Block 1: Key news

- UBS invites itself onto Ethereum

UBS Asset Management, part of Swiss bank UBS, has launched a pilot project for a tokenized investment fund on the Ethereum blockchain, as part of its Guardian project, in collaboration with the Monetary Authority of Singapore (MAS). This initiative aims to explore and understand the tokenization of funds, drawing on UBS's expertise in the tokenization of bonds and structured products. Thomas Kaegi, Head of Asset Management at UBS, points out that the project will work with financial institutions and technology providers to improve liquidity and market access for customers.

- Do Kwon played with Terra's volumes

Do Kwon, ex-CEO of Terra (LUNA), has admitted to falsifying Terra's trading volume, according to US SEC documents. Message exchanges reveal a conversation between Kwon and Daniel Shin, founder of payments app Chai (and co-founder of Terra), discussing the creation of indistinguishable fake trades. Shin, who left Terra in 2020, is currently charged in South Korea with illegal trading and breach of trust, while Kwon, detained in Montenegro, will be extradited and tried in several countries.

- Brazil: identity cards on blockchain

Brazil is starting to use blockchain technology for its new identity cards, as a result of a decree published earlier this year. From November 6, the new cards, equipped with QR Codes and digital duplicates, will use blockchain to secure data. The states of Goiás, Paraná and Rio de Janeiro have initiated the rollout, which will extend to the whole country. Technology from Serpro, a national technology solutions provider, is facilitating this change using the private blockchain platform b-Cadastros, designed with Hyperledger Fabric.

- Hacks exploded in September

September 2023 was the worst month of the year for cryptocurrency hacks, with losses amounting to over $332 million, mainly due to the attack on the Mixin Network protocol. Despite this high figure, the year's total losses, approximately $1.34 billion, remain lower than those recorded in 2022 and 2021. The year 2023 had been relatively quiet until September. The Lazarus group, associated with North Korea, has often been identified as responsible for numerous cryptocurrency hacks.

#CertiKStatsAlert 🚨

— CertiK Alert (@CertiKAlert) September 30, 2023

Combining all the incidents in September we’ve confirmed ~$332M lost to exploits, hacks and scams.

Exit scams were ~$1.9M

Flash loans were ~$0.4M

Exploits were ~$329.8M

See more details below 👇 pic.twitter.com/DMFN9LWU8V

Block 2: Crypto Analysis of the Week

This week, Sam Bankman-Fried, the 31-year-old former cryptocurrency mogul, appeared in court for a highly anticipated trial, where he faces a litany of fraud charges related to the FTX collapse. Dressed in a gray suit, white shirt and striped tie, the former "prodigy" sported short hair and neatly tied shoelaces, looking like a freshly inducted army recruit on the first day of boot camp.

JANE ROSENBERG/REUTERS

Cameras are not allowed inside the courtroom, which means Bankman-Fried's appearance can only be gleaned from courtroom sketches.

Gone are the days when Bankman-Fried, often referred to as SBF, ignited the crypto community and Washington D.C.'s social salons with his distinctive tousled hair and garish Bermuda shorts, once symbols of his provocative ease. This abrupt transformation seems to herald a sobering reality: he now faces the prospect of spending much of his life behind bars.

FTX's legal documentation is indeed controversial. However, the prevailing sentiment among legal experts suggests a damning scenario for SBF, with a conviction looming on the horizon.

At the start of proceedings on Wednesday, US prosecutors portrayed Mr. Bankman-Fried as a master of deception, orchestrating a "fraud on an epic scale". Prosecutors accuse him of systematically lying to a trio of stakeholders: investors, lenders and FTX customers. "A monumental hold-up that stole billions from thousands of people," stressed Assistant U.S. Attorney Thane Rehn.

The prosecutor went on to explain that Bankman-Fried had used customer funds, accumulated through a mountain of lies, to finance an extravagant lifestyle. This included buying opulent residences and currying favor with high-profile personalities such as sports icon Tom Brady and political stalwarts like former Democratic President Bill Clinton.

However, Mark Cohen, Bankman-Fried's defense attorney, presented a contrasting narrative in a low-key opening statement. He portrayed "Sam" as a victim of hindsight legal scrutiny and stressed that his client's actions were based on good faith.

The opening salvos from both legal camps set the stage for a grueling six-week legal battle to determine the fate of the former billionaire who, until recently, was a luminary in the cryptosphere. The defense is expected to argue that SBF was simply a naive young man, tricked and misguided by more experienced and devious advisors. Consequently, the defense team should invoke an "advice" defense, suggesting that SBF's litigious actions were primarily a response to misguided advice from others.

The prosecution case is expected to rely heavily on the testimony of former key witnesses, including former Bankman-Fried associates, most of whom have agreed to cooperate with government officials. The testimony of Gary Wang, co-founder of FTX and a close acquaintance of Bankman-Fried, begins today.

In early exchanges, prosecutors described SBF's business as a fragile "house of cards built on deception", while the defense sought to highlight its ostensibly sincere intentions. The trial is expected to feature testimony from disgruntled FTX investors and customers affected by the company's insolvency, promising a gripping legal drama in the weeks ahead.

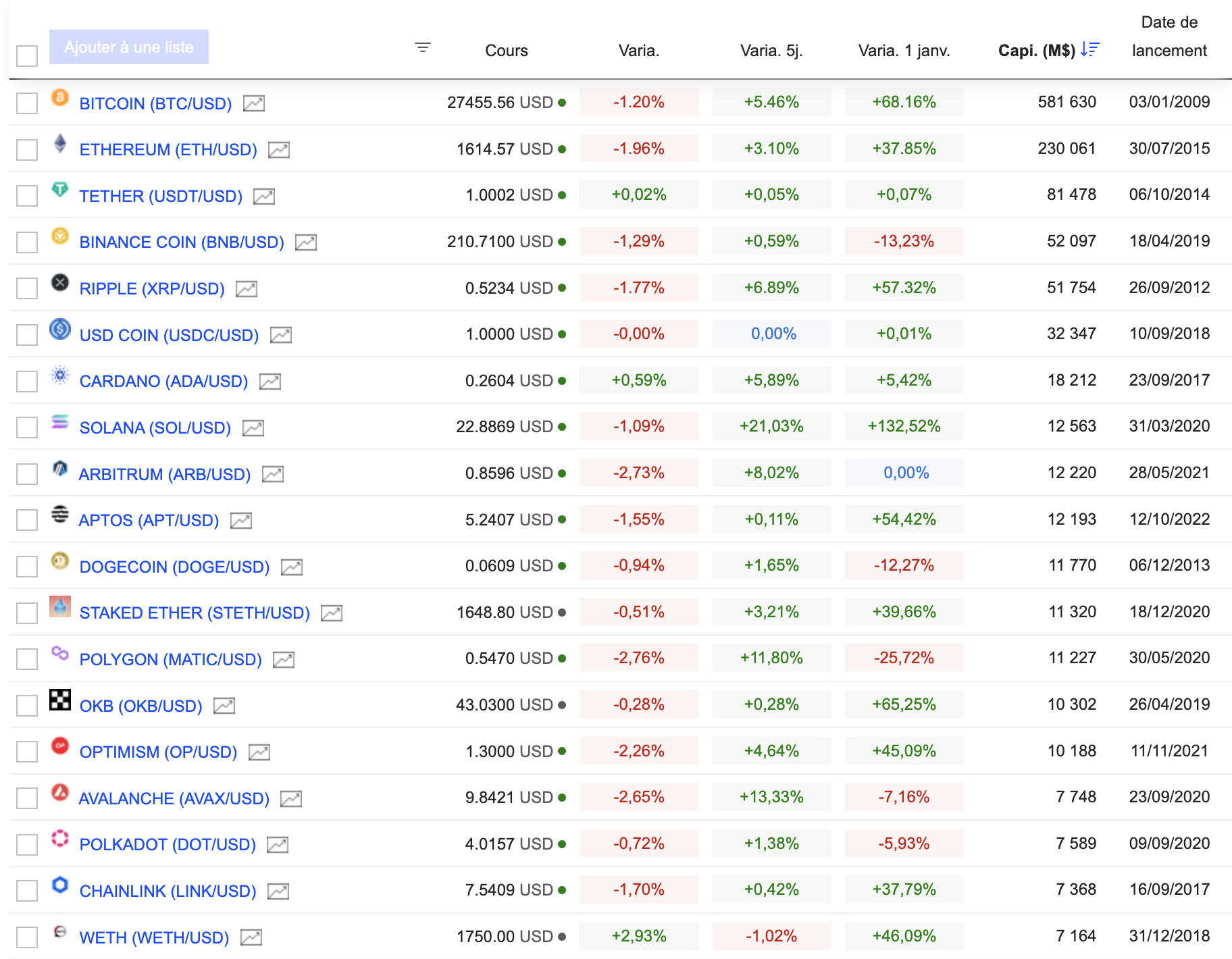

Block 3: Gainers & Losers

By

By