In the classic sense of the term, momentum is an investment vision that favors stocks that have been trending upward over the past six and twelve months. At MarketScreener, Raytheon Technologies, Air Products & Chemicals, Broadcom, Unitedhealth Group and Black Stone Minerals. A portfolio weighted on these five positions would have generated a return of +17.05% compared to +3.24% for our benchmark, the S&P 500 Index, over the fourth quarter of 2022 (from 9/29/2022 to 12/31/2022). At the individual level, Raytheon Technologies gained +22.08% for the quarter, Air Products & Chemicals +32.41%, Broadcom +21.31%, Black Stone Minerals +6.44% and Unitedhealth Group +2.99%. This selection significantly outperformed the U.S. Broad Index while offering lower volatility.

The Momentum Picks selection started on January 1, 2022 ended the year with a much better performance than the S&P 500: +2.67% versus -19.44% for the US index. This outperformance was mainly achieved in Q2 and Q4 2022.

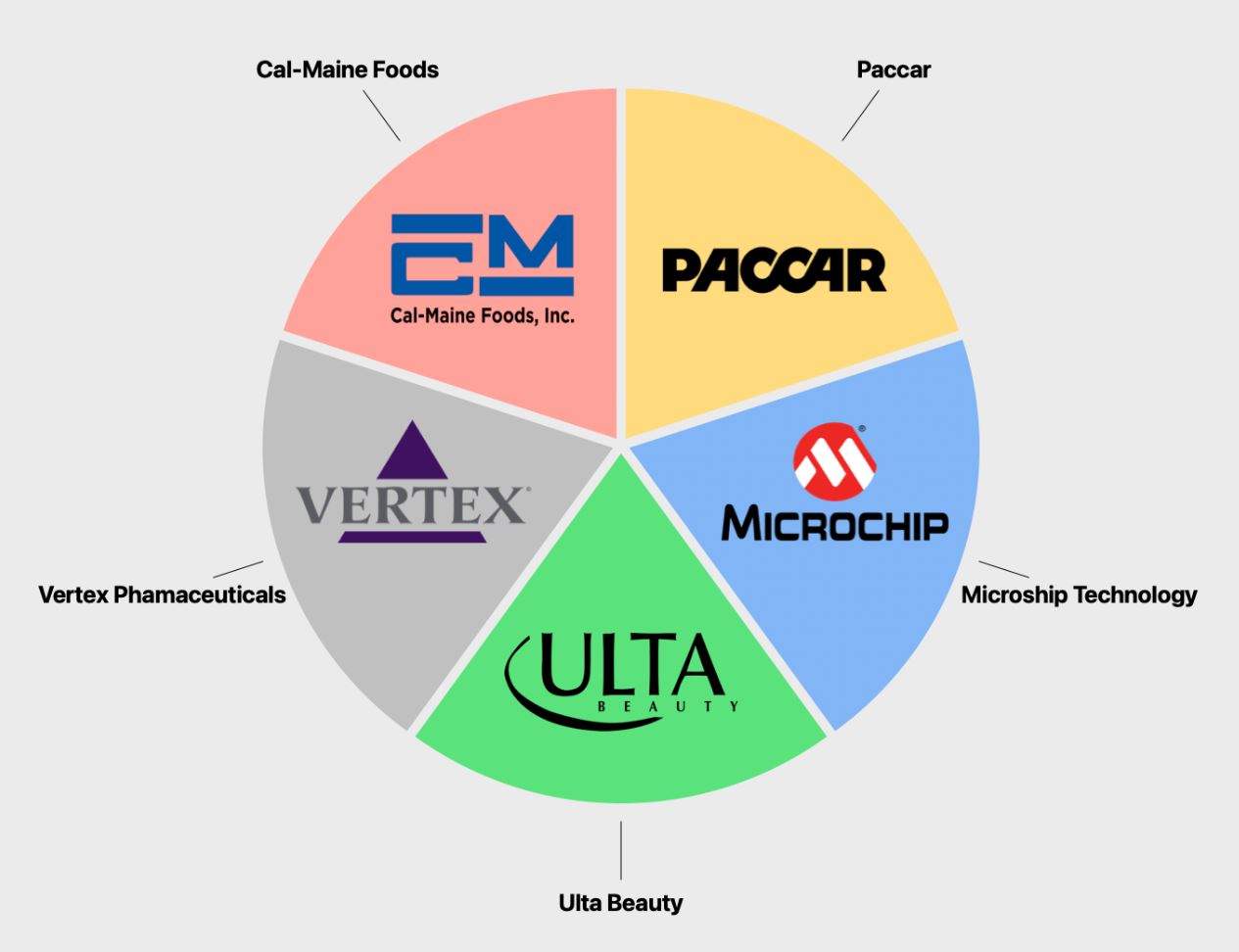

Let's take a closer look at the five U.S. stocks selected for the first quarter of 2023:

Paccar

Paccar is a very well-run company, arguably the best manufacturer of heavy-duty vehicles. The company provides a ROIC of almost 12% to its shareholders. Over the past 20 years, sales have grown at a steady rate of 8% per year, with low volatility even during recessions. EPS and sales revisions are bullish and momentum is good.

Source: Paccar

Microchip Technology

Microchip Technology is a U.S. manufacturer of semiconductors for the home goods, automotive, computer and telecom industries. Its flagship products are microcontrollers, which account for more than 50% of its revenues, and programmable logic arrays (FPGAs for those in the know). Microcontrollers enable automation and are becoming more and more indispensable in a number of devices, notably in the automotive and connected object industries. The company should continue to grow this year with a strong demand from its customers. The group's profitability is exemplary (net margin estimated at 27% in 2023 and ROE of 50%). The valuation seems to be quite cheap compared to the quality of the company and its future prospects

.

Source: Microchip Technology

Ulta Beauty

The undisputed leader in the sale of beauty products in the United States, Ulta, as it is known, has been able to thwart the growth plans of Sephora, the rival cosmetics retailer of the powerful LVMH group, for several years. With a vast network of 1,300 stores, Ulta Beauty has established itself over the past 30 years as the leading destination for consumers for cosmetics, fragrances, skin care, hair care and beauty services. Customers have a wide range of products to choose from. In Ulta's shelves, you can find an assortment of more than 25,000 items from over 600 brands. Ulta Beauty also distributes its own brand, sold under the same name, which today represents nearly 6% of sales in terms of revenue. The group is experiencing significant growth and its territorial implementation strategy is exemplary. More than 350 stores under its own name have been opened over the last five years and a strategic partnership with the American retailer Target has enabled the opening of around 100 shop-in-shops. This expansion, unlike some of its peers, has not been at the expense of profitability. Regular share buybacks and the defensive but growth-oriented nature of the company support the stock.

Source: Ulta Beauty

Vertex Pharmaceuticals

Vertex Pharmaceuticals is an American pharmaceutical company specializing in the research and development of drugs for the treatment of cancer, viral, inflammatory and autoimmune diseases. Numerous treatments are in development and the pipeline is full. These include the promising VX-522 in co-location with Moderna to treat cystic fibrosis patients and Exa-cel in collaboration with CRISPR Therapeutics to treat sickle cell disease and beta thalassemia, which is in late Phase 3 and is expected to be completed in Q1 2023. Vertex Pharmaceuticals has capitalized on its cystic fibrosis treatments to invest in new high-potential treatments, including cystic fibrosis. Revenues should continue to grow in the coming years and 2023 will certainly be a good year for Vertex. Beyond the potential, the company's outstanding profitability and healthy financial position make it a defensive growth stock to be favored in times of recession

.

Source: Vertex Pharmaceuticals

Cal-Maine Foods

What is more boring than an egg company? Cal-Maine Foods is the largest U.S. egg producer in the United States. Its operations include hatching chicks, raising and maintaining flocks of pullets, layers and breeders, manufacturing feed, and producing, processing, packing and distributing shell eggs. Boring. But hey, what we're interested in is what's behind the appearances. The company is taking advantage of the HPAI epidemic that has caused egg prices to spike by more than 30% in 2022 in the US. The company supplies most US retailers, including Walmart, who regularly buy fresh eggs (this ensures regular revenue). The last few quarters have been exceptional as this price increase has boosted the Ridgeland firm's net margins to 24.8% in Q3 2022. Everyone seems to agree that this won't last forever. I'm pretty much in favor of this idea, but it may not be for a while yet. 2023 should be another great year, especially the first half of the year. The company should continue to benefit from high egg prices. Momentum is good and earnings revisions continue to be bullish.

.

Source: Cal-Maine Foods

You notice that this Momentum Picks portfolio is well balanced across 5 sectors (consumer staples with Cal-Maine, healthcare with Vertex, consumer discretionary with Ulta, technology with Microchip and industrials with Paccar). We shall meet again at the end of March 2023 to review its progress and propose a selection for the following quarter.

By

By