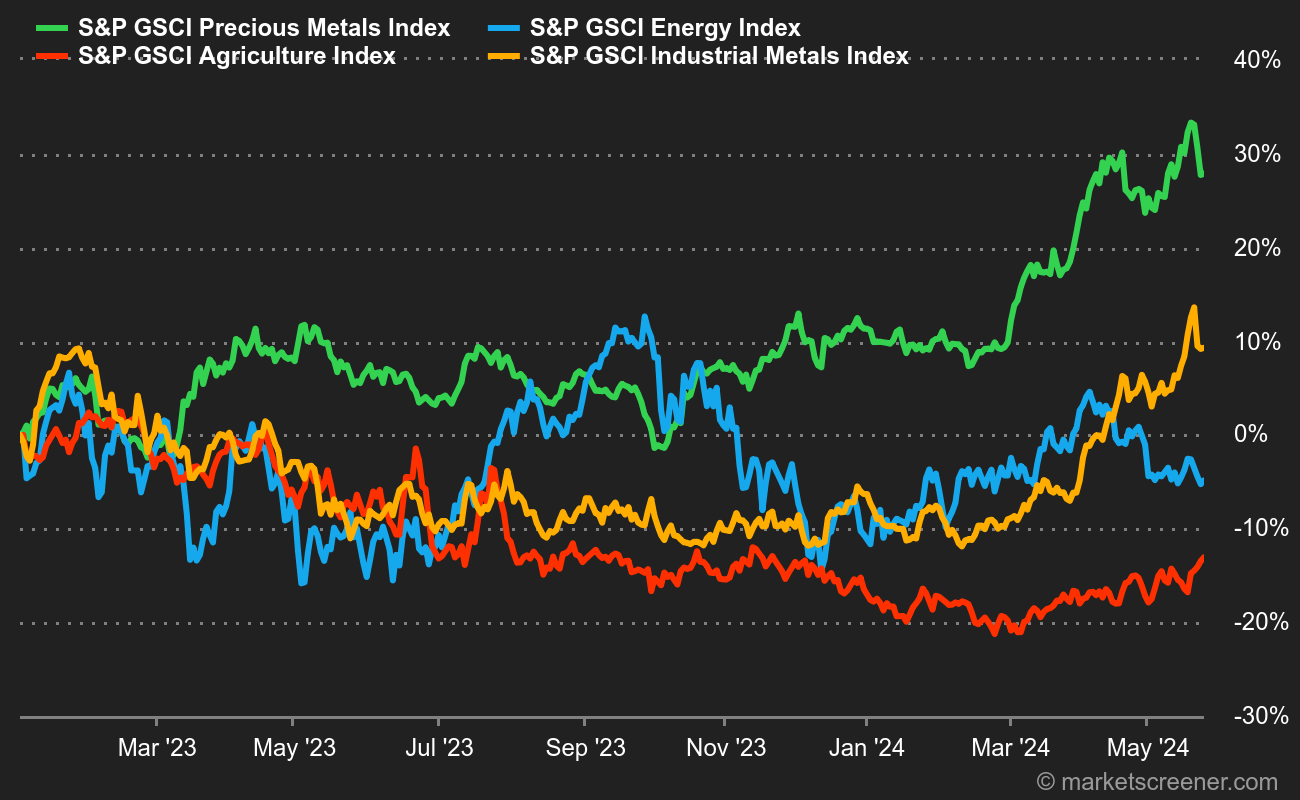

Energy: Oil prices stagnated overall, despite a busy week on the oil front. To begin with, it was OPEC, and more specifically Saudi Arabia, that caused a stir, not because the cartel extended its production quotas, but because the Saudi Kingdom raised its official selling prices to its Asian customers. Let's stay in Asia with China, which unveiled its latest trade data, with oil imports up year-on-year, but with a trend towards slower growth month-on-month. We end this world tour with the United States, where weekly inventories continue to rise, albeit modestly. In terms of prices, Brent crude is trading at around USD 82.50, while WTI is trading at around USD 78.

Metals: What can we learn from China's latest economic data? Metal imports and exports are fairly robust, a sign that industrial demand is improving. Metal prices are reacting positively: a tonne of copper is trading at USD 8,600 in London, aluminum is up to USD 2,250 and zinc is gaining ground at USD 2,530. Nevertheless, the star of the moment is precious metals. We are of course referring to gold, which posted a third consecutive week of gains to USD 2180. Dollar-denominated gold hit an all-time high thanks to bets on lower interest rates, which favors the precious metal, an asset which, by definition, delivers no yield.

Agricultural products: In Chicago, the euphoria of the equity markets was far from over, as grain prices continued to slide. Wheat broke through its 2023 low and is now trading at around 525 cents, a level not seen since 2020. Corn put up more resistance, rising to 440 cents a bushel. Elsewhere, cocoa remains high at USD 6,500 per tonne.

By

By