Block 1: Key news

- Coinbase against the SEC

The January 17, 2024 hearing before Judge Katherine Polk Failla was crucial in the case pitting the SEC against Coinbase, where the stock market watchdog accused Coinbase and Binance of treating cryptocurrencies as securities. The judge expressed doubts about the generality of the SEC's approach, based on the Howey test, a legal standard that may not be suitable for cryptocurrencies. If the case is dropped, it could positively influence the cryptocurrency market, but also potentially lead to stricter regulation specific to the digital currency industry.

- Cathie Wood is very positive about bitcoin

Cathie Wood is brimming with optimism for the evolution of the bitcoin price. The Ark Invest CEO shared her forecasts for BTC, estimating that the crypto-asset could reach $1.5 million by 2030 in a very favorable scenario. She evoked a more moderate estimate of $600,000 in less favorable scenarios. These forecasts come after the SEC approved Bitcoin spot ETFs last week.

Cathie Wood makes her $1.5 million bull case for the price of bitcoin by 2030. https://t.co/r34iRNA9bG pic.twitter.com/chWWDH7ioE

- CNBC (@CNBC) January 11, 2024

- ETF Ethereum Spot: coming soon?

Following SEC approval of 11 Bitcoin spot ETFs, attention is now turning to Ethereum spot ETFs. Given that Ethereum is considered crucial to the future of blockchain technologies and backed by major players such as BlackRock, the likelihood of approval for spot Ethereum ETFs is likely. However, regulatory uncertainty looms, as if Ether is reclassified as a security by the US regulator, this could jeopardize ETF approval. Despite this, analysts such as Bloomberg's Eric Balchunas estimate a 70% chance of acceptance, and BlackRock's track record of ETF approval reinforces these probabilities.

- Donald Trump: anti-MNBC?

During a campaign speech in New Hampshire, Donald Trump vowed to oppose the creation of central bank digital currencies (CBDCs) in the US, claiming that this would protect Americans from "government tyranny". Trump has expressed concerns about excessive government control over citizens' money with such a currency. This stance follows the withdrawal of Vivek Ramaswamy, a proponent of blockchain technologies, from the presidential race, who endorsed Trump.

Trump says he will prevent implementation of Central Bank Digital Currencies (CBDC) pic.twitter.com/vheJDn2HBg

- Bertman (@manofbert) January 18, 2024

- BlackRock: leader in Bitcoin Spot ETFs

BlackRock's iShares Bitcoin Trust (IBIT), the recently launched bitcoin exchange-traded fund (ETF), is wowing investors by surpassing $1 billion in assets under management (AUM ) during its inaugural week of trading. Notably, IBIT is the first of the Bitcoin ETFs to reach this milestone, reflecting strong demand from investors seeking regulated exposure to bitcoin.

Block 2: Crypto Analysis of the week

In a departure from the usual pattern of large company bankruptcies, Core Scientific has announced that it will make a comeback on the stock market, thanks in part to bitcoin's surge in 2023.

As a reminder, in late 2022, after bitcoin bottomed at $16,800 in the wake of FTX's collapse, Core Scientific filed for Chapter 11 bankruptcy in the USA.

But the company, a luminary in the cryptocurrency mining sector, recently won bankruptcy court approval for a restructuring plan. This plan not only promises full debt repayment, but also generously endows its shareholders with around 60% of the new equity.

This resurrection contrasts sharply with the less fortunate fates of entities such as Three Arrows Capital, BlockFi Inc. and Genesis Global Holdco, which have succumbed to liquidation or are on similar trajectories.

Core Scientific's rebirth is meticulously documented in over 1,700 court documents, which paint a detailed picture of its strategic maneuvers to extricate itself from the mess. The company's December agreements with unsecured creditors and bankruptcy lender B. Riley Financial were a defining moment in this journey.

However, it is clear that the essential catalyst in this story is the meteoric rise in bitcoin's value after December 2022.

This 155% rise in bitcoin's value in 2023, coinciding with renewed investor interest catalyzed by the U.S. Securities and Exchange Commission's approval of bitcoin-focused exchange-traded funds, was a boon for Core Scientific.

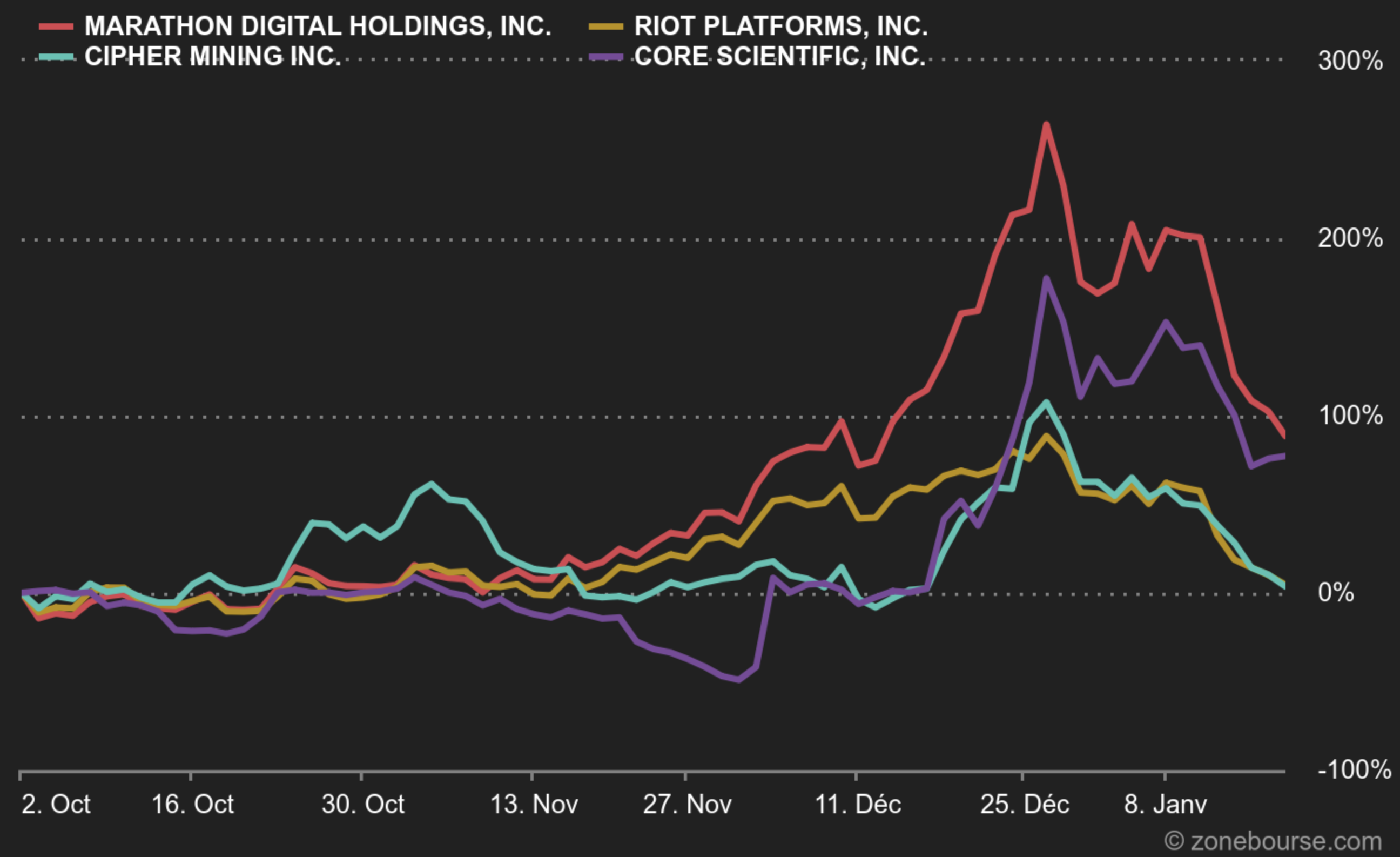

In the numbers, Core Scientific's (CORZQ) share price jumped by around 102% in Q4 2023, in a similar trend with most cryptosphere-exposed stocks such as Marathon Digital (MARA), Riot Platforms (RIOT) and Cipher Mining (CIFR).

One of the highlights of Core Scientific's relaunch, as part of its Chapter 11 proceedings, is the announcement of the purchase of 27,000 new, more efficient Bitcoin mining machines (Bitmain S19J XP 151 TH) for around $77 million, in a deal facilitated by the company's cash and equity

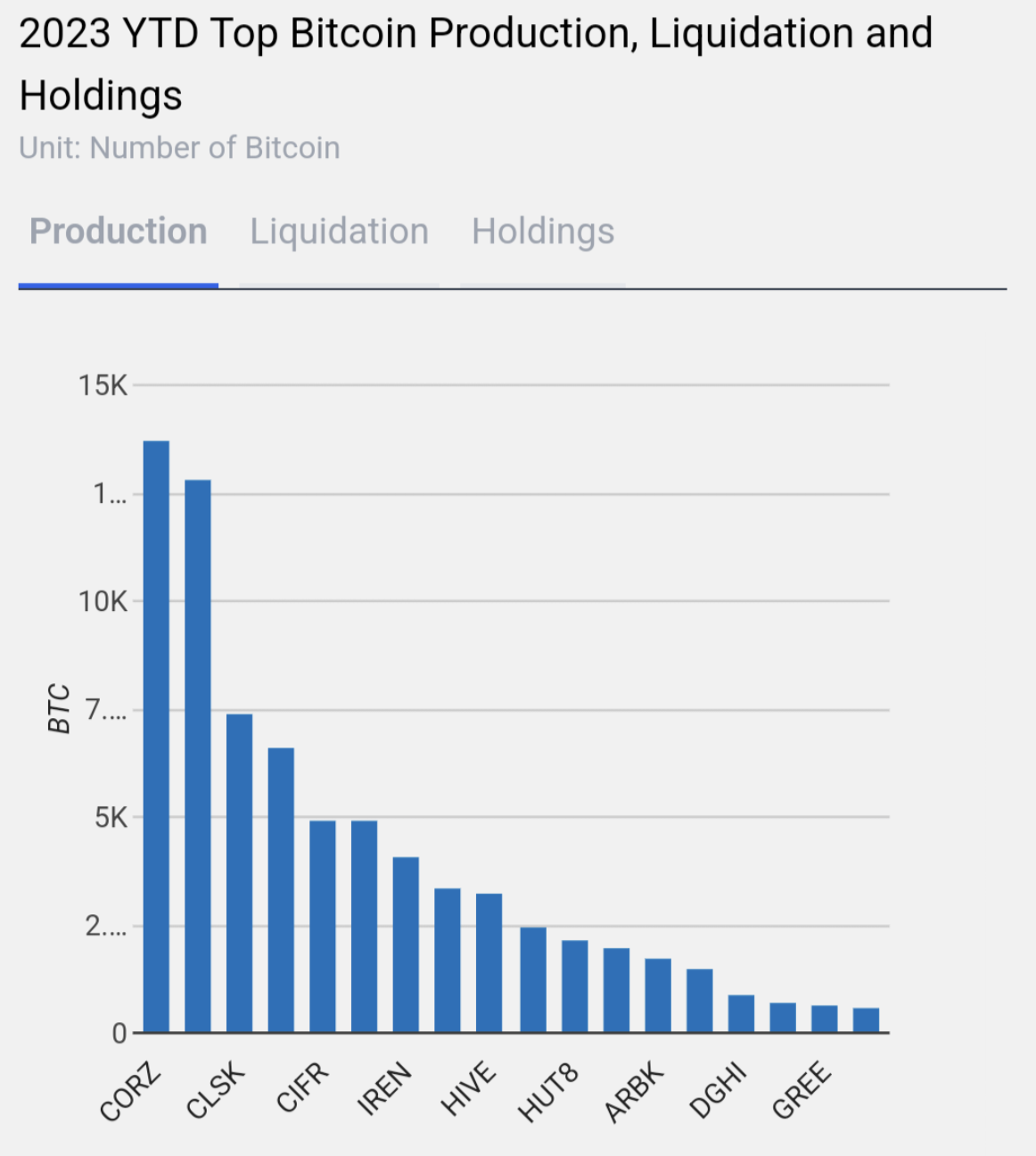

Among listed mining companies, Core Scientific mined the most BTC in 2023, at 13,762 BTC. Marathon Digital(MARA) came second with 12,853 BTC mined, while CleanSpark(CLSK) mined 7,391 in third place.

TheMinerMag

The fact that Core Scientific mined the most bitcoins among public mining companies in 2023, despite bankruptcy proceedings, naturally suggests resilience and operational efficiency. For creditors and stakeholders alike, Core Scientific's mining success could be seen as a positive signal for the months ahead.

Adam Sullivan, CEO of Core Scientific, attributes the company's optimistic outlook to the increased demand for bitcoin following the approval of the Bitcoin Spot ETF. With plans to exit Chapter 11 by January 23 and re-list on the Nasdaq thereafter, Core Scientific's story is certainly one of skilful operational navigation, but above all one of rescue in extremis by the rising bitcoin price.

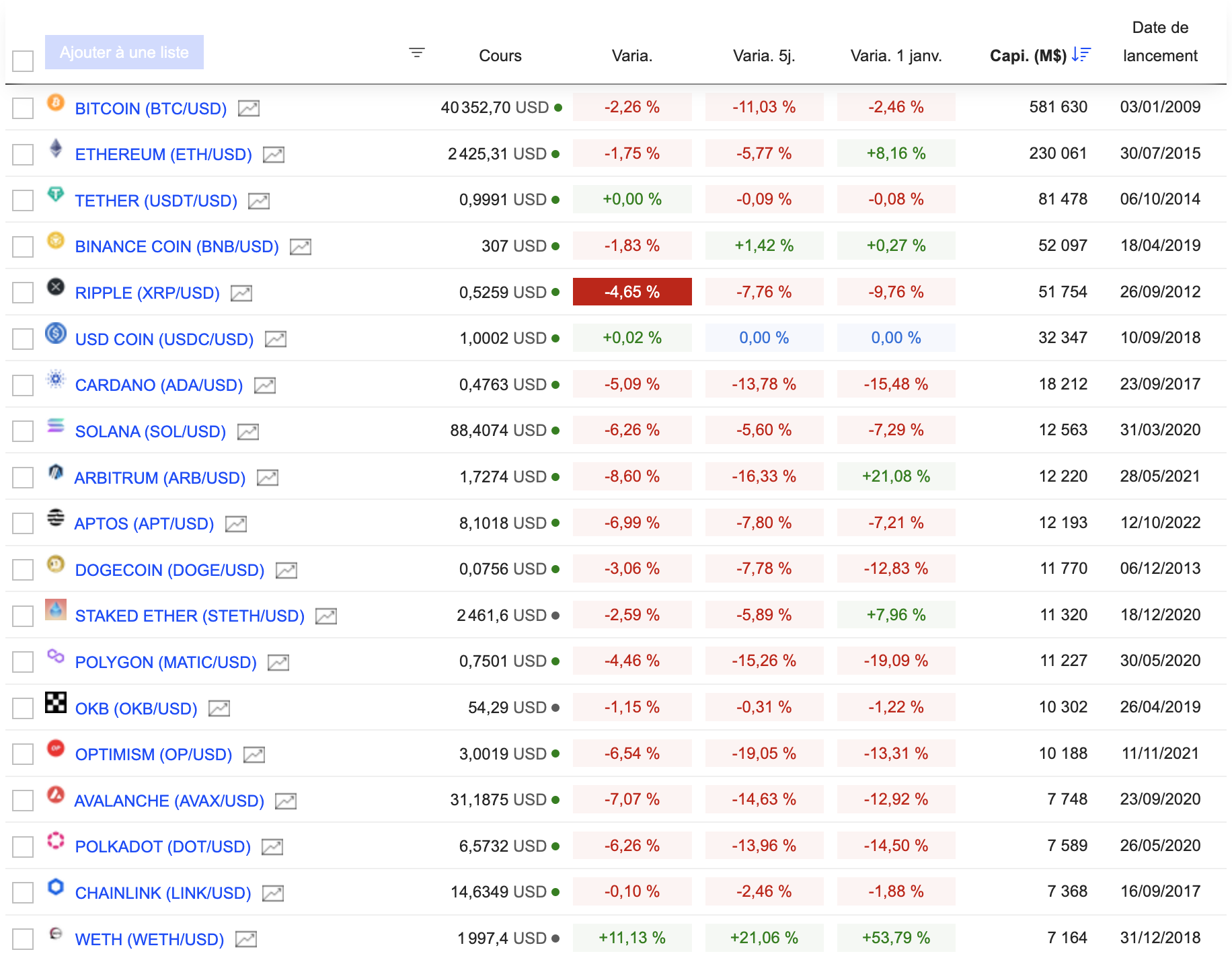

Block 3: Gainers & Fallers

Cryptocurrency chart

(Click to enlarge)

How a 27-year-old codebreaker shattered the myth of Bitcoin anonymity (Wired)

Bitcoin: four reasons why the price is set to soar in 2024 (The Conversation)

If Bitcoin ETFs are so attractive, why has the price of bitcoin fallen? (Financial Times)

By

By