Block 1: Key news

- X obtains crypto license

X, formerly known as Twitter, has been granted a Rhode Island license to offer cryptocurrency-related services, including exchanges and digital wallets. The precise details of what X plans to do with this license are not yet clear, as neither the platform nor Elon Musk have made any statements on the subject. It's also unclear whether this license will allow X to operate throughout the U.S. or just in Rhode Island. However, X has already integrated the possibility of making donations in bitcoins, which shows its degree of openness on the subject of crypto-assets.

- India favors the development of crypto-currencies

Indian Prime Minister Narendra Modi has called for the democratization and adoption of cryptocurrencies, stressing that it is "futile to try to curb their development". Modi advocates harmonized global regulation, including the countries of the South, and indicates that these assets could offer new economic avenues for emerging countries. This stance comes against the backdrop of the BRICS+ meetings and India's current presidency of the G20.

- Hong Kong develops blockchain bonds

The Hong Kong Monetary Authority (HKMA) has published a positive report on the tokenization of $102 million worth of green bonds, carried out in February as part of its Evergreen project. The report highlights the potential of distributed ledger technology (DLT) to improve the efficiency, liquidity and transparency of bond markets. For this project, HKMA used Hyperledger Besu and Canton, technologies that enable blockchain programming and interoperability. HKMA also explains that it will continue to work with market players to explore other blockchain applications.

- Ethereum is in good shape

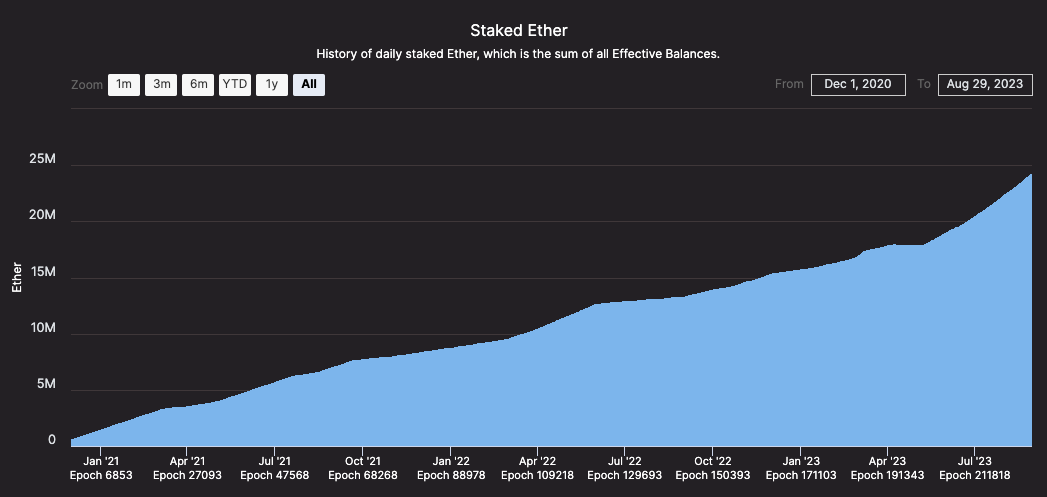

Staking on the Ethereum blockchain continues to grow in popularity, with over 24 million ETH (20% of the total supply) currently staked to secure the network. Since Ethereum's switch to Proof-of-Stake consensus nearly a year ago, the number of validators has increased by almost 35%. Despite a slowdown in on-chain activity and a drop in the ETH price, staking remains solid, offering an annual return of around 3.7%. These data indicate that Ethereum's health is robust, even in a complicated market.

Beaconcha.in

Block 2: Crypto Analysis of the week

The United States is potentially one step closer to authorizing a Bitcoin Spot Exchange-Traded Fund (ETF), considered the Holy Grail of financial products backed by the sacrosanct bitcoin. On Tuesday, the U.S. Court of Appeals, led by a trio of judges, undermined the Securities and Exchange Commission's (SEC) arguments for systematically rejecting proposals for spot ETFs on BTC in the Grayscale case. The Court found that the SEC had acted in an "arbitrary" and "capricious" manner, echoing a sentiment long expressed by the cryptosphere's most fervent supporters.

Specifically, the U.S. Court of Appeals for the District of Columbia sided with Grayscale Investments, the world's largest bitcoin manager with 635,000 BTC under management, in its lawsuit against the U.S. securities regulator.

This Court of Appeals decision paves the way for the metamorphosis of Grayscale's flagship product, the Grayscale Bitcoin Trust (GBTC), into an ETF. In essence, the court asked the SEC to re-evaluate Grayscale's ETF application, pressuring the US securities regulator to provide more compelling and justified reasons should it decide to reject the proposal again. Below is an interview with Grayscale's CEO on the subject.

Following this decision, crypto-asset enthusiasts were abuzz, not only because of a potential conversion of the GBTC into a bitcoin cash ETF, but also because of the court's explicit criticism of the SEC. The regulator's "inability to meet its own standards, coupled with its inability to sufficiently rationalize its decisions", drew widespread ire. In particular, the SEC failed to justify why it approved certain bitcoin-related financial products, particularly those based on futures contracts, while rejecting others.

The SEC's approach is all the more questionable in that it appears to ignore key data, such as the almost identical behavior of the bitcoin spot and futures markets - both markets being 99% positively correlated. On the other hand, the implications of this decision for current ETF applications, particularly after the surprising entry of investment giant BlackRock, remain unclear. In other words, this SEC setback doesn't necessarily mean that all Bitcoin cash ETFs will be accepted. The U.S. securities regulator may find new explanations for refusing ETF approval in the future.

But this legal step does have a double impact.

Firstly, ETF acceptance could allow billions of dollars of investment to flow into cryptocurrencies through regulated, traditional exchange platforms. It would also enable many people still wary of opening accounts with Binance and Coinbase to gain direct exposure to bitcoin.

In addition, the decision undermines the perception of the SEC's omnipotence in the crypto arena. In the wake of the landmark Ripple case in July, it's clear that the agency doesn't necessarily have the final say in the legal interpretation of digital assets; a role that the US judiciary and potentially Congress can also play. This point is all the more important given SEC Chairman Gary Gensler's assertion that almost all cryptocurrencies, with the exception of bitcoin, fall under SEC regulation.

This comes as lawmakers are actively debating the Lummis-Gillibrand Responsible Financial Innovation Bill, which challenges the SEC's jurisdiction over digital assets. The bill suggests that the nature of cryptocurrencies as a "commodity-like" entity could see them better regulated by the U.S. Commodity Futures Trading Commission (CFTC). The Internal Revenue Service (IRS), meanwhile, treats cryptocurrencies as property. In other words, things aren't quite so clear-cut.

For now, cryptocurrencies are digital cash, securities, commodities, property, but they are also tools that symbolize libertarian, progressive and apolitical movements. The cryptocurrency ecosystem, which presents itself as the interface of an ultramodern financial architecture, is disrupting traditional finance with its share of fascination and contradiction for Wall Street. Against this complex backdrop, the question arises: should the SEC be the sole guardian of the cryptocurrency world's destiny? To be continued...

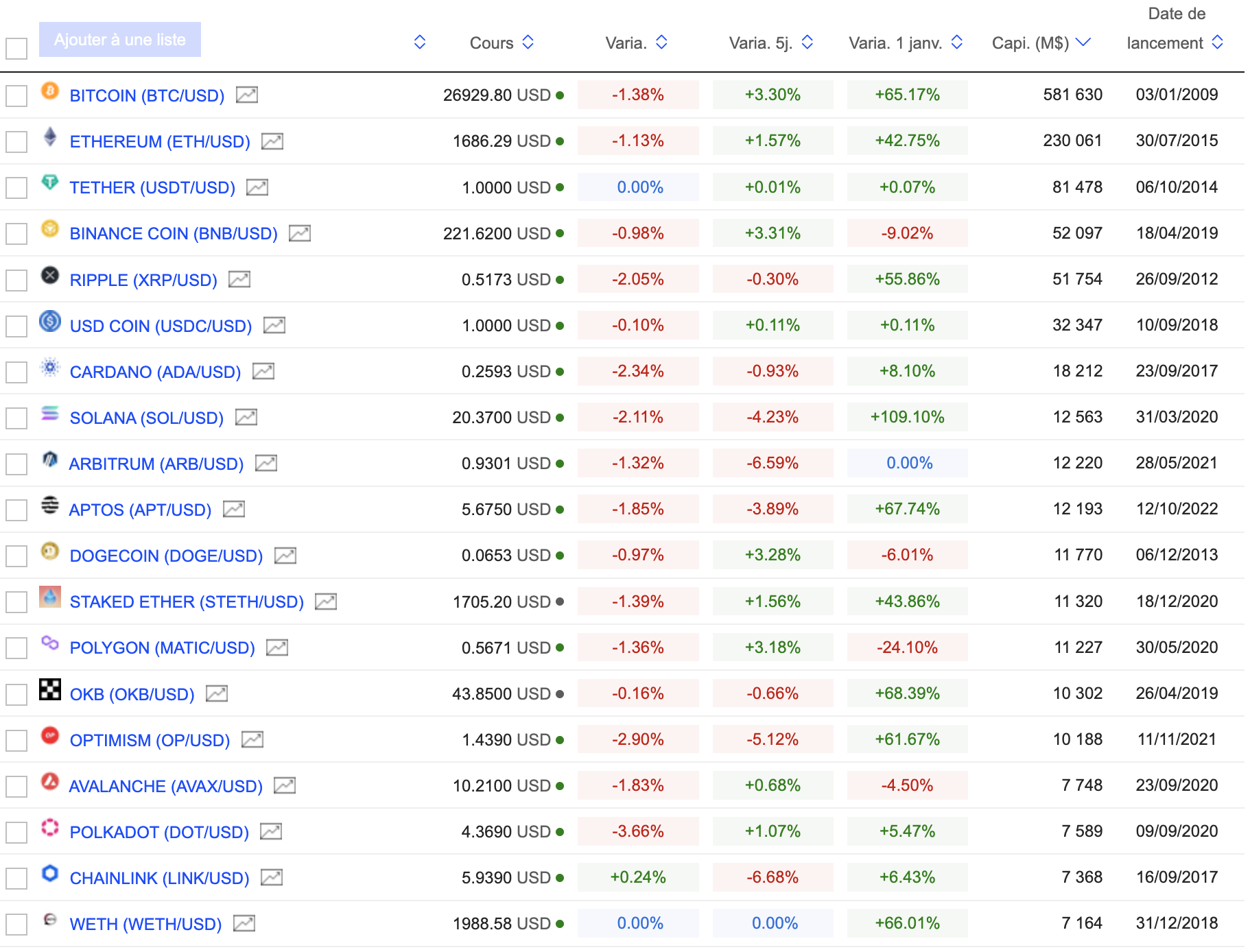

Block 3: Gainers & Losers

Crypto chart

(Click to enlarge)

Block 4: Readings this week

Unmasking Trickbot, one of the world's leading cybercrime gangs (Wired)

Regulation, not cryptography, is broken (Project Syndicate)

SEC strikes again at crypto (WSJ)

Investors flock to Crypto-IA startups (The Informations)

By

By