The rapid change in the relative values of these metals shows the scale of the economic damage investors fear that coronavirus containment measures are causing, said Carsten Menke, an analyst at Julius Baer.

"(This is) telling policymakers we are already in a deep recession," he said.

Gold is traditionally seen as a safer store of value than other assets in times of turmoil, but half of silver demand comes from industries such as solar panel manufacturing, while copper is used in power and construction.

Gold has not been immune from a general market sell-off in recent days and has slipped 2% this year to below $1,500 an ounce as investors sold metal to raise much-needed cash.

But copper has over the same period shed 22% to less than $5,000 a tonne, and silver has plunged 32% to around $12 an ounce.

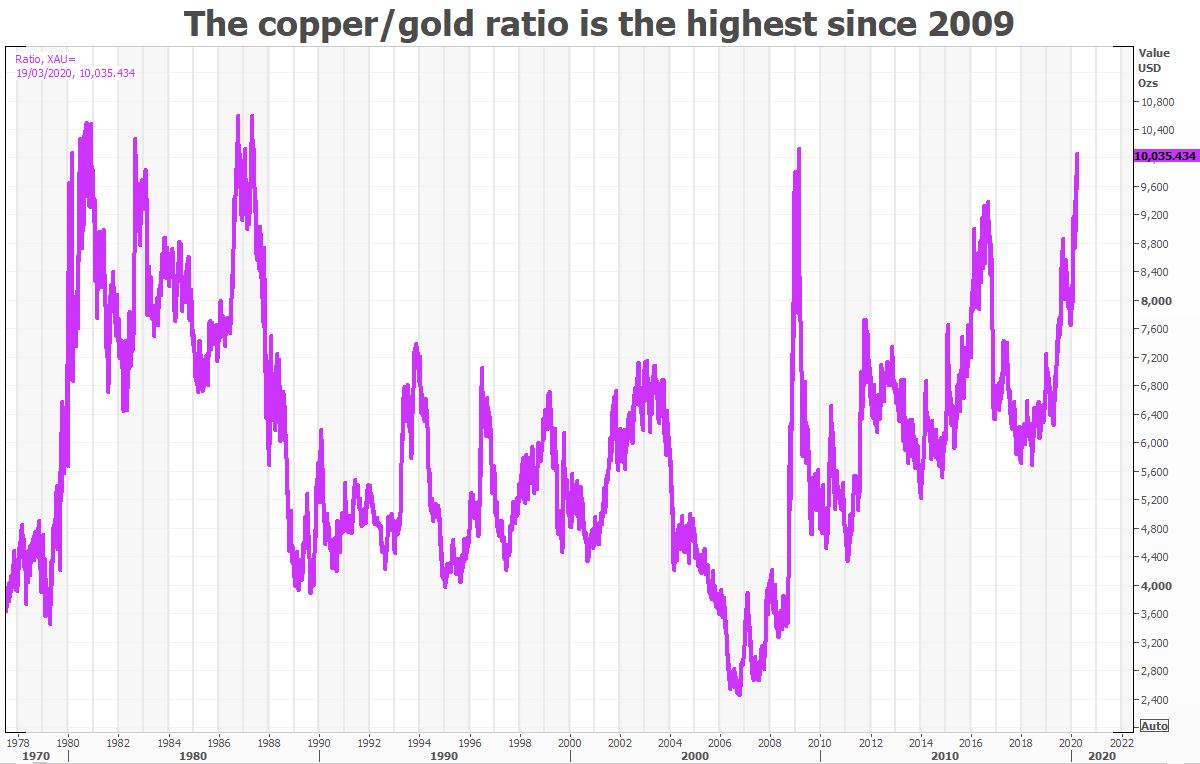

Copper on Thursday was just over 10,000 times less valuable than gold ? the biggest discount since 2009, when copper prices also tumbled during the financial crisis.

(GRAPHIC - Copper/gold ratio:  )

)

Silver was on Thursday 122 times cheaper than gold, its lowest price relative to gold on record.

(GRAPHIC - Gold-silver ratio:  )

)

(GRAPHIC - Gold's relative price performance:  )

)

In the near term, silver and copper could become even cheaper compared to gold, said Menke, with industrial metals gaining ground again only when the global economy begins to recover.

Silver may however benefit earlier if gold prices rise strongly, since it is also used by some as a cheaper alternative safe asset than gold, and as the two metals often move in parallel, said WisdomTree analyst Nitesh Shah.

"When gold makes a turnaround, I think silver will follow in its coattails," he said.

(Reporting by Peter Hobson; Editing by Veronica Brown and Jan Harvey)

S&P GSCI COPPER INDEX 2

S&P GSCI COPPER INDEX 2