|

|

| This week's gainers and losers |

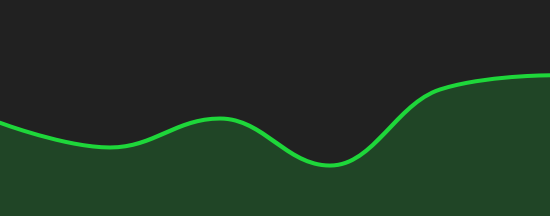

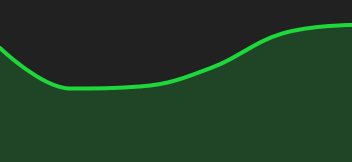

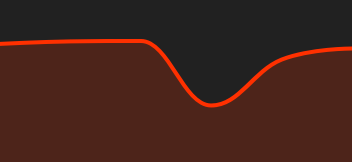

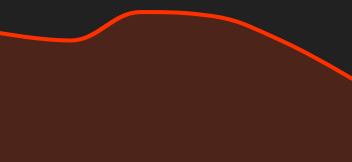

| Gainers: 888 Holdings (+40%): FS Gaming Investments has acquired a 6.6% stake in the London-listed gaming group. FS Gaming is an investment vehicle backed by gaming and betting industry specialists Kenny Alexander, Lee Feldman and Shay Segev, all former directors of GVC Holdings PLC, now known as Entain PLC. A fine comeback for a stock weakened by heavy debt, sudden departures from its executive team and fines for anti-money laundering violations. Gitlab (+36%): For the quarter just ended, the collaborative software development platform reported lower-than-expected losses, as well as higher-than-expected sales, driven by the subscription and license segment. It has therefore raised its annual outlook. The group also announced the launch this year of a product powered by artificial intelligence, which should offer, among other things, code-writing suggestions. Finally, the stock benefits from favorable recommendations. Icahn (+25%): Icahn Enterprises is doing better. After a report by short-seller Hindenburg Research last month which sent its shares plummeting, investor Carl Icahn's group has recovered thanks to a change of target by its detractor. Another catalyst: a whale seems to have taken a large position in the group, catching the eye of investors and boosting speculation around the stock. Warner Bros Discovery (+19%): The media and entertainment giant, heavily indebted following the merger of Warner Bros. and Discovery that gave birth to it, announced that it had repaid part of its debt thanks to intense efforts to cut costs. The group also won over investors by unveiling its plan to make its streaming business profitable this year, a year ahead of schedule. The market also seems to have appreciated the departure of Chris Licht, CEO of WBD-owned CNN, who had burned his wings by launching, among other things, the CNN+ streaming service. Tesla (+10%): Three pieces of good news for the electric vehicle manufacturer. The group sold more cars in China in May than in the previous month, all versions of the Model 3 are now eligible for the $7,500 tax credit under the US Inflation Reduction Act (IRA), and announced Cyber Truck production volumes exceed market expectations. The announcement of a partnership with GM on Tesla superchargers and rumors of investment in new production plants in Spain and India also pushed the stock higher. Losers: Lumen Technologies (-11%): The US telecom network provider disappointed investors, forecasting annual revenues down 19% and below market expectations, and cutting its dividend. Management unveiled a turnaround plan as part of its investor day and says it expects revenue and earnings headwinds through 2024. Coinbase (-15%): The leading crypto-currency exchange platform is in the doldrums, caught up in a legal turmoil. The SEC, the US financial markets watchdog, is accusing the group of failing to comply with regulations: of deliberately making business decisions to increase revenues, mainly from customer trading fees, by making crypto assets available for trading to the average investor, and of breaking the rules by creating a trading service for crypto currencies, some of which are considered unregistered securities. Croda (-17%): The British chemicals specialist plunged this week after alerting on its annual profit forecasts of £370-400 million in 2023, down 52% from £780 million in 2022. The group, which is suffering from significant destocking by its customers affecting sales volumes, has dragged its peers, such as Germany's Wacker Chemie (-8%), in its wake. Epam Systems (-18%): The US engineering software specialist this week cut its earnings and revenue outlook for the second quarter and full year, due to deteriorating demand in the "build" segment and a gloomy outlook for the IT market. The group also continues to suffer from its departure from Russia and the conflict in Ukraine, where it employs 20% of its workforce. |

|

| Commodities |

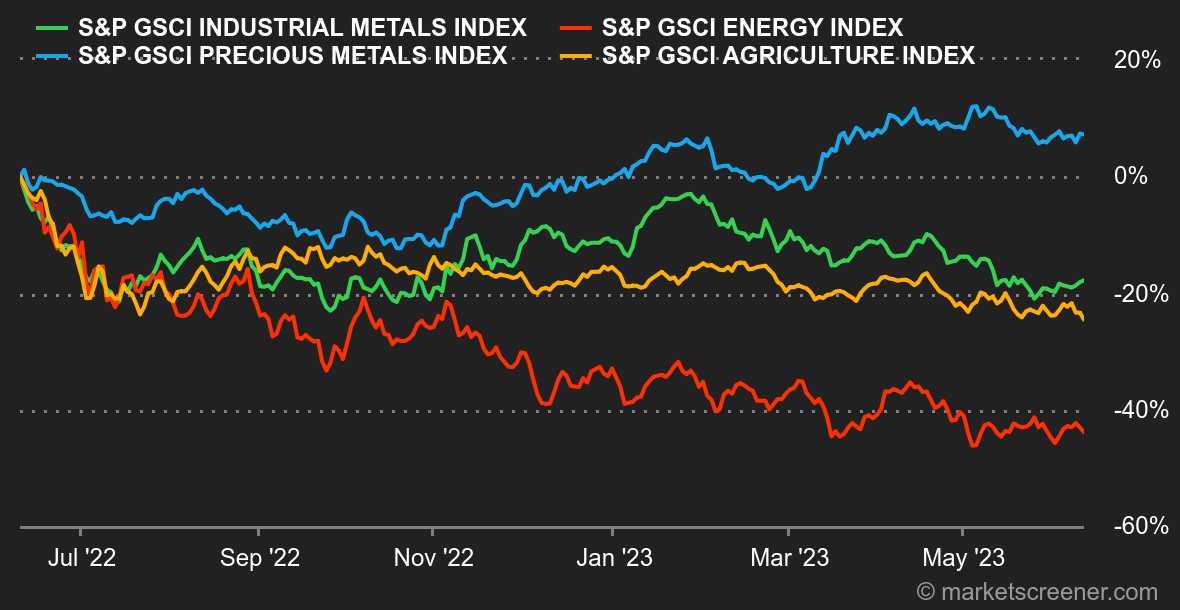

| Energy: Not the desired effect. Saudi Arabia has decided to go it alone to support oil prices and destabilize selling positions. The Kingdom has undertaken to unilaterally cut its supply by 1 million barrels a day from July 1 for a period of one month, a cut which can be extended if necessary. However, this initiative has not led to any buying pressure on oil prices. As proof of this, oil prices are set to close the week lower, for both European Brent (-2.60% to USD 75.80) and US WTI (-3.10% to USD 71). The message is clear: investors remain preoccupied by fears of recession, to the detriment of a tightening oil market, which is approaching by leaps and bounds. At the same time, the latest data from China are rather reassuring, with oil imports up 17% month-on-month. Metals: There's not much to report this week in the industrial metals segment. Prices were generally flat, at around USD 8,300 for copper, USD 2,100 for aluminum and USD 2,350 for zinc. Gold regained some height at USD 1960, albeit only moderately, as China continues to accumulate gold in its foreign exchange reserves. Beijing accumulated 0.5 million ounces of gold in May. Agricultural products: Grain prices gained a little ground this week in Chicago, where bushels of wheat and corn traded at 628 and 600 cents respectively. |

|

| Macroeconomics |

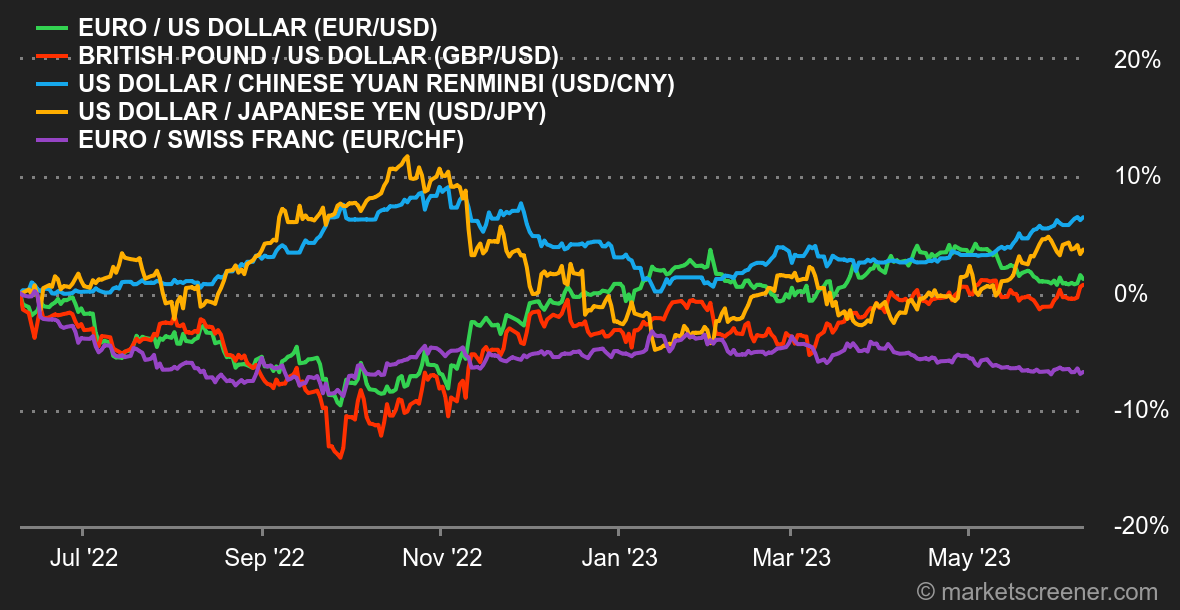

| Atmosphere: While awaiting the Fed and ECB rate decisions next week, the Australian and Canadian central banks took the market by surprise by resuming their rate hikes. This negative signal briefly weighed on investors' sentiment, but they were reassured by the fact that US activity indicators (services momentum, employment) are weakening, which means a more accommodating Fed. We remain in the "bad economic news is good financial news" configuration, as long as the bad economic news isn't TOO bad. Meanwhile, the US recession is still two months away. It has actually been 2 months away for a year now... Currencies. The Dollar Index, the basket that compares the greenback to six major currencies, was little changed this week. It stands at around 103.5, not far from last Friday's level. It did, however, tend to strengthen mid-week, but gains were systematically followed by a relapse. The dollar's strengthening coincided with unexpected rate hikes by the RBA and BOC. But weekly US employment data, worse than expected, pushed it back down again. There is likely to be further volatility next week, as the ECB and Fed approach their rate decisions. The Swiss franc climbed back to 0.9695 against the euro, following a statement by the head of the SNB to the effect that the rate hike cycle is not over for the Swiss Confederation. The strongest weekly variations were to the detriment of the Turkish lira (at TRY 23.50 to USD 1), following the arrival of a new executive presumably less inclined to defend the currency. Rates. On the interest rate front, the week was punctuated by a number of unexpected announcements. The Australian and Canadian central banks raised their key rates by 25 basis points to 4.10% and 4.75% respectively, in a bid to combat inflation still deemed too high. It's only a short step from there to thinking that the Fed and the ECB will join the party next week, but we'll refrain from taking that step. We're not alone, since 72% of investors are still betting on the status quo, according to CME's Fedwatch tool. Needless to say, against this backdrop, traders remain on the defensive, as evidenced by the stagnant yield on the US 10-year, even though it remains afloat above 3.60%. Meanwhile, the German 10-year isn't doing much better, stuck between 2.55% and 2.18%. Cryptocurrencies. Despite the SEC's heavy accusations against the two heavyweights of the crypto-asset industry, Binance and Coinbase, the price of bitcoin is down only slightly, shedding just over 1% this week, and hovering around $26,700 at the time of writing. The ether, meanwhile, is suffering a little more, shedding over 2% of its value and ending up at around $1,850. Still unsure of how to regulate crypto-currencies, US regulators are leaving things unclear on the other side of the Atlantic, but have nonetheless tended to become increasingly strict since the FTX debacle at the end of last year. This week's lawsuits against the two crypto giants contribute to the widespread anxiety and lack of visibility for crypto-investors. Agenda. Next week begins with a rather quiet Monday, before ramping up with the release of a host of economic data, mainly from the US. On Tuesday, we'll see the release of the UK jobseeker change early in the day, followed by US inflation figures and Bailey's (BoE) speech. Wednesday, undoubtedly the busiest day, will see the release of US producer price statistics, as well as the Fed's interest rate decision, preceded by the FOMC meetings. On Thursday, China will release its year-on-year industrial production and retail sales figures. The ECB will follow in the footsteps of its American counterpart by announcing its interest rate decision, followed by its monetary policy statement and a press conference. The Bank of Japan (BoJ) will also reveal its interest rate decision, accompanied by a press conference later in the day. Finally, the US consumer confidence index will be published. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By