Business

TopBuild operates in the construction sector in the United States and Canada. Its business is divided into two segments: installation and specialized distribution of insulation materials and other building products.

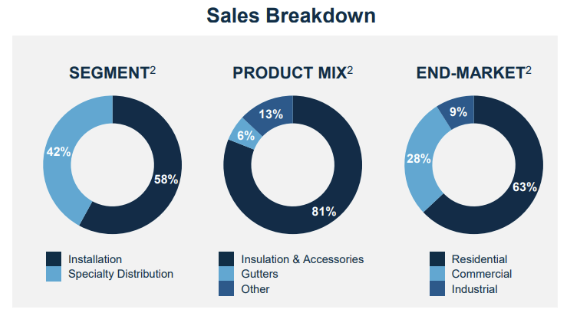

Its installation segment, which generates nearly 59% of its sales, deploys its insulation services through an extensive network of 230 branches across the US. In addition to insulation, which accounts for 79% of sales in this field, the company also offers the installation of a variety of other building products, including glazing, windows, gutters, post-finishings, etc.windows, gutters, post-paint finishes, fire safety systems, garage doors and chimneys, offering a complete range of building solutions.

Representing the remaining 41%, the distribution segment is dedicated to the supply of insulation materials and building products for the residential and commercial/industrial sectors. Dominated by insulation distribution, which accounts for 89% of sales, this segment is supported by a solid network of 162 distribution centers in the United States and 17 in Canada.

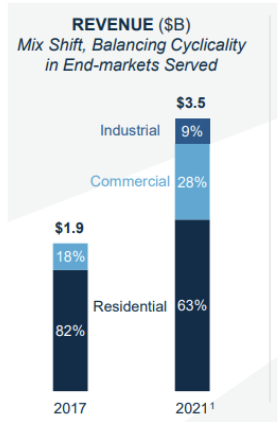

The residential sector predominates in the revenue breakdown, accounting for 63% of sales. The commercial sector is not to be outdone, contributing 28%, while the industrial sector rounds out the picture with 9%.

Topbuild has diversified its business sectors to reduce its dependence on new housing construction cycles.

Time for the accounts

Financially, the numbers are good. Since 2015, its average annual growth rate has been 17.5%, enabling the group to triple its sales in just 7 years. Its price/earnings ratio (P/E) stands at 18.8x, a level comparable to that of its main rivals in the sector.

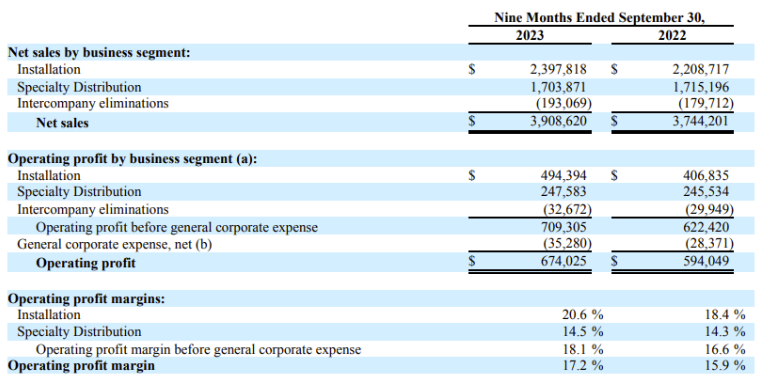

The year 2023 was full of uncertainties, mainly caused by rising interest rates that made home loans more expensive, discouraging potential buyers. Nevertheless, in the first nine months of the year, the company not only increased its operating margins by 1.3%, but also maintained its growth rate of 4.4%, testifying to its attractive pricing power.

Profitability ratios are high, with a return on equity (ROE) of 27.9% in 2023, and a net margin approaching 12% - a marked increase on the 4.9% recorded in 2015.

Earnings per share are also trending upwards, thanks to an active share buyback policy. Since 2015, the company has bought back $672.3 million worth of shares, reducing the number of outstanding shares by 15.6%.

Source : company

External growth: M&A strategy.

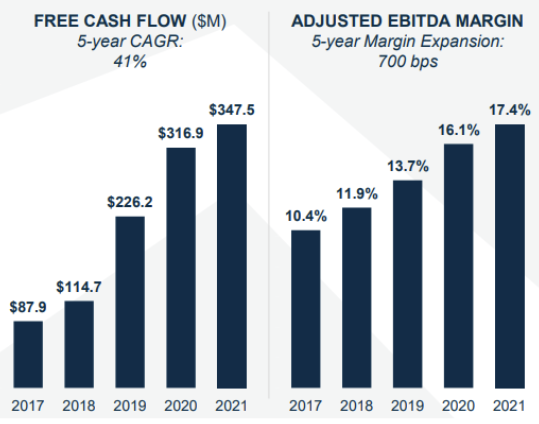

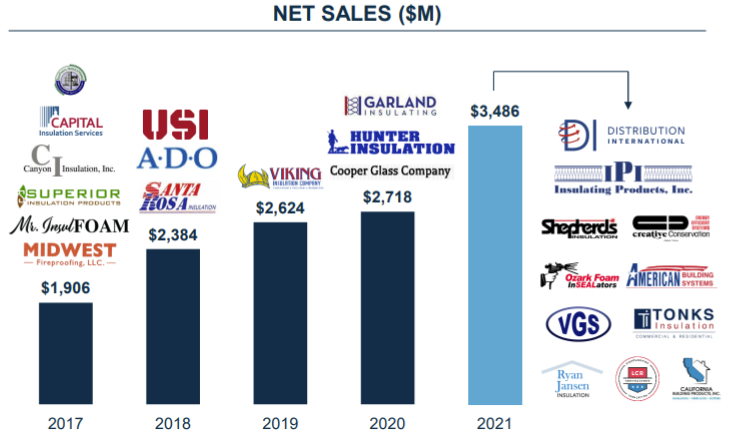

Since its spin-off, TopBuild has adopted a strategy of targeted acquisitions, to boost free cash flow (FCF) generation and increase margins through cost synergies.

Source : company

Even in 2023, the company has maintained its strategy by setting its sights on Specialty Products & Insulation (SPI), an operation valued at $960 million. This acquisition is part of the expansion of its "specialized distribution" segment.

The Group estimates that this reinforcement will increase segment sales by a third, thanks to the generation of significant recurring revenues, mainly from industrial maintenance and repair.

TopBuild's history is punctuated by more than 28 acquisitions in six years, which have added $1.6 billion to the company's sales.

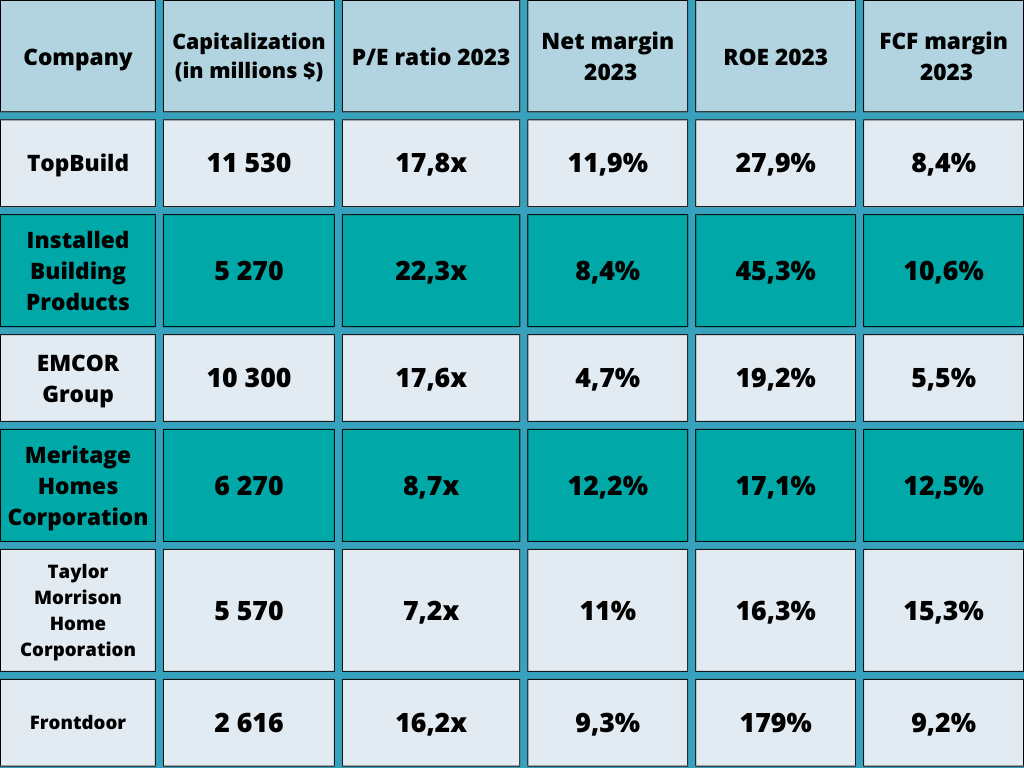

By way of comparison, here's a table showing TopBuild's main competitors listed on the stock exchange:

TopBuild has metamorphosed since its 2015 spin-off, becoming a leader in the insulation and building materials distribution sector. Far from being content with organic growth, the company has capitalized on strategic acquisitions to boost cash flow and widen margins, a recipe that has paid off. The company's share price has soared by 1,200% in less than a decade. At the latest earnings conference, the CEO spoke of an improvement in demand for new residential construction, noting an increase in single-family home building. This could indicate a return to normal, with the possibility of lower interest rates in 2024. A prospect that remains to be confirmed, of course, but one that has been driving some of the stock markets for several weeks now.

By

By