|

Monday May 18 | Weekly market update |

| Despite easing restrictions in several countries, which offer hope for a gradual recovery of economic activity, financial markets have been heckled last week, most of them undergoing heavy clearances. Operators have, in fact, reduced their exposure to risky assets, against a backdrop of fears of a new wave of Covid-19 contaminations. The worsening economic outlook and renewed trade tensions between China and the United States are two other reasons to justify this temporary withdrawal from equities. However, indices rallied today after Moderna unveiled positive trial results for a vaccine. |

| Indexes Over last week, all geographical areas have lost ground. In Asia, the Nikkei lost 0.7%, the Shanghai composite 0.9% and the Hang Seng 1.8%. In Europe, the losses were more significant. The CAC40 recorded a weekly loss of 5.1%, the Dax fell 3.5% and the Footsie by 1.8%. For the peripheral countries of the euro zone, Portugal fell 4.8%, Spain lost 2.5% and Italy 2%. In the United States, indices fared better. The Dow Jones lost 2.9%, the S&P500 2.6% and the Nasdaq100 confirmed its resilience, with a decline of only 1.4%. The technology stocks index has maintained a gain of more than 4% since January 1. |

| Commodities The International Energy Agency (IEA) was slightly less pessimistic in its forecasts for a drop in oil demand in 2020, thanks to the easing lockdown restrictions. Demand is expected to fall by 8.6 million barrels per day (bpd) according to the monthly report of the international organisation, a figure 690,000 higher than last month. This less pessimistic outlook comes on top of the surprise drop in US inventories (the first decline since January), allowing oil markets to gain some ground. Brent is thus trading at around USD 32, while WTI is trading around USD 28 per barrel. Gold remains highly sought-after and is moving towards its annual highs at USD 1736 per ounce. Silver offers itself an exit from congestion and advances to USD 16.22. On the contrary, industrial metal prices remain under pressure, undermined by trade tensions between Beijing and Washington. As such, copper fell to USD 5155, as did aluminium and nickel to USD 1433 and USD 12084 respectively. |

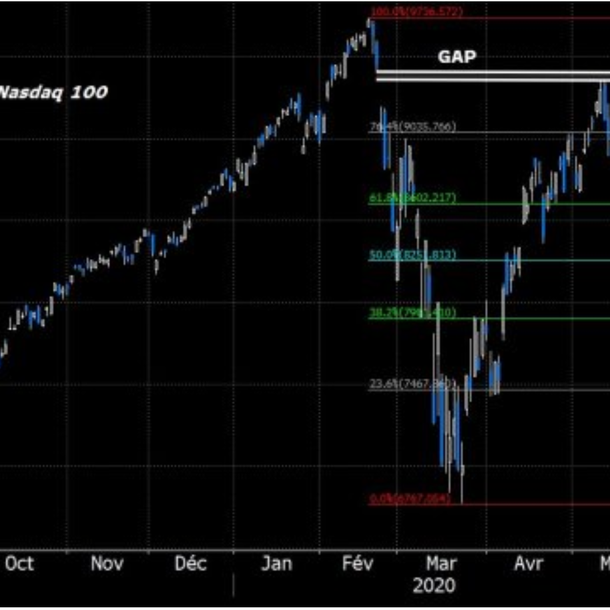

| Equities markets The Nasdaq100 hyper resilient The performance of the Nasdaq 100 since the low point on March 23 will go down in history. 2600 points of increase to reach the 9300 points. All the psychological resistances of the Fibonacci retracements could not oppose the power of the upward movement. The latter is characterized by its dynamism with a positive average of 80 points per day over the thirty or so sessions that separate the trough from the zenith. Indeed, tech giants continued to play an active role in the rise of the technology index. Winning companies in ordinary situations but also in times of crisis, these companies (Apple, Alphabet, Microsoft, Amazon and Facebook) account for nearly 50% of the total composition of the index published in Times Square. They alone represent nearly $6.2 trillion, or 50% of the total capitalization of the 100 largest technology stocks. The PER of the "club of 5" stands at 42 times the NBIs against an index average of 30, representing a premium for quality and growth. Violent rebound of the Nasdaq100  |

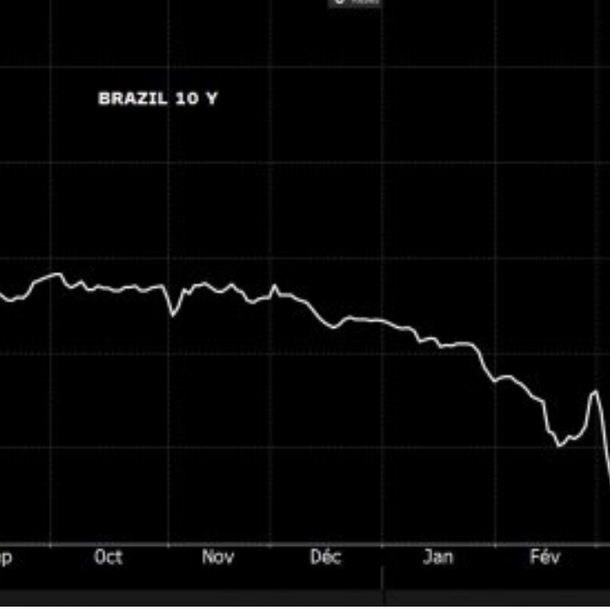

| Bond market While rates are generally trading at weekly lows, bond markets are in a sideways trend. Neither the bulls nor the bears have really been able to get the upper hand lately. In Europe, the main benchmarks are still sought after by investors, with the Bund trading on a -0.54% basis while the OAT barely maintains its negative yield at -0.04%. In Italy, pressure is easing on the 10-year bond (1.80%), which also benefits Spain (0.20%). Following the various pessimistic earnings reports on British GDP projections, demand for 2-year government bonds has risen sharply, pushing the yield on this maturity into negative territory. The government bond in question dropped from 0.35% at the beginning of March to -0.03% yield, while the 10-year benchmark yields 0.20%. This could be a harbinger of the evolution of rates in the United States. Despite Federal Reserve Chairman Powell's speech assuring that his country was not considering such a scenario, the market seems to be increasingly concerned about this trend and we can already see an easing in both the short end of the yield curve as well as in the 10-year US at 0.61%. Less impacted by the stress, Switzerland, for its part, maintains good conditions for borrowing, with yields stabilising at -0.57%. In parallel with the low-yielding sovereign bond markets, credit is doing well, as investment grade and high yield securities continue to offer attractive yields despite the sector risks. Tensions on the 10-year Brazilian interest rate  |

| Forex market The foreign exchange market retains its current structure with the strengthening of hard currencies, with the three values concerned (dollar, yen and Swiss franc) neutralizing each other in their exchanges. The USD/JPY pair is balanced on 1.07 while the USD/CHF parity duplicates the movement at 0.97. The almost non-existent interest rate differential between the euro and the Swiss franc still pushes Forex traders towards the stronger Swiss currency. As a result, the single currency hit a 5-year low against the Swiss franc at CHF 1.05. The decline has been gradual over the past two years (see chart). Against the dollar, the lethargy continues. In fact, the major parity is moving between two tight limits (USD 1.098 and USD 1.077). Fears of a break-up of the euro zone after last week's German court ruling have, in fact, had no impact on the conversion rate. Across the Channel, the pound weakened against strong currencies: 1.22 against the dollar or 1.19 against the Swiss franc, causing the pound to lose around 200 basis points at each of the parities. In the emerging zone, it is the Brazilian currency that is still under pressure and is losing ground against the BRL 5.90 note. This same parity was trading at R$4.1 at the beginning of the year. EUR/CHF down for the past two years  |

| Economic data The week was not very full in terms of European statistics. The CPI and PPI indices in Germany were mixed, at +0.4% and -0.7% respectively (vs. +0.3% and -0.6% expected). German GDP was in line with expectations at -2.2%, pushing Germany into recession due to the coronavirus. For the euro zone, industrial production fell by 11.3% (consensus -12.3%), GDP fell by 3.8% while the trade balance was better than expected (23.5B vs. 17.2B expected). In China, the data was mixed. Retail sales fell by 7.5%, unemployment rose to 6% but industrial production climbed by 3.8% while the market was expecting +1.5%. In the U.S., weekly unemployment registrations were at 2981K (2500K expected). Retail sales dropped 16.4% (consensus -12%), industrial production dropped 11.2% and the Empire State Manufacturing Index dropped to -48.5 (-65 expected). The highlight of the week was the intervention of Jerome Powell, who indicated that the Fed is not considering the use of negative rates for the time being, confirming nevertheless the maintenance/reinforcement of support measures. |

| Two forces oppose each other The economy is reopening in small steps. Despite this recent warning from indices, two forces continue to oppose each other: on the one hand, the sharp deterioration in macroeconomic conditions, such as the fall of the PMIs, and on the other, the unlimited interventions of central banks and governments. These support measures favour a riskier but highly targeted allocation among investors, even if the Sino-US skirmishes resurface and add volatility to asset prices. Regarding this health crisis, which is having a joint impact on supply and demand, the coming weeks will no doubt provide an answer to the question of whether this historic phase constitutes a cyclical recession or a sectoral shock. |

By

By