Block 1: Key news

Craig Wright is no Satoshi Nakamoto

On March 14, 2024, the British courts declared that Craig Wright is not Satoshi Nakamoto, the mysterious founder of Bitcoin. The ruling, long-awaited by the Bitcoin community, does not reveal Nakamoto's identity, but highlights Wright's unsuccessful attempts to claim this identity since 2016. The trial also exposed email exchanges between Nakamoto and developers, showing his concerns about the future of Bitcoin without confirming Wright's identity, which still leaves the mystery surrounding the true identity Satoshi Nakamoto.

Dencun successfully deployed on Ethereum

The Dencun update marked a turning point for Ethereum, drastically reducing fees for layers 2 Solutions, with median fees falling to $0.0009 per transaction. This development, the result of the introduction of proto-danksharding, promises to significantly increase the accessibility and scalability of the Ethereum blockchain. Despite these advances, the initial effects on the price of ETH and layer 2 tokens remain moderate, but Dencun's technological impact on the Ethereum eHowever, Dencun's technological impact on the Ethereum system is considered by many to be revolutionary, opening the way to a multitude of new, less costly use cases on the network.

Sam Bankman-Fried: 50 years in prison for ex-FTX boss?

Four months after Sam Bankman-Fried's trial, U.S. prosecutors have called for a sentence of 40 to 50 years in prison and an $11 billion fine for the former FTX CEO, following his conviction on seven counts, including fraud and money laundering. Prosecutors compare him to Bernard Madoff, known for embezzling $65 billion through a monumental Ponzi scheme, for which he was sentenced to 150 years in prison. For its part, Bankman-Fried's defense has proposed a sentence of 6 and a half years in prison, but the final decision rests with Judge Lewis Kaplan, with sentencing expected on March 28. Sam Bankman-Fried is currently being held at the Metropolitan Detention Center in Brooklyn.

First photo of Sam Bankman-Fried in jail at MDC Brooklyn (December 17, 2023) pic.twitter.com/QlENjjmeQG

- Tiffany Fong (@TiffanyFong_) February 20, 2024

Block 2: Crypto Analysis of the week

According to an SEC filing, asset management behemoth BlackRock has created a fund called the BlackRock USD Institutional Digital Liquidity Fund.

Launched in collaboration with Securitize, a company specializing in asset tokenization, the fund will be based in the British Virgin Islands. Although specific details of the assets the fund will contain are not disclosed, Securitize's involvement hints at a focus on the tokenization of real-world assets, also known by the acronym RWA - Real-world assets. This refers to the industry concept of tokenizing ownership of a variety of assets (real estate, artwork, collectibles, commodities, debt, receivables, business...) by means of a digital token on a blockchain. But such an initiative by BlackRock is not surprising.

Remember, the day after the iShares Bitcoin ETF (IBIT) was approved, in an interview with Bloomberg, the company's CEO Larry Fink revealed his vision, not of Bitcoin's milestone, but of BlackRock's position on the future of finance: tokenization.

Here's an excerpt from the interview, which highlights BlackRock's point of view:

"In terms of the beginnings of a Bitcoin ETF, we think ETFs are a technology, just as Bitcoin was an asset storage technology. We believe that the next step will be the tokenization of financial assets. This means that every stock, every bond will have its own QR code. They will appear in a single ledger. Every investor, you and I, will have our own number, our own identification. We can get rid of all the problems associated with illicit activities involving bonds, shares and digital thanks to tokenization. But most importantly, we'll be able to customize strategies through tokenization to suit each individual. We'd have instant settlement. Think of all the costs involved in settling bonds and equities. But with tokenization, everything would be immediate, because it's just a line item. So we think this is a technological transformation for financial assets.

I think you mean voting, voting choice and all those things. If we know at all times who the owner of that share is, and it's time to vote, each individual owner is identified, and they can vote for their own shares."

For those who want the original version, here it is:

This dialogue underlines that the concept of tokenization is not merely speculative, but a definitive roadmap that BlackRock intends to take. It hints at a future where the digitization of assets enhances the transparency, efficiency and personalization of the financial landscape. But BlackRock's enthusiasm is not isolated. So are the International Monetary Fund (IMF) and the Bank for International Settlements (BIS).

Returning to BlackRock, some market observers have pointed to blockchain data showing that $100 million of Circle's USDC stablecoin on the Ethereum network has been moved to an address linked to the blockchain. This could potentially constitute a seed investment in the fund - although this is not certain.

For the time being, the specific details of the fund's scope remain opaque, but this initiative is a clear indicator of BlackRock's shifting paradigms in finance. The creation of the fund not only corroborates BlackRock's commitment to tokenization, but also positions Ethereum as a crucial player in this perspective.

While many are awaiting the approval of an Ethereum Spot ETF, like those marketed on Bitcoin on January 11, 2024, the question is surely not whether they will be marketed, but rather when. As for BlackRock, which, incidentally, has filed an application for an Ethereum Spot ETF with the SEC, as has Fidelity, it's quite possible that the company is already at the next stage: tokenization.

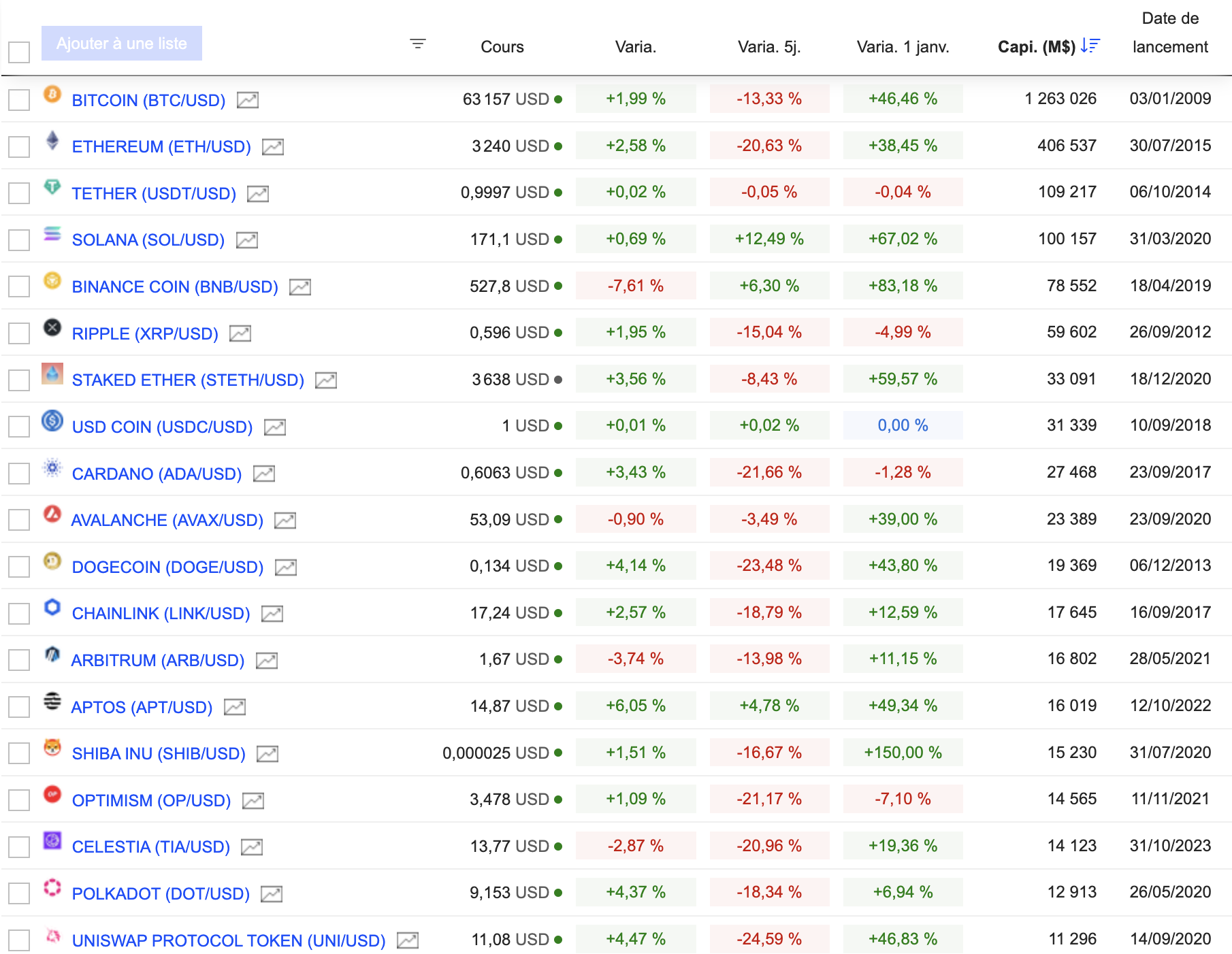

Block 3: Gainers & Losers

Cryptocurrency chart (Click to enlarge)

Block 4: Things to read this week

Crypto company believes it can help fight climate change (Wired)

Craig Wright is not Bitcoin creator Satoshi Nakamoto, judge rules (Wired).

Imminent halving creates chaos and opportunity in the Bitcoin market (Bitcoin Magazine)

By

By