|

Monday June 14 | Weekly market update |

| After the ECB's status quo and accelerating inflation in the United States, financial markets ended last week in disarray. Risk appetite and sectoral arbitrage continue, as traders seem to agree with the Fed that this inflationary surge is only temporary. This Wednesday's monetary policy meeting should therefore be followed closely and could lead to renewed volatility. |

| Indexes Over the past week, in Asia, the Nikkei and Shanghai Composite were stable while the Hang Seng fell by 0.1%. In Europe, the CAC40 stands out, continuing its record-breaking run. It has gained 1.25% over the past five days, while its German counterpart, the Dax, has lost 0.1%. The Footsie is also up 0.9%. For the peripheral countries of the euro zone, Italy is up 0.6%, Spain is the best weekly performance, with +1.2% and Portugal is up 0.1%. In the U.S., technology stocks are improving, with the Nasdaq100 rising 1.3%. The S&P500 managed to set a new all-time record, with a modest gain of 0.2%, but the Dow Jones lost 0.9%. |

| Commodities The barrel of American crude WTI is back around USD 70. Brent crude is trading over USD 72. The reopening of the economy and the optimized production management of the Opec+ continue to support prices. The International Energy Agency even pushed the envelope by announcing last week, in its forward-looking report, that global demand should return to and then exceed its record level of the fourth quarter of 2019 by the end of 2022. At the end of 2019, production reached 100.5 mb/d. Over the last few days, however, it is not oil and its compounds that have shifted the most, but some agricultural commodities. Corn in particular, after comments from the USDA on a stock level at its lowest in eight years due to strong demand from the ethanol and export sectors. Soybeans, on the other hand, are seeing a decline after peaks as the US Department of Agriculture reported an increase in storage as a result of falling demand due to high prices. Global Commodity Index  |

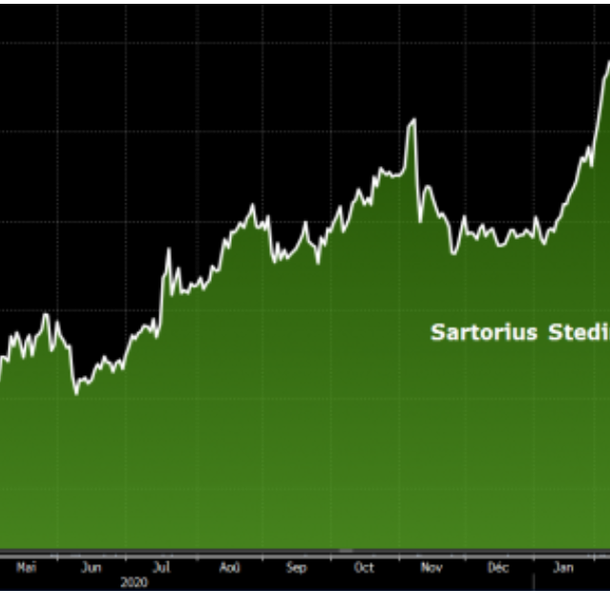

| Equity markets Sartorius Stedim Biotech, a specialist in cutting-edge technologies for the biotech sector, has gained 8.5% over the past five days. The stock was boosted by the approval of an Alzheimer's drug in the U.S. developed by Biogen, which is a customer of Sartorius. The company, which is worth 34 billion euros, is continuing its run, and since the beginning of 2020, the stock has posted a performance of 150%. The company, headquartered in the south of France, was one of the big winners of the pandemic. Despite the fact that the pharmaceutical and biotech sector has been torn by headwinds, sales have improved by almost 35%. On the one hand, the demand for laboratory products related to Covid boosted sales. On the other hand, health restrictions put the brakes on medical research unrelated to the coronavirus. Sartorius Stedim is showing impressive growth: over 10 years, revenues have increased by an average of 16% per year. For 2021, the group expects this same line to grow by 38%. The fundamentals are expensive, with the stock trading at 69 times net income. Stedim Biotech's stock  |

| Bond market In the rates market, the week had all the makings of a high-risk period, but the predictions were foiled. In fact, Thursday was the day that focused all the attention of the financial community, with the double event of May inflation in the United States and the European Central Bank meeting. Against all odds, volatility eased despite consumer prices still overheating in the United States. The yield on the 10-year U.S. bond even fell to 1.43%, compared with over 1.6% a week ago. The decline is also visible in Europe. The French OAT is now yielding only 0.09% and Swiss and German debt remains in negative territory, between -0.25 and -0.30%. Further south, Italian and Greek 10-years are stuck at 0.76% and Spain is at 0.32%. Japanese JGBs are at 0.02% and British Gilts at 0.69%. |

| Foreign exchange market If equity market participants have been complaining for the past few weeks that not much is happening, what about currency traders? The EUR/USD remains stuck in the USD 1.21/1.22 area, with the current opposing forces canceling each other out. The British pound did attempt to continue its upward climb, but a few niggles have come in the way of momentum, most notably the fear of a resurgence of the pandemic that would thwart the final stages of the UK economy's reopening. The GBP was trading at USD 1.41 on Friday. There is still some movement in the ruble, which rose against the dollar and the euro (to RUB 87.175) after May's inflation figures, which soared to 6% in Russia. Economists believe that the CBR will be forced to raise its key rate, probably from 5 to 5.5%. Verdict today. The Turkish lira also regained a few points against the greenback at TRY 8.3, ahead of a meeting between Joe Biden and Recep Tayyip Erdogan, although professionals see the TRY in pretty bad shape in the coming months. |

| Economic calendar Inflation will have focused the attention of operators. In China, the producer price index jumped by 9% while the consumer price index rose by 1.3%. The trade balance was also above expectations at 296B. For Germany, industrial orders declined by 0.2%, industrial production by 1% and the Zew fell to 79.8 (84.4 last month), while the WTI wholesale price index rose by 1.7% (consensus 0.9% and 1.1% last month). In the euro zone, GDP fell by 0.3%. The news was also light in the US, with a trade balance in line with expectations, oil inventories down (-5.2M), as well as weekly jobless claims at 376K. The surprise came from the CPI index, which rose by 0.6% (+0.7% excluding food and energy). |

| Lack of catalysts In Olympian form for more than a year, indices seem to be looking for new catalysts and answers to their questions, especially on inflation. The consumer price index beat expectations in May, reaching +5% in the US year-over-year. While a significant portion of the price rise is due to base effects, there are signs that more durable factors are pushing prices higher. However, traders seem unconcerned and markets continue to stabilize or rise on low volumes. |

By

By