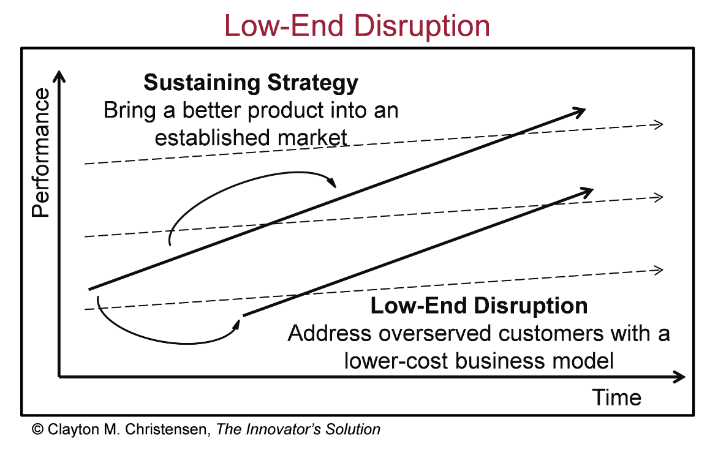

We need to distinguish between :

- Sustaining innovations, which create better products with higher customer benefits;

- Low-end innovations, which make it possible to offer cheaper products with acceptable customer benefits.

Low-end disruption disrupts the established order by offering simpler, less expensive products or services that attract previously neglected customers. Low-end disruptors successfully compete with incumbent industry players by reconfiguring their value chains to produce a product or service in a fundamentally different way to their peers, often valued for their ease of use, accessible price and immediate availability. Over time, disruptors in this segment enrich their offering, adding features and capabilities that enable them to compete with established companies and revolutionize industries.

Low-end disruptors are characterized by an offer of average to correct quality at the outset, targeting undemanding consumers with a desire for more accessible prices, and realizing their profits on high sales volumes.

Low-end disruption offers companies the opportunity to target these niches with simpler, less expensive solutions. By meeting the needs of customers with restricted budgets or specific requirements, companies can penetrate new markets and stimulate growth.

This form of disruption is necessary when the leading companies in a sector focus on the most affluent customers. By starting at the bottom of the market, newcomers can establish themselves firmly and gradually improve their value proposition. This tactic challenges market leaders and prompts them to rethink their strategy. Low-end disruptors often disrupt traditional players by offering competitive solutions which, although less comprehensive at first, become increasingly attractive over time.

It can serve as a driver of innovation in markets that have become stagnant or resistant to change. The arrival of this form of disruption often brings a breath of fresh air and drives continuous improvement. It stimulates innovation by encouraging companies to seek more economical solutions, perfect their processes and develop new technologies. This process benefits not only disruptors, but the entire sector.

Let's take a few emblematic examples of three players who have disrupted their respective industries: Toyota, Costco Wholesale and Ryanair.

Toyota, the Japanese automotive giant, began its foray into the American market in 1957. At that time, the automotive industry was dominated by American manufacturers, with giants such as General Motors, Ford and Chrysler leading the way. Toyota, then relatively small and unknown outside Japan, had to contend with an extremely competitive market and consumers loyal to American brands.

To succeed, it had to innovate. The company introduced the Toyota Production System (TPS), a revolutionary approach to manufacturing that emphasized efficiency and quality. TPS, also known as "Lean Manufacturing", is based on two fundamental principles: Jidoka" ("autonomation" in the simplified diagram below), which means that faults are corrected as soon as they are detected, and "Just-In-Time", which ensures that parts are produced only when they are needed.

Toyota Production System

.png)

This production method has enabled Toyota to reduce waste, improve product quality and cut costs, giving the company a significant competitive edge. Toyota vehicles quickly became synonymous with reliability and value, earning the trust of American consumers.

The disruption caused by Toyota in the American automotive market was considerable. Not only did Toyota offer a competitive alternative to American cars, but its production system also forced the entire industry to rethink its operations. American automakers, faced with declining market share, had to adopt similar practices to remain competitive, leading to an overall improvement in quality and efficiency in the automotive industry.

Over the years, Toyota has continued to innovate, notably in environmental technology with the launch of the Prius in 1997, the world's first mass-market hybrid vehicle. This breakthrough confirmed Toyota's position as a leader in the development of cleaner, more sustainable automotive technologies.

Today, it is one of the world's largest automakers, with a significant presence in the US market. The company continues to build on its heritage of innovation and quality, while meeting the mobility challenges of the future. The strategy that began in 1957 with the introduction of avant-garde production methods has enabled Toyota to transform the automotive landscape and become a key player on the world stage.

Costco 's innovation lies in its warehouse club business model, which has disrupted the mass retail market. By buying in bulk and limiting profit margins, Costco was able to offer prices well below those of the competition. This model forced traditional retailers to rethink their pricing and stocking strategies. In terms of innovation, Costco was one of the first to adopt the concept of selling products under its own brand, Kirkland Signature, launched in 1995. These products offer quality comparable to that of national brands, but at a lower price, which has strengthened customer loyalty and increased the company's margins.

The retail concept is as follows: customers pay an annual membership fee (US$45 standard) which gives access to the stores for one year, and in exchange, Costco applies a strategy of Every Day Low Price (Strategy EDLP) by marking up 14% on branded products and 15% on private label products, making prices very, very low. It's a very simple and honest consumer proposition in that membership fees buy customer loyalty (and account for almost all the profit) and Costco sells merchandise in return while simply covering operating costs. What's more, by adhering to a standard mark-up, savings made through purchasing or scale are returned to the customer in the form of lower prices, encouraging growth and extending the benefits of scale.

Very important to founder Jim Sinegal was that the company maintain this pricing policy over the long term to build the Costco brand image and strengthen consumer loyalty. Jim Sinegal was the first to speak out against price promotion strategies (Strategy Hi-Lo - High-Low Prices), still used by most retailers today, trying to influence store traffic by artificially raising and lowering prices. At Costco, the consumer knows: the price is 14% or 15% higher than the wholesale price, period. This transparency has played a large part in making Costco America's most loyal retailer.

While this strategy is easy to understand, it can be difficult to implement. Indeed, the act of buying a membership has the effect of increasing the company's share of mind with the customer in the same way that consumer goods companies hope to do with conventional advertising. At Costco, the consumer has chosen to commit to the retailer, and the reason they buy is that products are priced at a maximum mark-up of 14% over cost. This mark-up is half that of Walmart. Making money with such low gross margins is an art in itself, and obviously involves a degree of risk if the operation disappoints. Costco must therefore ensure that its operating costs are as low as possible, and that wholesale prices are as competitive as possible. To achieve this, the company maintains the maximum number of items in a store (around 4,000 SKUs), and each location is auctioned off to suppliers. Costco expects its suppliers to systematically and voluntarily offer the lowest possible acquisition price for all items, otherwise they are permanently banned as a source of purchase.

Finally, the company relies on sales growth, which acts as a virtuous circle. Costco benefits from an incredible effect of scale, and the savings made on operating costs are passed on to customers in the form of consistently competitive prices and an increasingly high-quality offering. While many companies seek to benefit from the effect of scale, few pass on their profits to customers by lowering their prices. Costco's obsession with sharing the benefits of scale with the customer makes the company's future far more predictable and less risky than that of the average business.

Costco Wholesale Flywheel

.png)

Famed investor Nick Sleep described Costco as a commercial version of perpetual motion in his famous article "Perpetual Growth Machine" of February 22, 2005. Even then, he explained Costco's ability to continue launched operations without additional energy being required to maintain them.

"Costco's advantage is its very low cost base, but where does it come from? Not from cheap land, or cheap wages or anything else, but from a thousand daily decisions to save money where it doesn't need to be spent. This saving is then returned to customers in the form of lower prices, the customer reciprocates and buys more product, triggering a virtuous feedback loop." - Nick Sleep

Ryanair, the Irish low-cost airline, has revolutionized air travel in Europe since its creation in 1984. Founded by the Ryan family, it began as a small business with just one route between Waterford in Ireland and London Gatwick. However, it was under the leadership of Michael O'Leary, who took the reins in 1994, that Ryanair transformed its business model and became a dominant player in the airline industry.

Inspired by the model of American low-cost airlines such as Southwest Airlines, Ryanair adopted and adapted this concept for the European market. The airline has cut costs by simplifying its operations. It opted for a standardized aircraft fleet, reducing maintenance and training costs. Ryanair also began to use secondary airports, which were less busy and therefore less costly, enabling it to reduce airport tariffs and offer lower prices to its customers.

At that time, when the hub-and-spoke network model was dominant, Ryanair's management deliberately chose the heterodox approach of point-to-point flights to increase the number of trips each aircraft could make per day, thereby reducing the average unit cost. This counter-positioning strategy enabled the company to make considerable savings.

In terms of pricing, Ryanair introduced a progressive fare system, where the first tickets sold are the cheapest, encouraging customers to book early. This strategy has maximized aircraft load factors and generated additional revenue through the sale of ancillary services such as priority boarding, checked baggage and seat assignments.

Ryanair's disruption also manifested itself in advertising and communication. The company has often used provocative advertising campaigns to attract attention, creating a brand known for its bold, unconventional approach.

The savings generated by these innovations enabled Ryanair to offer flights at extremely competitive prices, challenging the traditional airlines. This strategy not only attracted budget-conscious travelers, but also stimulated demand for air travel among those who might not previously have been able to afford to fly.

Over time, Ryanair has continued to evolve, adding new routes and expanding its fleet. It has become one of Europe's largest low-cost airlines, carrying millions of passengers every year. Despite criticism of its customer service and working practices, Ryanair's impact on the airline industry is undeniable. It has forced traditional airlines to review their own cost structures and introduce lower fares to remain competitive.

Ryanair's success story is a classic example of how a company can disrupt an industry by adopting a strategy of innovation and cost reduction. By focusing on simplicity, efficiency and low fares, Ryanair has not only survived in a competitive market, but thrived, becoming a model for other low-cost airlines such as Easyjet or Wizz Air.

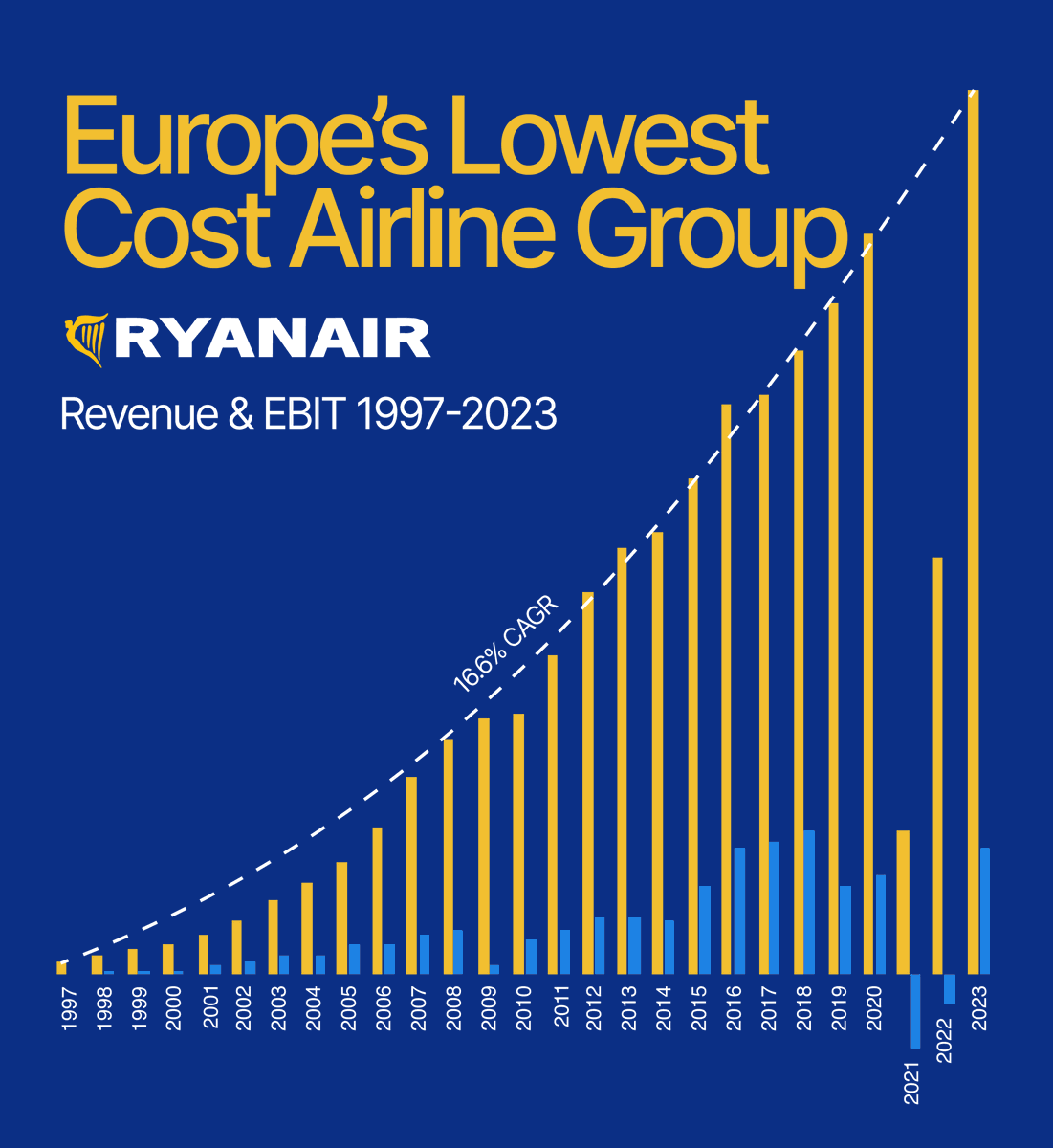

Ryanair growth between 1997 and 2023

Source: Quartr

These three companies share a number of traits. Firstly, the appeal of low-cost disruptors is their resilience in the face of competition. At first, the incumbents are generally not too wary of these new players. They tell themselves that these new entrants are not playing on the same ground. But as time goes by, they stabilize their business model, gain market share and start to encroach on more generalist segments. At that point, it's often very difficult for the incumbents. General Motors suffered greatly from the rise of Toyota, as did Lufthansa with the arrival of Ryanair. Incumbents sometimes end up launching a counter-offensive based on a price war. But this usually doesn't work, simply because their cost structure is higher, which prevents them from fully committing to this strategy, an essential ingredient for success. This predictability in their capture of disruptive industry value is their greatest strength.

As an investor, these companies can be very interesting stocks to add to your portfolio. They generally combine a more sustainable growth path with greater predictability in their business model, for the reasons outlined above.

By

By