The adoption and democratization of Bitcoin continues to grow year after year, and many questions naturally arise, whether on an economic, social, ethical or political level. Here we are going to focus on a widely debated angle, for which it is necessary to have an overall vision. Let's start by recalling how BTC mining works.

Bitcoin mining

In simple terms, Bitcoin mining consists in validating transactions and recording them on the blockchain. The consensus algorithm used, called "Proof of Work", is fundamental to the philosophy of Bitcoin because it allows the system to be secure and guarantees that all users are acting correctly. But as you can imagine, this process is rather complex and is not achieved by the simple will of the Holy Spirit. Imagine a Bitcoin miner, not with a pickaxe, but with a powerful computer that allows him to solve complex mathematical calculations and validate transactions on the blockchain. This process implies, by its operation, a high power consumption. Let's zoom in on this phenomenon.

The energy consumption of Bitcoin

When we say "powerful computer equipment" we mean "electricity consumption". Let's set the scene:

.png)

(assuming continuous power at current rate)

Source: cbeci.org

.png)

Source: cbeci.org

Energy sources of the Bitcoin network

Let's start this section with an infographic and then comment on it right after:

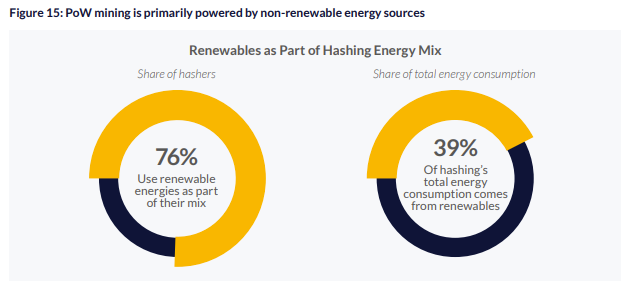

Source: University of Cambridge

The survey shows that a significant proportion of miners use renewable energy (76%) as part of their energy mix. However, this share represents "only" 39% of the overall energy consumption. To cross-check this information, the Bitcoin Mining Council has announced that it is able to collect sustainable energy information from 33% of the global Bitcoin network. This survey shows that BMC members and survey participants "currently use electricity with a sustainable energy mix of 65.9%" and that based on this data, globally the sustainable energy mix would reach more than 57% in the third quarter of 2021.

The share of energy for the Bitcoin network in the world

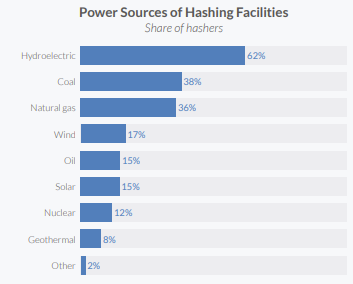

Source: University of Cambridge

A large number of miners use hydroelectric power to operate their infrastructures, but in a proportion that is very probably less important than the use of fossil fuels. Globally, this distribution is rather well respected on all continents, although the United States uses a large number of energies in quite significant proportions.

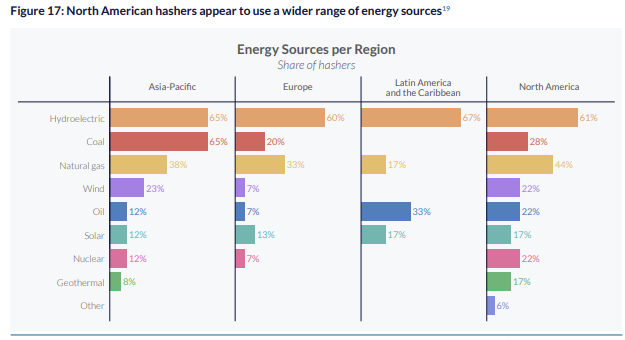

The different energy sources on the different continents

Source : University of Cambridge

A large number of energy sources are used to run the mining operations. Even though most of the electricity consumption comes from fossil fuels, efforts are being made to use less polluting alternatives, most certainly to save on electricity costs. On the other hand, this data will surely change significantly in the coming months with the ban on Bitcoin mining in China.

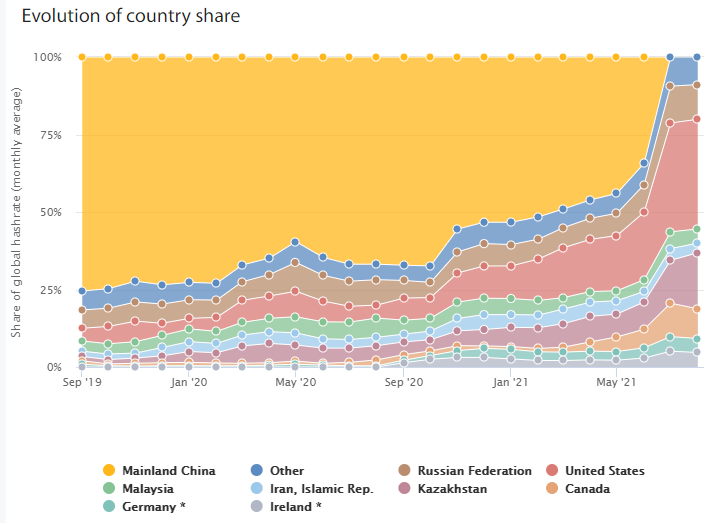

Distribution of Bitcoin mining by country

Source: University of Cambridge

After the fall of the middle empire of the mining world, it is the United States that is taking over 35% of the global Bitcoin hash rate (mathematical function related to the validation of transactions on the blockchain)

The prospects for network consumption

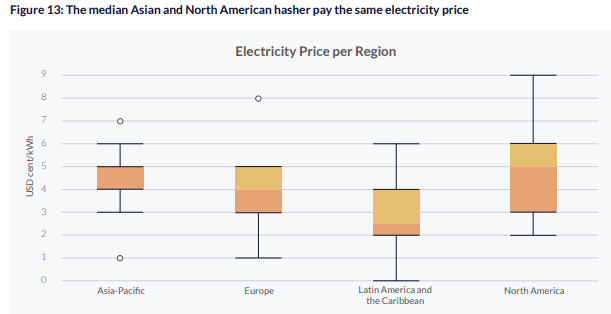

Obviously, the crypto mining industry will be moving to regions of the world where the cost of electricity is relatively low, as this will have a huge impact on their remuneration.

Electricity prices by region in kilowatt hours

Source: University of Cambridge

Comparatively, the median price of electricity in North America is higher but varies greatly by region, while the lowest price can be found in Latin America. One might ask why miners are heading globally to the US. A large number of mining players are heading to the state of Texas as it stands out for its rather low price when it comes to electricity costs. Yes, because if you plan to open your mining farm in California you will pay between 18 and 19 cents per kilowatt hour while in Texas this amount will be divided by more than two. It is also the Eldorado for renewable energies with a state as large as France. The Electric Reliability Council of Texas (ERCOT), the electric network that serves about 90% of the territory's electricity, has the cheapest large-scale solar energy in the country at 2.8 cents per kilowatt-hour.

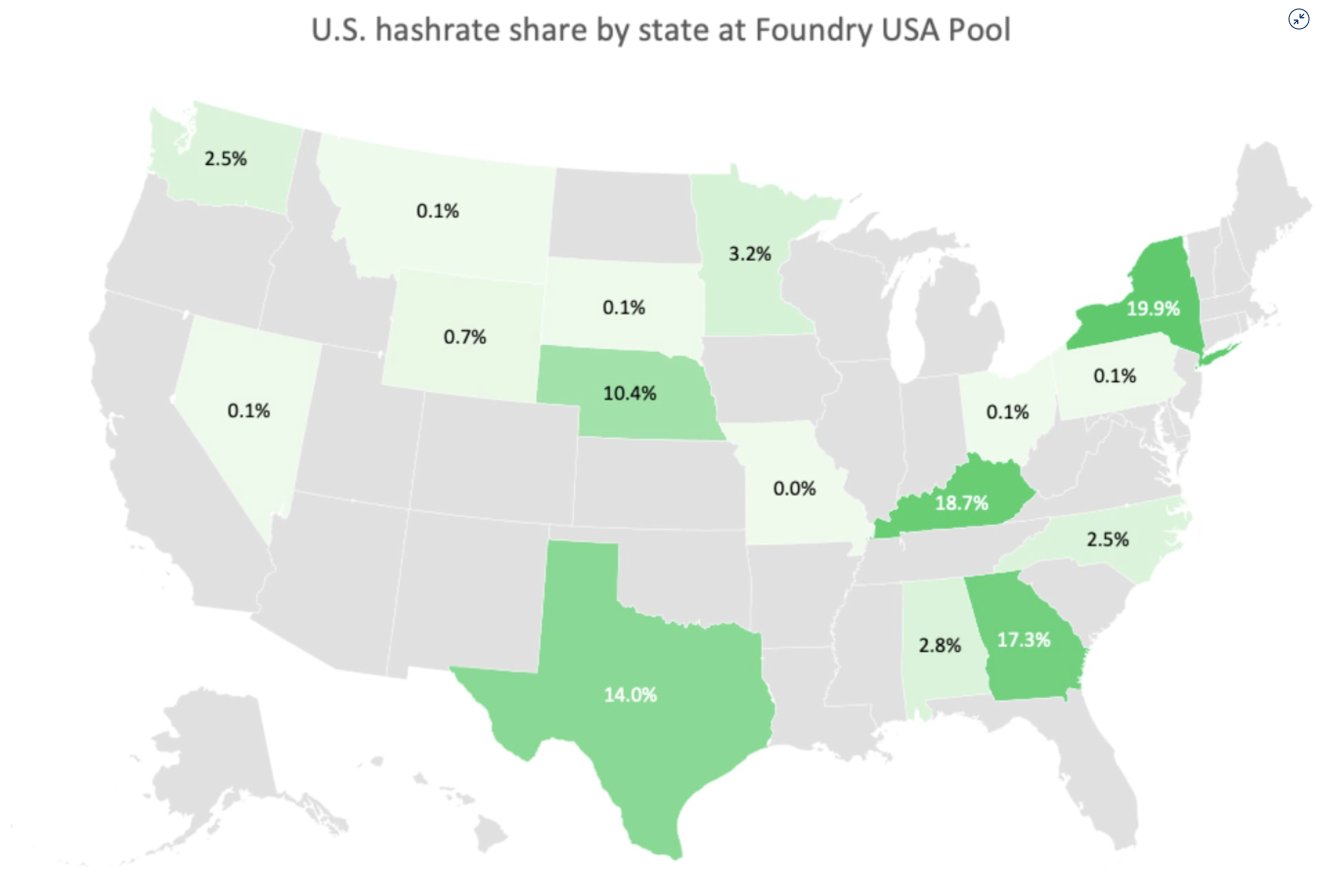

Source: Foundry USA

Although Texas has a lot to offer in terms of renewable energy production capacity, New York State stands out. Why? According to the Energy Information Administration, one third of its production comes from renewable energy, and New York produces more hydroelectric power than any other state east of the Rockies. It is also the third largest producer of hydroelectricity in the country. Finally, the country's cold climate is favorable to the infrastructure of the mining farms, which do not appreciate rising temperatures.

On the Kentucky side, the governor is rather favorable to the crypto assets industry. Miners would be exempt from paying 6% sales tax or 6% excise tax on electricity bills and mining equipment on their platforms. Kentucky is also one of the largest coal producers in the country but also known for its hydroelectric and wind power development. All of these factors have attracted a large number of miners.

While miners intend to regain their ecological virginity in the US, a Canadian initiative is pushing the envelope even further.

Canada: Using Bitcoin mining for heating

The city of North Vancouver is set to become the first city in the world to use mining for building heating needs. A press release from the city's Lonsdale Energy Corporation (LEC) cites a partnership with crypto asset mining company MintGreen to use thermal energy recovered from Bitcoin mining to help heat about 100 residential and commercial buildings connected to the district's energy utility. The technological process (digital boilers) theoretically recovers 96% of the electricity used for Bitcoin mining as thermal energy to be used to heat buildings.

LEC estimates that with this partnership, no less than 20,000 tons/megawatt of greenhouse gas emissions are reduced compared to natural gas. LEC is expected to provide a room to MintGreen so that the company can install servers that manage a large amount of data to mine cryptocurrencies.

We are excited to announce that MintGreen will be providing low carbon heating at scale to North Vancouver, making them the first city in the world to be heated by #Bitcoin 🌱⚡⛏️ https://t.co/fD8PHkfGNK

— MintGreen (@MintGreenHQ) October 14, 2021

The migration of miners is taking place from the Middle Kingdom, mainly to the US. The mining players are concentrated in states and countries that give them a significant economic advantage for their activities. As far as the use of renewable energy is concerned, some will see this as "greenwashing" of Bitcoin and others will see it as a further step in the ecological dimension of crypto assets. It is clear that the crypto assets industry requires a colossal amount of electricity, however this observation needs to be put in perspective with other industries such as banking or gold for example. This is an eternal debate between the two camps. Here we are interested in the Bitcoin network, which includes the Proof of Work consensus algorithm, a mining process that involves, as we have seen, a massive use of electricity. On the other hand, a large number of alternatives exist, such as the Proof of Stake, which requires much less energy consumption, and it is this model that the second largest cryptocurrency in terms of market capitalization will turn to in the coming months. It will be interesting in a future article to study the different consensuses both on their functioning and on their energy consumption.

By

By