Novo 's announcement sent Fresenius Medical Care shares down 16%. In JPMorgan's view, there could not have been a worse announcement for the German group. FLOW, the name of the Danish company's study, evaluated the efficacy of semaglutide (Ozempic) in slowing the progression of chronic kidney disease in diabetics.

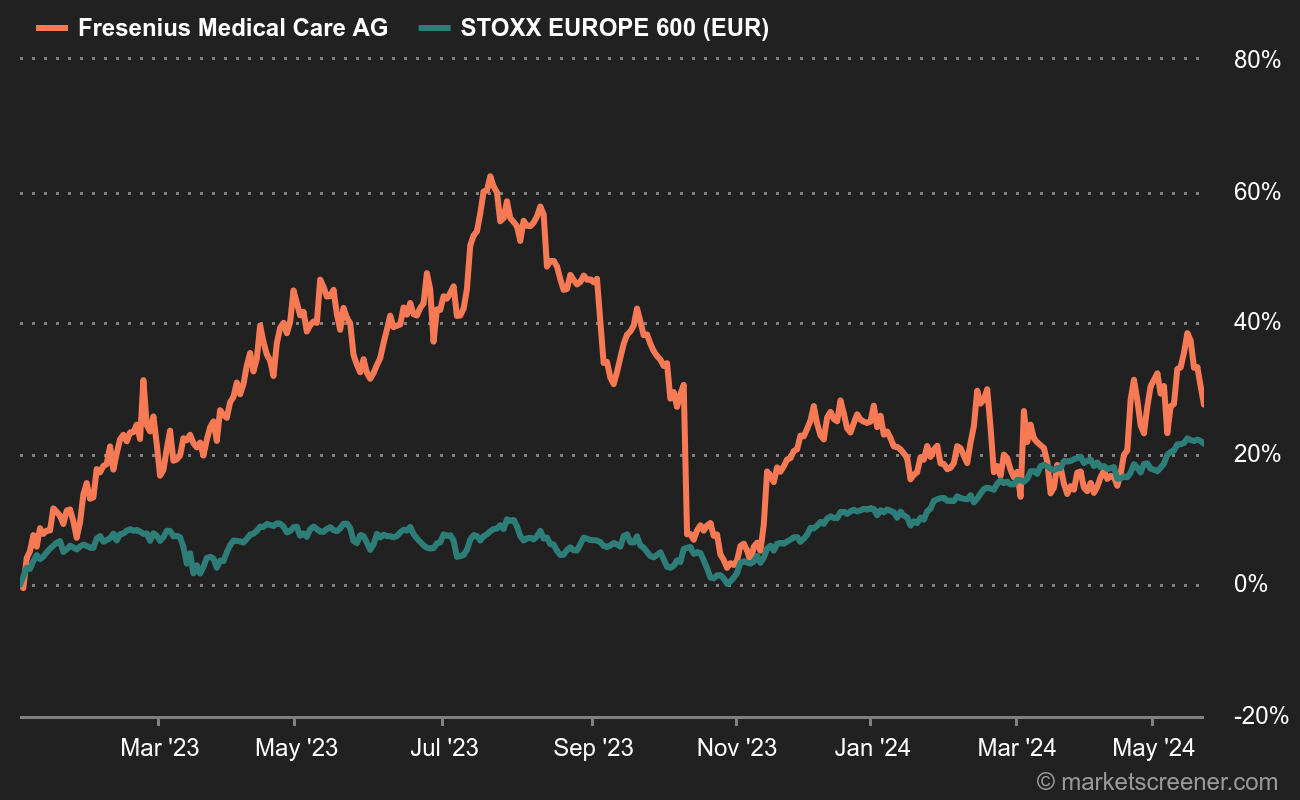

The stock's rebound, after a dreadful year in 2022 (-46.5%), is about to be eaten up.

A zero-sum game?

"FMC still sees no danger," writes DZ Bank in a study published mid-day. FMC considers that, while semaglutide may slow the progression of kidney disease and thus make dialysis necessary at a later stage, at the same time the life expectancy of kidney disease patients should increase. In other words, patients will be dialyzed later, but for longer as their life expectancy improves. It could therefore be a zero-sum game. DZ Bank believes this argument to be plausible, but applies a 20% discount to the stock, given the rising uncertainty. The target price has been adjusted from EUR 46 to EUR 36, with a "hold" recommendation. The market is clearly not buying it.

Other players in the dialysis sector are also likely to come under pressure. American DaVita plunged 15% in pre-market trading, while Baxter fell 9%. Fresenius SE, FMC's parent company, was down 8%.

By

By