Methodology

The hardest part may not be finding long-term winners, but finding winners that will perform well over the next three months, especially when you can't sell them along the way. The aim here is to build a high-performance, resilient selection. To achieve this, I rely on Evidence Based Investing, i.e. scientific research that has proven the relevance of certain investment strategies over time. This highly rational investment process has highlighted the relevance of certain investment factors.

The Momentum Picks selection is based primarily on two of these factors: Quality and Momentum.

- Momentum: In the classic sense of the term, momentum is an investment approach that favors stocks that have been on an upward trend over the past six and twelve months. At MarketScreener, momentum includes not only data on the stock's positive trend over the short (3 months), medium (6 months) and long term (12 months), a so-called "technical" momentum, but also analysts' revisions of net earnings per share and sales over the short and long term, weighted by the number of shares in issue. This is a more "fundamental" type of momentum, assuming that analysts are rather conservative in their revisions.

- Quality: The quality factor favors companies with solid fundamentals, i.e. good profitability, high return on equity, solid balance sheet, good credit rating and good credit rating, a solid balance sheet, low margin volatility, a good track record of earnings releases and good visibility on future results.

The selection is designed to generate the best possible risk/reward given its limited composition. However, a selection of just five stocks does not constitute a sufficiently diversified portfolio. Rather, Momentum Picks should be seen as a complement to an already diversified portfolio.

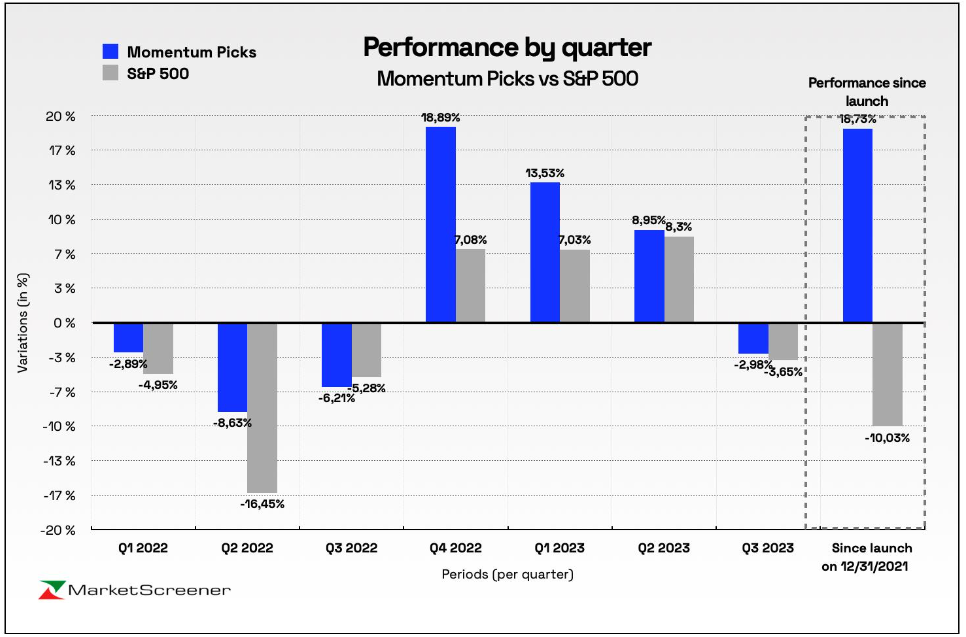

Analysis of past performance

In our previous selection, we chose Booking Holdings, AutoZone, Fastenal, Coty and Microchip Technology. A portfolio equally weighted on these five positions would have generated a return of -2.98% versus -3.65% for our benchmark, the S&P 500 index, over the third quarter of 2023 (from 06/30/2023 to 09/30/2023), i.e. a slight outperformance of +0.67%. At individual level, Booking Holdings gained +14.21% over the quarter and AutoZone 1.87%, while Fastenal lost -7.37%, Coty -10.74% and Microchip Technology -12.88%. This selection performed in line with, and slightly better than, the US Broad Index.

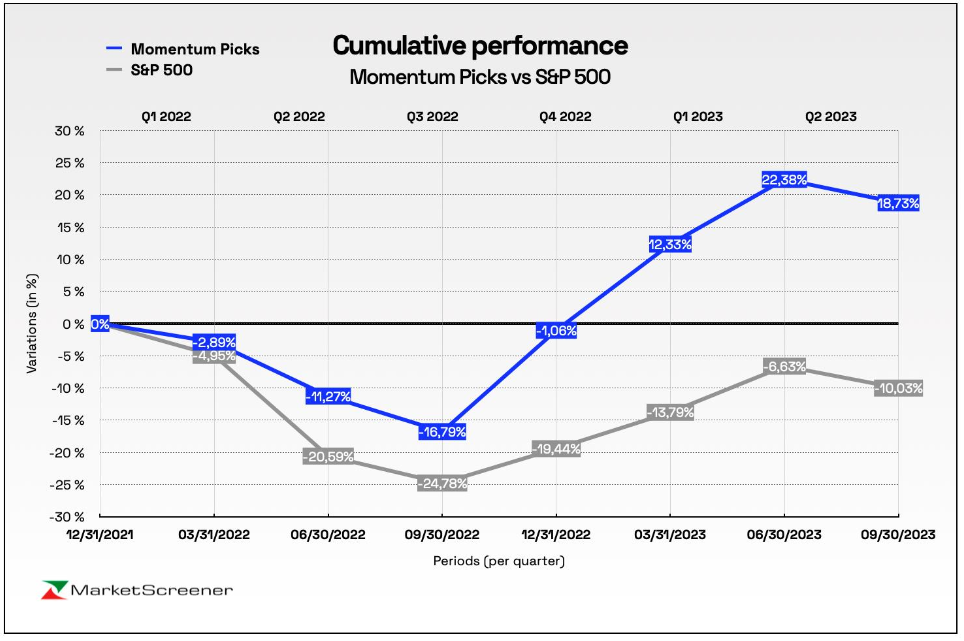

The Momentum Picks selection, which began on December 31, 2021, achieved a cumulative performance of +18. 73% versus -10. 03% for the US broad index (S&P 500), i.e. an outperformance of +28. 76% in 21 months. This performance does not include the payment of dividends to shareholders over the period, so the actual performance is still higher than these figures.

Performance by quarter :

Cumulative performance :

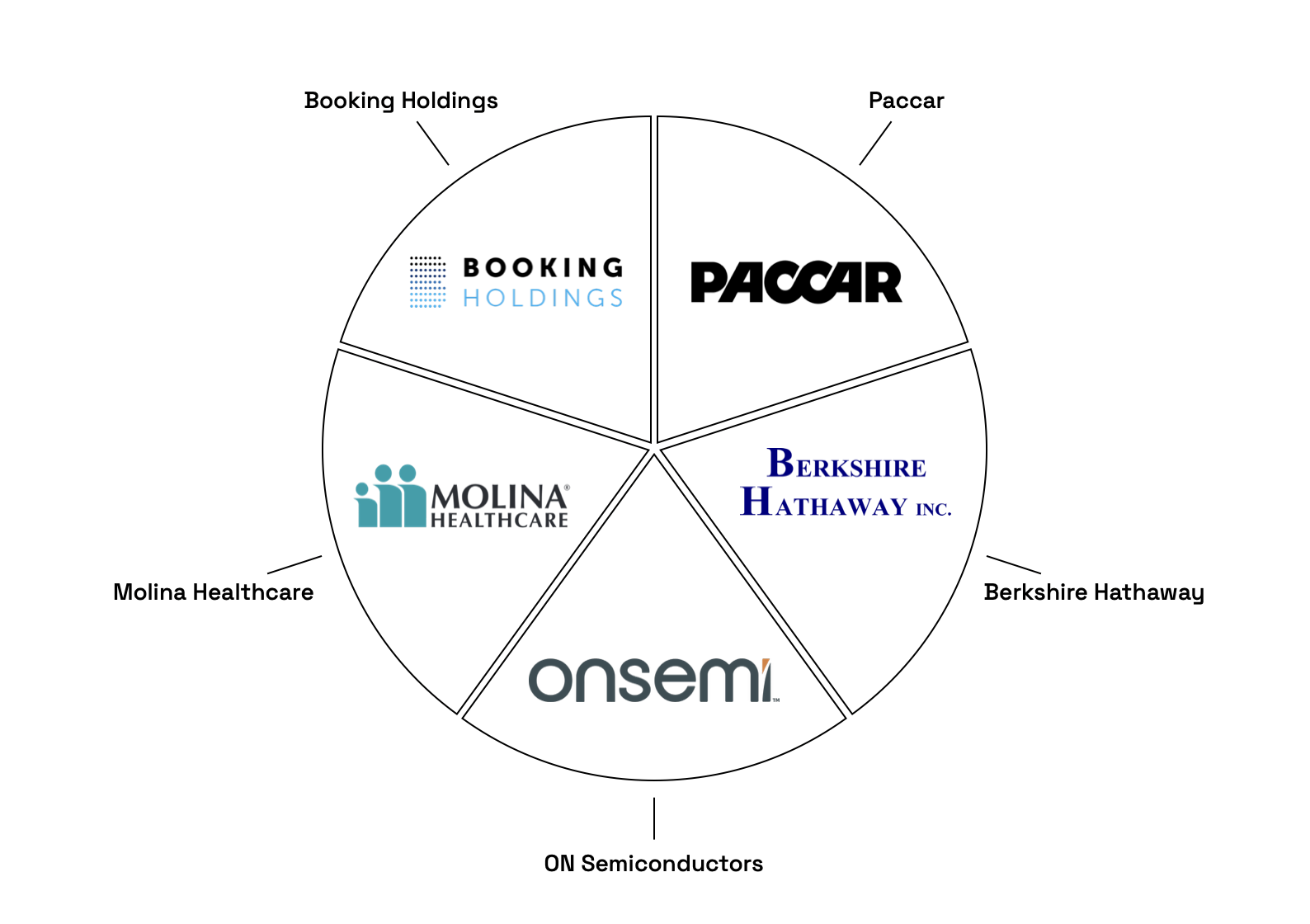

The new selection

Let's take a closer look at the five US stocks selected for the fourth quarter of 2023 (October to December).

Equal-weight Momentum Picks :

Let's start with a stock that has already made an appearance here. Paccar, present in the first selection of 2023 , has shown its credentials to be reinstated this quarter. Specializing in the design, manufacture and marketing of goods transport vehicles, the company mainly sells trucks under the DAF, Kenworth and Peterbilt brands (this segment accounts for over 70% of its sales). It also sells accessories, spare parts and industrial winches (21% of sales) under the Braden, Gearmatic and Carco brands. This latter activity ensures a steady flow of high-margin revenues. Half of sales are generated in the USA, with the remainder evenly split between Europe and Asia. Paccar is a very well-run company, surely the best manufacturer of heavy-duty vehicles. The company delivers an ROIC (return on invested capital) of almost 12% to its shareholders. Over the past 20 years, sales have risen at a steady pace of 8% a year, with, it should be noted at the moment, low volatility even during recessions. EPS (earnings per share) and sales revisions are bullish, and momentum is good. The stock is up around 20% over 6 months and 50% over 1 year. Chairman Mark Pigott, heir to company founder William Pigott (several generations ago, since the company was founded inwas founded in 1905) still owns 1% of the company, or half a billion dollars. The CEO is a shareholder of $11 million at the current price. A family success story that deserves attention.

It's hard not to know Berkshire Hathaway, the famous holding company of investment pope Warren Buffett. Berkshire is a holding company that operates through subsidiaries engaged in a variety of activities. It owns its own businesses (companies it has bought out at 100%) and shares in listed companies (the best-known being Apple, which accounts for almost 50% of its listed portfolio). While Warren Buffett began with the insurance (and reinsurance) sector, which still represents the holding's main business, the company has broadened its scope to include energy, utilities, rail transport, industry, services and distribution. Details of the companies held are shown in the diagram below. Decentralized organization, exemplary management, a track record of unrivalled performance... there's no shortage of strengths at Berkshire. And when it comes to diversification, it's an ETF unto itself. In addition to fulfilling all my quantitative selection criteria, Berkshire offers exemplary risk/reward - with low volatility and a history of resilience in the face of crises - which is necessary in these uncertain times.

PS: Berkshire Hathaway has two shares (the A and the B). The B (BRK.B) is the one we'll be choosing in this selection, as it's the most accessible.

Source : Berkshire Hathaway

ON Semiconductors

The technology sector is a must. My choice is On Semiconductors. After a few years of deregulation, ON Semiconductors is becoming one of the leaders in electrification, being a preferred supplier to GM, Ford, VW, Daimler, Stellantis, Toyota and Honda. It is well placed in the silicon carbide market. Silicon carbide is a basic material used in semiconductors. ON Semi also markets AutoX's Gen5 autonomous driving platform for its LiDAR and image detection technologies. Using 28 2D image sensors and four 3D LiDAR sensors, this Gen5 autonomous technology enables fully driverless RoboTaxi vehicles to transport goods and people. The company also offers a silicon carbide MOSFET module designed for electric vehicles. It reduces thermal resistance to lower chip temperature during operation.

In a sector hit by a sharp economic downturn, the American group continues to enjoy good health and promising development prospects. It's true that demand remains strong in its main market - the automotive industry. Equipment designed by ON Semi - sensors, transistors, advanced materials such as silicon carbide, among others - is increasingly ubiquitous, particularly in the production of electric vehicles. With the reconfiguration of its business portfolio, ON Semi expects to see demand for its components increase by almost thirty times per vehicle. This aggressive ambition is borne out by sales to the automotive sector, up 35% on the first half of the previous year.

The Group's other strategic pillar - 5G deployment and industrial automation - has been slow to deliver a comparable performance. Long-term prospects here are naturally excellent, but it takes longer to get the ball rolling. In financial terms, ON Semi stands out for its impressive growth track record - with sales quadrupling over the last decade - as well as its meticulous management and a particularly astute sequence of share buy-backs. Capitalistic imperatives have meant that profits and cash flows have stagnated, but the Group has now developed an exhaustive catalog of products; multiplied strategic acquisitions, such as Fairchild in 2016 and GT Advanced Technologies in 2021; and developed real vertical integration, all without damaging its balance sheet.

In a sector where scale is everything, ON Semi now expects to reap the rewards of these strategic investments. Management is targeting a gross margin of 45% (exceeded in the first half of 2023 despite widespread price cuts) and the ability to generate $2 billion in annual profits.

If you look at the share price trend, the market seems confident in the company's strategy. The curve is linear: it's hard to distinguish between a general downturn in the semiconductor sector in 2022, the war in Ukraine or fears of recession. ON Semiconductors joins the Momentum Picks team to finish 2023.

Source : MarketScreener.com

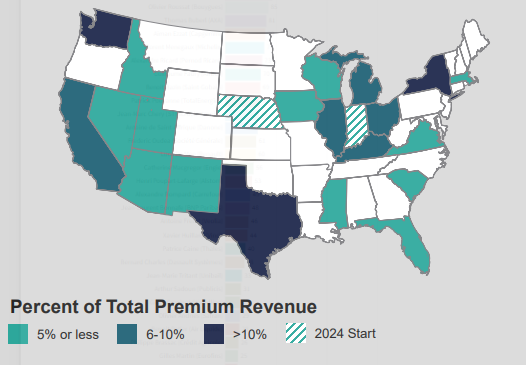

Molina Healthcare follows in the successful footsteps of industry giant Unitedhealth Group and its sales of some $450 billion. The United States is known for having some of the highest healthcare costs in the world, which represents an opportunity for insurers such as Molina. More than 300 million Americans need to be insured. Although the healthcare system is mainly private, the federal government has set up various programs and laws to extend access to health insurance. The Medicaid program accounts for 82% of revenues and is aimed at low-income people, while the Medicare program accounts for 13% of revenues and is aimed at disabled people and those over 65. Molina operates discontinuously throughout the US. The insurer generates the remaining 5% of its business through the marketplace, a program that acts as a last-resort solution for people who are not eligible for other programs. The U.S. health insurance sector is enjoying strong momentum, which, despite some anecdotal slowdowns for Medicaid, is set to continue. Molina represents a defensive position in this selection, with historical volatility contained even in bear markets.

Source : Molina Healthcare

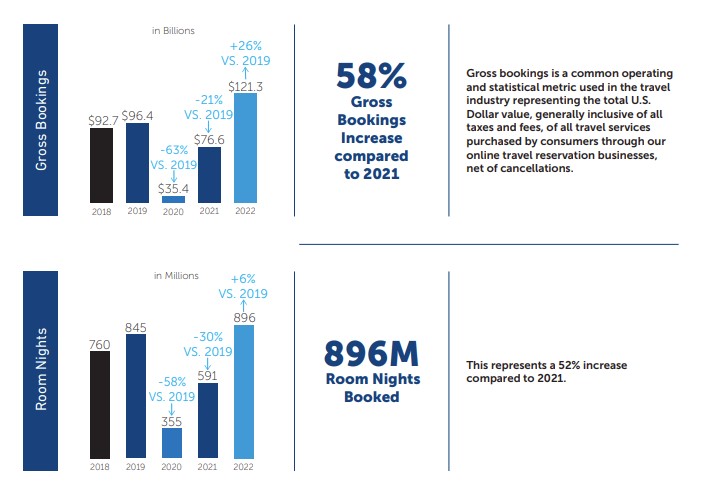

How we meet again Booking! Already present in the previous selection, Booking retains its well-deserved place in the very short Momentum Picks selection. It must be said that the company did not disappoint us in its last quarterly publication, with sales of $5.46 billion (5% above expectations) and above all EPS of $34.9 (27% above expectations). Booking Holdings is one of the leading online travel agencies. The group offers a wide range of travel-related services: hotel reservations, car rentals, airline reservations, combined holidays, tailor-made trips, cruises, etc. The company employs over 20,000 people and has a global presence. First and foremost, Booking is No. 1. The company has an incredible sustainable competitive advantage (called a "moat" in English) and is a perfect example of a company with a "network effect". Like LinkedIn or Wikipedia, Booking is "the place to go" when it comes to booking hotel accommodation, for the simple reason that it holds the world's largest available inventory. The quality of service is second to none, especially with the famous free booking option. It's rare for a business to combine industry dominance with unrivalled service quality. This is a direct credit to management. The company is paying itself 23 times its expected profits for 2023. This is reasonable in view of its solid fundamentals (FCF margin of 30%, ROE of 50%, solid balance sheet). The company should - like last year - have a good year. Find a full analysis here.

Source : Booking Holdings

Disclaimer : The information, analyses, charts, figures, opinions and comments provided in this article are intended for investors with the knowledge and experience required to understand and appreciate the information developed. This information is provided for information purposes only, and does not represent an investment obligation or an offer or solicitation to buy or sell financial products or services. It does not constitute investment advice. The investor is solely responsible for the use of the information provided, without recourse against MarketScreener or the author of this article, who are not liable in the event of error, omission, inappropriate investment or unfavorable market trends. Investing in the stock market is risky. You may incur losses. Past performance is not a guide to future performance, is not constant over time, and is not a guarantee of future performance or capital.

By

By