To start with, it is important to know that a split has absolutely no impact on the value of the company. It is like taking the same cake and dividing it into more shares. The previous shareholders will keep for themselves exactly the same share of the cake in proportion to the shares they hold. For example, in a 4-way split, my USD 1,000 share will automatically be replaced in my portfolio by four shares of USD 250.

There are five main benefits to a split:

- It significantly improves the liquidity of the stock and facilitates transactions for individual or small institutional shareholders, both on entry and on exit, whether complete or partial. If the impact in terms of liquidity is limited with giant capitalisations such as Amazon or Google, it is considerable for small capitalisations whose share price has risen to 5 or 6 figures.

- For large institutional investors, this can reduce transaction costs just as dramatically - because the massive increase in liquidity reduces the spread between the bid and ask price. This is negligible when investing small amounts, but such a spread of a few cents or tens of cents can be very costly for institutional investors on transactions in the hundreds of millions or billions.

- Generally, and various academic studies have proven it, companies that "split" their shares benefit from a revitalized valuation in the months that follow, perhaps even in the years that follow. This may be because it gets rid of the "expensive stock" stigma.

- This simplifies the management of stock option compensation, especially for technology companies that use them massively, including for all sorts of junior positions.

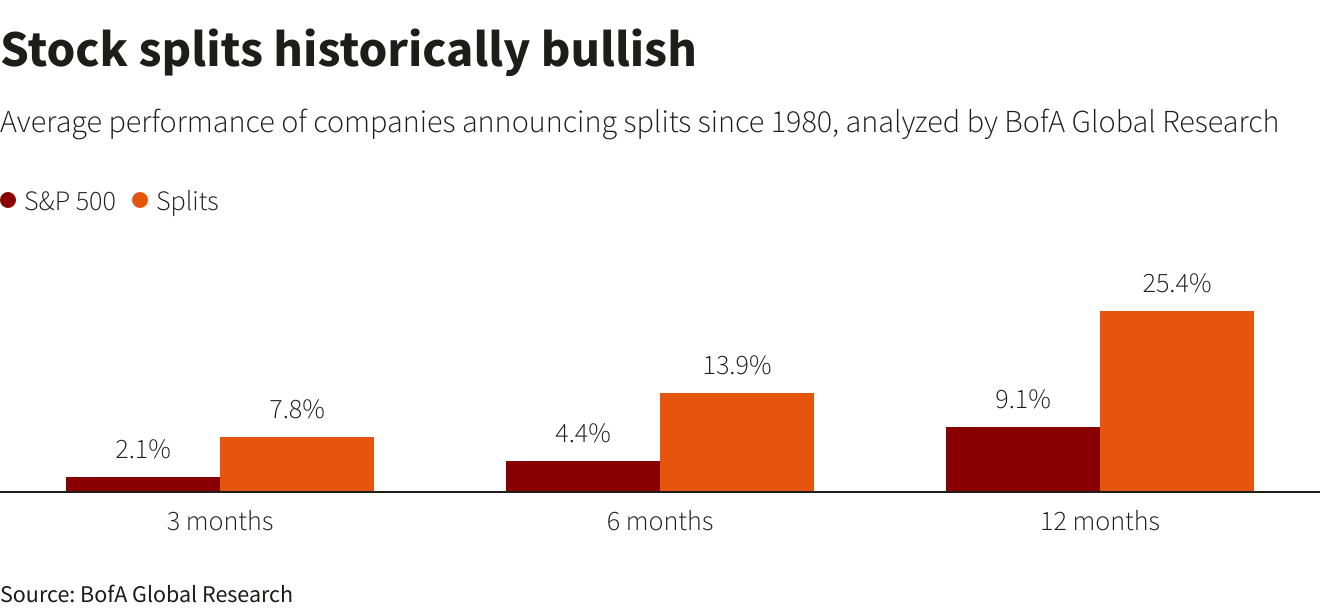

- Finally, stocks that "split" tend to perform better than others, as shown in the following chart by BofA. This is of course because the stocks that rise high enough to qualify for a split are already those of companies that are doing well and outperforming the market.

There are also some negative elements to consider:

- If there is an operational or financial upset at the company level, this can have a damaging impact on its image with the public. For example, let's take a company whose stock was at USD 1000, which splits in 10 to bring it down to USD 100. If a complicated news item or a bad news item occurs, this will bring the stock down to USD 40 or USD 50. Even if the market capitalization remains the same, the public perception will not be the same.

- In some specific cases, this operation can contribute to lowering the quality of the shareholder base, by attracting a new public that is more volatile and less familiar with the company. This is why Warren Buffett has for decades opposed the Berkshire Hathaway stock split. A higher entry ticket served him to "sort out" and somehow ensured that he would only attract shareholders who were sympathetic to his cause, are familiar with Berkshire's philosophy, and with capital for the long or very long term. Berkshire shares are worth $471,500 at the time of writing. There is a more accessible B-share, which is worth $313.66, but it definitely has less cachet - and weight - than the "real" stock.

- Finally, and this is an anecdotal disadvantage because it is limited to small caps, the operation may involve a non-negligible administrative cost.

By

By