1st quarter of 2021 highlights

- Discretionary cash flow over the last 12 months at $142 million, in line with the 2023 target of $140 to $150 million

- EBITDA(A) of $151 million ($162 million) in Q1-2021 compared to $149 million ($169 million) in Q1-2020

- Net earnings of $38 million ($43 million) in Q1-2021 vs $44 million ($37 million) in Q1-2020

- Total combined production in line with corresponding quarter in 2020

- Total production: in line with Q1-2020 and 1% below anticipated production 1

- Wind production: decrease of 4% compared to Q1-2020 and 1% below anticipated production

- Recent acquisitions and projects commissioning met expectations

- Contribution of $29 million ($20 million) to EBITDA(A) from acquisitions of CDPQ's equity interests in three wind farms in Quebec, seven solar farms in the United States, as well as projects commissioning

- Additional 180 MW in new projects and good progress of projects in development

- Addition of 180 MW to project portfolio: 143 MW in solar power and 37 MW in wind power

- Progress in the Growth Path of 71-MW Moulins du Lohan wind project in France following a favorable decision by the Conseil d'État

- Commissioning on May 1 of the Bazougeais wind farm in France, with an additional 12 MW in total installed capacity

- Signing of a five-year renewable power purchase agreement to benefit IBM France

- Sale of the Blendecques power station in France, the Company's last fossil fuel facility, thus making Boralex a 100% renewable energy producer

MONTREAL, May 5, 2021 /PRNewswire/ - For the quarter ending March 31, 2021, Boralex Inc. ("Boralex" or the "Company") (TSX: BLX) continued to add new projects to its project portfolio and to advance existing projects to the secured and ready to build phases of its Growth Path. The Company also generated production in line with the corresponding quarter of 2020.

"Since the beginning of the year, we have kept the course on our strategic plan and have continued to generate a high level of discretionary cash flow, one of our three financial objectives for 2023," stated Boralex President and CEO, Patrick Decostre. "Our two most recent acquisitions and projects commissioning were in line with our expectations. Wind conditions in France were in line with anticipated production but lower than the exceptionally strong conditions of first quarter 2020," Mr. Decostre added.

Early in 2021, major announcements were made regarding two large-scale projects: the signing of the 200 MW Apuiat wind project contract in Quebec (100 MW net to Boralex), in partnership with the Innu's and the favorable decision on the 71 MW Moulins du Lohan wind farm project in Brittany, France. These announcements are very encouraging for the Company's continued growth. Boralex also released its first Corporate Social Responsibility (CSR) report, Beyond Renewable Energy. The report, which is separate from the annual report, depicts the rigorous approach taken by the Company in developing its CSR strategy, which is fully aligned with its strategic plan and its financial objectives. In 2021, Boralex is focusing on the following issues: diversity and equal opportunities, reporting on greenhouse gas emissions, and occupational health and safety, including mental health.

__________________________ |

(1) Calculated based on adjusted historical averages of commissioning and planned outages for experimental and other sites, based on producible material studies |

(2) The figures in brackets reflect the combined EBITDA(A), versus those calculated according to the IFRS. See the "Combined EBITDA(A) — Non-IFRS Measures" section |

Regarding the Company's outlook, Mr. Decostre stated, "Over the next quarter, we will continue to enhance our strategic plan to consider greater opportunities arising from the acceleration of the green energy transition following the publication of recovery plans by various governments around the world. This update, along with a review of our 2023 financial objectives given our strong performance over the last two years, will be unveiled on June 17, 2021 during an Investor Day," he added.

1st quarter of 2021 highlights

Three-month periods ended March 31

IFRS | Combined (1) | |||||||

(in millions of Canadian dollars, unless otherwise | 2021 | 2020 | Change | 2021 | 2020 | Change | ||

specified) (unaudited) | $ | % | $ | % | ||||

Power production (GWh)(2) | 1,630 | 1,533 | 97 | 6 | 1,830 | 1,837 | (7) | — |

Revenues from energy sales and | ||||||||

feed-in premium | 206 | 200 | 6 | 3 | 228 | 232 | (4) | (2) |

EBITDA(A)(1) | 151 | 149 | 2 | 1 | 162 | 169 | (7) | (4) |

Net earnings | 38 | 44 | (6) | (13) | 43 | 37 | 6 | 18 |

Net earnings (loss) attributable to | ||||||||

shareholders of Boralex | 34 | 41 | (7) | (18) | 39 | 34 | 5 | 15 |

Per share - basic and diluted | $0.33 | $0.43 | ($0.10) | (23) | $0.38 | $0.35 | $0.03 | 8 |

Net cash flows related to operating | ||||||||

activities | 133 | 133 | — | — | 132 | 136 | (4) | (1) |

Cash flows from operations (1) | 115 | 124 | (9) | (7) | 125 | 137 | (12) | (8) |

Three-month periods ended | Twelve-month periods ended | |||||||

(in millions of Canadian dollars, unless otherwise | March 31, | March 31, | Change | March 31, | December 31, | Change | ||

specified) (unaudited) | 2021 | 2020 | $ | % | 2021 | 2020 | $ | % |

Discretionary cash flows (1) - IFRS | 60 | 68 | (8) | (12) | 142 | 146 | (4) | (4) |

(1) | For more details, see the Non-IFRS Measures section in the 2021 Interim Report 1 available on the websites of Boralex (boralex.com) and SEDAR (sedar.com). |

(2) | The production level for which NRWF wind farm was compensated following power generation limitations imposed by the IESO were included in power production, as |

In the first quarter of 2021, Boralex generated 1,630 GWh (1,830 GWh) of electricity, representing an increase of 6% on an IFRS basis and a comparable level on a combined basis versus 1,533 GWh (1,837 GWh) for the same quarter in 2020. The increase is due to recent acquisitions in the wind sector in Quebec and solar sector in the U.S., as well as an increase in hydroelectric production in Canada.

For the three-month period ending March 31, 2021, revenues from energy sales totaled $206 million ($228 million), up 3% on an IFRS basis and down 2% on a combined basis compared to the first quarter of 2020. For Q1 2021, the Company posted a consolidated EBITDA(A) of $151 million ($162 million), up 1% on an IFRS basis and down 4% on a combined basis compared to the first quarter of 2020. The increase in revenues and EBITDA(A) on an IFRS basis is also due to the previously depicted increase in production.

For the three-month period ending March 31, 2021, Boralex posted net earnings of $38 million ($43 million) compared to net earnings of $44 million ($37 million) for the corresponding period in 2020. As shown in the above table, the net earnings attributable to Boralex shareholders were $34 million ($39 million) or $0.33 ($0.38) per share (basic and diluted), compared to net earnings attributable to Boralex shareholders of $41 million ($34 million) or $0.43 ($0.35) per share (diluted) for the corresponding period in 2020.

Outlook

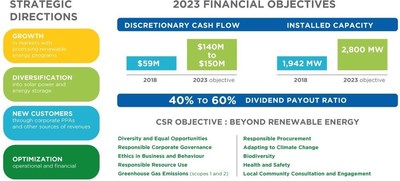

In June of 2019, Boralex's Management unveiled the strategic plan that guides its actions toward achieving its 2023 financial objectives. The plan is structured around four main guidelines and three financial objectives. It stems from a rigorous market analysis and trends in the renewable energy sector. It's also part of a process in which a deep and rapid industry transformation is underway, partly due to the high number of technological innovations and the acceleration of the green energy transition.

To successfully implement its strategic plan and achieve its financial objectives, the Company relies on its strong expertise in small- and medium-sized project development. This is a key advantage for capitalizing on opportunities in increasingly competitive markets, including solar power.

Boralex's strategic plan builds on the growth potential of the markets in which it operates.

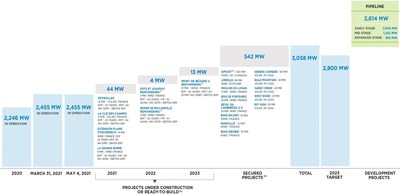

The Company has a portfolio of projects at various stages of development, based on clearly stated criteria, for a total of 2,614 MW, as well as a Growth Path of 603 MW, as illustrated below.

(1) | The Evits et Josaphat repowering project represents a total capacity of 14 MW with an increase of 2 MW while the Remise de Reclainville repowering project represents a total capacity of 14 MW with an increase of 2 MW, and the Mont de Bézard 2 repowering project represents |

(2) | The Corporation holds 50% of the shares of the 200 WM wind power project but does not have control over it. |

(3) | The total project investment and the estimated annual EBITDA for projects in France have been translated into Canadian dollars at the closing rate on March 31, 2021. |

(4) | Some projects will be commissioned after 2023. |

In order for the implementation of the strategic plan to translate into disciplined growth, while creating value for shareholders, Boralex's Management is monitoring the evolution of the three criteria retained as financial objectives.

For the twelve-month period ending March 31, 2021, the Company's discretionary cash flow reached 142 M$, in line with the $140 million to $150 million 2023 target.

The dividend paid to shareholders in the quarter ending March 31, 2021, was equivalent to a dividend payout ratio of 47%, in line with the target dividend payout ratio of 40% to 60% set according to the 2023 financial objectives.

Finally, as of May 4, 2021, Boralex's installed capacity was 2,455 MW. By adding construction-ready projects and those under construction, as well as secure projects on the Company's Growth Path, installed capacity increases to 3,058 MW, exceeding the 2023 target of 2,800 MW. However, some secured projects may be commissioned after 2023.

Dividend declaration

The Company's Board of Directors has authorized and announced a quarterly dividend of $0.1650 per common share. This dividend will be paid on June 15, 2021, to shareholders of record at the close of business on May 31, 2021. Boralex designates this dividend as an "eligible dividend" pursuant to paragraph 89(14) of the Income Tax Act (Canada) and all provincial legislation applicable to eligible dividends.

About Boralex

Boralex develops, builds and operates renewable energy power facilities in Canada, France, the United Kingdom and the United States. A leader in the Canadian market and France's first independent onshore wind power producer, the Corporation is recognized for its solid experience in optimizing its asset base in four power generation types – wind, hydroelectric, thermal and solar. Boralex ensures sustainable growth by leveraging the expertise and diversification developed for more than 30 years. Boralex's shares are listed on the Toronto Stock Exchange under the ticker symbol BLX.

For more information, go to www.boralex.com or www.sedar.com. Follow us on Facebook, LinkedIn and Twitter.

Disclaimer regarding forward-looking statements

Certain statements contained in this release, including those related to results and performance for future periods, the Company's strategic plan, business model and growth strategy, the Company's financial targets and portfolio of renewable energy projects, or the Company's Growth Path are forward-looking statements based on current forecasts, as defined by securities legislation.

Forward-looking statements are based on major assumptions, including those about the Company's return on its projects, as projected by management with respect to wind and other factors, opportunities that may be available in the various sectors targeted for growth or diversification, assumptions made about EBITDA(A) margins, assumptions made about the sector realities and general economic conditions, competition, as well as the availability of funding and partners. While the Company considers these factors and assumptions to be reasonable, based on the information currently available to the Company, they may prove to be inaccurate.

Boralex wishes to clarify that, by their very nature, forward-looking statements involve risks and uncertainties, and that its results, or the measures it adopts, could be significantly different from those indicated or underlying those statements, or could affect the degree to which a given forward-looking statement is achieved. The main factors that may result in any significant discrepancy between the Company's actual results and the forward-looking financial information or expectations expressed in forward-looking statements include the general impact of economic conditions, fluctuations in various currencies, fluctuations in energy prices, the Company's financing capacity, competition, changes in general market conditions, industry regulations, litigation and other regulatory Issues related to projects in operation or under development, as well as other factors listed in the Company's filings with the various securities commissions.

Unless otherwise specified by the Company, forward-looking statements don't take into account the effect that transactions, non-recurring items or other exceptional items announced or occurring after such statements have been made may have on the Company's activities. There is no guarantee that the results, performance or accomplishments, as expressed or implied in the forward-looking statements, will materialize. Readers are therefore urged not to rely unduly on these forward- looking statements.

Unless required by applicable securities legislation, Boralex's management assumes no obligation to update or revise forward-looking statements in light of new information, future events or other changes.

Percentage figures are calculated in thousands of dollars.

Combined - Measure not compliant with IFRS

The combined EBITDA(A) shown above and in the Company's management report results from the combination of Boralex Inc.'s ("Boralex" or the "Company") financial information, established in accordance with IFRS, and data relating to the share of Investments. The Investments represent significant investments by Boralex, and although IFRS don't allow for their financial information to be combined with Boralex's information, Management considers the combined EBITDA(A) to be useful data in assessing the Company's performance. In order to calculate the combined EBITDA(A), Boralex first prepared its financial statements and those of Investments, in accordance with IFRS. Next, the items Investments in Associates and Joint Ventures, Share of Profits (Losses) of Associates and Joint Ventures and Distributions Received from Associates and Joint Ventures are replaced with Boralex's respective share (ranging from 50.00% to 59.96%) in all items of the Investments' financial statements (i.e., revenue, expenses, assets, liabilities, etc.). For more information, please refer to the note Investments in Associates and Joint Ventures in the annual audited consolidated financial statements for the fiscal year ended December 31, 2020.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/boralex-adds-180-mw-to-its-project-portfolio-and-posts-net-earnings-of-38-million-in-q1-2021-301284188.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/boralex-adds-180-mw-to-its-project-portfolio-and-posts-net-earnings-of-38-million-in-q1-2021-301284188.html

SOURCE Boralex Inc.