At the time of writing, the Nikkei 225 , the Tokyo Stock Exchange's main index of 225 companies, was over 35,901 points, a level it had not reached for 3 decades, in 1990. In addition to the strength of local components, such as financial companies and shipping lines, and healthy exports, the index is also benefiting from hopes of an imminent cut in US interest rates.

Similarly, its compatriot, the Topix, which more accurately reflects price variations in Japanese companies, climbed above the 2,520 mark, a level it has not reached for over 30 years.

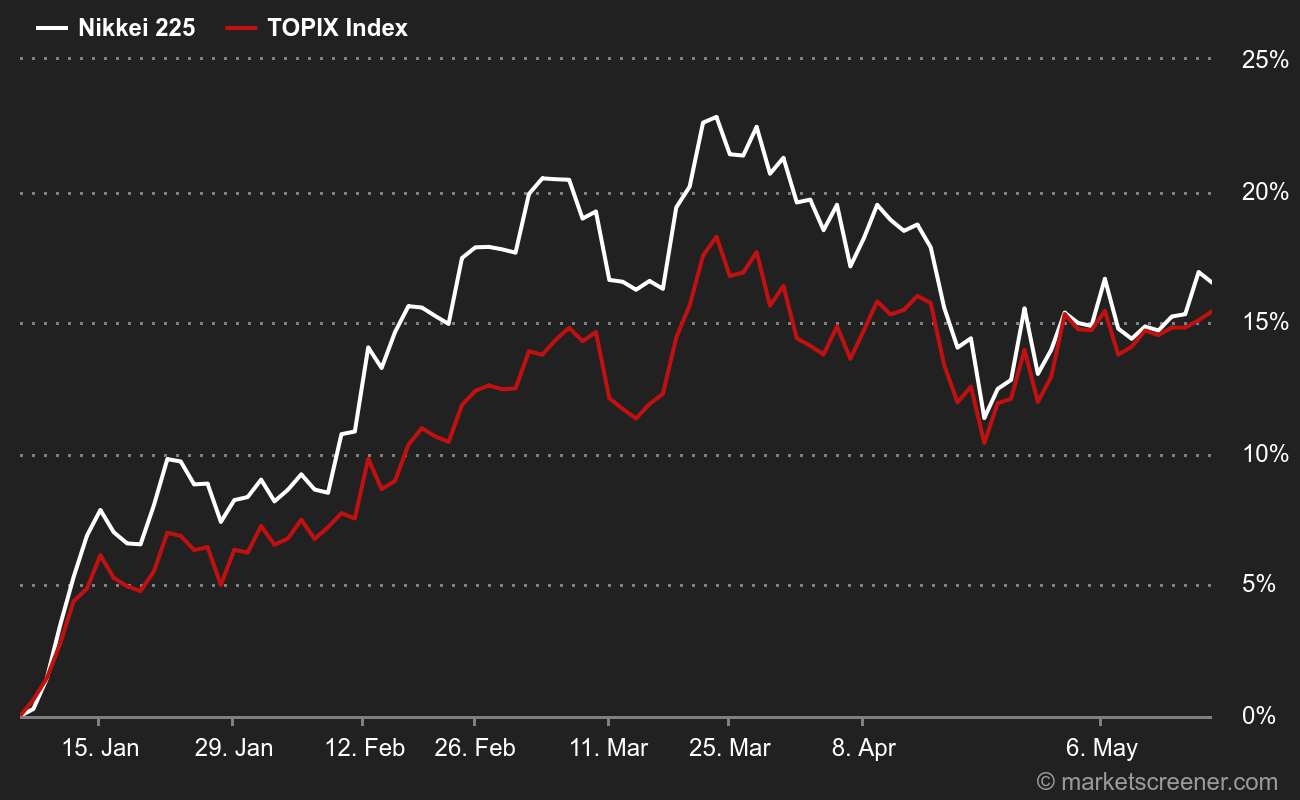

While the Nikkei is heavily weighted towards technology stocks, the Topix gives pride of place to industrials. Throughout 2023, both indices benefited from renewed foreign investor interest in the Japanese economy, fueled by the country's efforts in the area of corporate governance and a weak yen. The Topix has thus gained over 35% since January 2023, and the Nikkei over 37%.

Year-to-date, the Topix is up 6.7% and the Nikkei 7.2%.

Decline for MSCI and Shanghai A

On the other side of the East China Sea, the mood is quite different. Plagued by sustained weak growth, persistent difficulties in the real estate sector, sluggish consumer prices, growing disinterest on the part of international investors and mistrust on the part of locals, indexes have been looking grim for several weeks.

Beijing's efforts to reassure the markets and heal the wounds of developers have done nothing. Global funds have massively dumped Chinese equities, in favor of Indian and Japanese companies, or sometimes the continent's emerging challengers.

On Monday, traders were faced with yet another disappointment: China's central bank decided not to cut interest rates, even though this was eagerly awaited by investors, thus accentuating the fall in its flagship indices.

The MSCI China has lost 65% since January 2023, and 4.4% since the start of the year. The Shanghai A is down nearly 15% since its 2023 highs, and 3% since January 1.

By

By