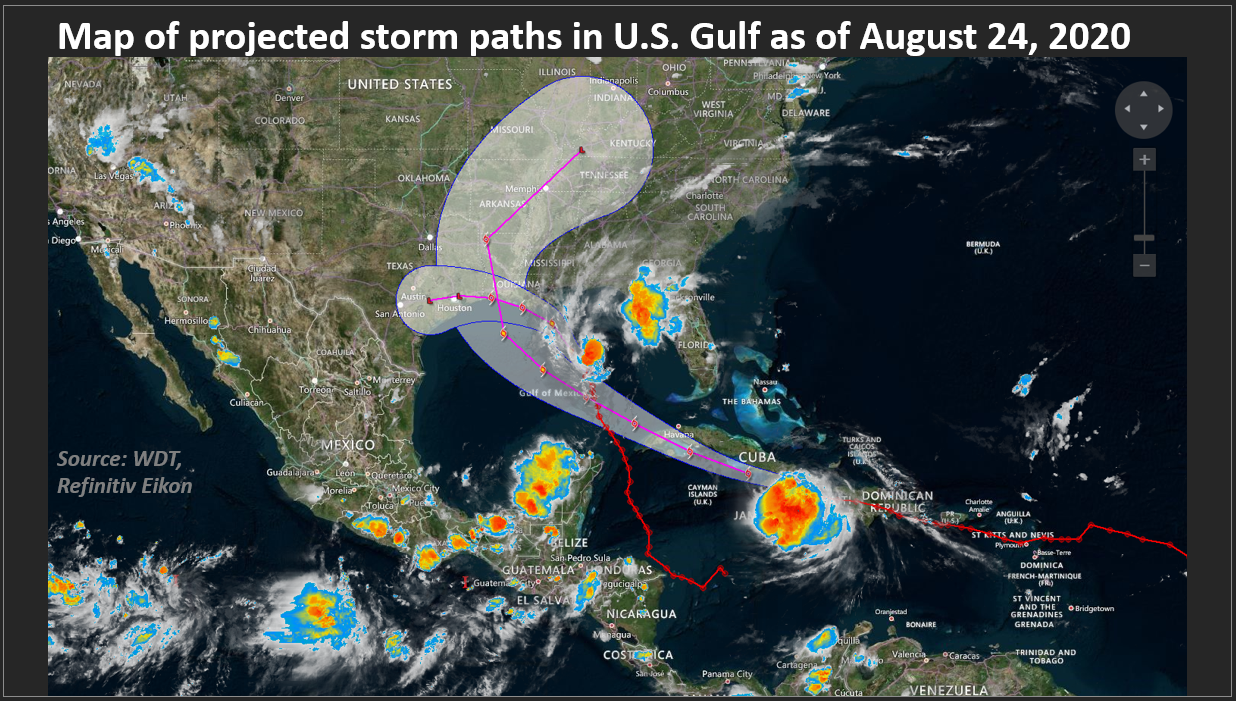

Energy companies shut more than 1 million barrels per day (bpd) of offshore crude oil supply in the U.S. Gulf of Mexico and evacuated more than 100 production platforms because of the twin threat from Tropical Storms Marco and Laura.

Marco reached the coast Monday, and Laura was expected to accelerate to a hurricane and hit by midweek.

U.S. gasoline futures jumped roughly 7% as refiners idled plants as a precaution.

"As is often the case within the energy complex, developments that are bullish to the products can be bearish to the crude futures as crude demand from the refiners is curtailed," said Jim Ritterbusch of Ritterbusch and Associates.

The storms could also curtail U.S. exports. Brent's gains outpaced U.S. crude on expectations that other countries might be able to boost exports while Gulf facilities are shut.

"Because the U.S. is a major exporter, some of the supplies that we normally would be exporting are going to be stuck in the harbor," said Phil Flynn, senior analyst at Price Futures Group in Chicago. "That's going to offset what we're losing in production."

Motiva Enterprises began preparations to shut its Port Arthur, Texas, crude refinery, the country's largest, sources told Reuters.

(Graphic: U.S. Gulf storm track as of August 24, 2020  )

)

Total SA also cut production to minimum at its 225,500 bpd Port Arthur refinery and was preparing for a possible shutdown.

Also supporting oil prices was a Financial Times report that U.S. President Donald Trump is considering fast-tracking an experimental COVID-19 vaccine being developed by AstraZeneca and Oxford University.

AstraZeneca denied having discussed an emergency use authorization for its potential vaccine with the U.S. government and called speculation of such use "premature."

By Laila Kearney