|

Monday February 24 | Weekly market update |

|

Concerns about the evolution of the coronavirus are regaining the upper hand. China warns that trade will decline significantly in the first two months of the year. Fears of an extension of the epidemic are therefore used as a basis for legitimate profit taking after the graphical peaks on the various indices. Arbitrages benefit safe havens such as gold, sovereign debt with excellent credit ratings and the greenback. |

| Indexes Over the past week, the financial markets depreciated overall, a movement supported by downward accelerations at the end of the week. In Europe, weekly performances were down, as was the CAC40, which fell by 1.2%. The DAX fell by 1.6% and the Footsie by 1.3%. For the peripheral countries of the euro zone, Portugal gained 1.8% while Spain fell by 1.3%. In the United States, equities retraced markedly, like the S&P500 (-1.3%) or the Nasdaq100 (-1.1%), weighed down by profit-taking by tech heavyweights. The Dow Jones also lost 1.7%. In Asia, performance was more mixed. The Hang Seng fell by 2.3% while the Nikkei slipped by 3%. Only Shanghai is gaining ground with a weekly score of 3.3%, buoyed by the accommodative measures of the Chinese monetary authorities. |

| Commodities Crude oil prices are down today after posting a positive performance last week. WTI is now trading at USD 51 while Brent is trading at USD 56 after breaking the USD 60 mark. Thanks to a favourable environment (lower bond yields, uncertainty in the equity markets), gold is still on a strong uptrend and is trading above the USD 1600 mark. Silver follows the same trajectory and progresses to USD 18.8. On the base metals side, copper continues its breathing phase at USD 5730, while lead rebounds to USD 1939 and nickel gives way to USD 12685. Breakthrough and theoretical target of gold  |

| Equities markets Created in 2006, SolarEdge is based in the United States. In order to finance its expansion and to gain more notoriety, the company was introduced on the Nasdaq in 2015. SolarEdge is the world leader in intelligent energy technologies. The company offers an inverter solution for solar photovoltaic systems. Employing 2,300 people worldwide, the green energy group sells its products in 133 countries to date. Its latest quarterly results have seen the share price reach historic highs. Revenues for the last quarter amounted to USD 418 million against an expected USD 415 million, resulting in an annual profit of USD 146.5 million or USD 2.9 per share for a turnover of USD 1.4 billion. SolarEdge shares have increased by 40% since the beginning of the year for a valuation of 6.2 billion dollars. The stock detected by the Outperformance methodology is part of the MarketScreener real portfolio dedicated to American stocks and generates more than 120% of unrealized gains. SolarEdge share price soars  |

| Bond market The Coronavirus remains the main factor in the development of the bond markets. The bull camp continues to drive up the sovereign debt barometer. There were concerns that some market players would liquidate their positions before the weekend, but this was unlikely to cause a reversal in the overall trend. Apprehensions about the ramifications of the coronavirus outbreak weigh too heavily for this to happen. The American "10 year" is trading on a yield basis down sharply to 1.47% as in Europe with the Bund at -0.49% or the French OAT at -0.25%. In this context of anxiety, it was therefore logical that investors, in search of yield, would quickly rush to debt instruments with more remunerative rates, which brought down rates in Italy to 0.95%, Spain to 0.19% and Greece to 0.96%. For its part, Switzerland's bond benchmark remains largely negative at -0.82%, in parallel with the firmness of its currency. |

| Forex market The greenback is benefiting from the coronavirus concerns as Europe and its currency are more exposed to trade with China than the United States. The dollar index, which measures the value of the greenback against a basket of major currencies, has risen to its highest level since May 2017. In contrast, the single currency remains weak at around $1.082, not far from a three-year low. The weakness of the single currency can also be seen in the level of the EUR/CHF pair at 1.06. It is the Yen that has suffered this week with violent stalls, as on the USD/JPY pair at 112, validating its worst series of bearish sessions in two years due to health risks. Forex traders are questioning whether the Japanese currency's traditional safe-haven status will change. On the Old Continent, the pound sterling is struggling to complete its rally to 1.29 against the dollar as trade talks with the EU under Brexit appear to be difficult. The greenback's hegemony since the beginning of 2020  |

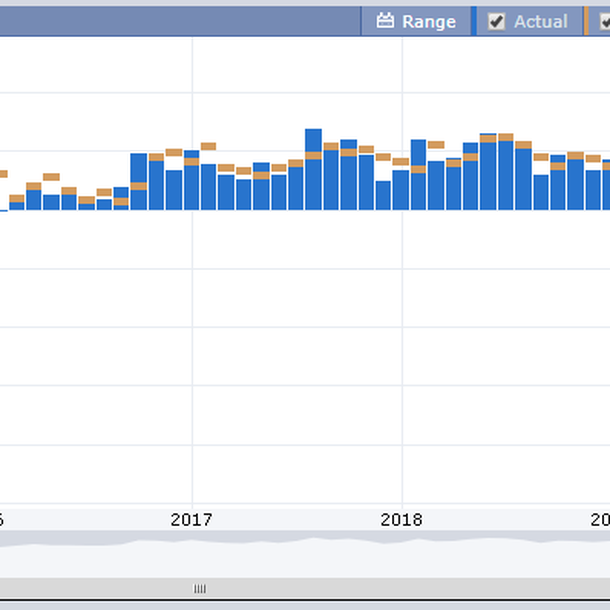

| Economic data The latest report from the Fed's Monetary Committee revealed that most officials were slightly more optimistic about the economic outlook, in part because trade uncertainties had recently diminished. Admittedly, the meeting took place before the spread of the coronavirus in China with all its potential implications for the global economy. The German ZEW indicator gives a foretaste of the reaction of market players to the situation. The indicator reached only 8.7 points, far from the consensus, which itself suggested a low reading of 20. For the euro zone as a whole, the same index fell to 10.4 points, down from 25.6 the previous month. The spotlight was on the IHS Markit readings of purchasing managers. The index for Germany came out surprisingly at 47.8 versus the expected 44.8. Also on the European front, the leaders of the EU-27 made no progress in the negotiations on the budget for the period 2021-2027, which is cut by 75 billion euros after the UK's withdrawal from the European Union. In the United States, manufacturing activity in the Philadelphia area improved sharply in February, when it was expected to deteriorate. On the other hand, Flash PMIs came out below expectations, 50.8 for manufacturing and especially 49.4 for services, the first contraction in four years. The Flash PMI index of services is in contraction  |

| Rising uncertainty The resilience of the equity market is being tested, as hesitation characterises the index paths. However, if we hide the excess liquidity resulting from accommodative monetary policies, it seems that for now, as we write these lines, the risk premium is playing fully in favour of equities. This quantification, which subtracts equity returns from the risk-free rate, offers a downside protection. Even if there are trade-offs in favour of safe havens, the fact remains that allocations are directed towards risky assets in the absence of other remunerative alternatives. In such an advantageous environment for the equity sub-fund, any downward revisions of the NBI or pressure on bond yields that could have a negative impact on the indices should be monitored. |

By

By