Better-than-expected results

EARNINGS/SALES RELEASES

2019 ended on a good note for Blackstone Resources, with FY net attributable income of CHF5.31m vs. CHF22.6m loss in 2018. While the group’s respective (growth) projects remain work-in-progress, the on-going COVID-19 uncertainties are a pertinent concern. However, Blackstone’s positioning, targeting near-term cash flows from gold refining and battery R&D still in early stages – thereby benefiting from lower input costs, could render some operational support.

FACT

Blackstone Resources ended 2019 on a good note, with full-year (FY) results marginally exceeding AV’s expectations. Given that most of the assets/growth investments are yet to hit (meaningful) operations, total sales were minimal (c.CHF21k). However, the underlying operating loss came in at CHF2.25m vs. AV’s estimate of CHF2.31m, despite depreciation & amortisation expenses of CHF0.52m – partly due to the Peruvian operations. The group realised CHF6.9m of one-time profit from an asset swap deal struck in the first half of 2019 (details discussed below), while interest expense dropped significantly (65%) to CHF0.34m. As a result, FY net attributable income came in at CHF5.31m (vs. CHF22.6m loss in 2018), compared to AV’s estimate of CHF3.34m.

Blackstone ended 2019 with net debt of CHF28.7m, with Ulrich Ernst – CEO and largest shareholder (c.46% stake) – continuing to be a (key) lender (>CHF5m) of the firm.

ANALYSIS

In May-June 2019, Blackstone sold its Mongolian molybdenum asset (i.e. Troi Gobi) – though it secured 3% royalty on revenue rights, with an option (valid until the end of 2022) to repurchase the sold participation. In exchange, the group purchased an additional c.30% stake in South America Ltd. (SAI), thereby becoming SAI’s majority owner (with c.51% stake). As a reminder, SAI owns a Peruvian gold refinery – which is expected to be a key source of Blackstone’s near-term cash flows. Furthermore, the acquisition of lithium concessions in Chile and the execution of a JV with an Indonesian minerals company were some of the other key developments of 2019. With respect to Blackstone’s battery R&D programme (based in Germany and Switzerland), the group has applied for various governments’ subsidy programmes to fund its research initiatives.

Just when operationally things were falling in place for Blackstone Resources, the global economy is now faced with serious macro challenges (possibly worse than the 2008-09 crises) due to the COVID-19 outbreak. So far, despite billions of dollars worth of rescue packages being announced, the marker sentiment remains bearish. Within AlphaValue’s Metals & Mining, and Automotive sectors, apt proxies for Blackstone’s businesses, over the past three months, combined 2020 net earnings expectation (for 34 corporates) in these sectors have been cut by an average c.47%, resulting in c.€39bn of net earnings estimates being wiped out.

According to IHS Markit, global vehicle sales in 2020 could fall by as much as 12%, with the US expected to fall 15%, followed by Europe (-14%) and China (-10%). As a reminder, new US car registrations in March 2020 were down 38% to 990k, while European sales almost halved (52%) to 853k and China sales had already plummeted 82% to 224k in February 2020 – as the virus infected the mainland region first, before recovery began in the following month. Unsurprisingly, talks of spiralling unemployment, bankruptcies and state-sponsored bailouts are regathering momentum. With dearth cheap oil, would (EV-driven) clean environment initiatives remain the respective governments’ top-priority?

At least, not in the immediate term. With almost the entire world being locked down and who knows until when, it is very unlikely that EV sales won’t plummet. Nevertheless, it would be too far-fetched to assume that the EV story is dead forever, especially given that massive state and corporate investments have been made (over the years) in this space, thereby increasing the (emerging) sector’s systematic importance.

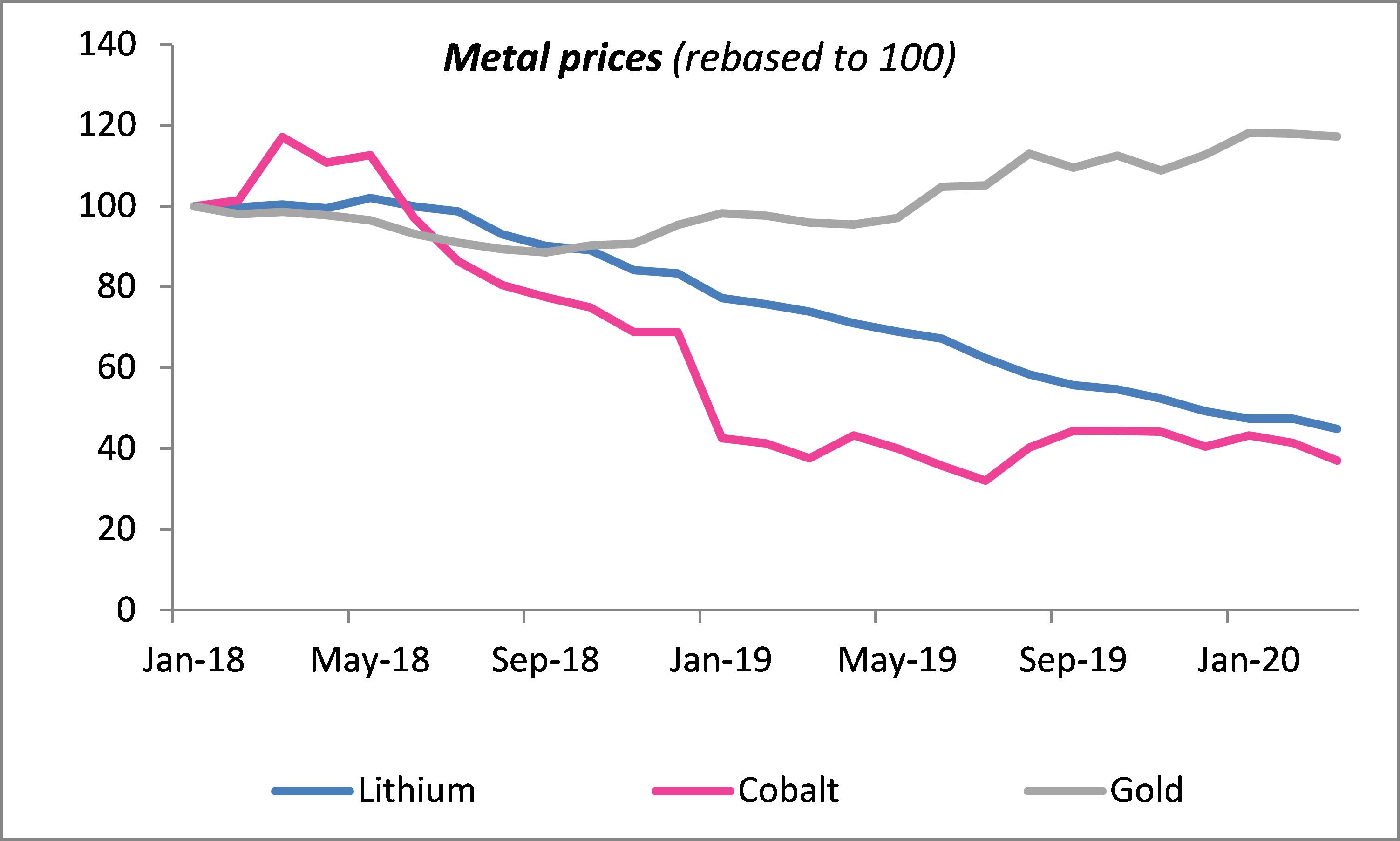

For an emerging player like Blackstone in the battery (material) industry, the prevalent downturn perhaps provides reasonable lead-time to develop scaleable and energy-efficient batteries. Moreover, materially lower prices of key battery metals (like cobalt and lithium) could instead provide a level-playing field (in input cost terms) for new entrants. And, until any battery-related R&D success is attained, Blackstone can benefit from the panic-driven gold price (trading at 8-year high of >$1,700/oz) tailwinds – given the early-stage cash flows expected from Blackstone’s Peruvian gold refinery.

Prevalent price headwinds – blessing in disguise

Source – Bloomberg

IMPACT

Our model is under review as we incorporate the impact of the 2019 results and add a new forecast year, i.e. 2022. Taking into consideration the tough macro context and downgrades across sectors, our estimates should be revised downwards. However, given the near-term gold refining benefits, and (long-term) prospects for battery remaining intact, the recommendation is likely to be maintained.