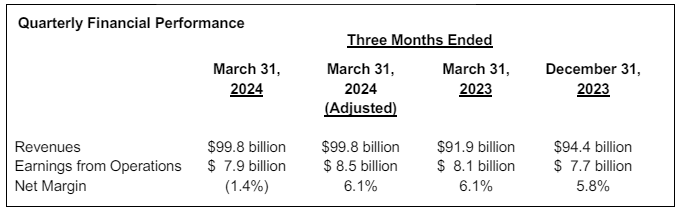

The company's sales reached $99.8 billion, up almost $8 billion on the previous year, exceeding analysts' expectations of $99.2 billion. Earnings per share were impacted in various ways: $0.74 due to the cyberattack on Change Healthcare, $0.49 for immediate response measures and $0.25 for operational disruptions, resulting in a net loss of $1.53 per share for the first quarter. Excluding the sale of Brazilian operations and response costs, adjusted earnings were $6.91 per share, including disruption-related costs. These results reflect widespread growth at both Optum and UnitedHealthcare.

The company also provided over $6 billion in advance financing and interest-free loans to distressed healthcare providers.

The restoration of Change Healthcare services is progressing well, with continued financial support for healthcare providers. The total impact of the cyber attacks is estimated at $0.74 per share for the quarter, with a full-year effect of $1.15 to $1.35 expected. Direct response costs, including the restoration of Change Healthcare and increased care expenses, cost $0.49 per share in the quarter, and are expected to reach $0.85 to $0.95 for the full year. These costs are included in net income and excluded from adjusted earnings.

Disruptions at Change Healthcare had an impact of $0.25 per share in the first quarter, with an annual projection of $0.30 to $0.40 per share. These costs are included in both net and adjusted earnings.

The sale of operations in Brazil resulted in a $7 billion charge, mainly non-cash, due to currency translation losses.

As a result, net income guidance for 2024 has been revised to $17.60-18.20 per share, incorporating the sale and the estimated costs of the cyber attack. The outlook for adjusted net income remains unchanged at $27.50-28.00 per share, excluding direct response costs and the Brazil sale, but including estimated disruption costs for Change Healthcare. This forecast is slightly above the analysts' average of $27.52.

The stock is up 3% today.

By

By