(via TheNewswire)

Toronto, ON- TheNewswire -August 23, 2023 -Star Royalties Ltd. (“Star Royalties”, or the “Company”) (TSXV:STRR) (OTC:STRFF)is pleased to report its financial results for the quarter ended June 30, 2023. All amounts are in U.S. dollars, unless otherwise indicated.

Q2 2023 Corporate and Portfolio Highlights

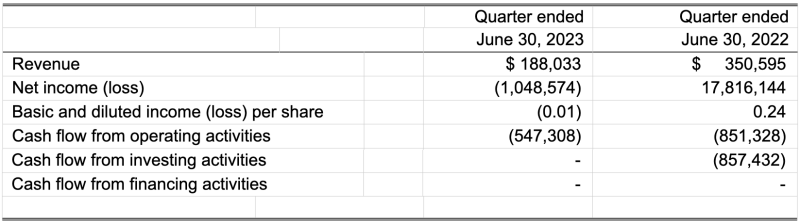

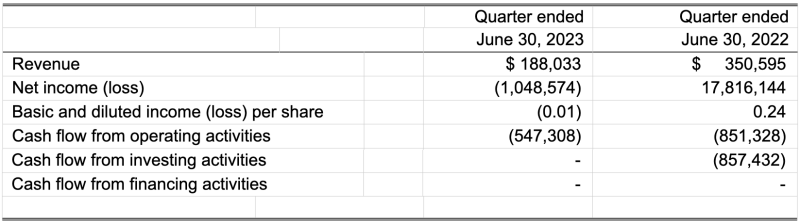

Quarterly revenues of $188,033, representing a 31% decline over the previous quarter due to timing and lower volume of mineral sands sales at Keysbrook.

Quarterly net loss of $1,048,574 was negatively impacted by the recognition of a $418,800 equity loss from the Green Star Royalties Ltd. joint venture (Green Star”), driven primarily by foreign currency translation.

Green Star’s flagship regenerative agriculture carbon farming program continues to grow from inbound farmer interest and is approaching its official listing under Verra’s Methodology for Improved Agricultural Land Management, v2.0 (VM0042).

MOBISMART Mobile Off-Grid Power Storage Inc. (MOBISMART”) continues to expand sales volumes and customer pipeline.

Alex Pernin, Chief Executive Officer of Star Royalties, commented: “During the second quarter of 2023, our team worked diligently to position both Star Royalties and Green Star for upcoming success. We believe that these efforts should translate to shareholder value across the coming months. Management continued to refine Green Star’s premium pipeline of opportunities, while also working closely with individual management teams across our investment portfolio to further de-risk their respective assets. Keysbrook performed in-line with internal expectations, despite the timing-related lower shipment volumes, and Copperstone’s Preliminary Economic Assessment demonstrated robust economics that we view as not reflected in that asset’s valuation. As Green Star’s flagship regenerative agriculture program continues to approach official listing under the Verra Registry, we look forward to several relevant catalysts over the coming months. Lastly but importantly, we continue to actively evaluate capital raising opportunities in order to be well positioned to begin transacting on Green Star’s expanded pipeline of carbon investments.”

Summary of Q2 2023 Financial Results

Click Image To View Full Size

For complete details, please refer to the Condensed Interim Consolidated Financial Statementsand associated Management Discussion and Analysis for the three and six months ended June 30, 2023, available on SEDAR+ atsedarplus.caor on the Company’s website atstarroyalties.com.

Significant Portfolio Updates

Keysbrook Mine

In the second quarter of 2023, royalty revenues from Keysbrookwere $135,232, which were lowercompared to the prior-year quarter due to timing and lower volume of mineral sands sales in the period, reflecting the variability inherent in bulk-shipped products. The overall outlook for 2023 remains in-line with the operator’s provided budget.

Elk Gold Mine

Gold Mountain Mining Corp. (“Gold Mountain”) (TSX: GMTN, OTCQB: GMTNF, FRA: 5XFA) continued ore mining operations and deliveries to New Gold Inc. (TSX, NYSE American: NGD) during the second quarter. The second quarter royalty payment from the Elk Gold Mine declined slightly to $52,801, compared to $54,959 in the previous quarter, due to lower shipments of ore by Gold Mountain. For its quarter ended April 30, 2023, Gold Mountain reported total sales of 1,798 ounces of gold and generated total revenue of C$4.2 million from the Elk Gold Mine.

In May, Gold Mountain reported that it had made its final C$3 million property payment to Sandbox Royalties Corp., thereby discharging all obligations owed relating to its purchase of the Elk Gold Mine, as well asentering into a C$3.3 million silver royalty on the Elk Gold Mine to enhance its financial position. In addition, Gold Mountain reported several changes to its management team during the period, including the appointment of Ron Woo, a founder of Gold Mountain, as Chief Executive Officer, and Simon Bucket as Chief Financial Officer.

Copperstone Gold Project

In June, Sabre Gold Mines Corp. (“Sabre Gold”) (TSX: SGLD, OTCQB:SGLDF) announced a Preliminary Economic Assessment (“PEA”) on the Copperstone Gold Project. Results of the economic analysis in the technical report (filed in August), show an after-tax IRR of 50.5% at the base case ($1,800/oz gold) and initial capital of $36 million. The PEA supports a high-grade gold underground mining operation to recover and sell 228,283 ounces gold over 5.7 years of operation with an all-in sustaining cost of $1,286/oz gold. The PEA mine plan prioritizes high-grade portions of the resource in early years to result in a payback period of less than two years, while generating nearly $90 million in after-tax cumulative undiscounted cash flow.

Following Sabre Gold’s PEA announcement, Star Royalties announced reaching an agreement with Sabre Gold to forego the third $6 million tranche of Star Royalties’ stream investment as originally contemplated, with a corresponding one-third decrease in its originally proposed gold entitlement under the stream. This is anticipated to provide Sabre Gold with greater flexibility to include other forms of financing in its construction capital to bring the Copperstone Gold Project to production.

Green Star Joint Venture (61.9% interest)

During the second quarter of 2023, Green Star continued to focus on evaluating capital raising opportunities, primarily through private markets, as well as on enhancing the depth and quality of its advanced-stage investment pipeline of premium, North American, nature-based environmental solutions. These opportunities include potential investments in regenerative agriculture, improved forest management, reforestation, livestock enteric methane reduction, grasslands, biochar, and other category types. Green Star is well positioned to transact on several of these projects upon completion of an eventual capital raise.

Voluntary Carbon Market Update

The first half of 2023 has been eventful in the development and publication of much-anticipated guidance geared towards providing clarity and certainty for the voluntary carbon market.

The Integrity Council for the Voluntary Carbon Market (“ICVCM”),an independent governance body focused on the supply side of the voluntary carbon market,released its Core Carbon Principles (“CCP’s”) and the Program-Level Assessment Framework and Assessment Procedure. The CCP’s are a global benchmark for identifying high-integrity carbon credits through rigorous thresholds on disclosure and sustainable development. The CCP’s are comprised of ten key principles around governance, emissions impact and sustainable development. The Program-Level Assessment Framework then leverages the CCP’s to establish the requirements for carbon-crediting programs, such as Verra. This assessment frameworkis also intendedto introduce a “CPP-approved” label, which is intended to provide market participants withconfidence regardingwhich carbon credits meet the highest benchmark of integritytoguide buyers in their carbon credit purchase strategy.

In June, The Voluntary Carbon Markets Integrity Initiative (“VCMI”), an independent governance body focused on the demand side of the voluntary carbon market,released the VCMI Claims Code of Practice. While the ICVCM CCP’s relate to the supply of carbon credits, the VCMI Claims Code of Practice relate to the demand for carbon credits. The Claims Code of Practice provides the rulebook for making credible claims on the use of carbon credits against a company’s net-zero target. The purpose of the Claims Code of Practice is to provide clear guidance to entities on when voluntary use of carbon credits should be a part of their emissions reduction objectives and to provide clarity on the associated claims those respective entities can make regarding the use of those carbon credits.

Additionally, other consultations are currently being carried out by organizations such as the Science-Based Targets Initiative, apartnership between Carbon Disclosure Project, the United Nations Global Compact, World Resources Institute, and the World Wide Fund for Nature. Through its participation in the International Emissions Trading Association and several consultation processes, Green Star will continue to monitor and contribute to the development and evolution of guidance frameworks for the voluntary carbon markets.

Regenerative Agriculture Carbon Farming Program

Green Star’s flagship regenerative agriculture CarbonNOW® farming program is a partnership with Anew Climate LLC (“Anew”) and Locus Agricultural Solutions® (“Locus AG”).During the first half of 2023, CarbonNOW continued to enroll farmers into the program, with current enrollment exceeding 300,000 acres. In addition to these enrolled acres, Locus AG and Anew are progressing through a meaningful pipeline of interested farmers with a target of participating in the Spring 2024 enrollment. Locus AG anticipates enrollment to accelerate going forward and has established a network of over 40 dealers and distributors to expand its probiotic fertilizer sales across multiple states. At present, the largest enrollment of acres has been from Kansas, Colorado, and Oklahoma, followed by Illinois, Iowa, Indiana, Idaho, Kentucky, and Nebraska.

The CarbonNOW program is currently being listed under Verra’s Methodology for Improved Agricultural Land Management, v2.0 (VM0042), with official listing anticipated in the next several weeks. A 30-day public consultation period will commence immediately after listing, and third-party audit site visits, as well as validation and verification efforts are expected to occur over the coming months, with anticipated completion and first offset issuance in late Spring 2024.

Green Star continues to expect to generate cash flow equivalent to well over 400,000 attributable carbon credits per year at the program’s full scope of 1.32 million acres.

MOBISMART

Green Star owns a 2.5% gross revenue royalty on MOBISMART, a private operating company that specializes in mobile solar power and fuel cell generation systems with integrated battery storage and diesel displacement capabilities. In early 2023, MOBISMART transitioned from research and development to commercialization, and became Green Star’s first cash flowing asset.

During the current period, MOBISMART recorded its largest quarterly revenue to date of C$517,000 as it continued to push into the telecommunications and Lidar sectors, with several additional multi-unit orders booked during the quarter. In addition, MOBISMART is making progress in the construction sector, with ongoing efforts to initiate several pilot programs with key industry participants to demonstrate the superior ROI of its mobile solar power and fuel cell generation systems over diesel generators. MOBISMART anticipates a roll out of its systems at numerous sites across Canada to occur upon a successful completion of these pilot programs.

CONTACT INFORMATION

For more information, please visit our website atstarroyalties.com or contact:

Alex Pernin, P.Geo.

Chief Executive Officer and Director

apernin@starroyalties.com

+1 647 494 5001

Dmitry Kushnir, CFA

Vice President, Investor Relations

dkushnir@starroyalties.com

+1 647 494 5088

About Star Royalties Ltd.

Star Royalties Ltd. is a precious metals and carbon credit royalty and streaming company. The Company innovated the world’s first carbon credit royalties in forestry and regenerative agriculture through its majority-owned, pure-green joint venture, Green Star Royalties Ltd., and offers investors exposure to precious metals and carbon credit prices. The Company’s objective is to provide wealth creation by originating accretive transactions with superior alignment to both counterparties and shareholders.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain statements in this news release may constitute "forward-looking statements", including those regarding future market conditions for metals, minerals and carbon offset credits. Forward-looking statements are statements that address or discuss activities, events or developments that the Company or Green Star expects or anticipates may occur in the future. When used in this news release, words such as "estimates", "expects", "plans", "anticipates", "will", "believes", "intends" "should", "could", "may" and other similar terminology are intended to identify such forward-looking statements. Forward-looking statements are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performances or achievements of Star Royalties and Green Star to be materially different from future results, performances or achievements expressed or implied by such statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be an accurate indication of whether or not such results will be achieved.

A number of factors could cause actual results, performances or achievements to differ materially from such forward-looking statements, including, without limitation, changes in business plans and strategies, market and capital finance conditions, ongoing market disruptions caused by the Ukraine and Russian conflict, metal and mineral commodity price volatility, discrepancies between actual and estimated production and test results, mineral reserves and resources and metallurgical recoveries, mining operation and development risks relating to the parties which produce the metals and minerals Star Royalties will purchase or from which it will receive royalty payments, carbon pricing and carbon tax legislation and regulations, risks inherent to the development of the ESG-related investments and the creation, marketability and sale of carbon offset credits by the parties, the potential value of mandatory and voluntary carbon markets and carbon offset credits, including carbon offsets, risks inherent to royalty companies, title and permitting matters, operation and development risks relating to the parties which develop, market and sell the carbon offset credits from which Green Star will receive royalty payments, changes in crop yields and resulting financial margins regulatory restrictions, activities by governmental authorities (including changes in taxation), currency fluctuations, the global, federal and provincial social and economic climate in particular with respect to addressing and reducing global warming, natural disasters and global pandemics, dilution, risk inherent to any capital financing transactions, risks inherent to a possible Green Star go-public transaction, the nature of the governance rights between Star Royalties and Agnico Eagle Mines Limited in the operation and management of Green Star and competition.

These risks, as well as others, could cause actual results and events to vary significantly. Accordingly, readers should exercise caution in relying upon forward-looking statements and the Company undertakes no obligation to publicly revise them to reflect subsequent events or circumstances, except as required by law.

Copyright (c) 2023 TheNewswire - All rights reserved.

Copyright (c) 2023 TheNewswire - All rights reserved., source Press Releases