Mainly active in New York and managed more like a private partnership than a listed financial institution, the bank distinguishes itself by the clientele it serves (wealthy families and other select institutions) and a niche portfolio of activities, concentrated for the most part in the financial sector.it serves (high net worth families and other carefully selected institutional clients) and a portfolio of niche activities, mostly focused on lending to investment funds (46% of the portfolio), high net worth families and (46% of the portfolio), wealthy families (a quarter of the portfolio) and commercial real estate operators (a fifth of the portfolio), as well as by an exceptional growth record over the last fifteen years (2006-2021), and a very conservative management style overall. There's a reason why it is dubbed "New York's most successful bank" by Crain's New York Business.

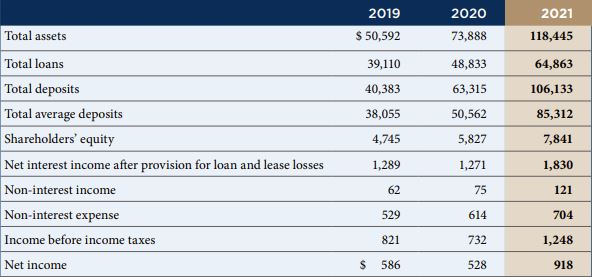

Financial highlights:

Source: Signature Bank - Annual Report 2021

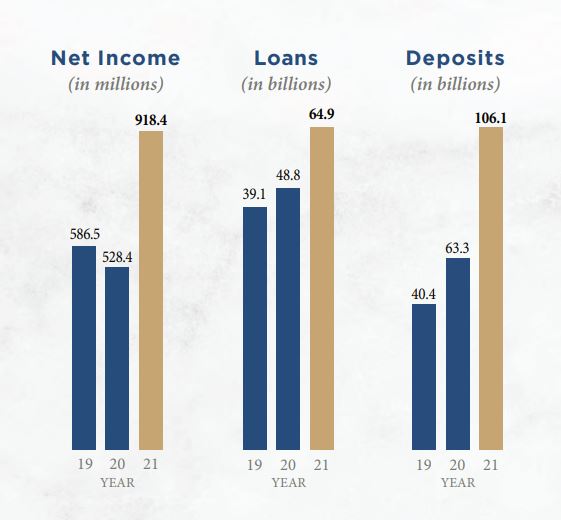

The bank's success and excellent reputation with its customers of collecting exponentially increasing deposits (from $4 billion to 106 billion in fifteen years), a good third of which is "non-interest bearing", i.e. without interest to be paid to customers. This feature is a kind of banking grail because it is equivalent to obtaining zero cost financing.

The loan portfolio is growing at a steady pace (from $1.5 billion to $65 billion) and cash is piling up in a big way (from $500 million to $30 billion), which reflects prudent management. Indeed, loans are growing much more slowly than deposits. That's the hallmark of a bank that doesn't rush to lend to the first guy who comes along and, no doubt, sets the stage for a future large acquisition. A little bird tells me that Signature has understood that certain states (such as California) are full of wealthy clients and the New York bank has been looking to expand on the West Coast for some time now.

.

Source: Signature Bank - Annual Report 2021

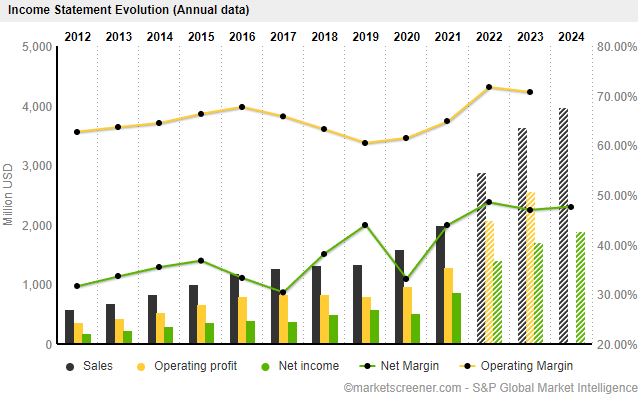

Revenues from lending activities have increased 20-fold over the past 15 years (from $100 million to $2 billion), while the net interest margin has followed a roughly similar trajectory. Consulting and proprietary investments contribute one-fifth of overall revenue. Even with frequent stock issuances (stock option payouts), earnings per share increased fifteenfold between 2006 and 2021 (from $1 to $15).

Like a metronome, the bank delivers returns on equity slightly above 10% PER (smoothed over the cycle) with a standard use of leverage. It is worth noting that it has weathered the storm of 2008 perfectly well (unlike most other banks). If we look at recent history, a substantial part of the provisions made during the pandemic should be released as early as this year, and thus give a boost to the consolidated profit.

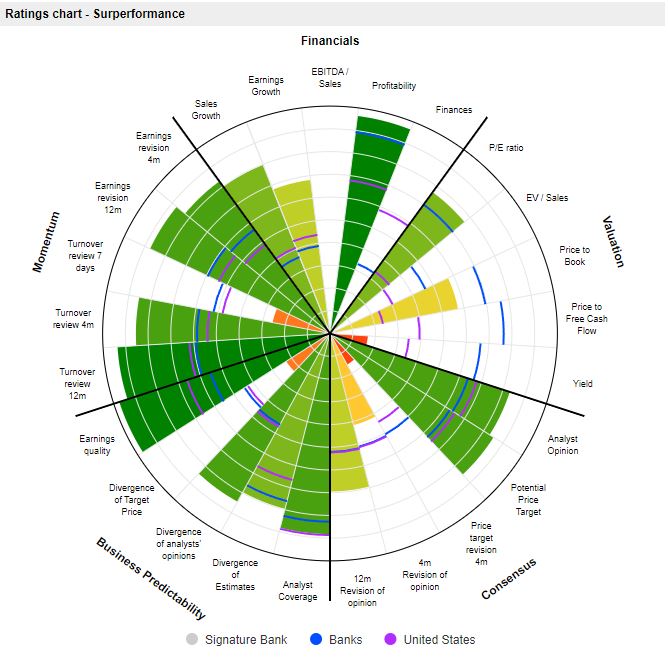

In terms of valuation, the bank is currently trading at 1.7 times equity value and 7.7 times expected net income next year, which are typical multiples.

However, no other bank has experienced such a growth track record over the last cycle, nor does it have Signature's development prospects

Imagine if management replicated its past cycle performance over the next cycle, the current valuation seems to be an excellent entry point.

In addition to the California expansion, the rise in interest rates is another major catalyst, as it should boost Signature's earnings power very significantly, both in terms of its cash and securities and its loan portfolio. The bank currently holds $30 billion in cash, which earns little or nothing (a 1% increase in rates results in $300 million in additional pre-tax profit on cash alone).In terms of financial performance, Signature combines the best of both banking worlds: on the one hand a well-secured loan portfolio, with a historically very low default rate (except for an isolated episode in 2018) and reduced provisioning requirements, all with a negligible funding rate. On the other hand, its cost structure is reduced to the extreme (activity concentrated on a "high net yield" portfolio).

The prestige of the bank helps with recruitment (this is another dimension of its success and of prestigious financial institutions in general), especially when it serves a wealthy clientele. It attracts the best elements of private bankers with a very low attrition rate: a sign that the corporate culture is healthy (banks with a high turnover is on the contrary a clear sign of a failing corporate culture). This flywheel effect on both employees and clients acts as a virtuous circle that strengthens over time.

Evolution of the income statement in annual data from 2012 to 2024 (actual and estimated):

Source: MarketScreener

The main risk of a stock like this is that the bank's executives could capture most of the value created by the business in bonuses, salaries and other remunerations to the detriment of shareholders. For the moment, their track record pleads in their favor, but one must of course remain vigilant on this point. If the bank is still managed by its founders, their direct participation in the capital remains limited (we would have liked to see more Insider ownership).

Another risk is that the bank has developed a crypto-asset business with nearly 15 billion dollars of deposits linked to these assets, considered speculative.This exposure to a tightening of regulations on crypto-currencies following repeated scandals in this polarized asset class, and/or massive client withdrawals following the bursting of the speculative bubble is to be taken into account, even if this risk is limited to one branch of Signature's activity.

A third risk is that the bank may in fact be a victim of its own success: deposits have grown much faster than loans, and it is not clear that Signature's teams will be as successful if they have to venture outside their historical expertise.

As you can see, Signature Bank is both a growth stock and a value stock that could benefit from the current high interest rate environment. Watch it closely.

By

By